A. UNIFORM CHARGE METHODS :

Depreciation is charged uniformly every year for those assets which are uniformly productive. Four methods fall in this category:

1. Fixed Instalment Method or Straight Line Method

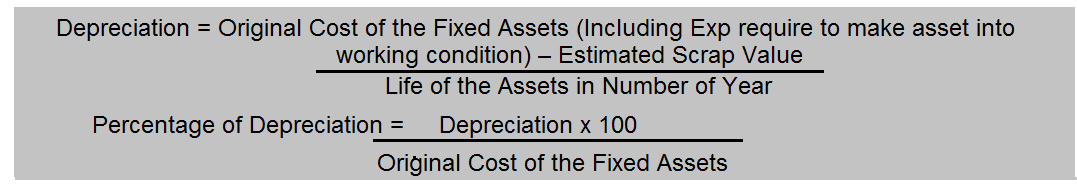

Under this method, a fixed proportion of the original cost of the asset (less residual value) is written off each year so that asset account may be reduced to its residual value at the end of its estimated economic useful life. It is assumed that depreciation is a function of time. Depreciation is charged on a uniform basis every year till the asset is written off.

Note:

– Additional asset purchased during the year must be depreciated only from the date of purchase to the close of the accounting period.

– When no date of addition is mentioned, depreciation may be charged for half of the year on the assumption that addition was made in the middle of the year.

– Assets sold during the year should be depreciated from the beginning of the year till the date of sale.

| ADVANTAGES | DISADVANTAGES |

| – It is a simple and easy method. | – The assumption that the asset shall be equally useful throughout its life seems to be illogical. |

| – The value of the asset can be completely written off, i.e. the value can be reduced to zero its estimated scrap value. | – It does not take into account the effective utilization of the asset. |

| – This method can be applied where asset gets depreciated because of effluxion of time like furniture, equipments, patents, leasehold etc. | – Even though the asset is used uniformly from period to period, the total charge for the use of the asset keeps on increasing every year. This is because cost of repairs in each subsequent year rises though equal amount of depreciation is written off every year. |

| – There is no change either in the rate or amount of depreciation over the useful life of the asset. | |

| – The value of the asset each year in the balance sheet is reasonably fair. |

Illustration :

A firm acquired a machinery on 1st July 2010 at a cost of Rs.45,000 and spent Rs.5,000 for its installation. The firm writes off depreciation at 10% per annum on the original cost every year. The books are closed on 31st March every year. Show Machinery Account and Depreciation Account for three years.

Solution:

Dr. Machinery Account Cr.

|

Date |

Particulars | Rs. | Date | Particulars |

Rs. |

|

2010 |

2011 |

||||

|

Jul 1 |

To Bank |

45,000 |

Mar.31 |

By Depreciation | |

|

Jul 1 |

To Bank (Installation | (10% on 250,000 for 9 | |||

| Expenses) |

5,000 |

months) |

3,750 |

||

|

________ |

Mar.31 |

By Balance c/d |

46,250 |

||

|

50,000 |

50,000 |

||||

|

2011 |

2012 |

||||

|

April 1 |

To Balance b/d |

46,250 |

Mar. 31 |

By Depreciation | |

| (10% on 250,000) |

5,000 |

||||

|

Mar. 31 |

By Balance c/d |

41,250 |

|||

|

46,250 |

46,250 |

||||

|

2012 |

2013 |

||||

|

April 1 |

To Balance b/d |

41,250 |

Mar. 31 |

By Depreciation | |

| (10% on 250,000) |

5,000 |

||||

|

________ |

Mar. 31 |

By Balance c/d |

36,250 |

||

|

41,250 |

41,250 |

||||

|

2013 |

|||||

|

April 1 |

To Balance b/d |

36,250 |

Dr. Depreciation Account Cr.

|

Date |

Particulars | Rs. | Date | Particulars |

Rs. |

|

2011 |

2011 |

||||

|

Mar.31 |

To Machinery A/c |

3,750 |

Mar.31 |

By Profit & Loss A/c |

3,750 |

|

2012 |

2012 |

||||

|

Mar.31 |

To Machinery A/c |

5,000 |

Mar.31 |

By Profit & Loss A/c |

5,000 |

|

2013 |

2013 |

||||

|

Mar.31 |

To Machinery A/c |

5,000 |

Mar.31 |

By Profit & Loss A/c |

5,000 |