ADJUSTMENT ENTRIES :

Usually, final accounts are prepared from the balances given in the trial balance. However, at times some account balances in the trial balance do not reflect the correct ‘amount’ when considered in relation to accounting period. For example, payment on account of expense, say, rent, may be less or more than the

actual payment that ought to have been made during the accounting period. Similar situation may arise in respect of some revenue items also, say interest on investments.

In order to ensure that the final accounts disclose the true trading results and correct balances, it is necessary that all expenses incurred whether paid or not and the whole amount of loss sustained whether ascertained or estimated should be taken into consideration. Similarly, incomes and gains whether actually received or not during the accounting period should be accounted for. All this requires adjustment entries which are used to establish correct values of account balances at the end of an accounting period. Thus, adjustment entries are those entries which are passed at the end of each accounting period for the purpose of adjusting various nominal and other accounts so that true net profit or loss is indicated in profit and loss account and the balance sheet represents a true and fair view of the financial condition of an enterprise.

The following are the usual adjustment entries which are made while preparing the final accounts.

(I) CLOSING STOCK

The unsold stock at the end of the accounting period is termed as closing stock. There can be two entries for closing stock.

(a) Closing Stock Account Dr.

To Trading Account

When this entry is passed the closing stock at the end appears in trading account and on the assets side of balance sheet. It becomes the opening stock for the next year.

(b) Stock Account Dr.

To Purchases Account

In this case, closing stock will appear in the trial balance, it means that double entry has been completed in the accounting period itself by reducing the purchases. Therefore it will appear as an asset in the balance sheet only.

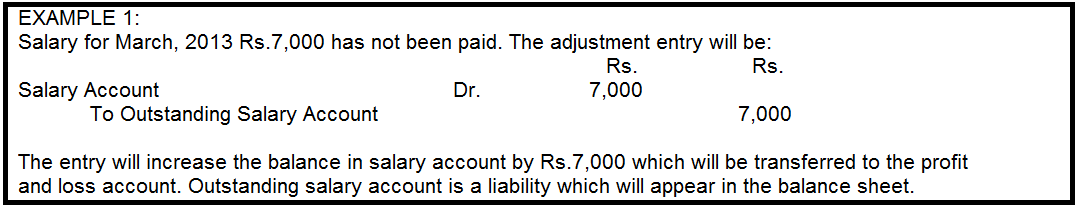

(II) ACCRUED OR OUTSTANDING EXPENSES

Expenses which have been incurred during the year and whose benefit has been derived during the year but payment in respect of which has not been made are called outstanding or accrued expenses. At the end of the year, all such expenses must be brought into books, otherwise, the profit will be overstated and liability will be understated. The following journal entry is passed:

Expense Account Dr.

To Outstanding/Accrued Expense Account

– The outstanding expenses are shown on the debit side of the trading account or profit and loss account, as the case may be, by way of addition to the respective expenses.

– These are also shown on the liabilities side of balance sheet.

– In the beginning of the next year, a reverse entry will be passed.

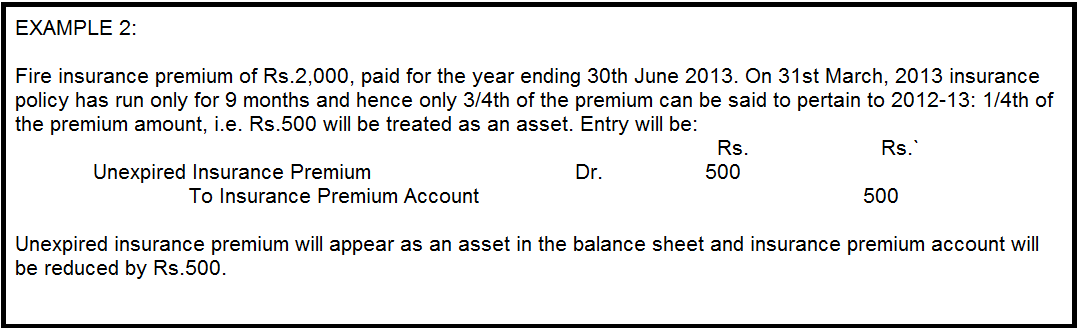

(III) UNEXPIRED OR PREPAID EXPENSES

Those expenses which have been paid in advance and whose benefit will be available in future are called unexpired or prepaid expenses e.g. insurance premium and rent paid in advance. An adjustment entry is made whereby the unexpired amount is credited to the appropriate expense account and debited to prepaid (unexpired) account as under:

Prepaid Expense Account Dr.

To Expense Account

– The amount of prepaid expenses is shown in the profit and loss account by way of deduction from the concerned expenses.

– These are also shown as assets in the balance sheet.

– In the beginning of the next year, a reverse entry will be passed to cancel the effect of adjusting entry.

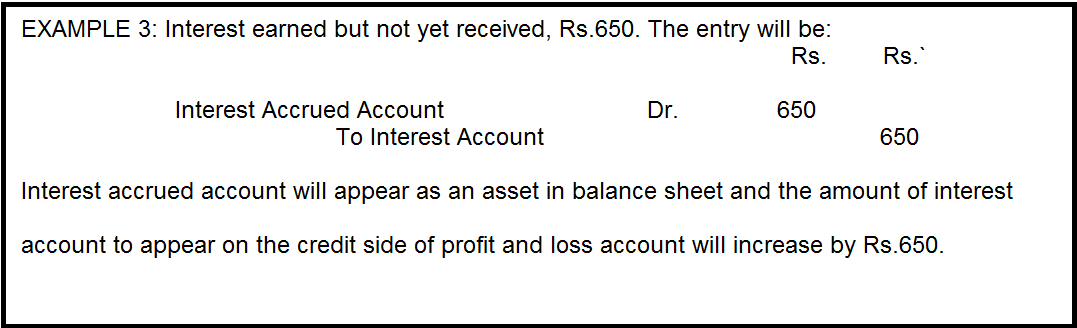

(IV) ACCRUED OR OUTSTANDING INCOME

Accrued income means income which has been earned by the business during the accounting year but which has not become due and hence has not been received. But outstanding income means any income which has become due during the accounting year but has not been so far received by the firm. Though there is a distinction between the two, for adjustment entry no such distinction is necessary, both the accrued income and outstanding income are added to the given income figure in the trial balance. The following entry is passed:

Accrued /Outstanding Income Account Dr.

To Income Account

– The amount of income is transferred to the credit side of profit and loss account as an addition to the respective income account.

– The accrued/outstanding income account also appears as an asset in the balance sheet.

– In the beginning of next year, a reverse entry will be passed.

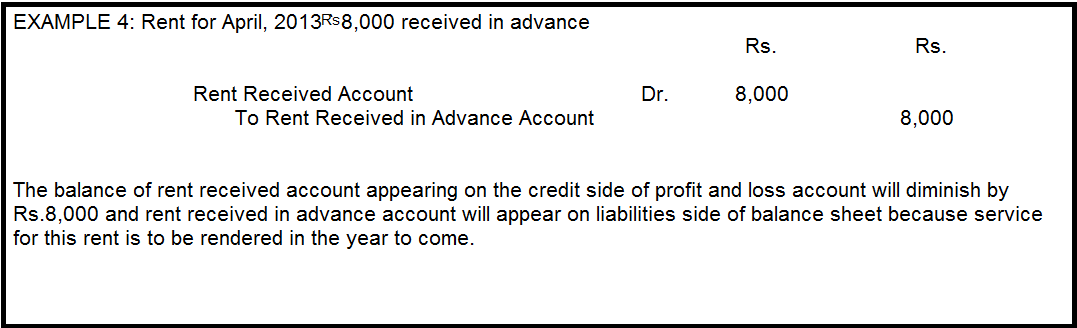

(V) UNEARNED INCOME OR INCOME RECEIVED IN ADVANCE

That portion of the revenue which remains received in advance (unearned) at the end of the accounting period is known as unearned income or income received in advance. For example, subscription received in advance by a club, insurance premiums received in advance by and insurance company, rent received in advance, etc. Any income in advance is not actually earned and it rather creates an obligation. The following adjustment entry is made at the end of the accounting year;

Income Account Dr.

To Income Received in Advance Account

– This item is shown on the credit side of the profit and loss account by way of deduction from the income.

– It is also shown in the balance sheet on the liabilities side as ‘Income received in advance’.

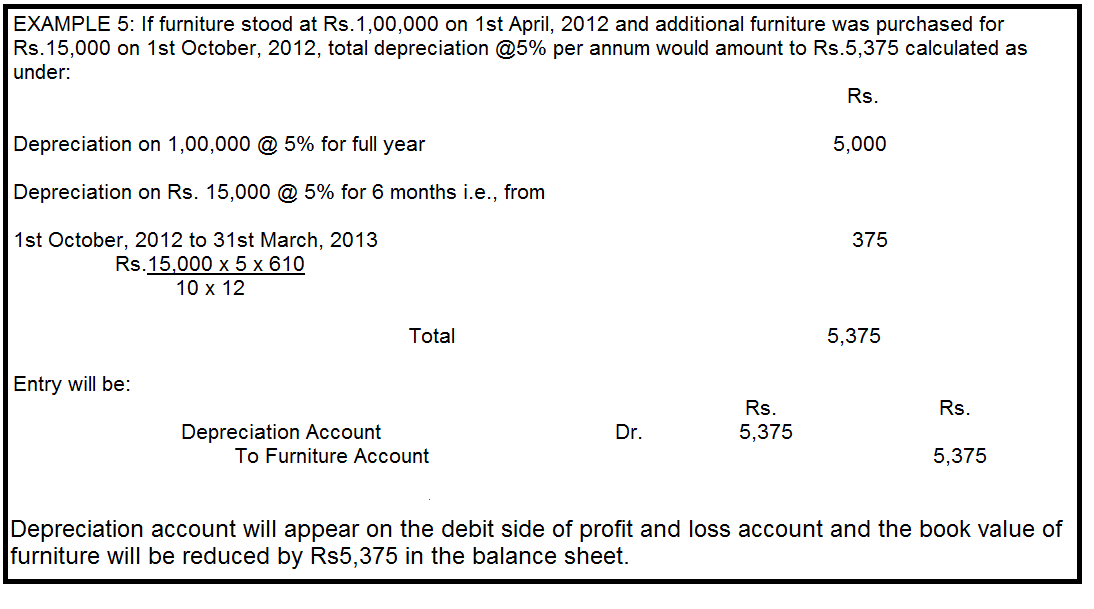

(VI) DEPRECIATION

Depreciation is the reduction in the value of fixed assets due to a use, wear and tear or obsolescence. When an asset is used for earning purpose, it is necessary that reduction due to its use must be charged to the profit for the year in order to show correct value in the balance sheet. The following journal entry is passed for charging depreciation:

Depreciation Account Dr.

To Fixed Asset Account

– The amount of depreciation is debited to the profit and loss account.

– Again it is shown on the assets side of the balance sheet by way of deduction from the concerned asset.

When depreciation is given in the trial balance, it means that the asset(s) has(ve) been credited with the amount of depreciation and the necessary debit to depreciation account has been made. The only entry then would be to transfer the depreciation account to profit and loss account and no adjustment entry would be needed.

Note: There are various methods of providing depreciation, but in questions on final accounts, it is most likely asked to be calculated at a fixed percentage on opening balance of the assets. If there are additions, depreciation is provided only for that part of the year for which the new asset has been used.

WHEN PROVISION FOR DEPRECIATION ACCOUNT IS MAINTAINED:

Depreciation Account Dr.

To Provision for Depreciation Account

Profit and Loss Account Dr.

To Depreciation Account

(VII) BAD DEBTS

Debts which cannot be recovered or become irrecoverable are called bad debts. It is a loss to the business and is brought into account by debiting bad debts account and crediting debtors’ accounts who are not able to pay the amount. The adjustment entry is as follows:

Bad Debts Account Dr.

To Sundry Debtors Account

– The bad debts account is debited to profit and loss account.

– The debtors balance is reduced by the same amount in the balance sheet.

– When the amount of bad debts is given in the trial balance itself no adjusting entry is required. It should only be transferred to profit and loss account.

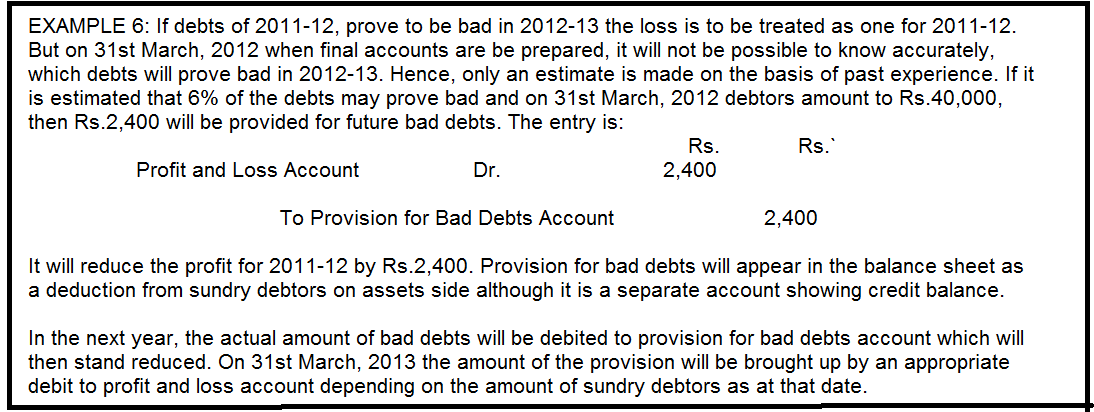

(VIII) PROVISION FOR BAD DEBTS

A firm may make a provision at the end of the accounting year for likely bad debts which may take place during the course of the next year. This is for the simple reason that if out of credit sales made during a particular year, some sales are likely to become bad in the course of the next year, the proper course would be to charge in the same accounting year with such likely bad debts in which the sales have been made. The following journal entry is passed for creating provision for bad debts:

Profit and Loss Account Dr.

To Provision for Bad Debts Account

– The provision for bad debts is charged to profit and loss account.

– It is also deducted from debtors in the balance sheet.

– Provision for bad debts created out of profit of the current year should be carried forward to the next period. Bad debts occurring during that period would be debited to bad debts account as usual, but total debits given to this account should be transferred to provision for bad debts account. At the end of the next year suitable adjustment entry is passed for keeping the provision for bad debts at an appropriate amount to be carried forward.

– Sometimes the balance brought down from the previous year is so large that even after debiting the current year’s bad debts and leaving the desired balance at the end of the year, a surplus is left. This surplus is transferred to the credit side of profit and loss account.

(IX) PROVISION FOR DISCOUNT ON DEBTORS

This is a charge made against profits in order to provide for an expected loss in the form of discounts which are likely to be allowed to the debtors, for encouraging them to make prompt payments. In order to incorporate such provision for discount on debtors, the following journal entry is passed:

Profit and Loss Account Dr.

To Provision for Discount on Debtors Account

– This provision is shown on the debit side of the profit and loss account.

– It is also shown in the balance sheet by way of deduction from sundry debtors.

Note: Provision for discount is always calculated on the amount of debtors left after deducting the provision for bad debts i.e. provision should be calculated on good debts. It is because no discount will be allowed on amounts which are not recovered and hence no provision for discount on such amounts is required.

For example, if 2% discount is allowed, debtors are of Rs.10,000 and 5% provision for bad debts is required then provision for discount will be made @2% on ` 9,500, i.e., on Rs.10,000 less 5% for provision for bad debts amounting to Rs.500.

(X) RESERVE FOR DISCOUNT ON CREDITORS

A firm may like to create reserve for discount on its creditors to record discounts expected to be received from them. The adjustment entry for this purpose is as follows:

Reserve for Discount on Creditors Account Dr.

To Profit and Loss Account

– The reserve for discount on creditors account is credited to the profit and loss account.

– It should also be deducted from the sundry creditors in the balance sheet. Keeping with the principle of conservatism, the provision for discount on creditors is often not made in actual practice.

(XI) INTEREST ON CAPITAL

It is a normal practice to charge business with interest on the capital employed in the business. The purpose is to know whether the profits of the business are more than what could be earned from simple investments outside business. Interest charged is an expense to the business but it is a gain to proprietor. The following adjustment entries are passed:

(i) Interest on Capital Account Dr.

To Capital Account

(ii) Profit and Loss Account Dr.

To Interest on Capital Account

– Interest on capital is debited to the profit and loss account and

– It is shown on the liabilities side of the balance sheet by way of addition to the capital.

(XII) INTEREST ON DRAWINGS

As business allows interest on capital, it also charges interest on drawings made by the proprietor. This is a gain to the business and an expense for the proprietor. The following adjustment entries are made:

(i) Capital Account Dr.

To Interest on Drawings Account

(ii) Interest on Drawings Account Dr.

To Profit and Loss Account

– It is credited to the profit and loss account and

– Shown on the liabilities side of the balance sheet by way of deduction from capital.

(XIII) ACCIDENTAL LOSS OF AN ASSET

When asset is not insured:

Sometimes asset of the organization may be destroyed due to earthquake, fire or accidents. The firm has to bear the entire loss if the asset is not insured. The following entries are passed to make adjustments for loss:

(a) When loss is incurred due to accident

Accidental Loss Account Dr.

To Asset Account

(b) When loss is transferred to profit and loss account

Profit and Loss Account Dr.

To Accidental Loss Account

When asset is insured:

When the asset destroyed by accident is insured, then the firm will not have to bear the entire loss. The insurance company will pay certain amount on loss of the asset. The amount of loss will be reduced to the extent of amount recovered from the insurance company. The difference in the book value of asset on the date of accident and the amount of claim admitted by the insurance company is the loss suffered by the company. This loss will be transferred to the profit and loss account.

On admission of claim:

Insurance Company Dr.

To Asset Account

On receipt of money claimed:

Bank Dr.

To Insurance Company

On transfer of loss:

Profit and Loss Account Dr.

To Asset Account

(XIV) ACCIDENTAL LOSS OF STOCK

Sometimes, stock in trade is lost due to fire or theft. If the firm has insured the stock, then loss can be made good fully or partly by the insurance company. The following adjustment entries are passed:

(a) If the stock is fully insured, the whole loss is fully recoverable from the insurance company. The journal entry is:

Insurance Company Account Dr.

To Trading Account

Insurance company account is shown on the credit side of the trading account and in the balance sheet it is treated as an asset until the amount is received.

(b) If the stock is not fully insured, the loss of stock covered by the insurance policy will be claimed from the insurance company and the rest will be treated as a loss. The journal entry in this case is:

Insurance Company Account Dr.

Profit and Loss Account Dr.

To Trading Account

(c) If the stock is not insured, nothing is recoverable from insurance company and the whole loss will be borne by the firm. The journal entry is:

Profit and Loss Account Dr.

To Trading Account

In all cases, trading account is credited with the gross amount of stock lost.

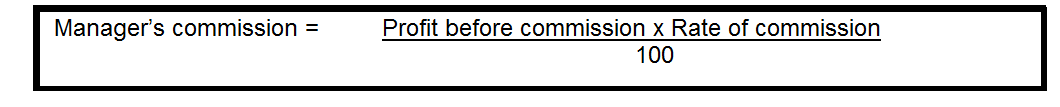

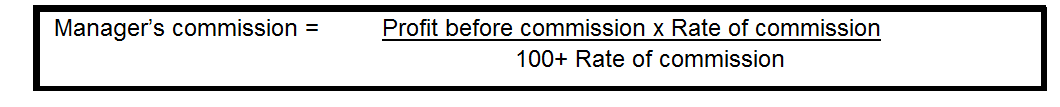

(XV) MANAGER’S COMMISSION ON NET PROFITS

Sometimes, the manager of a business is given a commission based on a fixed percentage of the net profit of the business. The adjustment entry for such commission payable is as follows:

Profit and Loss Account Dr.

To Commission Payable Account

– The commission payable is shown on the debit side of the profit and loss account and on the liabilities side of the balance sheet.

Calculation of Commission: It can be calculated in following two ways.

(a) Commission as a percentage of net profits before charging such commission

(b) Commission as percentage of net profits after charging such commission

(XVI) GOODS DISTRIBUTED AS FREE SAMPLES

Sometimes, in order to promote the sale of goods, some of the produced goods are distributed as free samples. It may be treated like an expenditure on advertisement and the following adjustment entry is passed:

Free Samples/Advertisement Account Dr.

To Trading/Purchases Account

– It is shown on the credit side of the trading account or deducted from the purchases and

– It is also shown on the debit side of profit and loss account as free samples or advertisement expense.

(XVII) DRAWINGS OF GOODS BY THE PROPRIETOR FOR PERSONAL USE

If goods have been withdrawn by the proprietor for personal use and no entry has been passed during the year, the following adjustment entry should be passed:

Drawings Account Dr.

To Purchases Account/ Trading Account

– Goods are deducted from the purchases on the debit side of the trading account or shown on the credit side of trading account and

– They are included in proprietor’s drawings which are ultimately deducted from the capital shown on the liabilities side of the balance sheet.

(XVIII) DEFERRED REVENUE EXPENDITURE

The expenditure which is incurred in one year but the benefit of which is available in a few subsequent years also is called deferred revenue expenditure. Part of such expenditure is written off each year and the rest is capitalized. The adjustment entry to write off this expenditure is as follows:

Profit and Loss Account Dr.

To (Respective) Expense Account

The written off amount is debited to profit and loss account and shown as a deduction from the capitalized expense in the balance sheet.

(XIX) GOODS ON SALE ON APPROVAL BASIS

Sometimes goods are sold to customers on approval basis. If consent is not received during the accounting period, it cannot be treated as sale. In such a case, the following adjustment entries are passed:

(i) Sales Account Dr.

To Debtors Account (with sale price)

(ii) Stock Account Dr.

To Trading Account (at cost price)

Thus, this item is shown on the credit side of trading account by way of deduction from the sales at sale price and added to the closing stock at cost price. At the same time, it is shown on the asset side as a deduction from sundry debtors at sale price and added to the closing stock at cost price.

(XX) GOODS RECEIVED BUT NOT RECORDED IN BOOKS

Often, goods may have been received but invoice has not been received or omitted to be recorded. In such a case, the following adjustment entry should be passed.

Profit and Loss Account Dr.

To General Reserve

General Reserve is shown on the debit side of Profit and Loss (Appropriation) Account and

It is shown on the liabilities side of the Balance Sheet.

(XXIII) CASH DISCOUNT

Cash discount is allowed and received for prompt payment. When cash discount is allowed to a cuctomer, a less amount is accepted as a full payment of a debt. Similarly when cash discount is received, a less amount is paid in full discharge of a liability. Discount allowed is debited to discount allowed account, cash received is debited to cash account and the total amount is credited to debtor making the payment. Discount received is credited to discount received account, cash paid is credited to cash account and the total of the two is debited to the creditor to whom the payment is made.

(XXIV) TRADE DISCOUNT

Trade discount is a deduction from the list (or catalogue) price allowed by the manufacturers to the wholesalers or by the wholesalers to the retailers for various reasons. The rate of trade discount allowed varies considerably. From accounting point of view no entries are made either in seller’s books or in the purchaser’s books for such a discount. Entries for purchases and sales are made at net price i.e. after deducting trade discount from the list price.

(