Adjustment Regarding Capitals of Partners :

It is often agreed that after the admission of a new partner, capitals of all the partners should be in proportion to their respective shares in profit. The basis may be the amount of capital brought in by the new partner or the new partner himself may be required to bring in capital equal to his share in the firm. If the new partner’s capital is given, the total capital of the firm should be ascertained on that basis. Then, the capital required for each one of the old partners should be ascertained and it should be compared with the actual balances in the accounts of the partners concerned, adjustments may then be made in cash or through current accounts to bring the balances of capital accounts of all the old partners to the desired figures. Suppose, C brings in Rs.10,000 for 1/5th share of profits. Total capital of the firm should be Rs.10,000 x 5 or Rs.50,000. If A and B are to share profits as to A 1/2 and B 3/10

then A’s capital account should show a balance of Rs.50,000 x 1/2 orRs.25,000 and B’s capital should show a balance of Rs.50,000 x 3/10 or Rs.15,000. If A’s capital account shows a balance of Rs.24,000 and the capital account of B shows a balance of ` 16,500, A will bring in Rs.1,000 and B will withdraw Rs.1,500.

Alternatively, the new partner may be required to bring capital on the basis of capital of old partners.

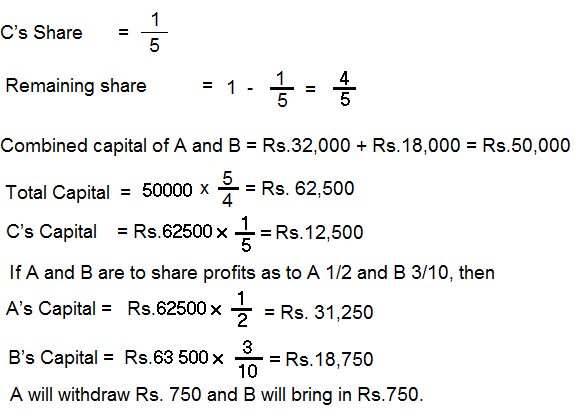

Suppose, the capital accounts A and B after all adjustments are Rs.32,000 and Rs.18,000 respectively and C is admitted as a new partner to whom 1/5th share of profits is given. Then

Illustration:

On 31st March, 2013 the following was the Balance Sheet of A and B who were equal partners:

| Liabilities | Rs. | Assets | Rs. |

| Sundry Creditors | 8,940 | Cash in hand | 950 |

| General Reserve | 10,000 | Stock | 32,710 |

| A’s Capital Account | 35,000 | Debtors 11000 | |

| B’s Capital Account | 20,000 | Less: Provision for Bad Debts 220 , | 10,780 |

| Furniture and Fittings | 9,500 | ||

| _________ | Land and Buildings | 20,000 | |

| 73,940 | 73,940 |

On 1st April 2013, C was admitted as a new partner on the following conditions:

(i) A, B and C share profits and losses in the ratio 4:3:2 respectively.

(ii) Prior to C’s admission appreciation of Rs.15,000 in the value of land and buildings would be recorded

and provision for bad debts would be brought upto Rs. 820.

(iii) C would bring Rs.20,000 in cash as his capital.

Pass journal entries to record the abovementioned transactions and show the balance sheet of firm immediately after C’s admission.

Solution :

Journal Entries

Dr. Cr.

| Particulars | Rs | Rs. |

| General Reserve Dr. | 10,000 | |

| To A’s Capital Account | 5,000 | |

| To B’s Capital Account | 5,000 | |

| (Transfer of general reserve to old partners in old profit sharing ratio) | ||

| Land and Building Account Dr. | 15,000 | |

| To Revaluation Account | 15,000 | |

| (Appreciation in the value of land and buildings as agreed on admission of C as a new partner)._____ | ||

| Revaluation Account Dr. | 600 | |

| To Provision for Bad Debts | 600 | |

| (Increase in provision for bad Debts by ` 600)_______ | ||

| 14,400 | ||

| Revaluation Account Dr. | 7,200 | |

| To A’s Capital Account | 7,200 | |

| To B’s Capital Account | ||

| (Transfer of net profit on revaluation to old Partners’ capital accounts in old profits sharing ratio)_ | ||

| 20,000 | ||

| Bank Dr. | 20,000 | |

| To C’s Capital Account | ||

| (Amount brought in by C as in his capital)_____________ | ||

Balance Sheet of A, B and C as on 1st April, 2013

| Liabilities | Assets | ||

| Sundry Creditors | 8,940 | Cash | 20,950 |

| A’s Capital Account | 47,200 | Stock | 32,710 |

| B’s Capital Account | 32,200 | Debtors 11,000 | |

| C’s Capital Account | 20,000 | Less: Provision for Bad Debts , 820 | 10,180 |

| Furniture and Fittings | 9,500 | ||

| ————- | Land and Buildings | 35,000 | |

| 1,08,340 | 1,08,340 |

Revaluation Account

Dr. Cr.

| Liabilities | Rs. | Assets | Rs. |

| To Provision for Bad Debts | 600 | By Land and Buildings | 15,000 |

| To A’s Capital Account | 7,200 | ||

| To B’s Capital Account | 7,200 | ||

| 15,000 | 15,000 |

Dr. Capital Accounts Cr.

|

Particulars |

A

Rs. |

B

Rs. |

C

Rs. |

Particulars | A

Rs. |

B

Rs. |

C Rs. |

| To Balance c/d |

47,200 |

32,200 |

20,000 |

By Balance b/fd |

35,000 |

20,000 |

|

| By General |

5,000 |

5,000 |

|||||

| Reserve | |||||||

| By Revaluation |

7,200 |

7,200 |

|||||

| By Cash |

20,000 |

||||||

|

47,200 |

32,200 |

20,000 |

47,200 |

32,200 |

20,000 |

||

| By Balance b/d |

47,200 |

32,200 |

20,000 |

If the values of assets and liabilities were not to be changed, the following would have been the solution:

Journal Entries

|

Particulars |

Dr. (Rs.) |

Cr. (Rs) |

| General Reserve Dr. |

10,000 |

|

| To A’s Capital Account |

5,000 |

|

| To B’s Capital Account |

5,000 |

|

| (Transfer of general reserve to old partners in old profit sharing ratio) | ||

| Memorandum Revaluation Account Dr. |

14,400 |

|

| To A’s Capital Account |

7,200 |

|

| To A’s Capital Account |

7,200 |

|

| (Record of profit on revaluation) | ||

| Bank Dr. |

20,000 |

|

| To C’s Account |

20,000 |

|

| (Amount brought in by C as his capital) | ||

| A’s Capital Account Dr. |

6,400 |

|

| B’s Capital Account Dr. |

4,800 |

|

| C’s Capital Account Dr. |

3,200 |

|

| To Memorandum Revaluation Account |

14,400 |

|

| (Transfer of Memorandum Revaluation Account after C’s admission to all the partners’ capital accounts in the new profit sharing ratio) | ||

Balance Sheet of A, B and C on 1st April, 2013

|

Liabilities |

Rs. |

Assets |

Rs. |

| Sundry Creditors |

8,940 |

Cash |

20,950 |

| A’s Capital account |

40,800 |

Stock |

32,710 |

| B’s Capital Account |

27,400 |

Debtors 11,000 | |

| C’s Capital Account |

16,800 |

Less: Provision | |

| for Bad Debts 220 |

10,780 |

||

| Furniture and Fittings |

9,500 |

||

|

________ |

Land and Buildings |

20,000 |

|

|

93,940 |

93,940 |

Working Notes:

Memorandum Revaluation Account

Dr. Cr.

|

|

|||

|

Particulars |

Rs. | Particulars |

Rs. |

| To A’s Capital Account |

7,200 |

By A’s Capital account |

6,400 |

| To B’s Capital Account |

7,200 |

By B’s Capital Account |

4,800 |

|

________ |

By C’s Capital Account |

3,200 |

|

|

14.400 |

14.400 |

Dr. Capital Accounts Cr.

|

Particulars |

A

Rs() |

B (Rs) |

C (Rs) |

Particulars | A

(Rs) |

B (Rs) |

C |

| To Memorandum |

6,400 |

4,800 |

3,200 |

By Balance b/fd |

35,000 |

20,000 |

|

| Revaluation A/c | |||||||

| To Balance c/d |

40,800 |

27,400 |

16,800 |

By General |

5,000 |

5,000 |

|

| Reserve | |||||||

| By Revaluation |

7,200 |

7,200 |

|||||

| By Bank |

20,000 |

||||||

|

47,200 |

32,200 |

20,000 |

47,200 |

32,200 |

20,000 |

||

| By Balance b/d |

40,800 |

27,400 |

16,800 |

Illustration :

On 31st March, 2013 the following was the balance sheet of P and Q who were carrying on business in partnership sharing profits and losses in the ratio of 5:3 respectively.

|

Liabilities |

Rs. | Assets |

Rs. |

| Sundry Creditors |

10,900 |

Furniture and Fittings |

15,000 |

| Capital Accounts | Stock |

48,000 |

|

| P |

45,000 |

Sundry Debtors |

16,500 |

| Q |

27,000 |

Cash |

3 400 |

|

82,900 |

82,900 |

On 1st April, 2013 R is admitted to the firm as a new partner, the new profit sharing ratio among P, Q and R is agreed upon as 7:5:4 respectively. R brings in ` 24,000 as his capital. R’s share of goodwill is fixed at RS.5,000.

Show journal entries and balance sheet immediately after R’s admission in each of the following cases:

(a) R brings cash for his share of goodwill and the old partners withdraw half of the amounts credited to their accounts for goodwill brought in by R.

(b) R does not bring anything by way of his share of goodwill.

(c) R brings Rs.3,000 as his share of goodwill and an adjustment in capital accounts is made for the balance amount.

Solution:

Case (a):

Journal Entries

| Particulars | Dr. (Rs.) | Cr. (Rs.) |

| Bank Dr. | 24,000 | |

| To R’s Capital A/c | 24,000 | |

| (Amount brought in by R as his capital) | ||

| Bank Dr. | 5,000 | |

| To P’s Capital Account | 3,750 | |

| To Q’s Capital Account | 1,250 | |

| P’s Capital Account Dr. | 1,875 | |

| Q’s Capital Account Dr. | 625 | |

| To Bank | 2,500 | |

| (Half of the amount of goodwill credited to old partners withdrawn by them in cash) |

Balance Sheet of P, Q and R as on 1st April, 2013

| Liabilities | Rs. | assets | Rs. |

| Sundry Creditors | 10,900 | Furniture and Fittings | 15,000 |

| Capital Accounts | Stock | 48,000 | |

| P | 46,875 | Sundry Debtors | 16,500 |

| Q | 27,625 | Bank | 29,900 |

| R | 24,000 | _______ | |

| 1,09,400 | 1,09,400 |

Case (b):

Journal Entries

| Particulars | Rs. | Rs. |

| Bank Dr. | 24,000 | |

| To R’s Capital Account | 24,000 | |

| (Capital brought in by R) | ||

| R’s Capital Account Dr. | 5,000 | |

| To P’s Capital Account | 3,750 | |

| To Q’s Capital Account | 1,250 | |

| (Being R’s share of goodwill credited to old partners’ capital account in the sacrificing ratio on his admission, credit being given to old partners in their ratio of sacrifice). |

Balance Sheet of P,Q and R as on 1st April, 2013

| Liabilities | Rs. | Assets | Rs. |

| Sundry Creditors | 10,900 | Furniture and Fittings | 15,000 |

| P | 48,750 | Stock | 48,000 |

| Q | 28,250 | Sundry Debtors | 16,500 |

| R | 19,000 | Cash | 27,400 |

| 1,06,900 | 1,06,900 |

Case (c):

Journal Entries

| Particulars | Rs.. | Rs.. |

| Bank Dr. | 24,000 | |

| To R’s Capital Account | 24,000 | |

| (Capital brought in by R) | ||

| Bank Dr. | 3,000 | |

| To P’s Capital Account | 2,250 | |

| To Q’s Capital Account | 750 | |

| (Being the amount of goodwill brought in by R credited to old partners in sacrificing ratio) | ||

| R’s Capital Account Dr. | 2,000 | |

| To P’s Capital Account | 1,500 | |

| To Q’s Capital Account | 500 | |

| (Being portion of R’s share of goodwill adjusted through the capital accounts by debiting new partner’s capital account and credited to old partners’ capital accounts in the sacrificing ratio.) |

Balance Sheet of P, Q and R

as on 1st April, 2013

| Liabilities | Rs. | Assets | Rs. |

| Sundry Creditors | 10,900 | Furniture and Fittings | 15,000 |

| Capital Accounts | Stock | 48,000 | |

| P | 48,750 | Sundry Debtors | 16,500 |

| Q | 28,250 | Bank | 30,400 |

| R | 22,000 | ______ | |

| 1,09,900 | 1,09,900 |

Illustration:

A and B sharing profits in proportion of three-fourth and one-fourth showed the following as their Balance Sheet as on 31st March, 2013:

| Liabilities | Rs. | Assets | Rs. |

| Creditors | 375,000 | Cash at Bank | 2,25,000 |

| General Reserve | 40,000 | Bills Receivable | 30,000 |

| Capital Account: | Debtors | 1,60,000 | |

| A `3,00,000 | Stock | 2,00,000 | |

| B `1,60,000 | Office Furniture | 10,000 | |

| 4,60,000 | Land and Buildings | 2,50,000 | |

| 8,75,000 | 8,75,000 |

They admit C into partnership on 1st April, 2013 on the following terms:

(1) That C pays Rs.10,000 as his capital for a fifth share in the future profits.

(2) That goodwill of the new firm is valued at ` 20,000 and C brings his share of goodwill in cash.

(3) That a stock and furniture be reduced by 10% and a 5% provision for doubtful debts is created on debtors.

(4) That the value of land and buildings be appreciated by 20%.

(5) That the capital accounts of all the partners be re-adjusted on the basis of their profits-sharing arrangement and any additional amount be immediately withdrawn by them.

Pass the journal entries; prepare the Profit and Loss Adjustment Account (Revaluation Account), Partners’ capital accounts and the opening Balance Sheet of the new firm.

| Particulars | Rs. | Rs. |

| Profit and Loss Adjustment Account Dr. | 29,000 | |

| To Stock | 20,000 | |

| To Office Furniture | 1,000 | |

| To Provision for doubtful debts | 8,000 | |

| (Adjustment for writing down the values of assets) | ||

| Land and Buildings Account Dr. | 50,000 | |

| To Profit and Loss Adjustment Account | 50,000 | |

| (Adjustment for appreciation in the value of Land and Buildings) | ||

| General Reserve Account Dr. | 40,000 | |

| To A’s capital Account | 30,000 | |

| To B’s Capital Account | 10,000 | |

| (Transfer of General Reserve to partners’ capital accounts in the profit sharing ratio) | ||

| Profit and Loss Adjustment Account Dr. | 21,000 | |

| To A’s Capital Account | 15,750 | |

| To B’s Capital Account | 5,250 | |

| (Transfer of profit arising from adjustments to partners’ capital accounts in their profit-sharing proportions) | ||

| Bank Dr. | 1,40,000 | |

| To C’s Capital Account | 1,40,000 | |

| (Amount brought in by C as his share capital and ¼th share of goodwill) | ||

| C’s Capital Account Dr. | 40,000 | |

| To A’s Capital Account | 30,000 | |

| To B’s Capital Account | 10,000 | |

| (Share of goodwill brought in by the incoming partner credited to old partners in their sacrificing ratio) | ||

| A’s Capital Account Dr. | 75,750 | |

| To Bank | 75,750 | |

| (Withdrawal of excess of capital over profitsharing proportion) | ||

| B’s Capital Account Dr. | 85,250 | |

| To Bank | 85,250 | |

| (Withdrawal of excess of capital over his profit sharing proportion) |

Profit and Loss Adjustment account

Dr. Cr.

| Particulars | Rs. | Particulars | Rs. |

| To Stock | 20,000 | By Land and Buildings | 5,000 |

| To Office Furniture | 1,000 | ||

| To Provision for Doubtful Debts | 8,000 | ||

| To Transfer of Profits of Capital | |||

| Accounts: Rs. | |||

| A 3/4th 15,750 | |||

| B 1/4th 5,250 | 21,000 | _________ | |

| 50,000 | 50,000 |

Dr. A’s Capital Account Cr.

|

Particulars |

Rs. | Particulars |

Rs. |

| To Bank |

75,750 |

By Balance b/fd |

3,00,000 |

| To Balance c/d |

3,00,000 |

By General Reserve |

30,000 |

| By Profit and Loss | |||

| Adjustment A/c |

15,750 |

||

|

________ |

By C’s Capital A/c |

30,000 |

|

|

3 75 750 |

3 75 750 |

||

| By Balance b/d |

3,00,000 |

Dr. . B’s Capital Account Cr.

|

Particulars |

Rs. | Particulars |

Rs. |

| To Bank |

85,250 |

By Balance b/fd |

1,60,000 |

| To Balance c/d |

1,00,000 |

By General Reserve |

10,000 |

| By Profit and Loss | |||

| Adjustment A/c |

5,250 |

||

| By C’s Capital A/c |

10,000 |

||

|

1 ,85 250 |

1 85 250 |

||

| By Balance b/d |

1,00,000 |

C’s Capital Account

Dr. Cr.

|

Particulars |

Rs. | Particulars |

Rs. |

|

| To A’s Capital A/c |

30,000 |

By Bank |

1,40,000 |

|

| To B’s Capital A/c |

10,000 |

|||

| To Balance c/d |

1 00 000 |

|||

|

1 40 000 |

1 40 000 |

|||

| By Balance b/d |

1,00,000 |

Balance Sheet of A, B and C

as at 1st April, 2013

|

Liabilities |

Rs. | Rs. | Assets | Rs. |

Rs. |

| Sundry Creditors |

3,75,000 |

Cash at Bank |

2,04,000 |

||

| Capital Account: | Bills Receivable |

30,000 |

|||

| A |

30,0,000 |

Office Furniture |

9,000 |

||

| B |

1,00,000 |

Sundry Debtors |

1,60,000 |

||

| C |

1 00 000 |

5,00,000 |

Less: Provision for | ||

| Doubtful Debts | |||||

| @ 5% |

8,000 |

1,52,000 |

|||

| Stock |

1,80,000 |

||||

|

_________ |

Land and Building |

3 00 000 |

|||

|

8 75 000 |

8 75 000 |

Note: from the above balance sheet, it is clear that the capitals of the partners now bear the same proportions as their profit sharing arrangement.

Ajay and Binoy are partners in a firm sharing profits and losses in the ratio of 2:1 respectively. On 31st March, 2013 their balance sheet stood as follows:

|

Liabilities |

(Z) | Assets |

(Z) |

| Bills payable |

6,000 |

Cash at bank |

90,000 |

| Sundry creditors |

90,000 |

Bills receivable |

20,000 |

| General reserve |

42,000 |

Sundry debtors |

1,00,000 |

| Ajay’s capital |

2,82,000 |

Stock |

1,60,000 |

| Binoy’s capital |

2,40,000 |

Furniture |

40,000 |

|

_________ |

Machinery |

2,50,000 |

|

|

6,60,000 |

6,60,000 |

On 1st April 2013, a new partner Harry is admitted into partnership on the following terms:

N That Harry brings in cash r 60,000 as goodwill for his one-third share in future profits.

- That Harry brings such an amount that his capital will be one-third of total capital of the new firm.

- That the value of stock be raised to Z 1,68,000.

- That furniture and machinery be depreciated by 5% and 10% respectively.

- That a provision for doubtful debts be created at 5% on sundry debtors.

- That the capital accounts of the partners be re-adjusted on the basis of their profit sharing ratio through their current accounts.

Prepare the necessary ledger accounts and the opening balance sheet of the new firm.

Solution:

Revaluation Account

Dr. Cr.

| Date | Particulars | Rs. | Particulars | Rs. |

| To Furniture A/c | 2,000 | By Stock A/c | 8,000 | |

| To Machinery A/c | 25,000 | By Ajay’s Capital A/c(2/3 loss) | 16,000 | |

| To Provision for doubtful debts A/c | 5,000 | By Binoy’s Capital A/c (1/3 loss) | 8,000 | |

| 32,000 | 32,000 |

Capital Accounts

Dr. Cr.

| Particulars | Ajay | Binoy | Harry | Particulars | Ajay | Binoy | Harry |

| To Revaluation A/c (Loss) |

16,000 | 8,000 | – | By Balance b/fd | 2,82,000 | 2,40,000 | – |

| To Ajay’s Capital A/c (Goodwill) | – | – | 40,000 | By General Reserve | 28,000 | 14,000 | |

| To Binoy’s Capital A/c (Goodwill) |

– | – | 20,000 | By Bank (Goodwill) | – | – | 60,000 |

| To Binoy’s Current A/c | – | 66,000 | – | By Harry’s Capital A/c (Goodwill) | 40,000 | 20,000 | – |

| To Balance c/d | 4,00,000 | 2,00,000 | 3,00,000 | By Bank | – | – | 3,00,000 |

| By Ajay’s Current A/c | 66,000 | – | – | ||||

| 4,16,000 | 2,74,000 | 3,60,000 | 4,16,000 | 2,74,000 | 3,60,000 | ||

Balance Sheet of Ajay, Binoy and Harry

as on 1st April, 2013

| Liabilities | Rs. | Assets | Rs. |

| Bills Payable | 6,000 | Cash at Bank | 4,50,000 |

| Sundry Creditors | 90,000 | Bills Receivables ` | 20,000 |

| Binoy’s Current A/c | 66,000 | Sundry Debtors 1,00,000 | |

| Ajay’s Capital A/c | 4,00,000 | Less : Provision for | |

| Binoy’s Capital A/c | 2,00,000 | Doubtful Debts 5,000 | 95,000 |

| Harry’s Capital A/c | 3,00,000 | Stock | 1,68,000 |

| Furniture | 38,000 | ||

| Machinery | 2,25,000 | ||

| ________ | Ajay’s Current Account | __66,000 | |

| 10,62,000 | 10,62,000 |

Working Notes:

(i) Calculation of Harry’s Capital

Total capital:

Ajay’s capital: Rs.(2,82,000 + 28,000 + 40,000 – 16,000) = Rs.3,34,000

Binoy’s capital: Rs.(2,40,000 + 14,000 + 20,000 – 8,000) = Rs.2,66,000

Total capital of Ajay and Binoy before Harry’s Admission = Rs.6,00,000

This capital is for 1-(1/3) = 2/3 share

So total capital of new firm (Rs.6,00,000 x 3/2) = Rs.9,00,000

Harry’s Capital = 1/3 x Rs.9, 00,000 = Rs.3,00,000

(ii) Calculation of new profit sharing ratio and capital of Ajay and Binoy:

Harry’s share = 1/3

Balance = 1-(1/3) = 2/3 to be shared by Ajay and Binoy

Ajay’s new share = 2/3 x 2/3 = 4/9

Binoy’s new share = 2/3 x 1/3 = 2/9

New profit share ratio = 4 : 2 : 3

Ajay’s capital in new firm = 4/9 x Rs.9,00,000 = Rs.4,00,000

Binoy’s capital in new firm = 2/9 x Rs.9,00,000 = Rs.2,00,000

Adjustment of capitals is made through partners’ current accounts

Sacrifice by Ajay = (2/3) – (4/9) = 2/9

Sacrifice by Binoy = (1/3) – (2/9) = 1/9

Sacrificing ratio = 2 : 1

So goodwill is distributed between Ajay and Binoy in the ratio of 2 : 1 respectively.

Illustration :

Bansal and Chandar were partners in a firm sharing profits and losses equally. Their balance sheet as on 31st March, 2013 was as follows:

| Liabilities | Rs. | Rs | Assets | Rs. |

| Sundry Creditors | 1,26,000 | Cash at Bank | 14,000 | |

| General Reserve | 70,000 | Debtors | 1,40,000 | |

| Capital Accounts: | Stock | 1,68,000 | ||

| Bansal | 2,10,000 | Furniture | 28,000 | |

| Chander | 1,68,000 | 3,78,000 | Buildings | 2,24,000 |

| 5,74,000 | 5,74,000 |

Sagar was admitted as a partner and was given one-fourth share of profits on the following terms:

– He would bring Rs.2,10,000 in cash as his capital.

– His share of goodwill was valued at Rs.70,000 but he was unable to bring it in cash.

– Stock and furniture be depreciation by 10%.

– A provision of 5% on debtors be created for doubtful debts.

– An amount of Rs.14,000 included in creditors not to be treated as a liability.

– A provision of Rs.7,000 be created against bills discounted.

– The buildings be treated as worth Rs.2,80,000.

It was agreed that except cash, the other assets and liabilities were to be shown at old figures in the balance sheet. Give journal entries to record the transactions and prepare Memorandum Revaluation Account and capital accounts of the partners. Also prepare the balance sheet after admission of Sagar.

Solution:

Journal Entries

| Particulars | Rs. | Rs. |

| General Reserve Account Dr. | 70,000 | |

| To Bansal’s Capital Account | 35,000 | |

| To Chander’s Capital Account | 35,000 | |

| (The transfer of general reserve to capital accounts of old partners in the old ratio) | ||

| Bank Dr. | 2,10,000 | |

| To Sagar’s Capital Account | 2,10,000 | |

| (The Amount brought in by Sagar as his capital) | ||

| Sagar’s Capital Account Dr. | 70,000 | |

| To Bansal’s Capital Account | 35,000 | |

| To Chander’s Capital Account | 35,000 | |

| (Sagar’s share of goodwill credited to old partners’ capital accounts in the ratio of sacrifice which is 1: 1) | ||

| Memorandum Revaluation A/c Dr. | 36,400 | |

| To Bansal’s Capital Account | 18,200 | |

| To Chander’s Capital Account | 18,200 | |

| (Profit on revaluation credited to the old partners in the old ratio) | ||

| Bansal’s Capital Account Dr. | 13,650 | |

| Chander’s Capital Account Dr. | 13,650 | |

| Sagar’s Capital Account Dr. | 9,100 | |

| To Memorandum Revaluation Account | 36,400 | |

| (Memorandum Revaluation Account closed by debiting all the partners in the new profit sharing ratio) |

Dr. Memorandum Revaluation Account Cr.

| Particulars | Rs. | Particulars | Rs. |

| To Provision for Doubtful Debts |

7,000 | By Buildings | 56,000 |

| To Stock | 16,800 | By Sundry Creditors | 14,000 |

| To Furniture | 2,800 | ||

| To Provision for Bills Discounted | 7,000 | ||

| To Profit transferred to : Rs. | |||

| Bansal ½ 18,200 | |||

| Chander ½ 18,200 | 36,400 | ________ | |

| 70,000 | 70,000 | ||

| To Buildings | 56,000 | By Provision for Doubtful Debts | 7,000 |

| To Sundry Creditors | 14,000 | By Stock | 16,800 |

| By Furniture | 2,800 |

| By Provision for Bills Discounted | 7,000 | ||

| By Loss transferred to: Rs | |||

| Bansal (3/8) 13,650 | |||

| Chander (3/8) 13,650 | |||

| Sagar(1/4) 9,100 | 36,400 | ||

| 70,000 | 70,000 |

Dr. Capital Accounts Cr.

|

Particulars |

Bansal (Rs.) |

Chander (Rs.) |

Sagar (Rs.) |

Particulars | Bansal (Rs.) |

Chander (Rs.) |

Sagar |

| To Bansal’s | By Balance | ||||||

| Capital A/c |

— |

— |

35,000 |

b/fd |

2,10,000 |

1,68,000 |

— |

| To Chander’s | By General | ||||||

| Capital A/c |

— |

— |

35,000 |

Reserve |

35,000 |

35,000 |

— |

| To | By Bank |

— |

— |

2,10,000 |

|||

| Memorandum | By Sagar’s | ||||||

| Revaluation | Capital A/c |

35,000 |

35,000 |

— |

|||

| A/c |

13,650 |

13,650 |

9,100 |

By | |||

| To Balance c/d |

Memorandum Revaluation | ||||||

|

2 84 550 |

2 42 550 |

1 30 900 |

A/c |

18,200 |

18,200 |

— |

|

|

2,98,200 |

2 56 200 |

2 10 000 |

2 98 005 |

2 56 200 |

2 10 000 |

||

| By Balance | |||||||

| b/d |

2,84,550 |

2,42,550 |

1,30,900 |

Balance Sheet of Mr. Bansal, Chander and Sagar as on 31st March, 2013

|

Liabilities |

Rs. | Assets |

Rs. |

| To Sundry Creditors |

1,26,000 |

By Cash at Bank |

2,24,000 |

| To Capital Accounts: Rs. | By Debtors |

1,40,000 |

|

| Bansal 2,84,550 | By Stock |

1,68,000 |

|

| Chander 2,42,550 | By Furniture |

28,000 |

|

| Sagar 1 30 900 |

6 58 000 |

By Buildings |

2 24 000 |

|

7 84 000 |

7 84 000 |