ADMISSION OF A NEW PARTNER :

A new partner can be admitted with the consent of all existing partners. The various reasons for admission of a new partner may be requirement of more capital, influence or managerial skill of the new partner etc.

A new partner may either purchase his share of profits from one or more of the existing partners or he may contribute to a share in the assets of the firm. In the former case, the total capital of the firm does not change; the amount brought in by the new partner is paid to the partners from whom share is purchased. In the latter case, however, the total capital of the firm is increased by the amount brought in by the new partner.

Suppose, A and B share profits and losses in the ratio of 2:1 respectively and their capitals stand at Rs.10,000 and Rs.5,000 respectively. If C is admitted and he buys 1/5th share from A, C will bring Rs.15,000 x1/5= or Rs. 3,000 in cash which will be withdrawn by A. The new balances of the capital accounts of A, B and C will be Rs. 7,000, Rs. 5,000 and 3,000 respectively. If C contributes to the capital for 1/5th share of profits, he will bring Rs. 15,000 x 5/4 x 1/5 = Rs. 3,750 Total capital of the new firm will be Total 18,750.

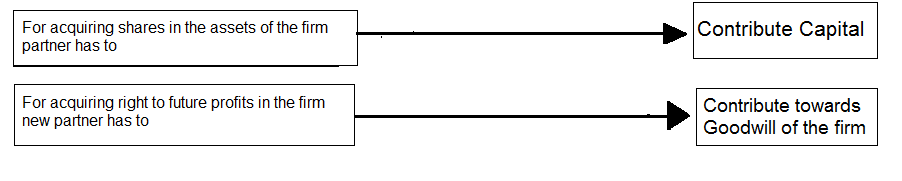

Admission of new partner results in the reconstitution of partnership firm, as a new agreement to carry on the business as a partnership firm comes into existence. When there is a change in the constitution of partnership, the profit sharing ratio of the existing partners may be revised. When a new partner is admitted, he is entitled to a share in the assets of the firm and in the future profits of the firm.

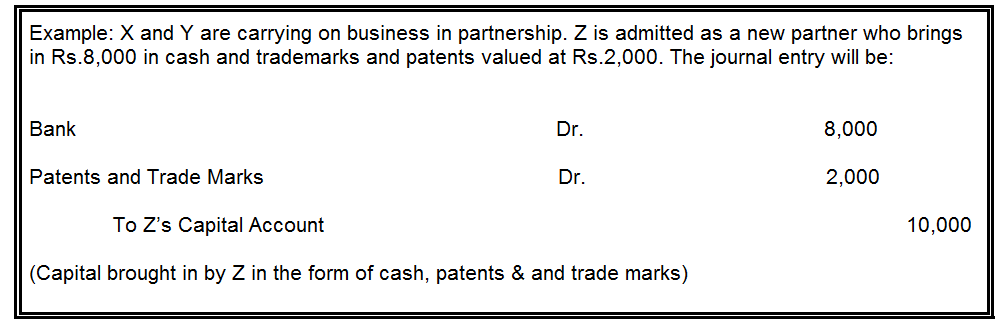

When a new partner is admitted, the amount may be contributed to the capital of the firm in the form of assets other than cash also. Journal entry will be :

When a new partner is admitted, the amount may be contributed to the capital of the firm in the form of assets other than cash also. Journal entry will be :

When a new partner is admitted, a number of things have to be done. Some of the major adjustments to be made are as follows:

–Calculation of new profit sharing ratio

–Calculation of sacrificing ratio

–Transfer of accumulated profits and reserves to existing partners

–Revaluation of assets and liabilities

–Treatment of goodwill