Anti-dumping duty [Section 9A of the Customs Tariff Act] :

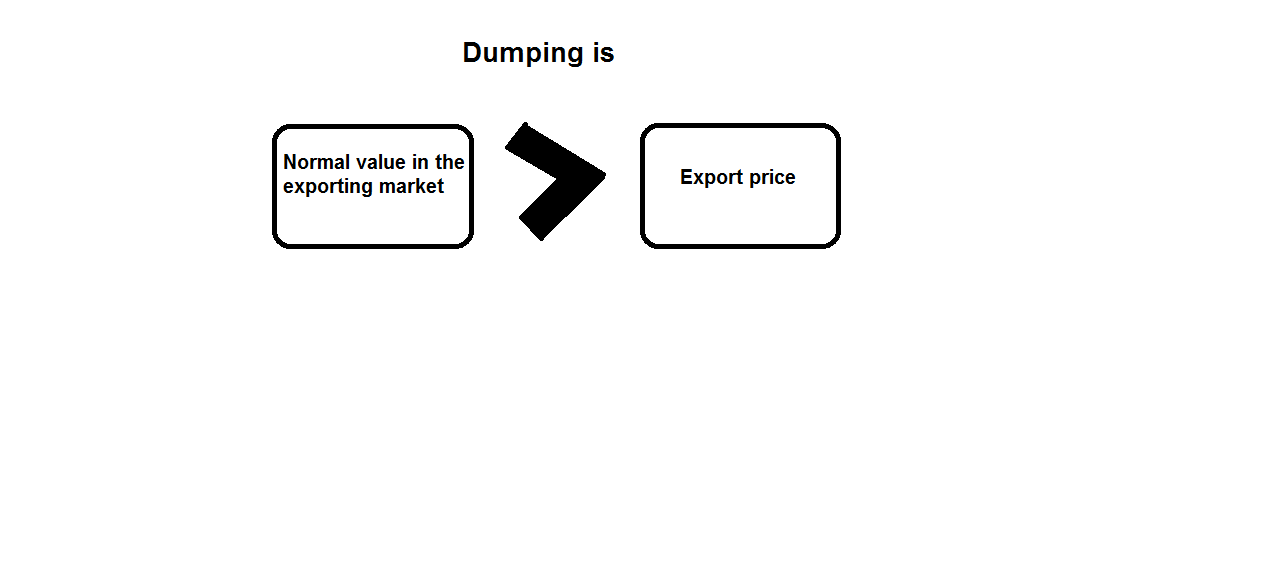

When the export price of a product imported into India is less than the Normal Value of ‘like articles‘ sold in the domestic market of the exporter , it is known as dumping. Although there is nothing inherently illegal or immoral in exporter charging a price less than the price prevailing in its domestic market, Designated Authority can initiate necessary action for investigations and subsequent imposition of anti-dumping duties, if such dumping causes or threatens to cause material injury to the domestic industry of India.

Anti-dumping action can be taken only when there is an Indian industry which produces “like articles” when compared to the allegedly dumped imported goods. Further, this duty is country specific i.e. it is imposed on imports from a particular country.

Under the General Agreement on Tariffs and Trade (GATT) provisions, anti-dumping duties higher than the margin of dumping cannot be imposed. However, a lesser duty which is adequate to remove the injury to the domestic industry, is permissible. In India, the Government is obliged to restrict the anti-dumping duty to the lower of the two i.e., dumping margin and the injury margin.

Section 9A(1) of the Customs Tariff Act, 1975 provides that where any article is exported by an exporter or producer from any country or territory (hereinafter in this section referred to as the exporting country or territory) to India at less than its normal value, then, upon the importation of such article into India, the Central Government may, by notification in the Official Gazette, impose an anti-dumping duty not exceeding the margin of dumping in relation to such article.

Every notification issued under this section shall as soon as may be after it is issued, be laid before each House of Parliament [Sub-section (7)]. Further, the provisions of the Customs Act, 1962 and the rules and regulations made thereunder, including those relating to the date for determination of rate of duty, assessment, non-levy, short levy, refunds, interest, appeals, offences and penalties shall, as far as may be, apply to the duty chargeable under this section as they apply in relation to duties leviable under that Act [Sub-section (8)].