Appearance by Authorised Representative [Section 288] :

1. Section 288 deals with appearance by authorised representative. Accordingly, any assessee who is entitled or required to attend before any income-tax authority of the Appellate Tribunal in connection with any proceeding under this Act otherwise than when required under section 131 to attend personally for examination on oath or affirmation, may attend by an authorised representative.

2. For the purpose of this section, “authorised representative” means, a person authorised by the assessee in writing to appear on his behalf. The following persons can be authorised representatives:

(a) A person related to the assessee in any manner by a person regularly employed by the assessee

(b) any officer of a Scheduled Bank with which the assessee maintains a current account or has other regular dealings

(c) any legal practitioner who is entitled to practice in any Civil Court in India

(d) an Accountant i.e., a chartered accountant as defined in section 2(1)(b) of the Chartered Accountants Act, 1949 who holds a valid certificate of practice under section 6(1) of that Act. However, the following persons are not included in the definition of accountant –

| Assessee | Person | ||||

| (i) | Company | A person who is not eligible for appointment as an auditor of the said company under section 141(3) of the Companies Act, 2013, namely, | |||

| (a) | A body corporate other than a limited liability partnership registered under the Limited Liability Partnership Act, 2008; | ||||

| (b) | an officer or employee of the company | ||||

| (c) | a person who is a partner, or who is in the employment, of an officer or employee of the company | ||||

| (d) | a person who, or his relative or partner – | ||||

| (i) | is holding any security of or interest in the company or its subsidiary, or of its holding or associate company or a subsidiary of such holding company | ||||

| (ii) | is indebted to the company, or its subsidiary, or its holding or associate company or a subsidiary of such holding company, in excess of Rs 5 lakh. | ||||

| (iii) | has given a guarantee or provided any security in connection with the indebtedness of any third person to the company, or its subsidiary, or its holding or associate company or a subsidiary of such holding company, in excess of Rs 1 lakh. | ||||

| (e) | a person or a firm who, whether directly or indirectly, has business relationship with the company, or its subsidiary, or its holding or associate company or subsidiary of such holding company or associate company of such nature as may be prescribed. | ||||

| (f) | a person whose relative is a director or is in the employment of the company as a director or key managerial personnel | ||||

| (g) | a person who is in full time employment elsewhere or a person or a partner of a firm holding appointment as its auditor, if such persons or partner is at the date of such appointment or reappointment holding appointment as auditor of more than 20 companies | ||||

| (h) | a person who has been convicted by a court of an offence involving fraud and a period of 10 years has not elapsed from the date of such conviction | ||||

| (i) | any person whose subsidiary or associate company or any other form of entity, is engaged as on the date of appointment in consulting and specialised services as provided in section 144 of the Companies Act, 2013. | ||||

| (ii) | Individual | The assessee himself or his relative | |||

| (iii) | Firm | Partner of the firm or his relative | |||

| (iv) | AOP | Member of the AOP or his relative | |||

| (v) | HUF | Member of the HUF or his relative | |||

| (vi) | Trust or Institution | (1) | The author of the trust or founder of the institution or his Relative | ||

| (2) | Any person who has made a substantial contribution to the trust or institution, i.e., any person whose total contribution upto the end of the relevant previous year exceeds Rs 50,000, or his relative | ||||

| (3) | Where such author, founder or person is a HUF, a member of the HUF or relative of such member | ||||

| (4) | Any trustee of the trust or manager of the institution, or relative of the trustee or manager | ||||

| (vii) | Any other person | The person who is competent to verify the return under section 139 in accordance with the provisions of section 140 or his relative. | |||

| (viii) | Any assessee referred to in (ii) to (vii) | (1) | An officer or employee of the assessee | ||

| (2) | An individual who is a partner, or who is in the employment, of an officer or employee of the assessee.

|

||||

| (3) | An individual who, or his relative or partner –

(I) is holding any security of, or interest in, the assessee4. (II) is indebted to the assessee5. (III) has given a guarantee or provided any security in connection with the indebtedness of any third person to the assessee. |

||||

| (4) | a person who, whether directly or indirectly, has business relationship with the assessee of such nature as may be prescribed. | ||||

| (5) | a person who has been convicted by a court of an offence involving fraud and a period of ten years has not elapsed from the date of such conviction. | ||||

However, the ineligibility for carrying out any audit or furnishing of any report/certificate in respect of an assessee shall not make an accountant ineligible for attending income-tax proceeding referred to in section 288(1) as authorised representative on behalf of that assessee.

(e) any person who has passed any accountancy examination recognised in this behalf by the Board. Rule 50 prescribes the accountancy examination recognised for this purpose. They are as follows:

(i) The National Diploma in Commerce awarded by the All India Council for Technical Education under the Ministry of Education, New Delhi, provided the diploma-holder has taken Advanced Accountancy and Auditing as an elective subject for the Diploma Examination

(ii) Government Diploma in Company Secretaryship awarded by the Department of Company Affairs under the Ministry of Industrial Development and Company Affairs, New Delhi

(iii) Final Examination of the Institute of Company Secretaries of India, New Delhi

(iv) The Final Examination of the Institute of Cost and Work Accountants of India constituted under the Cost and Works Accountants Act, 1959

(v) The Departmental Examination conducted by or on behalf of the Central Board of Direct Taxes for promotion

(vi) The Revenue Audit Examination for Section Officers conducted by the Office of the Comptroller and Auditor General of India

(f) any person who has acquired such education qualifications as the Board may, prescribe for this purpose. Rule 51 prescribes the concerned educational qualifications as follows:

A degree in Commerce or Law conferred by any of the following Universities:

(i) Indian Universities: Any Indian University incorporated by any law for the time being in force.

(ii) Rangoon University

(iii) English and Welsh Universities: The Universities of Birmingham, Bristol, Cambridge, Durham, Leeds, Liverpool, London, Manchester, Oxford, Reading, Sheffield and Wales

(iv) Scottish Universities: The Universities of Aberdeen, Edinburgh, Glasgow and St. Andrews

(v) Irish Universities: The Universities of Dublin (Trinity College), the Queen‘s University, Belfast and the National University of Dublin

(vi) Pakistan Universities: Any Pakistan University incorporated by any law for the time being in force.

3. The following persons shall not be qualified to represent an assessee:

(i) A person who has been dismissed or removed from government service.

(ii) A person who has been convicted of an offence connected with any income-tax proceeding or on whom a penalty has been imposed under this Act other than a penalty imposed on him under section 271(1)(ii) – In this case, the person will be disqualified for such time as the Principal Chief Commissioner or Chief Commissioner or the Principal Commissioner or Commissioner may, by order, determine.

(iii) A person has become insolvent – In this case, he will be disqualified for a period during which the insolvency continues.

(iv) A person convicted by a court of an offence involving fraud – He shall not be eligible to act as authorised representative for a period of 10 years from the date of such conviction.

4. If any person is a legal practitioner or an accountant and is found guilty of misconduct in his professional capacity by any authority entitled to institute disciplinary proceedings against him, an order passed by that authority shall have effect in relation to his right to attend before an income-tax authority as it has in relation to his right to practice as a legal practitioner or accountant.

5. If a person is not a legal practitioner or an accountant and is found guilty of misconduct in connection with any income-tax proceedings by the prescribed authority, the prescribed authority, may direct that he shall henceforth be disqualified to represent an assessee.

6. Before any order or direction of disqualification under point 3(ii) or 5 above is made, the following conditions must be satisfied :

(a) No such order or direction shall be made in respect of any person unless he has been given a reasonable opportunity of being heard

(b) any person against whom any such order or direction is made, may within one month of the making of the order or direction, may appeal to the Board to have the order or direction cancelled

(c) No such order or direction shall take effect until the expiration of one month from the making thereof or, where an appeal has been preferred, until the disposal of the appeal.

7. A person disqualified to represent an assessee under Indian Income-tax Act, 1922 shall stand disqualified under this Act also

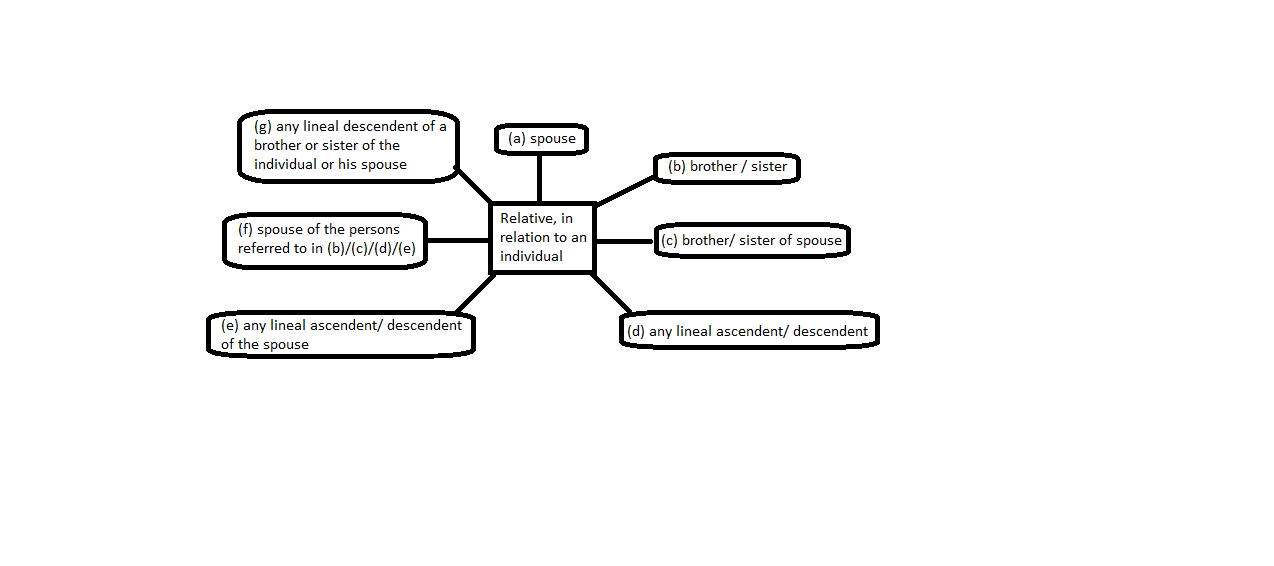

8. Meaning of the term “relative” for the purpose of section 288: