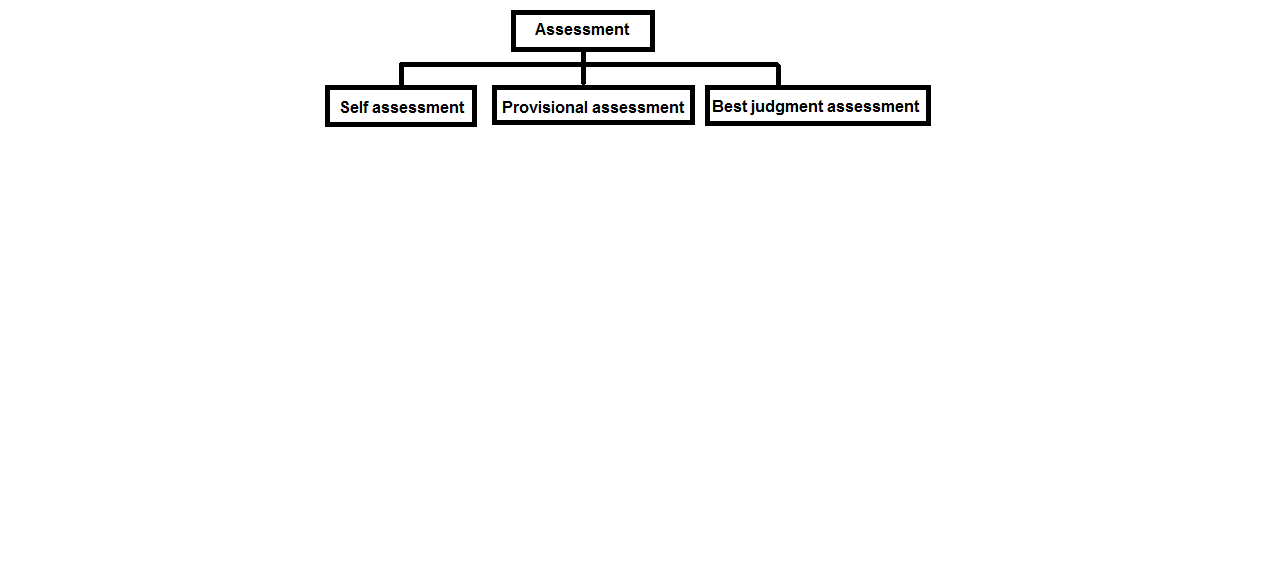

Assessment :

(1) Self assessment: Every person liable to pay the service tax shall himself assess the tax due on the services provided by him and shall furnish to the Superintendent of Central Excise, a return in prescribed manner.

(2) Provisional assessment [Sub-rule (4), (5) and (6) of rule 6 of the Service Tax Rules, 1994]: An assessee may make a request for provisional assessment of service tax if he is unable to correctly estimate the actual amounts of service tax payable for any month or quarter. The provisions of the Central Excise Rules, 2002 relating to provisional assessment shall apply except the provisions relating to execution of bond.

Procedure for provisional assessment

(a) Request for provisional assessment: The assessee shall make a request in writing to the Assistant Commissioner/Deputy Commissioner of Central Excise, as the case may be, to make a provisional payment of tax on the basis of the amount deposited.

(b) Order of provisional assessment of service tax: The Assistant Commissioner/Deputy Commissioner as the case may be, may, on receipt of such request, order provisional assessment of service tax.

(c) Memorandum in Form ST-3A to be submitted along with Form ST-3: In case of an assessee requesting for provisional assessment, he shall submit a memorandum in form ST-3A; giving details of difference between the provisional amount of service tax deposited and the actual amount of service tax payable for each month along with the half-yearly return in form ST-3.

(d) Finalization of provisional assessment: Where the assessee submits a memorandum in Form ST-3A, it shall be lawful of the Assistant Commissioner/Deputy Commissioner of Central Excise, as the case may be to complete the assessment, wherever he deems it necessary, after calling such further documents or records as he may consider necessary and proper in the circumstances of the case.

(3) Best judgment assessment [Section 72]: Section 72 empowers the Central Excise Officer to make best judgment assessment.

(A) Cases where Central excise officer is empowered to make best judgment assessment:Central excise officer can make best judgment assessment in the following two cases:-

If any person, liable to pay service tax,—

(a) fails to furnish the return under section 70 or

(b) having made a return, fails to assess the tax in accordance with the provisions of this Chapter or rules made thereunder.

(B) Procedure to be followed:-

1. Central Excise Officer would require the assessee to produce such accounts, documents or other evidence as he may deem necessary.

2. After taking into account all the relevant material which is available or which he has gathered, he shall issue notice to the assessee quantifying the value of taxable service to the best of his judgment, its basis for determination and service tax payable thereon.

3. The assessee shall be given an opportunity of being heard.

4. The Central Excise Officer shall pass an order in writing determining the sum payable/ refundable to the assessee on the basis of such assessment .