Classification of Accounts :

Transactions can be divided into three categories.

i. Transactions relating to individuals and firms

ii. Transactions relating to properties, goods or cash

iii. Transactions relating to expenses or losses and incomes or gains.

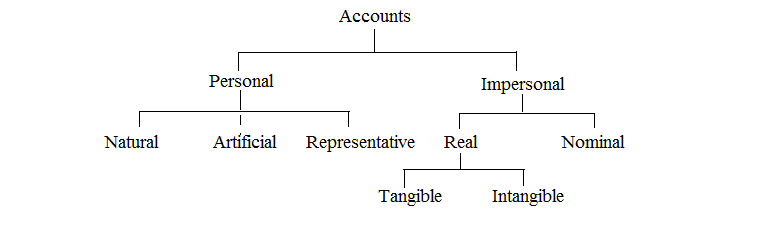

Therefore, accounts can also be classified into Personal, Real and Nominal. The classification may be illustrated as follows :

I. Personal Accounts : The accounts which relate to persons. Personal accounts include the following.

i. Natural Persons : Accounts which relate to individuals. For example, Mohan’s A/c, Shyam’s A/c etc.

ii. Artificial persons : Accounts which relate to a group of persons or firms or institutions. For example, HMT Ltd., Indian Overseas Bank, Life Insurance Corporation of India, Cosmopolitan club etc.

iii. Representative Persons: Accounts which represent a particular person or group of persons. For example, outstanding salary account, prepaid insurance account, etc.

The business concern may keep business relations with all the above personal accounts, because of buying goods from them or selling goods to them or borrowing from them or lending to them. Thus they become either Debtors or Creditors.

The proprietor being an individual his capital account and his drawings account are also personal accounts.

II. Impersonal Accounts: All those accounts which are not personal

accounts. This is further divided into two types viz. Real and Nominal

accounts.

i. Real Accounts: Accounts relating to properties and assets which are owned by the business concern. Real accounts include tangible and intangible accounts. For example, Land, Building, Goodwill, Purchases, etc.

ii. Nominal Accounts: These accounts do not have any existence, form or shape. They relate to incomes and expenses and gains and losses of a business concern. For example, Salary Account, Dividend Account, etc.