Classification of Assets and Liabilities :

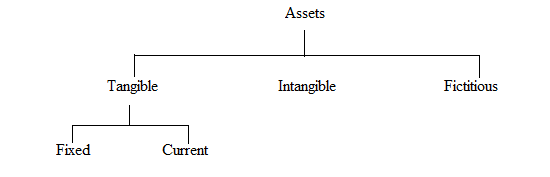

Assets

Assets represents everything which a business owns and has money value. In other words, asset includes possessions and properties of the business. Asset are classified as follows

a) Tangible Assets:

Assets which have some physical existence are known as tangible assets. They can be seen, touched and felt, e.g. Plant and Machinery Tangible assets are classified into

i. Fixed assets :

Assets which are permanent in nature having long period of life and cannot be converted into cash in a short period are termed as fixed assets.

ii. Current assets :

Assets which can be converted into cash in the ordinary course of business and are held for a short period is known as current assets.

This is also termed as floating assets. For example, cash in hand, cash at bank, sundry debtors etc.

b) Intangible Assets

The assets which have no physical existence and cannot be seen or felt. They help to generate revenue in future, e.g. goodwill, patents, trademarks etc.

c) Fictitious Assets

These assets are nothing but the unwritten off losses or non-recoupable expenses. They are really not assets but are worthless items. For example, Preliminary expenses.

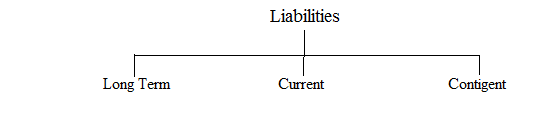

Liabilities

The amount which a business owes to others is liabilities. Credit balance of personal and real accounts together with the capital account are liabilities.

a) Long Term Liabilities

Liabilities which are repayable after a long period of time are known as Long Term Liabilities. For example, capital, long term loans etc.

b) Current Liabilities

Current liabilities are those which are repayable within a year. For example, creditors for goods purchased, short term loans etc.

c) Contingent liabilities

It is an anticipated liability which may or may not arise in future. For example, liability arising for bills discounted. Contigent liabilities will not appear in the balance sheet. But shown as foot note.