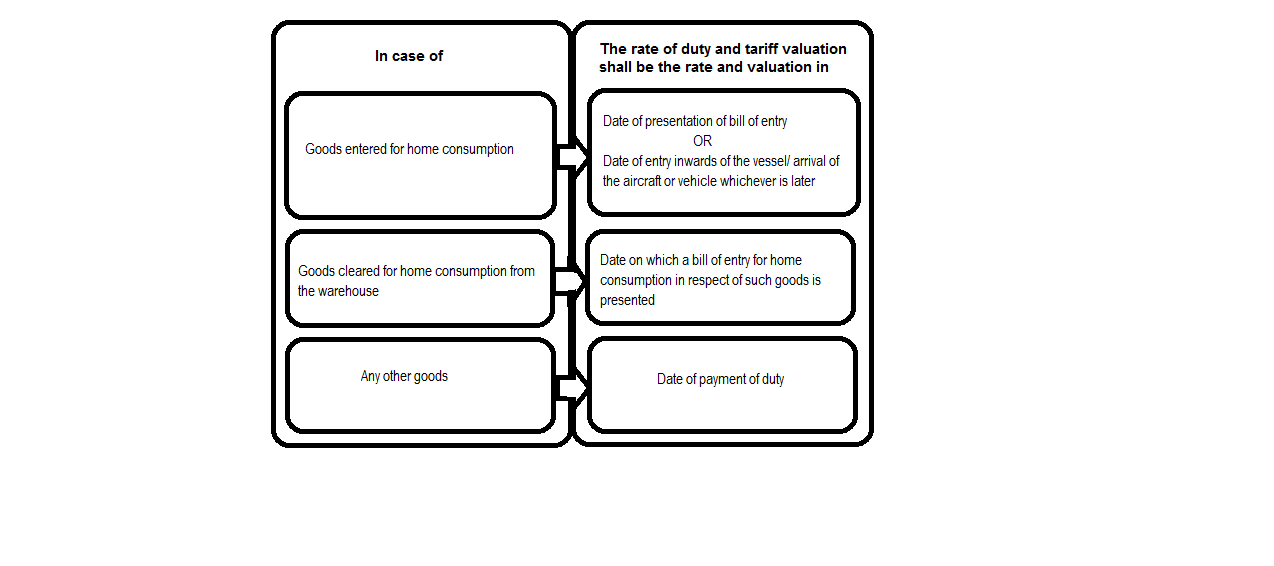

Date for determining the rate of duty and tariff valuation of imported goods [Section 15] :

Section 15 prescribes the relevant date for determining the rate of duty and tariff valuation, if any, applicable to any imported goods in the following manner:

| Example: Bill of entry is presented on 01.01.20XX, the vessel arrives on 03.01.20XX. In this situation, relevant date for determination of the rate of import duty is 03.01.20XX because though for procedural purposes, the Bill of Entry was filed on 01.01.20XX, for the purpose of determining the rate of duty and tariff valuation of such goods, Bill of Entry will be deemed to have been filed on 03.01.20XX. |

In respect of baggage and goods imported by post, the provisions of section 15 will not be applicable as they are independently covered by other sections.

Relevant case laws

Section 15 has generated a lot of interest in terms of case law development. In Bharat Surfacants Pvt. Ltd. v. UOI 1989 (43) ELT 189, the Supreme Court held that the rate of duty and tariff valuation would be done on the date of final entry of the ship. In this case, a ship entered Bombay and made prior entry on 4.7.81 at which time the duty was 12.5%. Since there was no space, the ship proceeded to Karachi and after that came back to Bombay on 23.7.81 and was granted final entry on 4.8.81 when the duty rate had been revised to 15.0%. The Supreme Court held that the rate applicable would be 15.0% only since the formality of entry inward could be done only on 4.8.81.

It would also be important to note that date of contract is not relevant and only the date of importation is relevant as per the decision of the Supreme Court in Rajkumar Knitting Mills P.Ltd vs CC 1998 (98) ELT 292.

It is also relevant to note that Section 15 deals with only the rate of duty and tariff valuation and not the valuation under section 14.