Definition of person liable to pay service tax under rule 2(1)(d):

As per rule 2(1)(d)(i) of Service Tax Rules, 1994, person liable to pay service tax in respect of the taxable services notified under sub-section (2) of section 68 of the Act means –

(A) in relation to service provided or agreed to be provided by an insurance agent to any person carrying on the insurance business, the recipient of the service.

(AA) in relation to service provided or agreed to be provided by a recovery agent to a banking company or a financial institution or a non-banking financial company, the recipient of the service.

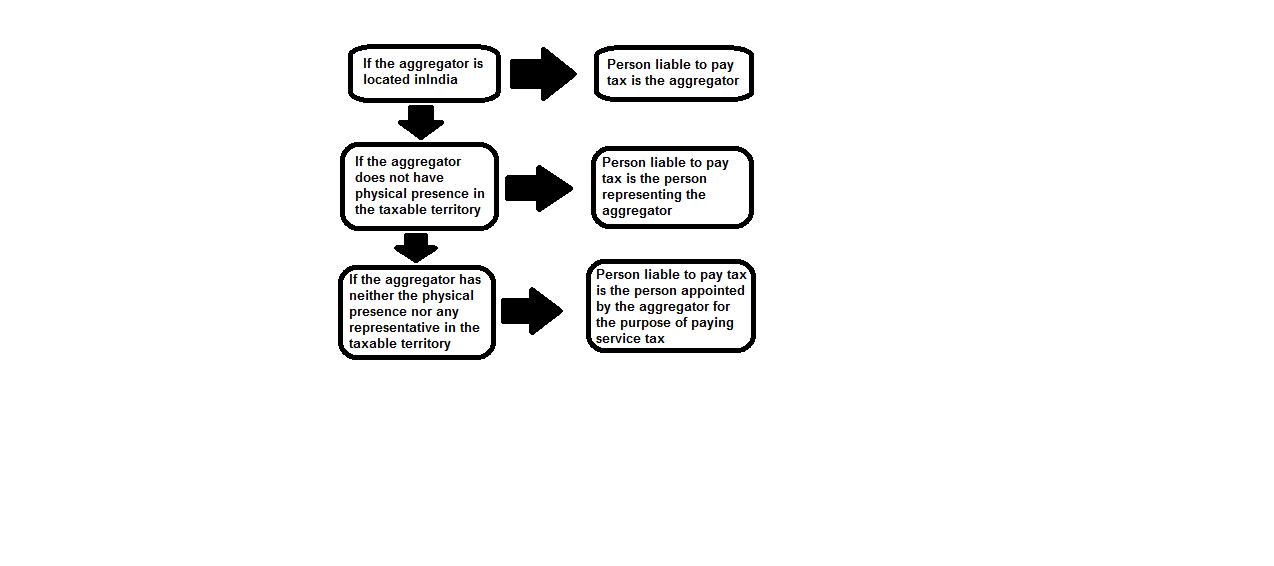

(AAA) in relation to service provided or agreed to be provided by a person involving an aggregator in any manner, the aggregator of the service would be the person liable for paying service tax.

In case, the aggregator does not have a physical presence in the taxable territory, any person representing the aggregator for any purpose in the taxable territory will be liable for paying service tax.

However, if the aggregator neither has a physical presence nor does it have a representative for any purpose in the taxable territory, it will have to appoint a person in the taxable territory for the purpose of paying service tax and such person will be the person liable for paying service tax.

The above has been represented in the diagram given.

(B) in relation to service provided or agreed to be provided by a goods transport agency in respect of transportation of goods by road, where the person liable to pay freight is,—

- any factory registered under or governed by the Factories Act, 1948;

- any society registered under the Societies Registration Act, 1860 or under any other law for the time being in force in any part of India;

- any co-operative society established by or under any law;

- any dealer of excisable goods, who is registered under the Central Excise Act, 1944 or the rules made thereunder;

- any body corporate established, by or under any law; or

- any partnership firm whether registered or not under any law including association of persons;

any person who pays or is liable to pay freight either himself or through his agent for the transportation of such goods by road in a goods carriage:

However, when such person is located in a non-taxable territory, the provider of such service shall be liable to pay service tax.

(C) in relation to service provided or agreed to be provided by way of sponsorship to anybody corporate or partnership firm located in the taxable territory, the recipient of such service;

(D) in relation to service provided or agreed to be provided by, –

- an arbitral tribunal, or

- an individual advocate or a firm of advocates by way of legal services, to any business entity located in the taxable territory, the recipient of such service;

(E) in relation to support4 services provided or agreed to be provided by Government or local authority except

(i) renting of immovable property, and

(ii) services specified in sub-clauses (i), (ii) and (iii) of clause (a) of section 66D of the Finance Act,1994

to any business entity located in the taxable territory, the recipient of such service;

(EE) in relation to service provided or agreed to be provided by a director of a company or a body corporate to the said company or the body corporate, the recipient of such service;

(F) in relation to services provided or agreed to be provided by way of : –

(a) renting of a motor vehicle designed to carry passengers, to any person who is not engaged in a similar business; or

(b) supply of manpower for any purpose; or

(c) security services; or

(d) service portion in execution of a works contract

by any individual, Hindu Undivided Family or partnership firm, whether registered or not, including association of persons, located in the taxable territory to a business entity registered as a body corporate, located in the taxable territory, both the service provider and the service recipient to the extent notified under sub-section (2) of section 68 of the Act, for each respectively.

(G) in relation to any taxable service provided or agreed to be provided by any person which is located in a non-taxable territory and received by any person located in the taxable territory, the recipient of such service.

| 1. Partnership firm includes limited liability partnership [Rule 2(1)(cd)].

2. Body corporate has the meaning assigned to it in section 2(7) of the Companies Act, 1956 [Rule 2(1)(bc)]. 3. Goods carriage: Goods carriage means any motor vehicle constructed or adapted for use solely for the carriage of goods, or any motor vehicle not so constructed or adapted when used for the carriage of goods [Rule 2(1)(c1a)]. 4. Insurance agent: Insurance agent means an insurance agent licensed under Section 42 of the Insurance Act, 1938 who receives agrees to receive payment by way of commission or other remuneration in consideration of his soliciting or procuring insurance business including business relating to the continuance, renewal or revival of policies of insurance [Rule 2(1)(cba)]. 5. Legal service: means any service provided in relation to advice, consultancy or assistance in any branch of law, in any manner and includes representational services before any court, tribunal or authority [Rule 2(1)(cca)]. 6. Supply of manpower: means supply of manpower, temporarily or otherwise, to another person to work under his superintendence or control [Rule 2(1)(g)]. 7. Security services: means services relating to the security of any property, whether movable or immovable, or of any person, in any manner and includes the services of investigation, detection or verification, of any fact or activity [Rule 2(1)(fa)] 8. Aggregator means a person, who owns and manages a web based software application, and by means of the application and a communication device, enables a potential customer to connect with persons providing service of a particular kind under the brand name or trade name of the aggregator” [Rule 2(1)(aa)] 9. Brand name or trade name means a brand name or a trade name whether registered or not, that is to say, a name or a mark, such as an – ● invented word or writing, ● or a symbol, ● monogram, ● logo, ● label, ● signature, which is used for the purpose of indicating, or so as to indicate a connection, in the course of trade, between a service and some person using the name or mark with or without any indication of the identity of that person” [Rule 2(1)(bca)]. |