Demand of Service Tax :

Recovery of service tax not levied or paid or short-levied or short-paid or erroneously refunded [Section 73]: Section 73 deals with the value of taxable services escaping assessment. The provisions, as explained below, are similar to the provisions of section 11A of the Central Excise Act.

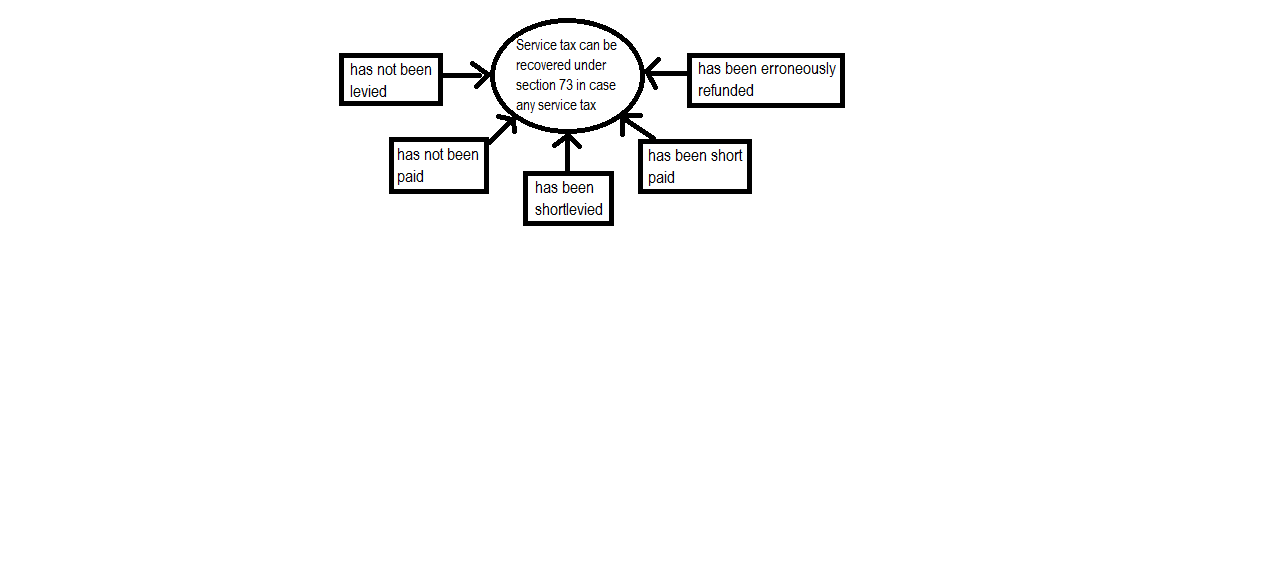

(1) Cases where service tax can be recovered under section 73: In any of the following cases, the Central Excise Officer may serve notice on the person chargeable with the service tax requiring him to show cause why he should not pay the amount specified in the notice:

(2) Time-limit for issue of show cause notice

| Where any service tax has not been levied or paid or has been short-levied or short-paid or erroneously refunded by | Time limit for issuing show cause notice* |

| (i) reason of:-

(a) fraud; or (b) collusion; or (c) wilful mis-statement; or (d) suppression of facts; or (e) contravention of any of the provisions of this Chapter or of the rules made thereunder with intent to evade payment of service tax |

Five years from the relevant date |

| (ii) any other reason | Eighteen months from the relevant date |

*Period of stay to be excluded from the time-limit

For this purpose, where the service of the notice is stayed by an order of a court, the period of such stay shall be excluded in computing the aforesaid period of one year or five years, as the case may be.

| Few relevant judgments

1. Mere inaction or failure to do something does not constitute suppression. There must be something positive to prove suppression [CCE v. Chemphar Drugs and Liniments 1989 (40) ELT 276 SC]. 2. Limitation for extended period invokable only if existence of both situations – (1) suppression, fraud, collusion etc. and, (2) intent to evade payment of duty proved [Tamilnadu Housing Board v. CCE 1994 (74) ELT 9 (SC)] . 3. Department cannot sleep over the matter for years and accuse the assessee of suppression [Mutual Industries Ltd v. CCE 2000 (117) ELT 578 (Tri-LB)]. |

(3) No need to re-type the grounds in the follow-up demand notices, if issued on same grounds as notices of earlier periods: Where a follow-up demand is to be given for a period subsequent to the previous notice(s) on same grounds, the Central Excise Officer may not issue a detailed show cause notice and instead serve a statement, containing the details of service tax not levied or paid or short levied or short paid or erroneously refunded for the subsequent period on the same assessee on whom earlier notice had been served. However, this is possible only when the grounds for subsequent notices are same as the grounds mentioned in the earlier notices. A point to note here is that the time limit of eighteen months for serving the notice for recovery of service tax will, however, apply to such statements.

This provision, therefore, aims to save the botheration of retyping the same charges (and save paper) when a follow-up demand is given for a period subsequent to the previous notice(s) on same grounds [Sub-section (1A)].

(4) Self-assessed service tax that is declared in the return but not paid, can be recovered under section 87 without service of any notice: Notwithstanding anything contained in section 73(1), in a case where the amount of service tax payable has been self-assessed in the return furnished under section 70(1), but not paid either in full or in part, the same will be recovered along with interest thereon in any of the modes specified in section 87, without service of notice under section 73(1).

It may be noted that the sub-section starts with the words ‘Notwithstanding anything contained in sub-section (1)’ and ends with the words ‘without service of notice under sub-section (1)’. Thus, once liability is admitted by the assessee in his returns, no show cause notice is required for recovery and since the provisions of section 73(1) will not apply, the period of limitation will not apply either [Subsection (1B)].

(5) Determination of service tax payable: The Central Excise Officer shall, after considering the representation, if any, made by the person on whom notice is served, determine the amount of service tax due from, or erroneously refunded to, such person (not being in excess of the amount specified in the notice) and thereupon such person shall pay the amount so determined [Sub-section (2)]

(6) SCN issued by invoking extended period of limitation, if not found sustainable, to be deemed to be a SCN issued for a period of eighteen months: In cases where the Department has raised a demand invoking the extended period of limitation (i.e. 5 years), and the appellate authority or Tribunal or Court concludes that extended period cannot be invoked because the charges for fraud, suppression, willful misstatement etc. are not established, the Central Excise Officer can determine the service tax liability for the normal period of limitation i.e, the last eighteen months and raise the demand accordingly.

It may be noted that in case of non/short levy or non/short payment of service tax in nonfraud cases, penalty under section 78 does not apply. For such cases, penalty under section 76 is invoked. However, interest is payable under section 75 in both the cases for the period of default. [Sub-section (2A)].

(7) Voluntary payment of service tax by the assessee before issuance of the show cause notice: Where any service tax has not been levied or paid or has been short – levied or short-paid or erroneously refunded, the person chargeable with the service tax, or the person to whom such tax refund has erroneously been made, may pay the amount of such service tax, chargeable or erroneously refunded, on the basis of his own ascertainment thereof, or on the basis of tax ascertained by a Central Excise Officer before service of notice on him in respect of such service tax, and inform the Central Excise Officer of such payment in writing, who, on receipt of such information shall not serve any notice in respect of the amount so paid [Sub-section (3)].

However, Central Excise Officer may determine the amount of short payment of service tax or erroneously refunded service tax, if any, which in his opinion has not been paid by such person and, then, Central Excise Officer shall proceed to recover such amount in the manner specified in this section, and the period of “eighteen months” shall be counted from the date of receipt of such information of payment.

Interest under section 75 payable on amount so paid : The interest under section 75 shall be payable on the amount paid by the person and also on the amount of short payment of service tax or erroneously refunded service tax, if any, as may be determined by the Central Excise Officer.

Penalty not to be imposed in case of voluntary payment of service tax and interest before issuance of show cause notice: No penalty under any of the provisions of this Act or the rules made there under shall be imposed in respect of payment of service tax under this sub-section and interest thereon.

(8) Voluntary payment of service tax before the issue of show cause notice not allowed in case of fraud, collusion, willful mis-statement etc.: The provisions of payment of service tax before the issue of show cause notice shall not allowed in a case where any service tax has not been levied or paid or has been short-levied or short-paid or erroneously refunded by reason of—

(a) fraud; or

(b) collusion; or

(c) wilful mis-statement; or

(d) suppression of facts; or

(e) contravention of any of the provisions of this Chapter or of the rules made there under with intent to evade payment of service tax [Sub-section (4)].

(9) Time limit for completion of adjudication: As per sub-section (4B), Central Excise Officer, where it is possible to do so, should determine the amount of service tax due within the following time limits from the date of notice:

| Cases whose limitation is specified as 18 months in sub-section (1) [i.e., cases not involving fraud, collusion, suppression of facts etc.) | 6 months |

| Cases falling under the proviso to sub-section (1) [i.e, cases involving fraud, collusion, suppression of facts etc.] or the proviso to subsection (4A) [cases where demand has arisen out of audit/investigation etc.) | 1 year |

(10) Meaning of relevant date [Sub-section (6)]

| In a case where | Relevant date | |

| (i) Taxable service in respect of which service tax has not been levied or paid or has been short-levied or short-paid | (a) where under the rules made under this Chapter, a periodical return, showing particulars of service tax paid during the period to which the said return relates, is to be filed by an assessee | the date on which such return is so filed |

| (b) where no periodical return as aforesaid is filed | the last date on which such return is to be filed under the said rules | |

| (c) in any other case | the date on which the service tax is to be paid under this Chapter or the rules made there under | |

| (ii) Service tax is provisionally assessed under this Chapter or the rules made thereunder | the date of adjustment of the service tax after the final assessment thereof | |

| (iii) Any sum, relating to service tax, has erroneously been refunded | the date of such refund |

(11) Adjudication under section 73: The monetary limits for adjudication under section 73 are as follows:-

| S No. | Central Excise Officer | Amount of Service Tax or CENVAT credit specified in a notice for the purpose of adjudication. |

| (1) | Superintendent of Central Excise* | Not exceeding Rs 1 lakh (excluding the cases relating to taxability of services or valuation of services and cases involving extended period of limitation.) |

| (2) | Assistant Commissioner of Central Excise or Deputy Commissioner of Central Excise | Not exceeding Rs 5 lakh (except cases where Superintendents are empowered to adjudicate.) |

| (3) | Joint Commissioner of Central Excise | Above Rs 5 lakh but not exceeding Rs 50 lakh |

| (4) | Additional Commissioner of Central Excise | Above Rs 20 lakh but not exceeding Rs 50 lakh |

| (5) | Commissioner of Central Excise | Without limit. |

*In respect of the above powers of adjudication conferred on the Superintendents, the following has been clarified:

(i) The Superintendents would be competent to decide cases that involve service tax and / or CENVAT credit upto Rs 1 lakh in individual show cause notices.

(ii) They would not be competent to decide cases that involve taxability of services, valuation of services, eligibility of exemption and cases involving suppression of facts, fraud, collusion, willful mis-statement etc.

(iii) They would be competent to decide cases involving wrong availment of CENVAT credit upto a monetary limit of Rs 1 lakh.