1. Diminishing Balance Method (Reducing Balance Method)

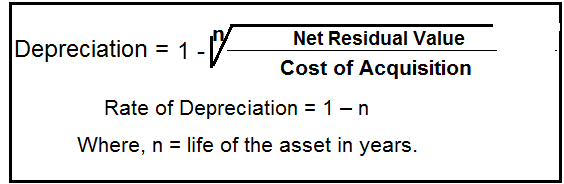

Under this method, depreciation is calculated at a certain percentage each year on the balance of the asset which is brought forward from the previous year. The amount of depreciation charged for each period is not fixed but it goes on decreasing gradually as the opening balance of the asset in each year will reduce. Thus, amount of depreciation becomes higher at in the earlier periods and becomes gradually lower in subsequent periods, while repairs and maintenance charges increase gradually.

| ADVANTAGES | DISADVANTAGES |

| – It is a simple and easy method. | – It is difficult to determine an appropriate rate of depreciation. |

| – Every year, there is an equal burden for using the asset. This is because depreciation goes on decreasing every year whereas cost of repairs ncreases. |

– The value of the asset cannot be brought down to zero. |

| – The obsolescence problem is given due care since major part of the depreciation is charged in earlier years and the management may find it easy to replace the asset. | – Depreciation is neither based on the use of the asset nor distributed evenly throughout the useful life of the asset. |

| – Income tax authorities recognize this method. | |

| – All items including additions are added together and depreciated at the same rate. |