Analysis of Expenses that can be Claimed under “Income from Business or Profession ” Admissible Deductions [Section 36] :

This section authorises deduction of certain specific expenses. The items of expenditure and the conditions under which such expenditures are deductible are: ( For Anlaysis of Expenses (Residuary ) under Admissible Deductions [Section 37] -click here)

(1) Insurance premia paid [Section 36(1)(i)] – If insurance policy has been taken out against risk, damage or destruction of the stock or stores of the business or profession, the premia paid is deductible. But the premium in respect of any insurance undertaken for any other purpose is not allowable under the clause.

(2) Insurance premia paid by a Federal Milk Co-operative Society [Section 36(1)(ia)] – Deduction is allowed in respect of the amount of premium paid by a Federal Milk Co-operative Society to effect or to keep in force an insurance on the life of the cattle owned by a member of a co-operative society being a primary society engaged in supply of milk raised by its members to such Federal Milk Co-operative Society. The deduction is admissible without any monetary or other limits.

(3) Premia paid by employer for health insurance of employees [Section 36(1)(ib)] – This clause seeks to allow a deduction to an employer in respect of premia paid by him by any mode of payment other than cash to effect or to keep in force an insurance on the health of his employees in accordance with a scheme framed by (i) the General Insurance Corporation of India and approved by the Central Government; or (ii) any other insurer and approved by the IRDA.

(4) Bonus and Commission [Section 36(1)(ii)] – These are deductible in full provided the sum paid to the employees as bonus or commission shall not be payable to them as profits or dividends if it had not been paid as bonus or commission. It is a provision intended to safeguard against a private company or an association escaping tax by distributing a part of its profits by way of bonus amongst the members, or employees of their own concern instead of distributing the money as dividends or profits.

(5) Interest on borrowed capital [Section 36(1)(iii)] – In the case of genuine business borrowings, the department cannot disallow any part of the interest on the ground that the rate of interest is unreasonably high except in cases falling under section 40A.

Under section 36(1), deduction of interest is allowed in respect of capital borrowed for the purposes of business or profession in the computation of income under the head “Profits and gains of business or profession”.

Capital may be borrowed for several purposes like for acquiring a capital asset, or to pay off a trading debt or loss etc. The scope of the expression ‘for the purposes of business‘ is very wide. Capital may be borrowed in the course of the existing business as well as for acquiring assets for extension of existing business. Explanation 8 to section 43(1) clarifies that interest relatable to a period after the asset is first put to use cannot be capitalised. Interest in respect of capital borrowed for any period from the date of borrowing to the date on which the asset was first put to use should, therefore, be capitalised.

Section 36(1)(iii) provides that no such deduction shall be allowed in respect of any amount of interest paid, in respect of capital borrowed for acquisition of new asset (whether capitalised in the books of account or not) for any period beginning from the date on which the capital was borrowed for acquisition of the asset till the date on which such asset was first put to use.

| Note – Refer ICDS IX on Borrowing Costs, which requires borrowing costs which are directly attributable to the acquisition, construction or production of a qualifying asset to be capitalized as part of the cost of that asset. |

(6) Discount on Zero Coupon Bonds (ZCBs) [Section 36(1)(iiia)] – Section 36(1)(iiia) provides deduction for the discount on ZCB on pro rata basis having regard to the period of life of the bond to be calculated in the manner prescribed. The Explanation seeks to provide the meaning of the expression ‘discount‘ as a difference of the amount received or receivable by an infrastructure capital company/infrastructure capital fund/public sector company/ scheduled bank on issue of the bond and the amount payable by such company or fund or bank on maturity or redemption of the bond. The expression ‘period of life of the bond‘ has been defined to mean the period commencing from the date of issue of the bond and ending on the date of the maturity or redemption.

For definitions of “infrastructure capital company” and “infrastructure capital fund”, refer sections 2(26A) and 2(26B) in Chapter 1 of this Study Material – Basic Concepts.

(7) Contributions to provident and other funds [Section 36(1)(iv) and (v)] ‘ Contribution to the employees‘ provident and other funds are allowable subject to the following conditions:

(a) The fund should be settled upon a trust.

(b) In case of Provident or a superannuation or a Gratuity Fund, it should be one recognised or approved under the Fourth Schedule to the Income-tax Act, 1961.

(c) The amount contributed should be periodic payment and not an adhoc payment to start the fund.

(d) The fund should be for exclusive benefit of the employees.

The nature of the benefit available to the employees from the fund is not material; it may be pension, gratuity or provident fund.

(8) Employer‟s contribution to the account of the employee under a Pension Scheme referred to in section 80CCD [Section 36(1)(iva)]

(i) Section 36(1)(iva) to provide that the employer‘s contribution to the account of an employee under a Pension Scheme as referred to in section 80CCD would be allowed as deduction while computing business income.

(ii) However, deduction would be restricted to 10% of salary of the employee in the previous year.

(iii) Salary, for this purpose, includes dearness allowance, if the terms of employment so provide, but excludes all other allowances and perquisites.

(iv) Correspondingly, section 40A(9), which provides for disallowance of any sum paid by an employer towards contribution to any fund or trust has been amended to exclude from the scope of its disallowance, contribution by an employer to the pension scheme referred to in section 80CCD, to the extent to which deduction is allowable under section 36(1)(iva).

Illustration

X Ltd. contributes 20% of basic salary to the account of each employee under a pension scheme referred to in section 80CCD. Dearness Allowance is 40% of basic salary and it forms part of pay of the employees. Compute the amount of deduction allowable under section 36(1)(iva), if the basic salary of the employees aggregate to Rs 10 lakh. Would disallowance under section 40A(9) be attracted, and if so, to what extent?

Solution

Computation of deduction under section 36(1)(iva) and disallowance under section 40A(9)

| Particulars | Rs |

| Basic Salary | 10,00,000 |

| Dearness Allowance@40% of basic salary [DA forms part of pay] | 4,00,000 |

| Salary for the purpose of section 36(1)(iva) (Basic Salary + DA) | 14,00,000 |

| Actual contribution (20% of basic salary i.e., 20% of Rs 10 lakh) | 2,00,000 |

| Less: Permissible deduction under section 36(1)(iva) (10% of basic salary plus dearness pay = 10% of Rs 14,00,000 = Rs 1,40,000) | 1,40,000 |

| Excess contribution disallowed under section 40A(9) | 60,000 |

(9) Amount received by assessee as contribution from his employees towards their welfare fund to be allowed only if such amount is credited on or before due date – Clause (va) of section 36(1) and clause (ia) of section 57 provide that deduction in respect of any sum received by the taxpayer as contribution from his employees towards any welfare fund of such employees will be allowed only if such sum is credited by the taxpayer to the employee‘s account in the relevant fund on or before the due date. For the purposes of this section, “due date” will mean the date by which the assessee is required as an employer to credit such contribution to the employee‘s account in the relevant fund under the provisions of any law on term of contract of service or otherwise.

As per the Employees Provident Funds Scheme, 1952, the amounts under consideration in respect of wages of the employees for any particular month shall be paid within 15 days of the close of every month. A further grace period of 5 days is allowed.

(10) Allowance for animals [Section 36(1)(vi)] – This clause grants an allowance in respect of animals which have died or become permanently useless. The amount of the allowance is the difference between the actual cost of the animals and the price realised on the sale of the animals themselves or their carcasses. The allowance under the clause would thus recoup to the assessee the entire capital expenditure in respect of animal.

(11) Bad debts [Section 36(1)(vii) and section 36(2)] – These can be deducted subject to the following conditions:

(a) The debts or loans should be in respect of a business which was carried on by the assessee during the relevant previous year.

(b) The debt should have been taken into account in computing the income of the assessee of the previous year in which such debt is written off or of an earlier previous year or should represent money lent by the assessee in the ordinary course of his business of banking or money lending.

Deduction under section 36(1)(vii) for bad debts limited to the amount by which bad debts exceed credit balance in the provision for doubtful debts account under section36(1)(viia)

Under section 36(1)(vii), bad debt actually written off as irrecoverable in the books of account of the assessee is deductible. However, in the case of entities for which provision for bad and doubtful debts is allowable under section 36(1)(viia), deduction for bad debts written off under said clause (vii) shall be limited to the amount by which the bad debt written off exceeds the credit balance in the provision for bad and doubtful debts account made under section 36(1)(viia). This is provided in the proviso to section 36(1)(vii).

Further, the provisions of section 36(1)(vii) are subject to the provisions of section 36(2). Section 36(2)(v) provides that where the debt or part thereof relates to advances made by an assessee, to which section 36(1)(viia) applies, no deduction shall be allowed unless the assessee has debited the amount of such debt or part of such debt in that previous year to the provision for bad and doubtful debts account made under section 36(1) (viia).

Explanation 2 to section 36(1)(vii) states that for the purposes of the proviso to section 36(1)(vii) and section 36(2)(v), only one account as referred to therein shall be made in respect of provision for bad and doubtful debts under section 36(1)(viia) and such account shall relate to all types of advances, including advances made by rural branches.

Therefore, in the case of an assessee to which section 36(1)(viia) applies, the amount of deduction in respect of the bad debts actually written off under section 36(1)(vii) shall be limited to the amount by which such bad debts exceeds the credit balance in the provision for bad and doubtful debts account made under section 36(1)(viia) without any distinction between rural advances and other advances.

Illustration 12

The following are the particulars in respect of a scheduled bank incorporated in India –

| Particulars | Rs in lakh | |

| (i) | Provision for bad and doubtful debts under section 36(1)(viia) upto A.Y.2015-16 | 100 |

| (ii) | Gross Total Income of A.Y.2016-17 [before deduction under section 36(1)(viia)] | 800 |

| (iii) | Aggregate average advances made by rural branches of the bank | 300 |

| (iv) | Bad debts written off (for the first time) in the books of account (in respect of urban advances only) during the previous year 2015-16 | 210 |

Compute the deduction allowable under section 36(1)(vii) for the A.Y.2016-17.

Solution

| Particulars | Rs in lakh | |

| Bad debts written off (for the first time) in the books of account | 210 | |

| Less: Credit balance in the “Provision for bad and doubtful debts” under section 36(1)(viia) as on 31.3.2016 | ||

| (i) Provision for bad and doubtful debts u/s 36(1)(viia) upto A.Y.2015-16 | 100 | |

| (ii) Current year provision for bad and doubtful debts u/s 36(1)(viia) [7.5% of Rs 800 lakhs + 10% of Rs 300 lakhs] | 90 | 190 |

| Deduction under section 36(1)(vii) in respect of bad debts written off for A.Y.2016-17 | 20 | |

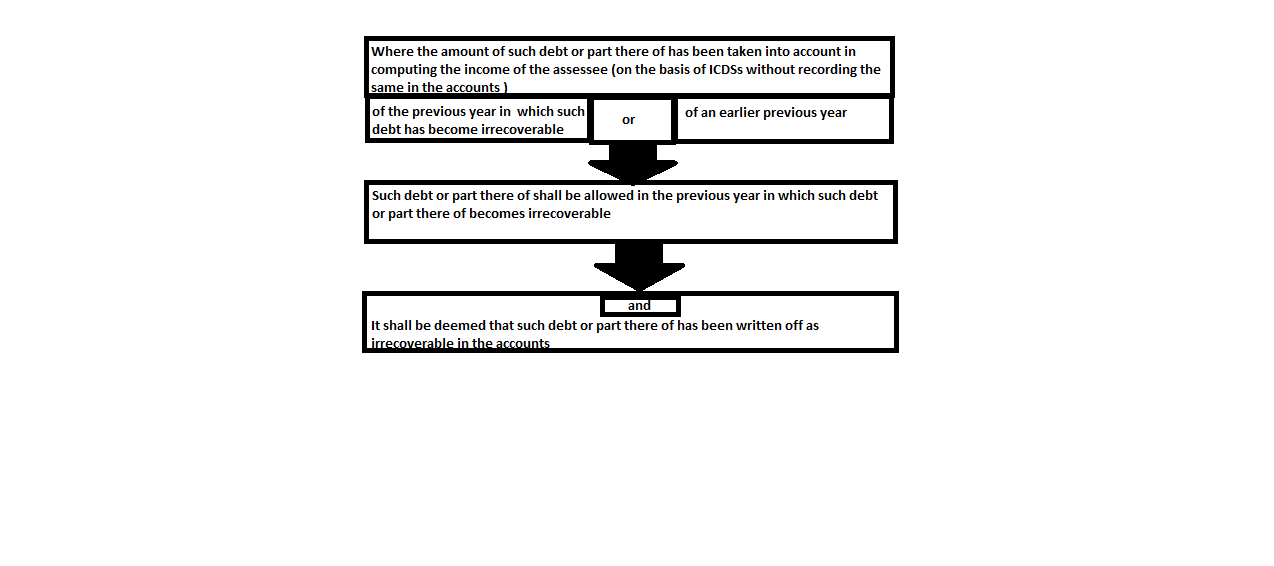

Amount of debt taken into account in computing the income of the assessee on the basis of notified ICDSs to be allowed as deduction in the previous year in which such debt or part thereof becomes irrecoverable [Section 36(1)(vii)]

(i) Under section 36(1)(vii), deduction is allowed in respect of the amount of any bad debt or part thereof which is written off as irrecoverable in the accounts of the assessee for the previous year.

(ii) Therefore, write off in the books of account is an essential condition for claim of bad debts under section 36(1)(vii).

(iii) The Central Government has, vide Notification dated 31.3.2015, in exercise of the powers conferred under section 145(2), notified ten income computation and disclosure standards (ICDSs) to be followed by all assessees, following the mercantile system of accounting, for the purposes of computation of income chargeable to income-tax under the head “Profit and gains of business or profession” or “Income from other sources”. This notification shall come into force with effect from 1st April, 2015, and shall accordingly apply to the A.Y. 2016-17 and subsequent assessment years.

(iv) There are significant deviations between the notified ICDSs and Accounting Standards which are likely to have the effect of advancing the recognition of income or gains or postponing the recognition of expenditure or losses under tax laws and consequently, impacting the computation of tax liability under the Income-tax Act, 1961.

(v) Due to early recognition of income under tax laws, it is possible that in certain cases, income-tax is paid on income which may not be realized in future. In such cases, there would also be no possibility of claiming bad debts since the income would not have been recognized in the books of account as per the Accounting Standards and consequently, cannot be written off as bad debts in books of account.

(vi) For example, ICDS IV requires revenue from sale of goods to be recognized when there is reasonable certainty of its ultimate collection. However, “reasonable certainty for ultimate collection” is not a criterion for recognition of revenue from rendering of services or use by others of person‘s resources yielding interest, royalties or dividends. By implication, revenue recognition cannot be postponed in case of significant uncertainty regarding collectability of consideration to be derived from rendering of services or use by others of person‘s resources yielding interest, dividend or royalty.

Consequently, interest on sticky loans or interest on overdue payments as mentioned in invoice may have to be recognized even though there may be uncertainty regarding their collection. In case of non-realisation of such interest in future, it would not also be possible to claim bad debts since such interest, which would not have been recognized in the books of account as per AS 9, cannot be written off. Write off of bad debts in the books of ac count is an essential condition for claiming deduction under section 36(1)(vii).

(vii) In order to overcome this difficulty arising out of the notified ICDSs, a second proviso has now been inserted in section 36(1)(vii).

(viii) Consequently, if a debt, which has not been recognized in the books of account as per the requirement of the accounting standards but has been taken into account in the computation of income as per the notified ICDSs, has become irrecoverable, it can still be claimed as bad debts under section 36(1)(vii) since it shall be deemed that the debt has been written off as irrecoverable in the books of account by virtue of the second proviso to section 36(1)(vii).

Deduction of differential amount of debts due as bad debts in the year of recovery, to the extent of deficiency in recovery

If on the final settlement the amount recovered in respect of any debt, where deduction had already been allowed, falls short of the difference between the debt due and the amount of debt allowed, the deficiency can be claimed as a deduction from the income of the previous year in which the ultimate recovery out of the debt is made. It is permissible for the Assessing Officer to allow deduction in respect of a bad debt or any part thereof in the assessment of a particular year and subsequently to allow the balance of the amount, if any, in the year in which the ultimate recovery is made, that is to say, when the final result of the process of recovery comes to be known.

Recovery of a bad debt subsequently [Section 41(4)] – If a deduction has been allowed in respect of a bad debt under section 36, and subsequently the amount recovered in respect of such debt is more than the amount due after the allowance had been made, the excess shall be deemed to be the profits and gains of business or profession and will be chargeable as income of the previous year in which it is recovered, whether or not the business or profes sion in respect of which the deduction has been allowed is in existence at the time.

For example, let us assume that a debt of Rs 10,000 was claimed as a bad debt in the previous year 2014-15. However, the Assessing Officer allowed only a sum of Rs 5,000 as bad debt. If in the previous year 2015-16, a sum of Rs 4,000 is recovered ultimately in respect of the debt, then the Assessing Officer should allow a deduction in respect of the deficiency namely, Rs 1,000 i.e., the difference between the amount ultimately recovered and the amount disallowed earlier under section 36(1)(vii). If on the other hand, the sum ultimately recovered is Rs 6,000 then there will be a liability, under section 41(4) in respect of sum of Rs 1,000, which would be deemed to be the profits and gains of business or profession. Such a liability under section 41(4) would arise even if the business or profession in respect of which deduction has been allowed is not in existence at that time.

(12) Special provision for bad and doubtful debts in cases of Rural Branches of Scheduled Banks [Section 36(1)(viia)]

(a) In the case of a scheduled bank which is not a bank incorporated by or under the laws of a country outside India or a non-scheduled bank, the following deductions will be allowed:

(i) an amount not exceeding 7.5% of the total income (computed before making any deduction under this clause and Chapter VI-A), and

(ii) an amount not exceeding 10% of the aggregate average advances made by the rural branches of such bank computed in the manner prescribed by the CBDT.

(b) A scheduled bank or a non-scheduled bank referred to in (a) above or a co-operative bank other than a primary agricultural credit society or a primary co-operative agricultural and rural development bank shall, at its option, be allowed a further deduction in excess of the limits specified in the foregoing provisions, for an amount not exceeding the income derived from redemption of securities in accordance with a scheme framed by the Central Government. It is also provided that this deduction shall not be allowed unless such income has been disclosed in the return of income under the head “Profits and gains of business or profession”.

Scheduled Bank: It refers to the State Bank of India or any of its subsidiaries or any of the nationalised banks and would also include any other bank which is listed in the Second Schedule to the Reserve Bank of India Act, 1935.

Non-Scheduled Bank: This refers to a banking company as defined in clause (c) of section 5 of the Banking Regulation Act, 1949 which is not a scheduled bank.

Rural branch: This means a branch of a scheduled bank or a non-scheduled bank situated in a place which has a population of not more than 10,000 according to the last preceding census of which the relevant figures have been published before the first day of the previous year.

(c) Foreign Banks: In the case of foreign banks the deduction will be an amount not exceeding 5% of the total income (computed before making any deduction under this clause and Chapter VI-A).

(d) A public financial institution, a State Financial Corporation and a State Industrial Investment Corporation will be entitled to a deduction in respect of provision for bad and doubtful debts made out of profits. The maximum amount to be al lowed as a deduction will be limited to 5% of its total income before making any deduction in respect of the provision for bad and doubtful debt or in respect of any deduction in Chapter VI -A.

“Public Financial Institution” shall have the meaning assigned to it in section 4A of the Companies Act, 1956.

“State Financial Corporation” means a financial corporation established under section 3 or section 3A or an institution notified under section 46 of the State Financial Corporations Act, 1951.

“State Industrial Investment Corporation” means a Government company within the meaning of Section 617 of the Companies Act engaged in the business of providing long-term finance for industrial projects and eligible for deduction under clause (viii) of this sub-section.

Co-operative bank, primary agricultural credit society and primary co-operative agricultural and rural development bank have the same meanings assigned in Explanation to section 80P(4).

(13) Special deduction to Specified Entities engaged in eligible business [Section 36(1)(viii)]

(a) This section provides deduction in respect of any special reserve created and maintained by a specified entity.

(b) The quantum of deduction, however, should not exceed 20% of the profits derived from eligible business computed under the head “Profits and gains of business or profession” carried to such reserve account.

(c) The eligible business for different entities specified are given in the table below –

| Specified entity | Eligible business | |

| 1. | Financial Corporation specified in section 4A of the Companies Act, 1956 Financial corporation which is a public sector company

Banking company Co-operative bank (other than a primary agricultural credit society or a primary co-operative agricultural and rural development bank) |

Business of providing long-term finance for –

(i) industrial or agricultural development or (ii) development of infrastructure facility in India; or (iii) development of housing in India. |

| 2. | A housing finance company | Business of providing long-term finance for the construction or purchase of houses in India for residential purposes. |

| 3. | Any other financial corporation including a public company | Business of providing long-term finance for development of infrastructure facility in India. |

(d) However, where the aggregate amount carried to such reserve account exceeds twice the amount of paid up share capital and general reserve, no deduction shall be allowed in respect of such excess.

(e) Infrastructure facility has been defined to mean –

(a) (1) an infrastructure facility as defined in the Explanation to clause (i) of subsection

(4) of section 80-IA i.e.

(i) a road including toll road, a bridge or a rail system;

(ii) a highway project including housing or other activities being an integral part of the highway project;

(iii) a water supply project, water treatment system, irrigation project, sanitation and sewerage system or solid waste management system; and

(iv) a port, airport, inland waterway or inland port or a navigational channel in the sea

(2) any other public facility of a similar nature as may be notified by the CBDT in this behalf in the Official Gazette and which fulfils the prescribed conditions;

(b) an undertaking referred to in clause (ii) or clause (iii) or clause (iv) of sub -section (4) of section 80-IA (i.e. an undertaking providing telecommunication services, an undertaking developing, developing and operating, maintaining and operating an industrial park or SEZ notified by the Central Government, an undertaking generating, distributing or transmitting power); and

(c) an undertaking referred to in sub-section (10) of section 80-IB i.e. an undertaking developing and building housing projects approved by a local authority.

Conditions to be fulfilled by a public facility to be eligible to be notified as an infrastructure facility [Notification No.187/2006 dated 20.7.2006 ] : Rule 6ABAA has been inserted in the Income-tax Rules, 1962 which specifies the conditions to be fulfilled by a public facility to be eligible to be notified as an infrastructure facility in accordance with the provisions of clause (d) of the Explanation to clause (viii) of sub-section (1) of section 36. The conditions specified therein are –

(a) it is owned by a company registered in India or by a consortium of such companies or by an authority or a board or a corporation or any other body established or constituted under any Central or State Act;

(b) it has entered into an agreement with the Central Government or a State Government or a local authority or any other statutory body for (i) developing or (ii) operating and maintaining or (iii) developing, operating and maintaining a new infrastructure facility similar in nature to an infrastructure facility referred to in the Explanation to section 80-IA(4)(i);

(c) it has started or starts operating and maintaining such infrastructure facility on or after 1 st April, 1995.

Notification of public facilities as infrastructure facility for the purpose of section 36(1)(viii) [Notification No. 188/2006, dated 20.7.2006]

The following public facilities have been notified by the CBDT as infrastructure facility for purposes of section 36(1)(viii)-

(1) Inland Container Depot and Container Freight Station notified under the Customs Act, 1962

(2) Mass Rapid Transit system

(3) Light Rail Transit system

(4) Expressways

(5) Intra-urban or semi-urban roads like ring roads or urban by-passes or flyovers

(6) Bus and truck terminals

(7) Subways

(8) Road dividers

(9) Bulk Handling Terminals which are developed or maintained or operated for development of rail system

(10) Multilevel Computerised Car Parking.

Deduction in respect of income from long-term finance for development of infrastructure facilities – The deduction will now be available also to approved financial corporations providing long-term finance for development of infrastructure facilities in India. For this purpose, the expression “infrastructure facility” shall have the meaning assigned to it in section 80-IA.

(14) Expenses on family planning [Section 36(1)(ix)] – Any expenditure of revenue nature bona fide incurred by a company for the purpose of promoting family planning amongst its employees will be allowed as a deduction in computing the company‘s business income; where, the expenditure is of a capital nature, one-fifth of such expenditure will be deducted in the previous year in which it was incurred and in each of the four immediately succeeding previous years. This deduction is allowable only to companies and not to other assessees. The assessee would be entitled to carry forward and set off the unabsorbed part of the allowance in the same way as unabsorbed depreciation. The capital expenditure on promoting family planning will be treated in the same way as capital expenditure for scientific research for purposes of dealing with the profit or loss on the sale or transfer of the asset including a transfer on amalgamation.

(15) Deduction for expenditure incurred by entities established under any Central, State or Provincial Act [Section 36(1)(xii)]

Any expenditure (not being in the nature of capital expenditure) incurred by a corporation or a body corporate, by whatever name called, if –

(a) it is constituted or established by a Central, State or Provincial Act;

(b) such corporation or body corporate is notified by the Central Government in the Official Gazette for this purpose having regard to the objects and purposes of the Act;

(c) the expenditure is incurred for the objects and purposes authorised by the Act under which it is constituted and established.

Accordingly, the Central Government has notified the Oil Industry Development Board for the purpose of deduction under section 36(1)(xii).

(16) Deduction in respect of banking cash transaction tax [Section 36(1)(xiii)]

(a) The Finance Act, 2005 had, through Chapter VII, introduced a tax called banking cash transaction tax, as an anti tax-evasion measure, in respect of every taxable banking transaction entered into on or after 1.6.2005.

(b) Section 36(1)(xiii) provides for deduction of any amount of banking cash transaction tax paid by the assessee during the previous year on the taxable banking transactions entered into by him.

Note – Banking Cash Transaction Tax is not chargeable in respect of any taxable banking transaction entered into on or after 1.4.2009.

(17) Deduction of contribution by a public financial institution to Credit guarantee fund trust for small industries [Section 36(1)(xiv)]

(i) Section 36(1)(xiv) provides for deduction of any sum paid by a public financial institution by way of contribution to such credit guarantee fund trust for small industries notified by the Central Government in the Official Gazette.

(ii) Public financial institution has the meaning assigned to it in section 4A of the Companies Act, 1956.

(18) Deduction of securities transaction tax paid [Section 36(1)(xv)]: The amount of securities transaction tax paid by the assessee during the year in respect of taxable securities transactions entered into in the course of business shall be allowed as deduction under section 36 subject to the condition that such income from taxable securities transactions is included under the head ‘Profits and gains of business or profession‘. Thus, securities transaction tax paid would be allowed as a deduction like any other business expenditure.

(19) Deduction for commodities transaction tax paid in respect of taxable commodities transactions [Section 36(1)(xvi)]

(a) The Finance Act, 2013 has introduced a new tax called Commodities Transaction Tax (CTT) to be levied on taxable commodities transactions entered into in a recognised association, vide Chapter VII of the Finance Act, 2013.

(b) For this purpose, a ‘taxable commodities transaction‘ means a transaction of sale of commodity derivatives in respect of commodities, other than agricultural commodities, traded in recognised associations.

(c) CTT is to be levied at 0.01% on sale of commodity derivative. CTT is to be paid by the seller.

(d) A “commodity derivative” means –

(1) A contract for delivery of goods which is not a ready delivery contract

(2) A contract for differences which derives its value from prices or indices of prices –

(i) of such underlying goods; or

(ii) of related services and rights, such as warehousing and freight; or

(iii) with reference to weather and similar events and activities having a bearing on the commodity sector.

(e) Consequently, clause (xvi) of section 36(1) provides that an amount equal to the CTT paid by the assessee in respect of the taxable commodities transactions entered into in the course of his business during the previous year shall be allowable as deduction, if the income arising from such taxable commodities transactions is included in the income computed under the head “Profits and gains of business or profession”.

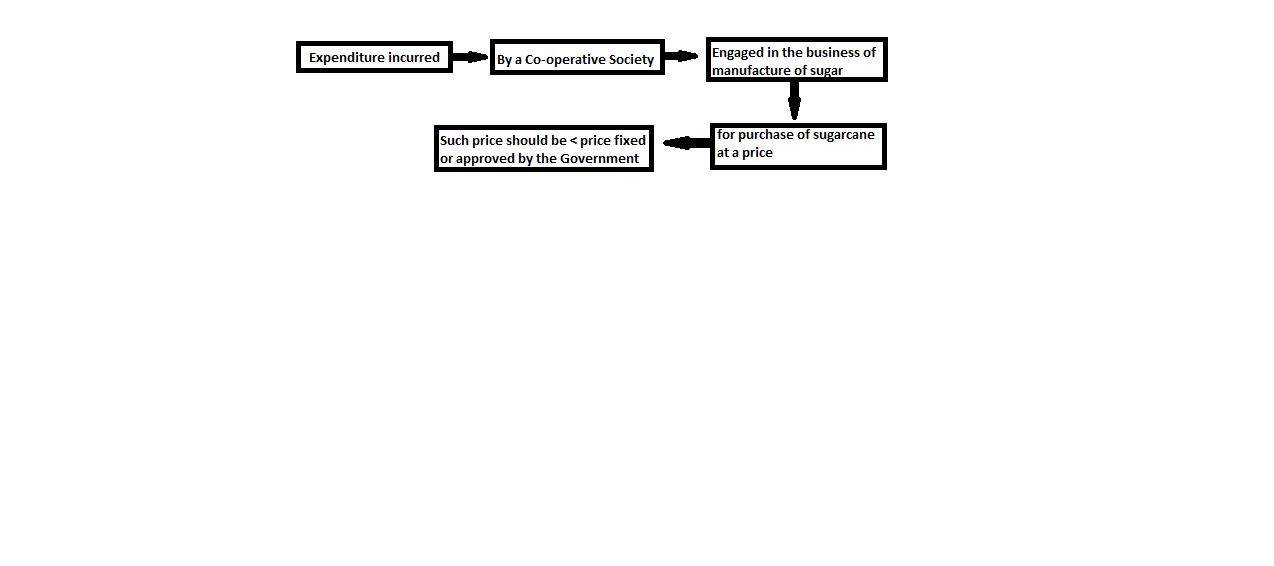

(20) Amount of expenditure incurred by a co-operative society for purchase of sugarcane at price fixed by the Government allowable as deduction [Section 36(1)(xvii)]

New clause (xvii) has been inserted in section 36 to provide for deduction of: