Increase in threshold limit of gross receipts/turnover under section 44AD of a business to be eligible for opting the presumptive taxation scheme

Related amendments in sections: 44AA, 44AB and 211

Effective from: A.Y.2017-18

(i) Section 44AD contains the presumptive taxation scheme for an eligible business.

(ii) As per this scheme, where in the case of an eligible assessee engaged in eligible business having total turnover or gross receipts not exceeding rupees one crore, a sum equal to 8% of the total turnover or gross receipts, or as the case may be, a sum higher than the aforesaid sum shall be deemed to be profits and gains of such business chargeable to tax under the head “Profits and gains of business or profession” [Section 44AD(1)]

(iii) Under the scheme, the assessee will be deemed to have been allowed the deductions under sections 30 to 38.

(iv) Further, if an eligible assessee claims that the income earned by him is less than the deemed income of 8% of the total turnover or gross receipts, he has to maintain books of accounts as per section 44AA and get the same audited as per 44AB.

(v) Also, an eligible assessee, as far as eligible business is concerned, is not required to pay advance tax. It would be sufficient compliance if they pay their tax while filing their return of income before the due date.

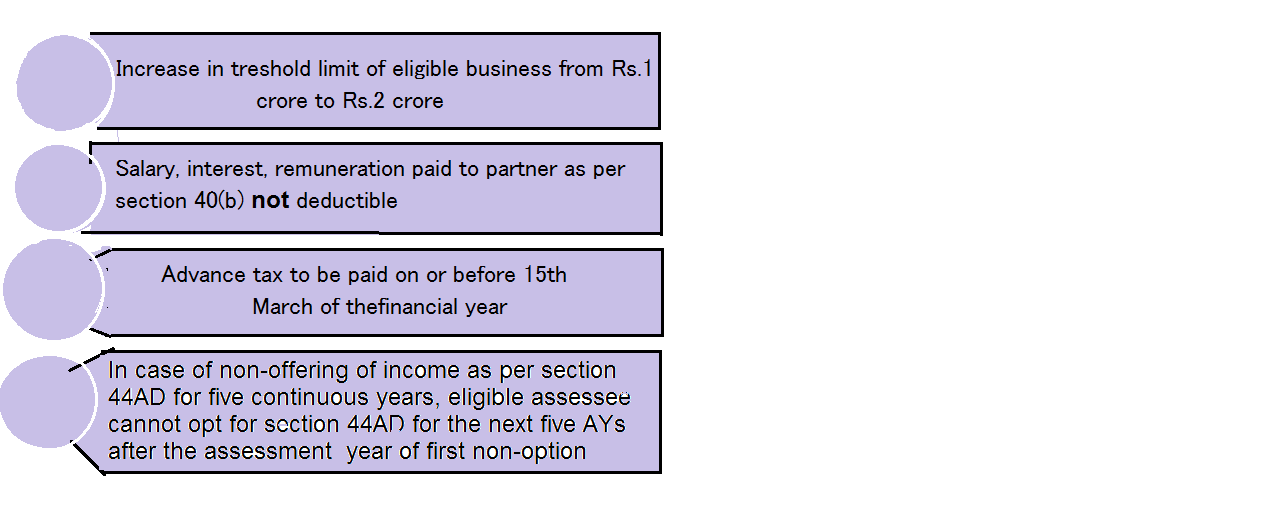

(vi) For the purpose of reducing the compliance burden of the small tax payers and facilitating the ease of doing business, the threshold limit specified in the definition of “eligible business” has been increased from ` 1 crore to ` 2 crore.

(vii) Further, expenditure in the nature of salary, remuneration, interest etc. paid to the partner as per section 40(b) shall not be deductible while computing the income under section 44AD since section 40 does not mandate for allowance of any expenditure; it merely places a restriction on deduction of amounts, otherwise allowable under section 30 to 38. Therefore, the proviso to section 44AD(2) has been omitted.

(viii) Where an eligible assessee declares profit for any previous year in accordance with the provisions of this section and he declares profit for any of the five consecutive assessment years relevant to the previous year succeeding such previous year not in accordance with the provisions of sub-section (1), he shall not be eligible to claim the benefit of the provisions of this section for five assessment years subsequent to the assessment year relevant to the previous year in which the profit has not been declared in accordance with the provisions of sub-section (1). This is provided in new sub-section (4) of section 44AD.

(ix) An eligible assessee to whom the provisions of sub-section (4) are applicable and whose total income exceeds the basic exemption limit has to maintain books of account under section 44AA and get them audited and furnish a report of such audit under section 44AB. This is provided in new sub-section (5) of section 44AD.

(x) Consequential amendments have been made in sections 44AA and 44AB to require maintenance of books of account and audit of the same in the case of an eligible assessee, where the provisions of section 44AD(4) are applicable and his income exceeds the basic exemption limit.

(xi) Further, since the threshold limit of presumptive taxation scheme has been enhanced to ` 2 crore, the eligible assessee is now required to pay advance tax by 15th March of the financial year.

(xii) Summary of amendments in section 44AD

(xiii) Example:

Let us consider the following particulars relating to a resident individual, Mr. A, being an eligible assessee whose gross receipts do not exceed ` 2 crore in any of the assessment years between A.Y.2017-18 to A.Y.2019-20 –

| Particulars | A.Y.2017-18 | A.Y.2018-19 | A.Y.2019-20 |

| Gross receipts (` ) | 1,80,00,000 | 1,90,00,000 | 2,00,00,000 |

| Income offered for taxation (` ) | 14,40,000 | 15,20,000 | 12,00,000 |

| % of gross receipts | 8% | 8% | 6% |

| Offered income as per presumptive

taxation scheme u/s 44AD |

Yes | Yes | No |

In the above case, Mr. A, an eligible assessee, opts for presumptive taxation under section 44AD for A.Y.2017-18 and A.Y.2018-19 and offers income of ` 14.40 lakh and ` 15.20 lakh on gross receipts of ` 1.80 crore and ` 1.90 crore, respectively.

However, for A.Y.2019-20, he offers income of only ` 12 lakh on turnover of ` 2 crore, which amounts to 6% of his gross receipts. He maintains books of account under section 44AA and gets the same audited under section 44AB. Since he has not offered income in accordance with the provisions of section 44AD(1) for five consecutive assessment years, after A.Y.2017-18, he will not be eligible to claim the benefit of section 44AD for next five assessment years succeeding A.Y.2019-20 i.e., from A.Y.2020-21 to 2024-25.

| Note – Section 44AB makes it obligatory for every person carrying on business to get his accounts of any previous year audited if his total sales, turnover or gross receipts exceed ` 1 crore. However, if an eligible person opts for presumptive taxation scheme as per section 44AD(1), he shall not be required to get his accounts audited if the total turnover or gross receipts of the relevant previous year does not exceed ` 2 crore. The CBDT, has vide its Press Release dated 20th June, 2016, clarified that the higher threshold for non-audit of accounts has been given only to assessees opting for presumptive taxation scheme under section 44AD. |