Interest other than interest on securities [Section 194A] under Deduction of Tax at Source :

This section deals with the scheme of deduction of tax at source from interest other than interest on securities. The main provisions are the following:

(1) This section applies only to interest, other than “interest on securities”, credited or paid by assessees other than individuals or Hindu undivided families not subject to tax audit under section 44AB in the immediately preceding financial year. In other words, individuals and HUFs subject to tax audit in the immediately preceding financial year, companies, firms, association of persons, local authorities and artificial juridical persons are under a legal obligation to deduct tax at source in respect of the interest other than “interest on securities” paid by them.

(2) These provisions apply only to interest paid or credited to residents. In respect of payments to non-residents, the provisions are contained under section 195.

(3) The deduction of tax must be made at the time of crediting such interest to the payee or at the time of its payment in cash or by any other mode, whichever is earlier.

(4) Where any such interest is credited to any account in the books of account of the person liable to pay such income, such crediting is deemed to be credit of such income to the account of the payee and the tax has to be deducted at source.

(5) The account to which such interest is credited may be called “Interest Payable account” or “Suspense account” or by any other name.

The CBDT has, vide Circular No.3/2010 dated 2.3.2010, given a clarification regarding deduction of tax at source on payment of interest on time deposits under section 194A by banks following Core-branch Banking Solutions (CBS) software. It has been clarified that Explanation to section 194A is not meant to apply in cases of banks where credit is made to provisioning account on daily/monthly basis for the purpose of macro monitoring only by the use of CBS software. It has been further clarified that since no constructive credit to the depositor‘s / payee‘s account takes place while calculating interest on time deposits on daily or monthly basis in the CBS software used by banks, tax need not be deducted at source on such provisioning of interest by banks for the purposes of macro monitoring only. In such cases, tax shall be deducted at source on accrual of interest at the end of financial year or at periodic intervals as per practice of the bank or as per the depositor’s / payee’s requirement or on maturity or on encashment of time deposits, whichever event takes place earlier, whenever the aggregate of amounts of interest income credited or paid or likely to be credited or paid during the financial year by the banks exceeds the limits specified in section 194A.

(6) The deduction of tax at source is to be made in all cases where the amount of income by way of interest or, as the case may be, the aggregate of the amounts of interest credited or paid or likely to be credited or paid during the financial year to the account of or to the payee or any other person on his behalf is more than Rs 5,000.

(7) The rate at which the deduction is to be made are given in Part II of the First Schedule to the Annual Finance Act. The rate at which tax is to be deducted is 10% both in the case of resident non-corporate assessees and domestic companies.

(8) No deduction of tax shall be made in the following cases:

(a) If the aggregate amount of interest paid or credited during the financial year does not exceed Rs 5,000.

This limit is Rs 10,000 in respect of interest paid on –

(i) time deposits with a banking company;

(ii) time deposits with a co-operative society engaged in banking business; and

(iii) deposits with post office under notified schemes.

In all other cases, the limit would be Rs 5,000.

The limit will be calculated with respect to income credited or paid by a branch of a bank or a co-operative society or a public company in case of:

(i) time deposits with a bank

(ii) time deposits with a co-operative society carrying on the business of banking; and

(iii) deposits with housing finance companies, provided:

– they are public companies formed and registered in India

– their main object is to carry on the business of providing long-term finance for construction or purchase of houses in India for residential purposes.

As per the proviso to section 194A(3)(i), in the case of income credited or paid in respect of time deposits with a banking company or a co-operative bank or a public company with the main object of providing long-term finance for construction or purchase of houses in India for residential purposes, the threshold limit for deduction of tax at source (i.e., Rs 10,000 or Rs 5,000, as the case may be) shall be computed with reference to the income credited or paid by a branch of the banking company or the co-operative society or the public company.

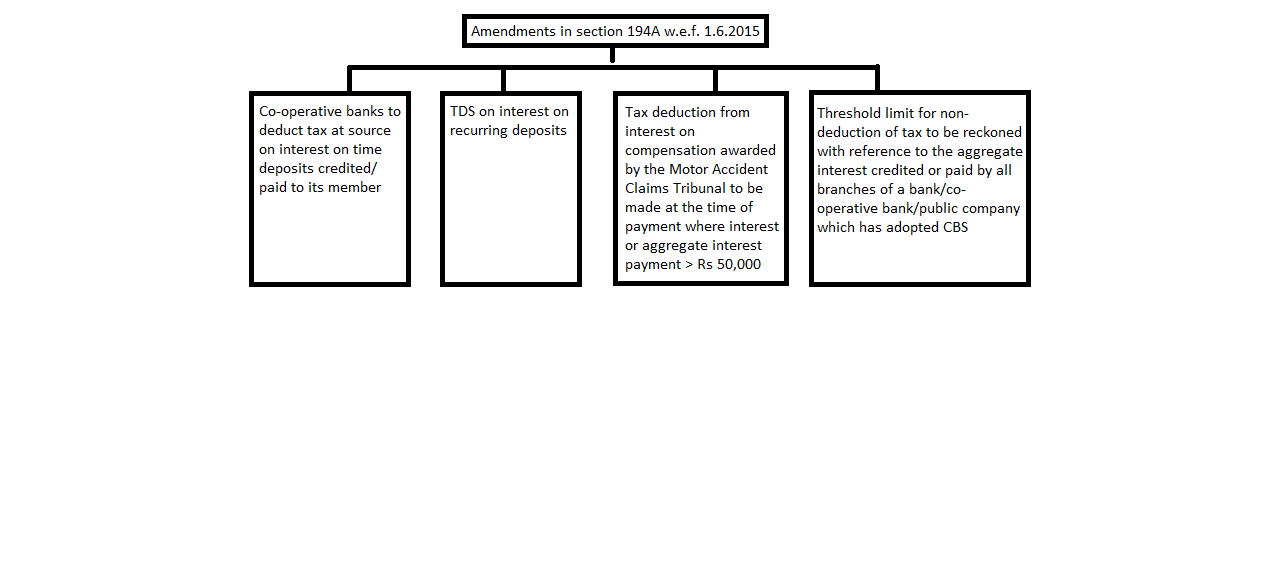

A second proviso has been inserted in section 194A(3)(i) to provide that the threshold limit will be reckoned with reference to the total interest credited or paid by the banking company or the co-operative society or the public company, as the case may be, (and not with reference to each branch), where such banking company or co-operative society or public company has adopted core banking solutions.

(b) Interest paid or credited by a firm to any of its partners;

(c) Income paid or credited by a co-operative society (other than a co-operative bank) to a member there of or to such income credited or paid by a co-operative society to any other co-operative society;

(d) Interest paid or credited in respect of deposits under any scheme framed by the Central Government and notified by it in this behalf;

(e) Interest income credited or paid in respect of deposits (other than time deposits made on or after 1.7.1995) with

(i) a bank to which the Banking Regulation Act, 1949 applies; or

(ii) a co-operative society engaged in carrying on the business of banking.

(f) Interest credited or paid in respect of deposits with primary agricultural credit society or a primary credit society or a co-operative land mortgage bank or a co-operative land development bank.

(g) Interest income credited or paid by the Central Government under any provisions of the Income-tax Act, 1961, the Estate Duty Act, the Wealth-tax Act, 1957, the Gift-tax Act, the Companies (Profits) Surtax Act or the Interest Tax Act.

(h) Interest paid or credited to the following entities:

(1) banking companies, or co-operative societies engaged in the business of banking, including co-operative land mortgage‘ banks;

(2) financial corporations established under any Central, State or Provincial Act.

(3) the Life Insurance Corporation of India.

(4) companies and co-operative societies carrying on the business of insurance.

(5) the Unit Trust of India; and

(6) notified institution, association, body or class of institutions, associations or bodies.

(National Skill Development Fund has been notified by the Central Government for this purpose)

(i) income credited by way of interest on the compensation amount awarded by the Motor Accidents Claims Tribunal;

(j) income paid by way of interest on the compensation amount awarded by the Motor Accidents Claims Tribunal where the amount of such income or, as the case may be, the aggregate of the amounts of such income paid during the financial year does not exceed Rs 50,000.

(k) income paid or payable by an infrastructure capital company or infrastructure capital fund or public sector company in relation to a zero coupon bond issued on or after 1.6.2005.

(9) The expression “time deposits” [for the purpose of (8)(a),(e) and (f) above] means the deposits, including recurring deposits, repayable on the expiry of fixed periods.

(10) The time for making the payment of tax deducted at source would reckon from the date of credit of interest made constructively to the account of the payee.

Illustration

Examine the TDS implications under section 194A in the cases mentioned hereunder –

(i) On 1.10.2015, Mr. Harish made a six-month fixed deposit of Rs 10 lakh@9% p.a. with ABC Co-operative Bank. The fixed deposit matures on 31.3.2016.

(ii) On 1.6.2015, Mr. Ganesh made three nine month fixed deposits of Rs 1 lakh each carrying interest@9% with Dwarka Branch, Janakpuri Branch and Rohini Branches of XYZ Bank, a bank which has adopted CBS. The fixed deposits mature on 28.2.2016.

(iii) On 1.4.2015, Mr. Rajesh started a 1 year recurring deposit of Rs 20,000 per month@8% p.a. with PQR Bank. The recurring deposit matures on 31.3.2016.

Answer

(i) ABC Co-operative Bank has to deduct tax at source@10% on the interest of Rs 45,000 (9% × Rs 10 lakh × ½) under section 194A. The tax deductible at source under section 194A from such interest is, therefore, Rs 4,500.

(ii) XYZ Bank has to deduct tax at source@10% under section 194A, since the aggregate interest on fixed deposit with the three branches of the bank is Rs 20,250 [1,00,000 × 3 × 9% × 9/12], which exceeds the threshold limit of Rs 10,000. Since XYZ Bank has adopted CBS, the aggregate interest credited/paid by all branches has to be considered. Since the aggregate interest of Rs 20,250 exceeds the threshold limit of Rs 10,000, tax has to be deducted@10% under section 194A.

(iii) Tax has to be deducted under section 194A by PQR Bank on the interest of Rs 10,400 falling due on recurring deposit on 31.3.2016 to Mr. Rajesh, since –

(1) “recurring deposit” has been included in the definition of “time deposit”; and

(2) such interest exceeds the threshold limit of Rs 10,000.