ISSUE AND ALLOTMENT OF UNITS :

1. A REIT shall make an initial offer of its units by way of public issue only.

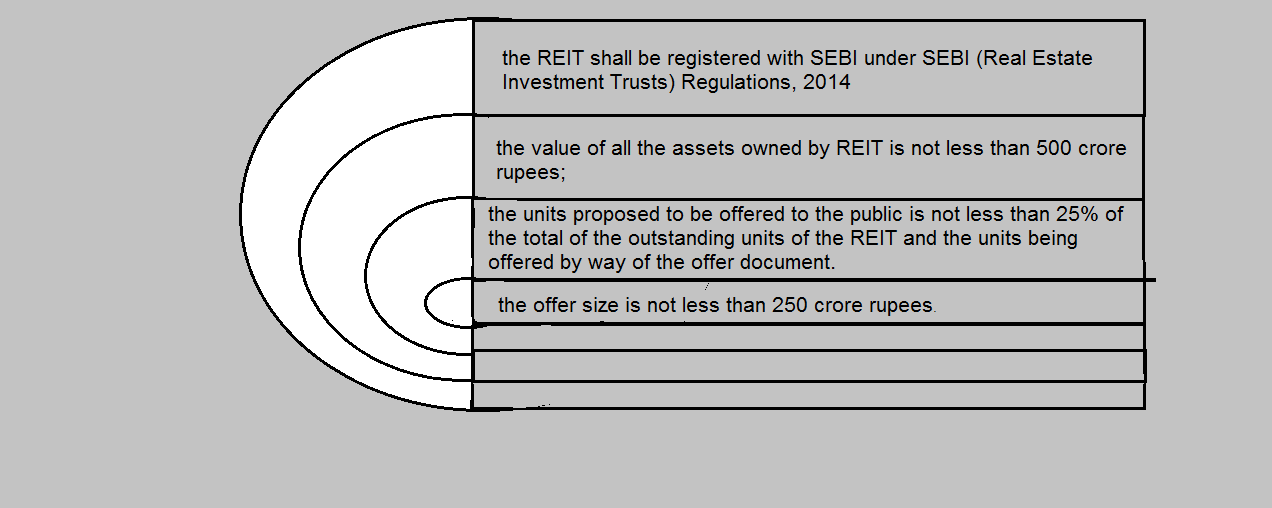

2. No initial offer of units by the REIT shall be made unless,-

Note:-

(i) In case of initial offer of value greater than 500 crore rupees, if prior to the initial offer units of the REIT are held by the public, the units proposed to be offered to the public shall be calculated after reducing such existing units for satisfying the aforesaid percentage requirement.

(ii) the requirement of ownership of assets and size of REIT may be complied with after initial offer subject to a binding agreement with the relevant party(ies) that the requirements shall be fulfilled prior to allotment of units, a declaration to SEBI and the designated stock exchanges to that effect and adequate disclosures in this regard in the initial offer document.

3. Any subsequent issue of units by the REIT may be by way of follow-on offer, preferential allotment, qualified institutional placement, rights issue, bonus issue, offer for sale or any other mechanism and in the manner as may be specified by SEBI.

4. REIT, through the manager, shall file a draft offer document with the designated stock exchange(s) and SEBI, not less than 21 working days before filing the final offer document with the designated stock exchange.

5. The draft offer document filed with SEBI shall be made public, for comments, to be submitted to SEBI, within a period of at least 10 days, by hosting it on the websites of SEBI, designated stock exchanges and merchant bankers associated with the issue.

6. The draft and final offer document shall be accompanied by a due diligence certificate signed by the Manager and lead merchant banker.

7. SEBI may communicate its comments to the lead merchant banker and, in the interest of investors, may require the lead merchant banker to carry out such modifications in the draft offer document as it deems fit.

8. The lead merchant banker shall ensure that all comments received from SEBI on the draft offer document

are suitably taken into account prior to the filing of the offer document with the designated stock exchanges.

9. In case no modifications are suggested by SEBI in the draft offer document within 21 working days, then REIT may issue the final offer document or follow-on offer document to the public after filed with the designated stock exchange.

10. The final offer document shall be filed with the designated stock exchanges and SEBI not less than 5 working days before opening of the offer and such filing with SEBI shall be accompanied by filing fees as specified under these regulations.

11. The initial offer or follow-on offer shall be made by the REIT within a period of not more than six months from the date of last issuance of observations by SEBI, if any or if no observations have been issued by SEBI , within a period of not more than six months from the date of filing of offer document with the designated stock exchanges.

However, if the initial offer or follow-on offer is not made within the specified time period, a fresh offer document shall be filed.

12. The REIT may invite for subscriptions and allot units to any person, whether resident or foreign. In case

of foreign investors, such investment shall be subject to guidelines as may be specified by RBI and the

government from time to time.

13. The application for subscription shall be accompanied by a statement containing the abridged version

of the offer document, detailing the risk factors and summary of the terms of issue.

14. Under both the initial offer and follow-on public offer, the REIT shall not accept subscription of an amount

less than two lakh rupees from an applicant.

15. Initial offer and follow-on offer shall not be open for subscription for a period of more than thirty days.

16. In case of over-subscriptions, the REIT shall allot units to the applicants on aproportionate basis rounded

off to the nearest integer subject to minimum subscription amount per subscriber as specified above.

17. The REIT shall allot units or refund application money as the case may be, within twelve working days

from the date of closing of the issue.

18. The REIT shall issue units only in dematerialized form to all the applicants.

19. The price of REIT units issued by way of public issue shall be determined through the book building process or any other process in accordance with the circulars or guidelines issued by SEBI and in the manner as may be specified by SEBI.

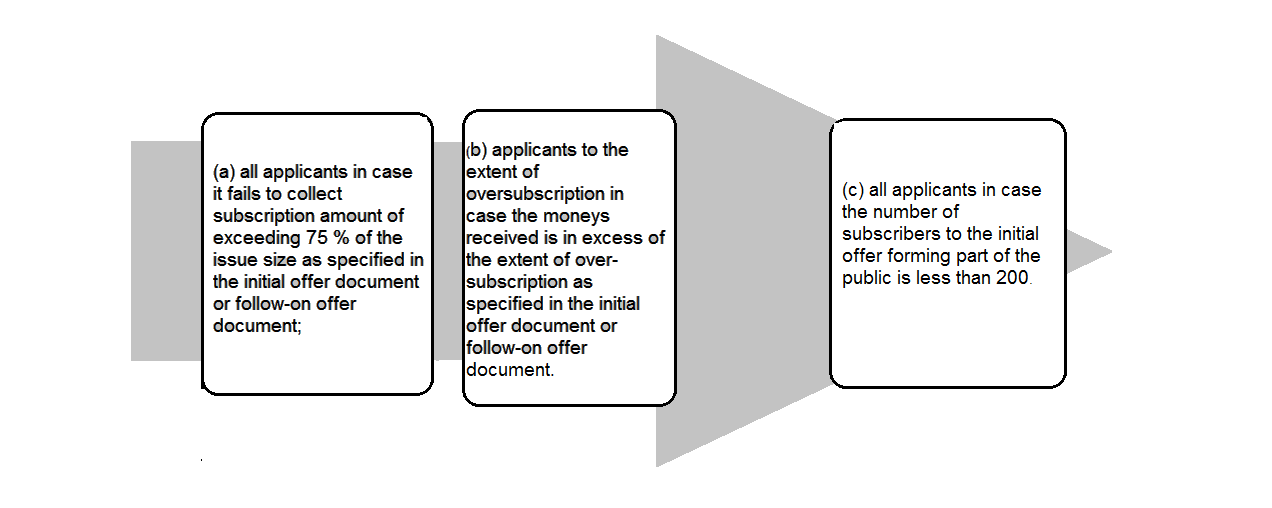

20. The REIT shall refund money to, –

Note : In case of Clause (b), right to retain such over subscription cannot exceed twenty five percent of the issue size.

21. If the manager fails to allot, or list the units, or refund the money within the specified time, then the manager shall pay interest to the unit holders at 15% per annum, till such allotment/ listing/refund and such interest shall not be recovered in the form of fees or any other form payable to the manager by the REIT.

22. Units may be offered for sale to public:-

a) If such units have been held by the existing unit holders for a period of at least one year prior to the filing of draft offer document with SEBI.

However, the holding period for the equity shares or partnership interest in the SPV against which such units have been received shall be considered for the purpose of calculation of one year period.

b) Subject to other circulars or guidelines as may be specified by SEBI in this regard.

23. If the REIT fails to make its initial offer within three years from the date of registration with SEBI, it shall surrender its certificate of registration to SEBI and cease to operate as a REIT. SEBI if it deems fit, may extend the period by another one year. Further, the REIT may later re-apply for registration, if it so desires.

24. SEBI may specify by issue of guidelines or circulars any other requirements, as it deems fit, pertaining

to issue and allotment of units by a REIT.