Issue of Debentures at a Discount :

If the debentures are issued at a price lower than the nominal value of the debentures, the debentures are said to be issued at a discount. The difference between the nominal value and the issue price is regarded as the discount. Such discount being a capital loss must be shown specifically as a deduction of general Reserve on the liabilities side of the balance sheet under the heading ‘Reserves and Surplus’. If there are no Reserves, the discussion on issue of debentures is to be shown as a negative item under the heading

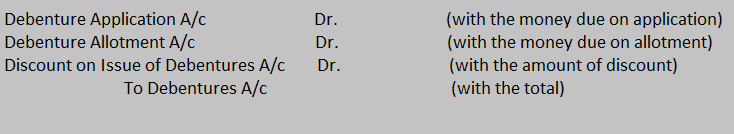

‘Reserves and Surplus’. Such discount on issue of debentures may either be written off against revenue profits or capital profits of the company. When debentures are issued at a discount, the Debentures Account should be credited with the nominal value of the debentures and the discount allowed on issue of debentures, being a capital loss, should be debited to “Discount on Issue of Debentures Account”.

Illustration :

X Ltd. made an issue of 10,000 12% Debentures of Rs.100 each, payable as follows:

Rs. 25 on Application

Rs. 25 on Allotment

Rs. 50 on First and Final Call.

Applications were received for 12,000 debentures and the directors allotted 10,000 debentures rejecting applications for 2,000 debentures. The money received on applications for 2,000 debentures rejected was duly refunded. The call was made and the moneys were duly received.

Show the necessary cash book and journal entries to record the above transactions and above the relevant items in the balance sheet of the company.

Cash Book (Bank Columns)

Dr. Cr.

| Particulars | Amount (Rs.`) | Particulars | Amount (Rs.`) |

| To 12% Debenture Application | 3,00,000 | By 12%A /Dcebenture Application A/c | 50,000 |

| (Application money on 12,000 12% Debenture @ Rs. 25 per debenture) |

(Refund of Application money on 2,000, 12% Debenture @ Rs. 25 per debenture) |

||

| To 12% Debenture Allotment | 2,50,000 | By BalaAn/ce c/d | 10,00,000 |

| (Allotment money on 10,000 12% Debenture @ Rs.25 per debenture) |

|||

| To 12% Debenture First and Final Call A/c | 5,00,000 | ||

| (First and final call money on 10,000 debentures @Rs. 80 per debenture) |

|||

| 10,50,000 | 10,50,000 |

In the books of X Ltd.

Journal Entries

| Particulars | Debit (Rs.) |

Credit (Rs.) |

| 12% Debenture Application A/c Dr. | 2,50,000 | |

| 12% Debenture Allotment A/c Dr. | 2,50,000 | |

| To 12% Debentures A/c | 5,00,000 | |

| (Being capitalization of application money @ Rs.25 per debenture and allotment money due on 10,000 debentures as per Boards resolution dated…..) |

||

| 12% Debenture First and Final Call A/c Dr. | 5,00,000 | |

| To 12% Debentures A/c | 5,00,000 | |

| (First and final call money due on 10,000, 12% debentures @ Rs.50 per debenture as per board’s resolution dated…) |

| Particulars | Note No. | Amount (Rs.) |

| I Equity and Liabilities | ||

| Non-current Liabilities | ||

| Long-term Borrowings | 1 | 10,00,000 |

| Total | 10,00,000 | |

| II Assets | ||

| Current Assets | ||

| Cash and Cash Equivalents | 3 | 10,00,000 |

| Total | 10,00,000 | |

| Notes: | ||

| 1. Long-term Borrowings | ||

| 12% Debentures | 10,00,000 | |

| 2. Cash and Cash Equivalent | ||

| Balance with Bank | 10,00,000 |

Illustration :

B Ltd. issued 2,000, 13% Debentures of Rs.100 each atRs. 110 payable as follows:

On Application Rs. 25

On Allotment Rs. 35 (including premium)

On First and Final Call Rs.50

The debentures were fully subscribed and the moneys were duly received. Prepare cash book, pass thenecessary journal entries and about the relevant portions of the balance sheet of the company.

Solution:

Cash Book (Bank Columns)

Dr. Cr.

| Particulars | Rs. | Particulars | Rs. |

| To 13% Debenture Application | 50,000 | By BalaAn/cce c/d | 2,20,000 |

| (Application money on 2,000 debentures @ Rs 25 per each) | |||

| To 13% Debenture Allotment A/c | 70,000 | ||

| (Allotment money on 2,000 debentures @Rs 35 per debenture including premium of Rs10 each) | |||

| To 13% Debenture First and Final Call A/c |

1,00,000 | ||

| (First and final call money on 2,000 debentures @ Rs.50 per debenture) | |||

| 2,20,000 | 2,20,000 |

In the books of B Ltd.

Journal Entries

| Particulars | Debit (Rs.) |

Credit (Rs.) |

| 13% Debenture Application A/c Dr. | 50,000 | |

| 13% Debenture Allotment A/c Dr. | 70,000 | |

| To 12% Debentures A/c | 1,00,000 | |

| To Securities Premium A/c | 20,000 | |

| (Being capitalization of application money @ Rs.25 per debenture and allotment money due on 2,000 debentures @ Rs. 35 including premium of Rs. 10 each as per Boards resolution dated…..) | ||

| 13% Debenture First and Final Call A/c Dr. | 1,00,000 | |

| To 13% Debentures A/c | 1,00,000 | |

| (First and final call money due on 10,000, 12% debentures @Rs 50 per debenture as per board’s resolution dated…) |

Balance Sheet of B Ltd. as at…

| Particulars | Note No. | Amount (Rs.) |

| I Equity and Liabilities | ||

| Shareholders’ Funds | ||

| Reserves and Surplus | 1 | 20,000 |

| Non-current Liabilities | ||

| Long-term Borrowings | 2 | 2,00,000 |

| Total | 2,20,000 | |

| II Assets | ||

| Current Assets | ||

| Cash and Cash Equivalents | 3 | 2,20,000 |

| Total | 2,20,000 | |

| Notes: | ||

| 1. Reserves and Surplus | ||

| Securities Premium | 20,000 | |

| 2. Long-term Borrowings | ||

| 13% Secured Debentures | 2,00,000 | |

| 3. Cash and Cash Equivalents | ||

| Balance with Bank | 2,20,000 |

Illustration :

W Ltd. issued 2,000, 14% Debentures of Rs.100 each at discount of 5%, the discount being adjustable on allotment. The debentures were payable as follows:

On Application – Rs.25

On Allotment – Rs.20

On First and Final Call – Rs.50

The debentures were fully subscribed and the moneys were duly received. Show the cash book and journal entries and prepare the balance sheet of the company.

Cash Book (Book Columns Only)

In the books of W Ltd.

Solution:

| Particulars | Rs. | Particulars | Rs. |

| To 14% Debenture Application A/c | 50,000 | By Balance c/d | 1,90,000 |

| (Application money on 2,000 debentures @ Rs. 25 per each) | |||

| To 14% Debenture Allotment A/c | 40,000 | ||

| (Allotment money on 2,000 debentures @ Rs. 20 each) | |||

| To 14% Debenture First and Final Call A/c | |||

| (First and final call money on 2,000 debentures @Rs.50 per debenture) | 1,00,000 | ||

| 1,90,000 | 1,90,000 |

Journal Entries

| Particulars | Debit (Rs.) |

Credit (Rs.) |

| 14% Debenture Application A/c Dr. | 50,000 | |

| 14% Debenture Allotment A/c Dr. | 40,000 | |

| Discount on issue of debentures A/c Dr. | 10,000 | |

| To 12% Debentures A/c | 1,00,000 | |

| (Being capitalization of application money @ Rs.25 per debenture and allotment money due on 2,000 debentures @ Rs. 20 after adjusting discount of Rs.5 each as per Boards resolution dated…..) |

||

| 14% Debenture First and Final Call A/c Dr. | 1,00,000 | |

| To 13% Debentures A/c | 1,00,000 | |

| (First and final call money due on 2,000, debentures @ Rs.50 per debenture as per board’s resolution dated…) |

Balance Sheet (Relevant Items Only)

| Particulars | Note No. | Amount (Rs.) |

| I Equity and Liabilities | ||

| Shareholders’ Funds | ||

| Reserves and Surplus | 1 | (10,000) |

| Non-current Liabilities | ||

| Long-term Borrowings | 2 | 2,00,000 |

| Total | 1,90,000 | |

| II Assets | ||

| Current Assets | ||

| Cash and Cash Equivalents | 3 | 1,90,000 |

| Total | 1,90,000 | |

| Notes: | ||

| 1. Reserves and Surplus | ||

| Discount on Issue of Debentures | (10,000) | |

| 2. Long-term Borrowings | ||

| 13% Debentures | 2,00,000 | |

| 3. Cash and Cash Equivalents | ||

| Balance with Bank | 1,90,000 |