Issue of Shares for cash

The procedure of issuing shares for cash is given below:

1. Issue of Prospectus

When shares are issued to public for cash it should satisfy the provisions of the Companies Act and the Securities Exchange Board

of India (SEBI) guidelines. Every public issue must be accompanied by an issue of prospectus. The terms and conditions of the issue of shares are stated in the prospectus. On reading the prospectus, the public will have to apply for the shares in the prescribed form.

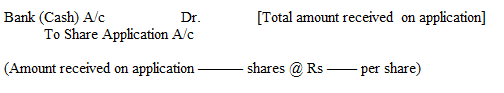

2. Receipt of application money

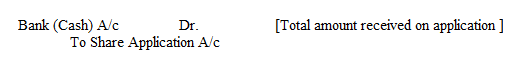

Whenever a public company issues shares, advertisements appear in the leading newspapers about the issue. Those who are interested in purchasing the shares may get an application form along with a copy of the prospectus. If he is satisfied with the information available in the prospectus, he remits the application money along with the filled-in application form to any one of the banks (branches) mentioned in the application. The applicant is required to remit at least 5% of the nominal value of the share with the application as application money (Sec 69(3)). However, as per the SEBI guidelines, the minimum application should be 25% of its issue price. The accounting entry passed to record the same is

(Amount received on application on ——— shares @ Rs —— per share)

The banker will send the application money to the company along with a list of applicants. The public issue must be kept open for atleast three working days and not more than ten working days. The issue price of shares may be received in one instalment or in different instalments.

Note : Journal Entries

There are two types of journal entries connected with issue of shares. They are called cash entries and transfer entries. Cash entries

involve the receipt of various instalments of the share. Transfer entries relate to transfer of these amounts to share capital. In case of share application, cash entry is made first followed by transfer entry. But in case of allotment and calls the transfer entry is passed first, then on receiving cash, cash entry is passed. This is because immediately allotment or call is made, money becomes due and therefore share capital is credited without waiting for the receipt of cash.

3. Allotment of Shares

While application is an offer to buy shares, allotment of shares by the company constitutes an acceptance of such offer. If the company does not receive the minimum subscription (is the least amount of shares which should be subscribed for by the public before the Directors can proceed to allotment) of 90% of the issued amount, the company has to refund the entire subscription. Once the shares are allotted, the applicants now get the status of shareholders or members of the company.

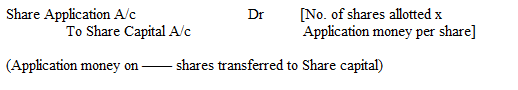

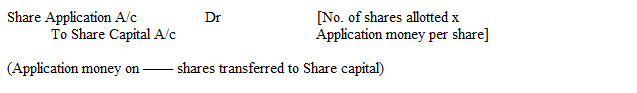

Transfer of Application money

On the date of allotment the company considers the application money on those shares which are allotted as a part of the share capital. Therefore the application money has to be transferred to share capital account. The accounting entry passed to record the same is:

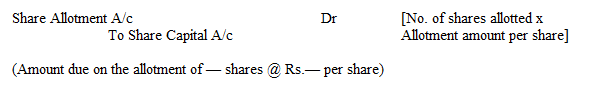

Amount Due on Allotment

As soon as shares are allotted, the shareholders are liable to pay the allotment money, which is due. The accounting entry passed to record the same is:

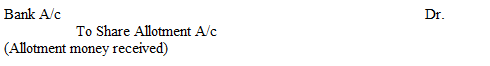

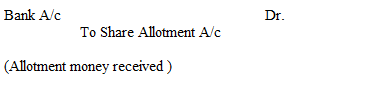

Receipt of Allotment money

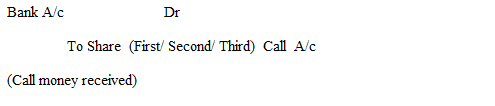

On receipt of allotment money, the following entry is made:

4. Call on Shares

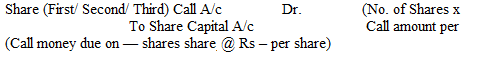

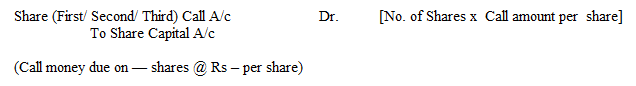

If the shares are not fully called up after allotment the Directors have the right to call the remaining amount. Call is an instalment due on shares. A call letter will be generally issued to every shareholder. The maximum number of calls that a company can make is three. There should be at least one month gap between two calls unless otherwise provided by the Articles of Association of the company. The accounting entry passed to record the same is:

Amount due on Call

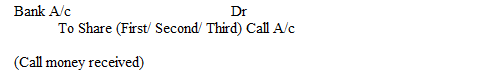

On Receipt of Call money

Summary of the above journal entries is given below :

1. Receipt of Application Money:

2. Transfer to share capital :

3. Allotment money due:

4. Receipt of allotment money:

5. Call Money due :

6. Receipt of call money :