Levy and collection of duty :

Chapter II of the Central Excise Act, 1944 deals with levy and collection of the duty. This chapter contains sections 3, 4 & 4A.

Section 3 is the charging section, section 4 provides for the method of valuation of excisable goods and section 4A deals with valuation based on maximum retail price (MRP).

Section 3(1) which is the charging section states:

There shall be levied and collected in such manner as may be prescribed:

(a) a duty of excise on all excisable goods (excluding goods produced or manufactured in special economic zones [SEZ]) which are produced or manufactured in India as, and at the rates set forth in the First Schedule to the Central Excise Tariff Act, 1985;

(b) a special duty of excise, in addition to duty of excise specified in clause (a) above, on excisable goods (excluding goods produced or manufactured in special economic zones) specified in the Second Schedule to the Central Excise Tariff Act, 1985 which are produced or manufactured in India, as, and at the rates set forth in the Second Schedule.

However, the excise duty leviable on any excisable goods manufactured by a hundred percent export oriented undertaking (100% EOU) and brought to any other place in India shall be an amount equal to the aggregate of the customs duties which would be leviable under the Customs Act or any other law for the time being in force on like goods produced or manufactured outside India if imported into India. The value of such goods shall be determined in accordance with the provisions of the Customs Act, 1962 if the duty to be levied is based on the value of such goods (ad valorem).

Where in respect of any such like goods, any duty of customs leviable for the time being in force is leviable at different rates, then, such duty shall, be deemed to be leviable at the highest of those rates.

Here, 100% EOU means an undertaking which has been approved as a 100% EOU by the Board appointed in this behalf by the Central Government in exercise of the powers conferred by section 14 of the Industries (Development and Regulation) Act, 1951 and the rules made under that Act.

SEZ has the meaning assigned to it in clause (za) of section 2 of the Special Economic Zones Act, 2005. A Special Economic Zone (SEZ) is a geographically bound zone where the economic laws relating to export and import are more liberal as compared to other parts of the country. Goods manufactured in Special Economic Zones are not leviable to excise duty. SEZ is considered to be a place outside India for all tax purpose.

Section 3(1A) provides that there is no distinction between excisable goods produced by the Government and those produced by others, with regard to payment of excise duty. Excise duty is payable on goods manufactured by or on behalf of the Government (both Central and State) also.

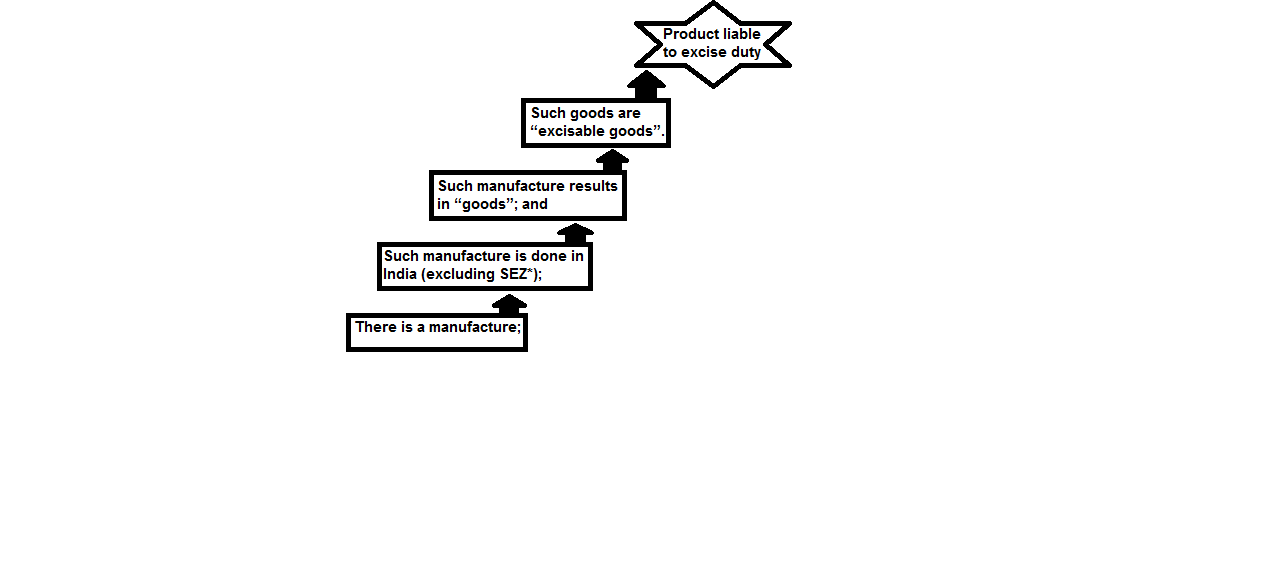

| An analysis of section 3 of the Central Excise Act, 1944 which is the charging section, throws out the following propositions:-

(a) There must be a manufacture (b) Manufacture must be in India and (c) The manufacture must result in “goods” (d) The resultant goods must be “excisable goods” |

Excise duty is not concerned with ownership or sale. Liability under excise law is event based and irrespective of whether the goods are sold or captively consumed. [Moriroku Ut India P Ltd v. State of UP 2008, (224) ELT 365 (SC)]

*A Special Economic Zone (SEZ) is a geographically bound zone where the economic laws relating to export and import are more liberal as compared to other parts of the country. Goods manufactured in Special Economic Zones are not leviable to excise duty. SEZ is considered to be a place outside India for all tax purpose.