Offences and prosecution – Specific provisions :

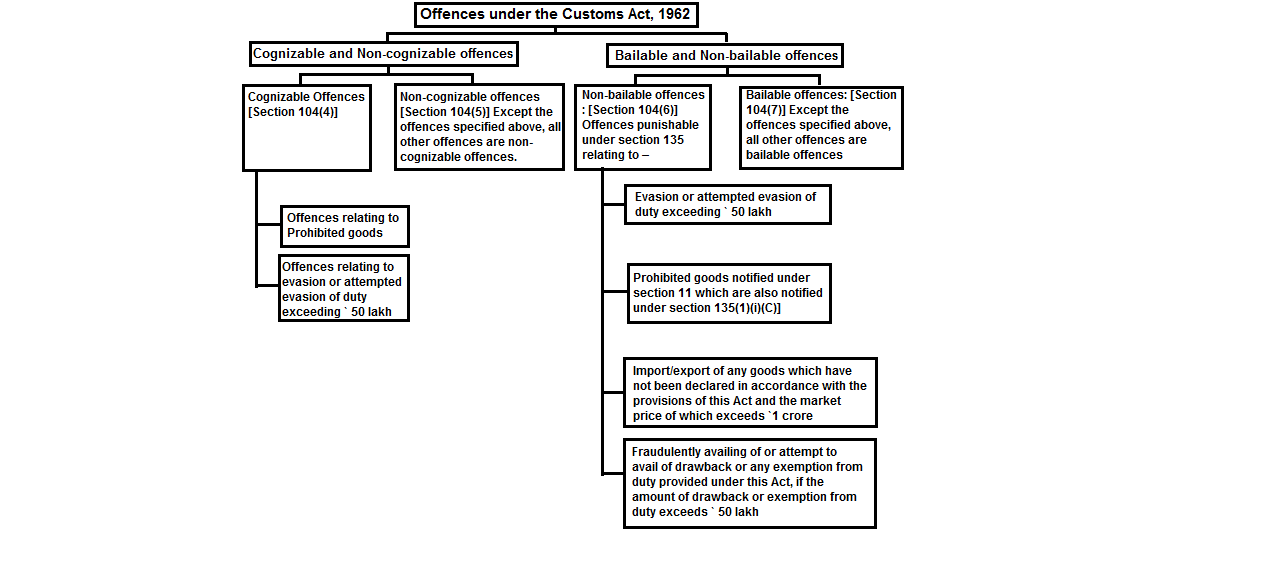

The scheme of offences under the Customs Act can be understood with the help of the following diagram:

Prosecution: No prosecution proceedings can be launched in a Court of Law against any person under Customs Act, and no cognizance of any offence under sections 132 to 135 of the Customs Act, 1962 can be taken by any Court, except with the previous sanction of concerned Principal Commissioner/Commissioner of Customs. Based upon the results of investigations and evidence brought on record, Principal Commissioner/Commissioners of Customs apply their mind before sanctioning prosecution- after being satisfied that there are sufficient reasons justifying prosecution. Criminal complaint is thereafter filed in appropriate Court of law and followed up with a view to get expeditious orders / conviction.

Specific provisions: Adjudication and appellate remedies are measures, which sometimes may not be adequate to contain smuggling and evasion of custom duty. As an exemplary measure it becomes necessary in certain situations to initiate criminal proceedings and impose stiffer actions against the offenders. Apart from prosecution in a court of law the Government had introduced the COFEPOS ACT in 1974 to preventively detain such smugglers and foreign exchange racketeers.

Sections 132 to 140 contain detailed provisions regarding the offences which are liable to prosecution in a criminal court of law, the cognisance of the offences, the procedure to try these offences and the presumption that can be had in such proceedings. These provisions are briefly discussed below:

1. False declaration, false documents, etc [Section 132] : Whoever makes, signs declaration, statement or document in the transaction of any business relating to the customs, knowing or having reason to believe that such declaration, statement or document is false in any material particular, shall be punishable with imprisonment for a term which may extend to 2 years, or with fine, or with both.

2. Obstruction of officer of Customs [Section 133] : If any person intentionally obstructs any officer of customs in the exercise of any powers conferred under this Act, such person shall be punishable with imprisonment for a term, which may extend to two years, or with fine, or with both.

3. Refusal to be X-rayed [Section 134]: If any person resists or refuses to allow a radiologist to screen or to take X-ray picture of his body in accordance with an order made by a Magistrate under section 103, or resists or refuses to allow suitable action being taken on the advice and under the supervision of a registered medical practitioner for bringing out goods liable to confiscation secreted inside his body, as provided in section 103, he shall be punishable with imprisonment for a term which may extend to six months, or with fine, or with both.

4. Evasion of duty or prohibitions [Section 135] : If any person—

(a) is in relation to any goods in any way knowingly concerned in misdeclaration of value or in any fraudulent evasion or attempt at evasion of any duty chargeable thereon or of any prohibition for the time being imposed under this Act or any other law for the time b eing in force with respect to such goods; or

(b) acquires possession of or is in any way concerned in carrying, removing, depositing, arbouring, keeping, concealing, selling or purchasing or in any other manner dealing with any goods which he knows or has reason to believe are liable to confiscation under section 111 or section 113, as the case may be; or

(c) attempts to export any goods which he knows or has reason to believe are liable to confiscation under section 113; or

(d) fraudulently avails of or attempts to avail of drawback or any exemption from duty provided under this Act in connection with export of goods,

then,

| Particulars | Punishment |

| (A) in the case of an offence relating to | |

| (i) any goods the market price of which exceeds one crore of rupees | Imprisonment for a term which may extend to 7 years and with fine |

| (ii) the evasion or attempted evasion of duty exceeding ` 50 lakh | Imprisonment for a term which may extend to 7 years and with fine |

| (iii) such categories of prohibited goods as the Central Government may, by notification in the Official Gazette, specify | Imprisonment for a term which may extend to 7 years and with fine |

| (iv) fraudulently availing of or attempting to avail of drawback or any exemption from duty referred to in clause (d), if the amount of drawback or exemption from duty exceeds ` 50 lakh | Imprisonment for a term which may extend to 7 years and with fine |

| (B) in any other case | Imprisonment for a term which may extend to 3 years, or with fine, or with both |

However, in the absence of special and adequate reasons to the contrary to be recorded in the judgment of the court, such imprisonment (mentioned in point (i) above) shall not be for less than 1 year.

If any person is convicted for a second time, he shall be punishable for the second and subsequent offence with imprisonment for a term which may extend to seven years and with fine.

The following shall not be considered as special and adequate reasons for awarding sentence of imprisonment for less than one year:

1. the accused is convicted for the first time

2. the accused has been ordered to pay a penalty or the goods which are the subject matter of such proceedings have been ordered to be confiscated or any other action has been taken against him for the same act

3. the accused was not the principal offender and was a secondary party to the commission of the offence

4. the age of the accused.

5. Preparation [Section 135A]: If a person makes preparation to export any goods in contravention of the provisions of this Act, and from the circumstances of the case it may be reasonably inferred that if not prevented by circumstances independent of his will, he is determined to carry out his intention to commit the offence, he shall be punishable with imprisonment for a term which may extend to three years, or with fine, or with both.

6. Power of court to publish name, place of business, etc., of persons convicted under the Act [Section 135B]: Where any person is convicted under this Act for contravention of any of the provisions thereof, it shall be competent for the court convicting the person to cause the name and place of business or residence of such person, nature of the contravention, the fact that the person has been so convicted and such other particu lars as the court may consider to be appropriate in the circumstances of the case, to be published at the expense of such person in such newspapers or in such manner as the court may direct.

No publication shall be made until the period for preferring an appeal against the orders of the court has expired without any appeal having been preferred, or such an appeal, having been preferred, has been disposed of. The expenses of any publication shall be recoverable from the convicted person as if it were a fine imposed by the court.

7. Offences by officers of customs [Section 136] : The officers of Customs also cannot escape serious action including prosecution action, if they are found abusing their powers or are shown to be colluding/conniving with tax evaders. In the following cases, prosecution proceeding against a customs officer may be initiated under section 136 of the Customs Act:-

| S. No. | Offence by Customs Officers | Punishment |

| (i) | If a customs officer enters into or acquiesces in any agreement to do, abstains from doing, permits, conceals or connives at any act or thing whereby any fraudulent export is effected or any duty of customs leviable on goods [or any prohibition for the time being in force under this Act or any other law for the time being in force with respect to any goods] is or may be evaded [Sub-section 1]. | Imprisonment up to three years, or with fine, or with both |

| (ii) | If a customs officer requires any person to be searched for goods liable to confiscation or any document relating thereto, without having reason to believe that he has such goods or document secreted about his person [Sub-section 2(a)]. | Imprisonment upto six months, or with fine extendible upto `1,000, or with both |

| (iii) | If a customs officer arrests any person without having reason to believe that he has been guilty of an offence punishable under section 135, he may be punishable [sub-section 2(b)] | |

| (iv) | If a customs officer searches or authorises any other officer of customs to search any place without having reason to believe that any goods, documents or things of the nature referred to in section 105 are secreted in that place [Sub-section 2(c)] | |

| (v) | If any officer of customs, except in the discharge in good faith of his duty as such officer or in compliance with any requisition made under any law for the time being in force, discloses any particulars learnt by him in his official capacity in respect of any goods [Sub-section 2] |

8. Offences by companies [Section 140]: Every person who at the time the offence was committed was in charge of, and was responsible to, the company for the conduct of business of the company, as well as the company, shall be deemed to be guilty of the offence and shall be liable to be proceeded against and punished accordingly. Nothing shall render any such person liable to such punishment provided in this Chapter if he proves that the offence was committed without his knowledge or that he exercised all due diligence to prevent the commission of such offence. Explanation to sub-section (2) defines ―company‖ as a body corporate and includes a firm or other association of individuals.

9. Cognizance of offences [Section 137]: No court shall take cognizance of:

(a) any offence under section 132, section 133, section 134 or section 135 or section 135A except with the previous sanction of the Principal Commissioner/Commissioner of Customs.

(b) any offence under section 136

– where the offence is alleged to have been committed by an officer not lower in rank than Assistant Commissioner of Customs, except with the previous sanction of the Central Government.

– where the offence is alleged to have been committed by an officer of lower in rank than Assistant Commissioner of Customs, except with the previous sanction of the Principal Commissioner/Commissioner of Customs.

Compounding of Offences: Sub-section (3) of section 137 provides for compounding of offences, either before or after the institution of prosecution, by Principal Chief Commissioner/Chief Commissioner of Customs on payment of the prescribed compounding amount in the prescribed manner. Such amount shall be paid to the Central Government by the person accused of the offence. Section 156 empowers Central Government to make rules for specifying the amount to be paid for compounding and the manner of compounding of offences under section 137.

However, in the case of following persons the provisions relating to compounding of offences will not apply: –

(a) a person who has been allowed to compound once in respect of any offence under sections 135 and 135A;

(b) a person who has been accused of committing an offence under this Act which is also an offence under any of the following Acts, namely:—

(i) the Narcotic Drugs and Psychotropic Substances Act, 1985;

(ii) the Chemical Weapons Convention Act, 2000;

(iii) the Arms Act, 1959;

(iv) the Wild Life (Protection) Act, 1972;

(c) a person involved in smuggling of goods falling under any of the following, namely: —

(i) goods specified in the list of Special Chemicals, Organisms, Materials, Equipment and Technology in Appendix 3 to Schedule 2 (Export Policy) of ITC (HS) Classification of Export and Import Items of the Foreign Trade Policy, as amended from time to time, issued under section 5 of the Foreign Trade (Development and Regulation) Act, 1992;

(ii) goods which are specified as prohibited items for import and export in the ITC (HS) Classification of Export and Import Items of the Foreign Trade Policy, as amended from time to time, issued under section 5 of the Foreign Trade (Development and Regulation) Act, 1992;

(iii) any other goods or documents, which are likely to affect friendly relations with a foreign State or are derogatory to national honour;

(d) person who has been allowed to compound once in respect of any offence under this Chapter for goods of value exceeding rupees one crore;

(e) person who has been convicted under this Act on or after 30.12.2005.

10. Presumption of culpable mental state [Section 138A] : As per section 138A of the Customs Act, in prosecution proceedings under the said Act for an offence under the said Act, the culpable (guilty conscience or mens rea) on the part of the accused person shall be presumed and it will be for the accused to prove the fact that he had no such mental state with respect to the act charged as an offence in that prosecution. When the presumption of culpable mental state is drawn under this provision, it includes intention, motive, knowledge, belief as well as reason to belief. The presumption could be deemed as rebutted only if the proof is beyond reasonable doubt and not merely when its existence is established by a preponderance of probability.

11. Relevancy of statements under certain circumstances [Section 138B]: A statement made and signed by a person before any gazetted officer of customs during the course of any inquiry or proceeding under this Act shall be relevant, for the purpose of proving, in any prosecution for an offence under this Act, the truth of the facts which it contains, –

(a) when the person who made the statement is dead or cannot be found, or is incapable of giving evidence, or is kept out of the way by the adverse party, or whose presence cannot be obtained without an amount of delay or expense which, under the circumstances of the case, the court considers unreasonable; or

(b) when the person who made the statement is examined as a witness in the case before the court and the court is of opinion that, having regard to the circumstances of the case, the statement should be admitted in evidence in the interests of justice.

12. Admissibility of micro films, etc as evidence [Section 138C] : The following are deemed to be also a document for the purposes of this Act and the rules made thereunder and shall be admissible in any proceedings thereunder, without further proof or production of the original:

1. a micro film of a document or the reproduction of the image; or

2. a facsimile copy of a document; or

3. computer printout.

1.3 Presumption as to documents in certain case [Section 139]: Where any document

– is produced by any person or has been seized from the custody, under this Act or any other law

– has been received from any place outside India in the course of investigation of any offence under this Act,

It is presumed, unless the contrary is proved, that the signature and every other part of such document which purports to be in the handwriting of any particular person or which the court may reasonably assume to have been signed by, or to be in the handwriting of, any particular person, is in that person‘s handwriting, and in the case of a document executed or attested, that it was executed or attested by the person by whom it purports to have been so executed or attested. The document can be admitted as evidence, notwithstanding that it is not duly stamped, if such document is otherwise admissible in evidence. Further the same shall be presumed, unless the contrary is proved, to be admissible.

14. Offences to be tried summarily [Section 138]: Notwithstanding anything contained in the Code of Criminal Procedure, 1898, an offence under this Chapter (ie., Chapter XVI) may be tried summarily by a Magistrate. However, the exceptions are:

1. Offence under clause (i) of sub-section (1) of section 135

2. Offence under sub-section (2) of section 135.

Customs Act is a special enactment. This section provides for summary trial of all offences under the Act. Therefore, the provisions of section 262 of Cr. P.C., which allows trial as warrant case of all offences punishable with imprisonment more than 2 years is inapplicable to the offences under this Act. [Ruli Ram and Ors vs. ACCE, 1987 (30) ELT 657 (HP)].