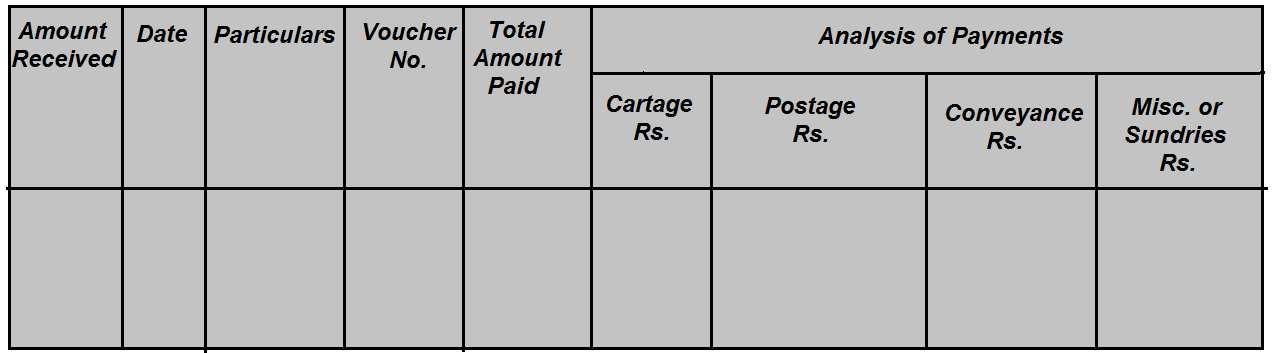

PETTY CASH BOOK :

Payments in cash of small amounts like traveling expenses, postage, carriage etc. are petty cash expenses. These petty cash expenses are recorded in the petty cash book. The petty cash book is maintained by separate cashier known as petty cashier. The firm may adopt Imprest System of maintaining petty cash. The petty cashier is given a certain sum of money at the beginning of the fixed period (e.g. a month/fortnight) which is called float. The amount of float is so fixed that it may be adequate to meet petty expenses of the prescribed period. The balance in the petty cash book shows cash lying with the petty cashier.

Petty Cash Book

The advantages of the imprest system are as follows:

– It saves the time of the chief cashier.

– Petty cashier is not allowed to keep idle cash with him if the float is found to be more than adequate; its amount will be immediately reduced. This reduces the chances of misuse of cash by the petty cashier.

– The record of petty cash is checked by the cashier periodically, so that a mistake, if committed, is soon rectified.

– It enables a great saving to be effected in the posting of small items to the ledger accounts.

– The system trains young staff to handle cash responsibilities.

Petty Cash Book may be treated either as a part of the double entry system or merely as a memoranda book. If the former course is adopted, each payment to petty cashier is shown on the credit side of the main Cash Book which is considered to have been balanced by a debit entry in the petty cash book. The two entries are folioed against each other completing the double entry aspect. Payments recorded in the Petty Cash Book are directly posted to the different nominal accounts. Of course, entries for expenses are made only with the periodical totals of expenses under various heads. If the latter course is adopted, for amounts paid to petty cashier, petty cash account in the ledger is debited besides entering the amounts (paid to petty cashier) on the credit side of the main cash book. Periodically, different nominal accounts are debited and the petty cash account is credited in ledger for expenses recorded in Petty Cash Book.

Illustration 6:

Prepare an analytical Petty Cash Book from the following information:

Petty cash is maintained on the basis of imprest system. On 21st January, 2013 the petty cashier had with him Rs. 328. He received Rs. 672 to make up the expenses of the previous week. During the week the following expenses were met by the petty cashier:

| 2013 | Rs. | ||

| March | 21 | Bus fare 6 | 6 |

| ” | 21 | Revenue stamps | 85 |

| 21 | Tea for customers | 22 | |

| ” | 22 | Cartage | 43 |

| ” | 24 | Payment to Coolie | 10 |

| 24 | Telegram charges | 76 | |

| 24 | Refreshment for customer | 52 | |

| ” | 25 | Repairs to furniture | 100 |

| 25 | Taxi charges | 87 | |

| 25 | Post cards | 90 | |

| 25 | Cloth for dusters | 74 | |

| 25 | Tea for customers | 20 |

Solution:

| Amount Received |

Date | Particulars | Vouc her No. |

Total Amou nt Paid | Cartage & Cooli |

Printing & Stationery |

Customers Entertainm ent |

Conveya nce |

Sundri es |

|

2013 |

|||||||||

|

Jan. |

|||||||||

| 328 |

22. |

To Balance b/d | |||||||

| 672 |

21. |

To Cash | |||||||

|

21. |

By Bus Fare |

6 |

6 | ||||||

|

21. |

By Rev. Stamps |

85 |

85 |

||||||

|

21. |

By Tea for Customers |

22 |

22 |

||||||

|

22. |

By Cartage |

43 |

43 | ||||||

|

24. |

By Cooli |

10 |

10 | ||||||

|

24. |

By Telegram charges |

76 |

76 |

||||||

|

24. |

By Refreshment to | ||||||||

| customers |

52 |

52 |

|||||||

|

25. |

By Repairs to | ||||||||

| Furniture |

100 |

100 |

|||||||

|

25. |

By Taxi Charges |

87 |

87 |

||||||

|

25. |

By Post Cards |

90 |

90 |

||||||

|

25. |

By Cloth for Dusters |

74 |

74 |

||||||

|

25. |

By Tea for Customers |

20 |

20 | ||||||

| By Balance c/d |

335 |

||||||||

|

1,000 |

1,000 |

||||||||

|

335 |

28. |

To Balance b/d | |||||||

|

665 |

28. |

To Cash A/c |

The journal entry required for various petty cash expenses are the following:

|

Z |

Z |

|

| Cartage A/c Dr. |

53 |

|

| Postage and Telegrams A/c Dr. |

251 |

|

| Conveyance A/c Dr. |

93 |

|

| Customer’s Entertainment A/c Dr. |

94 |

|

| Repairs A/c Dr. |

100 |

|

| General Expenses A/c Dr. |

74 |

|

| To Petty Cash Account |

665 |

The Petty Cash Account in the ledger will appear as follows:

Dr. Petty Cash Account Cr.

|

2013 |

2013 |

||||

|

Jan. 21 |

To Balance b/d |

328 |

Jan. 25 |

By Sundries* |

665 |

|

“ |

To Cash A/c |

672 |

” |

By Balance c/d |

335 |

|

1,000 |

1,000 |

||||

|

Mar. 28 |

To Balance b/d |

335 |

|||

|

31 |

To Cash |

665 |