Preparation of Final Accounts

Illustration :

Pass necessary adjustment entries for the following adjustments:

1. Salaries outstanding Rs.20,000

2. Prepaid Insurance Rs.400

3. Interest accrued on investments Rs.1000

4. Commission received in advance Rs.2,000

5. To provide 10% interest on capital of Rs.5,00,000

6. Closing Stock Rs.4,00,000

Solution:

Adjustment Entries

| Date | Particulars | L.F | Debit

Rs. |

Credit

Rs. |

| 1. | Salaries A/c Dr | 20,000 | ||

| To Salaries outstanding A/c | 20,000 | |||

| (Salaries outstanding) | ||||

| 2. | Prepaid Insurance A/c Dr | 400 | ||

| To Insurance A/c | 400 | |||

| (Insurance prepaid) | ||||

| 3. | Accrued Interest A/c Dr | 1,000 | ||

| To Interest A/c | 1,000 | |||

| (Interest accrued on investments) | ||||

| 4. | Commission received A/c Dr | 2,000 | ||

| To Commission received in advance A/c | 2,000 | |||

| (Commission received in advance) | ||||

| 5. | Interest on Capital A/c Dr | 50,000 | ||

| To Capital A/c | 50,000 | |||

| (10% interest on capital) | ||||

| 6. | Closing Stock A/c Dr | 4,00,000 | ||

| To Trading A/c | 4,00,000 | |||

| (Closing stock recorded) |

Illustration :

Pass necessary adjusting entries for the following adjustments:

1. Interest charged on drawings Rs.5,000

2. Interest on loan outstanding Rs.3,000

3. Depreciation at 10% is to be charged on Machinery Rs.3,00,000.

4. Write off bad debts Rs.2,000

5. To provide provision for Bad & doubtful debts at 2% on Sundry debtors Rs.60,000

6. To provide Provision for discount on creditors at 2% on Sundry Creditors worth Rs.1,00,000

Date |

Particulars |

L.F |

DebitRs. |

CreditRs. |

| Capital A/c Dr | 5,000 | |||

| To Interest on drawings A/c | 5,000 | |||

| (Interest charged on drawings) | ||||

| 2. | Interest on loan A/c Dr | 3,000 | ||

| To Interest outstanding A/c | 3,000 | |||

| (Interest due on loan) | ||||

| 3. | Depreciation A/c Dr | 30,000 | ||

| To Machinery A/c 30,000 | 30,000 | |||

| (Depreciation on Machinery) | ||||

| 4. | Bad debts A/c Dr | 2,000 | ||

| To Sundry debtors A/c | 2,000 | |||

| (Bad debts written off) | ||||

| 5. | Profit and Loss A/c Dr | 1,200 | ||

| To Provision for Bad & doubtful debts A/c | 1,200 | |||

| (2% provision for Bad & doubtful debts) | ||||

| 6. | Provision for discount on creditors A/c Dr | 2,000 | ||

| To Profit & Loss A/c | 2,000 | |||

| (2% provision for discount on Creditors) | ||||

Illustration :

The Trial Balance as on 31st March 2004 shows Sundry debtors as Rs.12,000 and bad debts as Rs.300. No adjustment given.

Solution:

Profit and Loss Account for

Dr . the year ended 31st March 2004 Cr.

|

Particulars |

Rs. | Particulars |

Rs. |

| To Bad Debts |

300 |

Balance Sheet as on 31st March 2004

|

Liabilities |

Rs. | Assets |

Rs. |

| Sundry debtors |

12,000 |

Illustration :

The Trial Balance as on 31st March 2004 shows the following:

Dr. Cr.

Sundry Debtors 40,800 ––

Bad debts written off 1,400 ––

Adjustment: Write off Rs.800/- as bad debts.

Solution:

Adjusting Entry

|

Date |

Particulars | L.P. | Debit Rs. |

Credit |

|

Bad debts A/c Dr.

To Sundry debtors A/c (bad debts written off) |

800 |

800 |

Note:

In the above example, Trial Balance shows Rs.1,400 as Bad debts. This means the double entry in respect of Rs.1,400 i.e.debiting Bad

debts and crediting Sundry debtors is already completed. Hence Rs.1,400 found in the Trial Balance will not affect the sundry debtors of Rs.40,800.

But for the adjustment given outside the Trial Balance, the adjustment has to be done after the preparation of Trial Balance and

this would result in increasing bad debts by Rs.800 and decreasing debtors by Rs.800.

Profit and Loss Account for

the year ending 31st March 2004

Dr. Cr.

|

Particulars |

Rs. | Rs. | Particulars | Rs. |

Rs. |

| To Bad Debts |

1,400 |

||||

| Add: Bad debts Written off |

__800 |

||||

|

2,200 |

Balance Sheet as on 31st March 2004

|

Liabilities |

Rs. | Rs. | Assets | Rs. |

Rs. |

| Sundry Debtors |

40,800 |

||||

| Less: Bad debts written off |

___800 |

||||

|

40,000 |

Note:

Dr. Bad Debts Account Cr.

|

Particulars |

Rs. | Particulars |

Rs. |

| To Balance b/d

To Sundry Debtors |

1,400 800 |

By Profit & Loss |

2,200 |

|

2,200 |

2,200 |

Illustration :

The following items are found in the Trial Balance of Mr.Vivekanandan as on 31st March 2004.

Sundry debtors Rs. 64,000

Bad debts Rs. 1,200

Provision for Bad & doubtful debts Rs. 2,800

Adjustment:

Provide for bad & doubtful debts at 5% on Sundry debtors.

Give necessary entries and show how these items will appear in the final accounts.

Solution:

Step :1

Transfer Entry

|

Date |

Particulars | LF. | Debit Rs. |

Credit |

| 2004

Mar 31 |

Provision for bad & doubtful debts A/c Dr. To Bad debts A/c |

1,200 |

1,200 |

Note:

If Provision for bad and doubtful debts account is maintained, the loss on account of bad debts is taken to Profit and Loss Account not

directly but via provision for bad and doubtful debts account.

Step 2:

Apply the rule:

Rs.

Bad debts 1,200

Add: New Provision required 5% on 64,000 3,200

Total required 4,400

Less: Existing provision 2,800

Amount required 1,600

Adjusting Entry

Date |

Particulars |

L.F |

DebitRs. |

CreditRs. |

| 2004 | ||||

| 31-Mar | Profit and Loass A/c Dr. | 1,600 | ||

| To Provision for bad and doubtful debts A/c | 1,600 | |||

| (Additional provision for bad and doubtful debts) |

Profit and Loss Account for

the Period ended 31st March 2004

Dr. Cr.

| Particulars | Rs. | Rs. | Particulars | Rs. |

Rs. |

| To Provision for bad & doubtful debts A/c |

|||||

| Bad debts |

1,200 |

||||

| Add: New provision |

3,200 |

||||

|

4,400 |

|||||

| Less: Old provision |

2,800 |

||||

|

1,600 |

Balance Sheet as on 31st March 2004

| Liabilities | Rs. | Rs. | Assets | Rs. | Rs. |

| Debtors | 64,000 | ||||

| Less: Provision for Bad & doubt–ful debts (New) | 3,200 | ||||

| 60,800 |

Note:

When the existing provision is larger than what is required even after the transfer of bad debts, the second step will give a negative

figure, which indicates that the profit and loss account is to be credited with the excess.

Illustration :

Following are the balances extracted from the Trial Balance of Mr. Mohan as on 31st March, 2002.

Trial Balance as on 31st March, 2002

| particulars | Debit Rs. |

Credit

|

| Sundry debtors | 60,000 | |

| Bad debts | 5,000 | |

| Provision for bad & doubtful debts | 10,000 |

Adjustment

Create provision for bad & doubtful debts @ 5% on Sundry Debtors.

Pass adjusting entry and show how these items will appear in the final accounts.

Solution:

Adjusting Entry

| Date | Particulars | L.F | Debit

Rs. |

Credit

Rs. |

| 2002 | ||||

| 31-Mar | Provision for Bad and Doubtful debts A/c Dr . | 2,000 | ||

| To Profit & Loss A/c | 2,000 | |||

| (Excess: 5% Provision for bad and doubtful debts) |

Profit and Loss Account for

Dr. the year ending 31s’ March, 20029 Cr.

|

Particulars |

Rs. | Rs. | Particulars | Rs. |

Rs. |

| By Provision for bad and doubt-ful debts: | |||||

|

Old Provision for bad & doubtful debts |

10,000 |

||||

| Less:Bad debts 5000 | |||||

| New Provision 3000 |

8,000 |

||||

|

2,000 |

Balance Sheet as on 31st March, 2002

|

Liabilities |

Rs. | Rs. | Assets | Rs. |

Rs. |

| Sundry debtors |

60,000 |

||||

| Less: New Provision |

3,000 |

||||

|

57,000 |

Illustration :

The following balances have been extracted from the trial balance of Mr.Ashok as on 31.3.2002.

Trial Balance of Mr.Ashok as on 31st March, 2002

| particulars |

Debit Rs. |

Credit Rs |

| Debtors | 2,01,200 | |

| Bad debts | 9,400 | |

| Provision for bad & doubtful debts | 24,000 | |

| Provision for Discount on debtors | 1,200 | |

| Discount allowed | 18,600 |

Adjustments:

1. Write off additional bad debts Rs.4,800

2. Create Provision of 10% for bad & doubtful debts on debtors.

3. Create Provision of 2% for discount on debtors.

Show how these items will appear in the Profit and Loss Account and Balance Sheet.

Solution:

Profit and Loss Account of Mr.Ashok

for the year ending 31st March, 2002

Dr. Cr.

|

Particulars |

Rs. | Rs. | Particulars | Rs. |

Rs. |

| To Provision for Bad & Doubtful debts A/c | |||||

| Bad debts |

9,400 |

||||

| Add: Bad debts written off |

4,800 |

||||

|

14,200 |

|||||

| Add: New Provision |

19,640 |

||||

|

33840 |

| Less: Old provision |

24,000 |

9,840 |

|||

| To Provision for discount on debtors Discount allowed |

18,600 |

||||

| Add: New provision |

3,535 |

||||

|

22,135 |

|||||

| Less: Old provision |

_1,200 |

|

20,935 |

Balance Sheet as on 31st March, 2002

|

Liabilities |

Rs. | Rs. | Assets | Rs. |

Rs. |

| Sundry debtors |

2,01,200 |

||||

| Less: Bad debts written off |

4,800 |

||||

|

1,96,400 |

|||||

| Less: New provision for bad & doubt-ful debts |

19,640 |

||||

|

1,76,760 |

|||||

| Less: New Provision for discount on debtors |

____3,535 |

||||

|

1,73,225 |

Illustration :

From the following trial balance of a trader, make out a Trading and Profit and Loss account and Balance Sheet as on 31st March, 2000.

| particulars | Debit Rs. |

Credit

Rs |

| Sales | 4,20,000 | |

| Purchases | 1,05,000 | |

| Printing Charges | 2,500 | |

| Wages | 77,500 | |

| Salaries | 12,500 | |

| Opening Stock | 2,25,000 | |

| Carriage Inwards | 8,800 | |

| General Expenses | 26,250 | |

| Trade Marks | 5,000 | |

| Rates and Taxes | 2,500 | |

| Capital | 1,74,800 | |

| Discount received | 1,250 | |

| Loan | 1,75,000 | |

| Buildings | 2,00,000 | |

| Furniture | 25,000 | |

| Machinery | 50,000 | |

| Cash | 1,000 | |

| Bank | 30,000 | |

| 7,71,050 | 7,71,050 |

Adjustments:

1. The closing stock was valued at Rs.3,20,000.

2. Outstanding Salaries Rs.10,000.

3. Prepaid rates & taxes Rs.500.

Solution:

Trading and Profit and Loss Account for

the year ending 31st March, 2000

| particulars | Rs. | Rs. | particulars | Rs. | Rs. |

| To Opening Stock | 2,25,000 | By Sales | 4,20,000 | ||

| To Purchases | 1,05,000 | By Closing Stock | 3,20,000 | ||

| To Wages | 77,500 | ||||

| To Carriage inwards | 8,800 | ||||

| To Gross Profit c/d | 3,23,700 | ||||

| (Transferred to Profit and Loss A/c) | |||||

| 7,40,000 | 7,40,000 | ||||

| To Printing charges | 2,500 | By Gross Profit b/d | 3,23,700 | ||

| To Salaries | 12,500 | (Transferred from Trading A/c) | |||

| Add: Outstanding | 10,000 | By Discount received | 1,250 | ||

| 22,500 | |||||

| To General expenses | 26,250 | ||||

| To Rates and Taxes | 2,500 | ||||

| Less: Prepaid | __500 | ||||

| 2,000 | |||||

| To Net Profit | 2,71,700 | ||||

| (Transferred to Capital A/c) | ____________ | ____________ | |||

| 3,24,950 | 3,24,950 |

Balance Sheet as on 31st March, 2000

| Liabilities | Rs. | Rs. | Assets | Rs. | Rs. |

| Outstanding Salary | 10,000 | Cash | 1,000 | ||

| Loans | 1,75,000 | Bank | 30,000 | ||

| Capital | 1,74,800 | Closing Stock | 3,20,000 | ||

| Add: Net Profit | 2,71,700 | 4,46,500 | Prepaid rates & taxes | 500 | |

| Building | 2,00,000 | ||||

| Furniture | 25,000 | ||||

| Machinery | 50,000 | ||||

| Trade Marks | 5,000 | ||||

| 6,31,500 | 6,31,500 | ||||

Illustration :

The following Trial Balance has been extracted from the books of Mr.Bhaskar on 31.03.2003.

Trial Balance

| Particulars |

Debit Rs. |

Credit Rs. |

| Machinery | 40,000 | |

| Cash at Bank | 10,000 | |

| Cash in Hand | 5,000 | |

| Wages | 10,000 | |

| Purchases | 80,000 | |

| Stock (01.04.2002) | 60,000 | |

| Sundry debtors | 40,000 | |

| Bills Receivable | 29,000 | |

| Rent | 4,000 | |

| Interest on Bank Loan | 500 | |

| Commission received | 3,000 | |

| General Expenses | 12,000 | |

| Salaries | 7,500 | |

| Discount received | 4,000 | |

| Capital | 90,000 | |

| Sales | 1,20,000 | |

| Bank Loan | 40,000 | |

| Sundry Creditors | 40,000 | |

| Purchase returns | 5,000 | |

| Sales returns | __4,000 | __________ |

| 3,02,000 | 3,02,000 |

Adjustments:

1. Closing Stock Rs.80,000

2. Interest on Bank loan not yet paid Rs.400

3. Commission received in advance Rs.1,000

Prepare Trading and Profit and loss Account for the year ended 31.03.2003 and Balance Sheet as on that date after giving effect to the

above adjustments.

Solution:

Trading and Profit and Loss Account of Mr.Bhaskar

for the year ending 31st March, 2003

Dr. Cr.

|

Particulars |

Rs. | Rs. | Particulars | Rs. |

Rs. |

| To Opening Stock |

60,000 |

By Sales |

1,20,000 |

||

| To Purchases |

80,000 |

Less: Returns |

___4,000 |

1,16,000 |

|

| Less: Returns |

__5,000 |

75,000 |

By Closing stock |

80,000 |

|

| To Wages |

10,000 |

||||

| To Gross Profit c/d |

51,000 |

||||

| (Transferred to Profit and Loss A/c) | |||||

|

1,96,000 |

1,96,000 |

||||

| To Rent |

4,000 |

By Gross Profit b/d |

51,000 |

||

| To Interest on Bank | (Transferred from Trading A/c) | ||||

| Loan |

500 |

By Commission received |

3,000 |

||

| Add: Outstanding |

400 |

Less: Received in advance |

1,000 |

||

|

900 |

2,000 |

||||

| To General Expenses |

12,000 |

By Discount received |

4,000 |

||

| To Salaries |

7,500 |

||||

| To Net Profit |

32,600 |

||||

| (Transferred to Capital A/c) | |||||

|

57,000 |

57,000 |

||||

Balance Sheet as on 31st March, 2003

| Liabilities | Rs. | Rs. | Assets | Rs. | Rs. |

| Sundry Creditors | 40,000 | Cash in hand | 5,000 | ||

| Bank Loan | 40,000 | Cash at Bank | 10,000 | ||

| Add: Outstanding interest on loan | 400 | Bills receivable | 29,000 | ||

| 40,400 | Sundry debtors | 40,000 | |||

| Commission received in advance | 1,000 | Closing Stock | 80,000 | ||

| Capital | 90,000 | Machinery | 40,000 | ||

| Add: Net Profit | 32,600 | ||||

| 1,22,600 | |||||

| 2,04,000 | 2,04,000 |

Illustration :

The following are the balances extracted from the books of Mrs.Suguna as on 31st March, 2004.

|

Debit Balances |

Rs. | Credit Balances |

Rs. |

| Drawings |

40,000 |

Capital |

2,00,000 |

| Cash at Bank |

17,000 |

Sales |

1,60,000 |

| Cash in hand |

60,000 |

Sundry Creditors |

45,000 |

| Wages |

10,000 |

||

| Purchases |

20,000 |

||

| Stock (31.03.03) |

60,000 |

||

| Buildings |

1,00,000 |

||

| Sundry debtors |

44,000 |

||

| Bills Receivable |

29,000 |

||

| Rent |

4,500 |

||

| Commission |

2,500 |

||

| General Expenses |

8,000 |

||

| Furniture |

5,000 |

||

| Suspense Account |

5,000 |

||

|

4,05,000 |

4,05,000 |

Adjustments:

- Closing Stock Rs.40,000 valued as on 31.03.04.

- Interest on Capital at 6% to be provided.

- Interest on Drawings at 5% to be provided.

- Depreciate buildings at the rate of 10% per annum.

- Write off Bad debts Rs.1,000.

- Wages yet to be paid Rs.500

Prepare Trading and Profit & Loss Account and Balance Sheet as on 31st March 2004

Solution:

Trading and Profit and Loss Account of Mrs. Suguna for

the year ending 31st Marh, 2004

Dr. Cr.

| Particulars | Rs. | Rs. | Particulars | Rs. | Rs. |

| To Opening Stock |

60,000 |

By Sales |

1,60,000 |

||

| To Purchases |

20,000 |

By Closing Stock |

40,000 |

||

| To Wages |

10,000 |

||||

| Add: Outstanding |

_____500 |

||||

|

10,500 |

|||||

| To Gross Profit c/d

(Transferred to Profit & Loss A/c) |

1,09,500 |

||||

|

2,00,000 |

2,00,000 |

||||

| To Rent |

4,500 |

By Gross Profit b/d

(Transferred from Trading A/c) |

1,09,500 |

||

| To Commission |

2,500 |

By interest on Drawings | 2,000 | ||

| To General Expenses |

8,000 |

||||

| To Interest on Capital |

12,000 |

||||

| To Depreciation on buildings |

10,000 |

||||

| To Bad debts written off |

1,000 |

||||

| To Net Profit

(Transferred to Capital A/c) |

73,500 |

||||

|

1,11,500 |

1,11,500 |

||||

Balance Sheet of Mrs.Suguna as on 31st March, 2004

| Liabilities | Rs. | Rs. | Assets | Rs. | Rs. |

| Sundry Creditors |

45,000 |

Cash in hand |

60,000 |

||

| Outstanding wages |

500 |

Cash at bank |

17,000 |

||

| Capital |

2,00,000 |

Bills Receivable |

29,000 |

||

| Add: Net Profit |

___73,500 |

Sundry Debtors |

44,000 |

||

|

2,73,500 |

Less: Bad debts written off |

1,000 |

|||

| Add: Interest on Capital |

__12,000 |

43,000 |

|||

|

2,85,500 |

Closing Stock |

40,000 |

|||

| Less: Drawings |

__40,000 |

Buildings |

1,00,000 |

||

|

2,45,500 |

Less: Depreciation |

__10,000 |

|||

| Less: Interest on Drawings |

___2,000 |

90,000 |

|||

|

2,43,500 |

Furniture |

5,000 |

|||

| Suspense Account |

5,000 |

||||

|

2,89,000 |

2,89,000 |

||||

Illustration :

Mr.Senthil’s book shows the following balances. Prepare his Trading and Profit and Loss account for the year ended 31st March 2005 and Balance Sheet as on that date.

|

Particulars |

Debit Rs. |

Credit |

| Stock on 1.4.2004 |

1,50,000 |

|

| Purchases |

1,30,000 |

|

| Sales |

3,00,000 |

|

| Carriage inwards |

2,000 |

|

| Salaries |

50,000 |

|

| Printing and Stationery |

8,000 |

| Drawings |

17,000 |

|

| Sundry Creditors |

20,000 |

|

| Sundry debtors |

1,80,000 |

|

| Furniture |

10,000 |

|

| Capital |

2,50,000 |

|

| Postage & Telephone |

7,500 |

|

| Interest paid |

4,000 |

|

| Machinery |

41,500 |

|

| Loan Account |

25,000 |

|

| Suspense A/c |

5,000 |

|

|

6,00,000 |

6,00,000 |

Adjustments:

1. Closing Stock Rs.1,20,000

2. Provide 5% for bad & doubtful debts on debtors

3. Depreciate machinery & furniture by 5%

4. Allow interest on capital at 5%

5. Prepaid printing charges Rs.2,000

Solution:

Trading and Profit and Loss Account of Mr.Senthil for

the period ending 31st March 2005

Dr. Cr.

|

Particulars |

Rs. | Rs. | Particulars | Rs. |

Rs. |

| To Opening Stock |

1,50,000 |

By Sales |

3,00,000 |

||

| To Purchases |

1,30,000 |

By Closing Stock |

1,20,000 |

||

| To Carriage inwards |

2,000 |

||||

| To Gross Profit c/d

(Transferred to Profit & Loss A/c) |

1,38,000 |

||||

|

4,20,000 |

4,20,000 |

||||

| To Salaries |

50,000 |

By Gross Profit b/d

(Transferred from Trading A/c) |

1,38,000 |

||

| To Printing & Stationery |

8,000 |

| Less: Prepaid |

2,000 |

6,000 |

|||

| To Postage & Telephone |

7,500 |

||||

| To Interest paid |

4,000 |

||||

| To Provision for Bad & Doubtful debts |

9,000 |

||||

| To Depreciation on: Machinery Furniture |

2075 _500 |

||||

| 2,575 | |||||

| To interest on Capital | 12,500 |

| To Net Profit (Transferred to Capital A/c) |

46,425 |

|

1,38,000 |

1,38,000 |

Balance Sheet of Mr.Senthil as on 31st March, 2004

| Liabilities | Rs. | Rs. | Assets | Rs. | Rs. |

| Sundry Creditors | 20,000 | Sundry Debtors |

1,80,000 |

||

| Loan Account | 25,000 | Less: Provision for bad & doubtful debts |

__9,000. |

||

| Capital |

2,50,000 |

1,71,000 |

|||

| Add: Net Profit |

__46,425. |

Closing stock |

1,20,000 |

||

|

2,96,425 |

Prepaid Printing charges |

2,000 |

|||

| Add: Interest on Capital |

12,500 |

Furniture |

10,000 |

||

|

3,08,925 |

Less: Depreciation |

___500 |

|||

| Less: Drawings |

17,000 |

9,500 |

|

2,91,925 |

Machinery |

41,500 |

|||

| Suspense Account |

5,000 |

Less: Depreciation |

__2,075 |

||

|

39,425 |

|||||

|

3,41,925 |

3,41,925 |

Illustration :

From the Trial Balance of Mr.Raghuraman as on 31st March, 2003 prepare Final accounts.

|

Particulars |

Debit Rs. |

Credit |

| Capital |

3,60,000 |

|

| Drawings |

6,400 |

|

| Stock (1.4.2002) |

18,000 |

|

| Purchases |

1,29,000 |

|

| Sales |

2,38,000 |

|

| Sales Returns |

4,000 |

|

| Wages |

32,000 |

|

| Insurance Premium |

3,000 |

|

| Packing Expenses |

4,000 |

|

| Postage |

200 |

|

| Advertisement |

2,000 |

|

| Carriage outwards |

16,000 |

|

| Bad debts |

600 |

|

| Commission received |

1,000 |

|

| Bills Payable |

18,000 |

|

| Bank overdraft |

6,000 |

|

| Land & Buildings |

2,61,000 |

|

| Plant & Machinery |

1,80,000 |

|

| Sundry Debtors |

50,800 |

|

| Sundry Creditors |

84,000 |

|

|

7,07,000 |

7,07,000 |

Adjustments:

1. Closing Stock on 31.03.2003, Rs.15,000.

2. Write off bad debts Rs.800 and make provision for Bad & doubtful debts @ 5% on Sundry debtors.

3. Commission accrued but not received Rs.2,000.

Solution:

Trading and Profit and Loss Account of Mr.Raguraman

for the year ending 31st March, 2003

Dr. Cr.

|

Particulars |

Rs. | Rs. | Particulars | Rs. |

Rs. |

| To Opening Stock |

18,000 |

By Sales |

2,38,000 |

||

| To Purchase |

1,29,000 |

Less:Sales Returns |

____4,000 |

||

| To Wages |

32,000 |

2,34,000 |

|||

| To Packing Expenses |

4,000 |

By Closing stock |

15,000 |

||

| To Gross Profit c/d

(Transferred to Profit & Loss A/c) |

66,000 |

||||

|

2,49,000 |

2,49,000 |

||||

| To Insurance |

3,000 |

By Gross Profit b/d

(Transferred from Trading A/c) |

66,000 |

||

| To Postage |

200 |

By Commission received |

1,000 |

||

| To Advertisement |

2,000 |

Add: Accrued Commission |

2,000 |

||

| To Carriage outwards |

16,000 |

3,000 |

|||

| To Bad debts |

600 |

||||

| Add: Bad debts written off |

800 |

||||

|

1400 |

|||||

| To Provision for bad & doubtful debts |

2,500 |

||||

| To Net Profit

(Transfered to Capital A/c) |

43,900 |

||||

|

69,000 |

69,000 |

|

Liabilities |

Rs. | Rs. | Assets | Rs. |

Rs. |

| Sundry Creditors |

84,000 |

Sundry Debtors |

50,800 |

||

| Bills Payable |

18,000 |

Less: Bad debts | |||

| Bank Overdraft |

6,000 |

written off |

___800 |

||

| Capital |

3,60,00 |

50,000 |

|||

| Add: Net Profit |

43,900 |

Less: Provision for Bad & Doubtful debts |

2,500 |

||

|

4,03,900 |

47,500 |

||||

| Less: Drawings |

6,400 |

Closing Stock |

15,000 |

||

|

3,97,500 |

Accrued Commission |

2,000 |

|||

| Land & Building |

2,61,000 |

||||

| Plant & Machinery |

1,80,000 |

||||

|

5,05,500 |

5,05,500 |

||||

Illustration :

From the following particulars of Mrs. Sulochana, prepare Trading and Profit and Loss Account and Balance Sheet for the year ending 31st March, 2004.

Trial Balance

|

Particulars |

Debit Rs. |

Credit |

| Capital |

7,50,000 |

|

| Cash |

40,000 |

|

| Buildings |

4,00,000 |

|

| Salary |

1,10,000 |

|

| Rent & Taxes |

21,000 |

|

| Opening Stock |

1,20,000 |

|

| Machinery |

1,20,000 |

|

| Drawings |

40,000 |

|

| Purchases |

5,00,000 |

| Sales |

7,50,000 |

|

| Carriage inwards |

5,000 |

|

| Fuel, Gas |

37,000 |

|

| Sundry Debtors |

2,50,000 |

|

| Sundry Creditors |

1,20,000 |

|

| Bills Receivable |

53,000 |

|

| Dividend |

28,000 |

|

| Loan |

60,000 |

|

| Bad debts |

2,000 |

|

| Advertisement |

16,000 |

|

| Provision for Bad & Doubtful Debts |

6,000 |

|

|

17,14,000 |

17,14,000 |

Adjustments:

1. Closing stock Rs.1,40,000.

2. Write off Rs.10,000 as bad debts; Provide 5% for Bad and

Doubtful debts.

3. Make provision for discount on Debtors at 2%.

4. Provision for discount on Creditors at 2%.

Solution:

Trading and Profit and Loss Account of Mrs. Sulochana

for the year ending 31st March, 2004

Dr. Cr.

|

Particulars |

Rs. | Rs. | Particulars | Rs. | Rs. |

|

To Opening Stock |

1,20,000 |

By Sales |

7,50,000 |

||

| To Purchases |

5,00,000 |

By Closing Stock |

1,40,000 |

||

| To Carriage inwards |

5,000 |

||||

| To Fuel, Gas |

37,000 |

||||

| To Gross Profit c/d

(Transferred to Profit & Loss A/c) |

2,28,000 |

||||

|

8,90,000 |

8,90,000 |

||||

| To Salary |

1,10,000 |

By Gross Profit b/d

(Transferred from Trading A/c) |

2,28,000 |

||

| To Rent & Taxes |

21,000 |

By Dividend |

28,000 |

| To Advertisement |

16,000 |

By Provision for discount on Creditors |

2,400 |

||

| To Provision for bad & doubtful debts A/c Bad debts |

2,000 |

||||

| Add: Bad debts written off |

10,000 |

||||

|

12,000 |

|||||

| Add: New Provision |

12,000 |

||||

|

24,000 |

|||||

| Less: Old Provision |

_6,000 |

||||

|

18,000 |

|||||

| To Provision for discount on debtors |

4,560 |

||||

| To Net Profit

(Transferred to Capital A/c) |

88,840 |

||||

|

2,58,400 |

2,58,400 |

||||

Balance Sheet of Mrs.Sulochana as on 31st March, 2004

|

Liabilities |

Rs. | Rs. | Assets | Rs. |

Rs. |

| Sundry Creditors |

1,20,000 |

Cash |

40,000 |

||

| Less: Provisio for discount on creditors |

2,400 |

1,17,600 |

Bills Receivable |

53,000

|

|

| Loan |

60,000 |

Sundry Debtors |

2,50,000 |

||

| Capital |

7,50,000 88,840 |

Less: Bad debts written off |

__10,000 |

||

| Add: Net Profit |

2,40,000 |

||||

|

8,38,840 |

|||||

| Less: Drawings |

40,000 |

Less: New Provision for Bad & doubtful debts |

12,000 |

||

|

7,98,840 |

Less: New Provision for discount on debtors |

2,28,000 |

|||

|

4,560 |

|||||

|

2,23,440 |

|||||

| Closing Stock |

1,40,000 |

||||

| Buildings |

4,00,000 |

| Machinery |

1,20,000 |

|

9,76,440 |

9,76,440 |

Illustration :

Prepare Trading, Profit and Loss A/c and Balance Sheet as on 31.3.2005 from the following Trial Balance of Mr.Imran.

| Particulars |

Debit

Rs. |

Credit Rs. |

| Capital | 1,50,000 | |

| Bank Overdraft | 25,200 | |

| Sales | 9,03,000 | |

| Furniture | 30,600 | |

| Business Premises | 1,20,000 | |

| Creditors | 79,800 | |

| Opening Stock | 1,32,000 | |

| Debtors | 1,08,000 | |

| Rent | 6,000 | |

| Purchases | 6,60,000 | |

| Discount | 2,400 | |

| Insurance | 16,000 | |

| Wages | 24,000 | |

| Salaries | 54,000 | |

| Advertisement | 13,200 | |

| Carriage on Purchases | 10,800 | |

| Provision for bad and doubtful debts | 7,000 | |

| Bad debts | 800 | |

| Income tax | 4,000 | |

| 11,73,4000 | 11,73,400 |

Adjustments:

1. Closing Stock on 31.03.2005 was Rs.1,20,000

2. Make a provision of 5% on Sundry debtors for bad and doubtful debts.

3. Rent received in advance Rs.2,000

4. Provide 10% depreciation on Furniture and Business Premises.

Solution:

Trading and Profit and Loss Account of Mr.Imran

for the year ending 31st March, 2005

Dr. Cr.

Particulars |

Rs. |

Rs. |

Particulars |

Rs. |

Rs. |

| To Opening Stock | 1,32,000 | By Sales | 9,03,000 | ||

| To Purchases | 6,60,000 | By Closing stock | 1,20,000 | ||

| To Wages | 24,000 | ||||

| To Carriage on Purchases | 10,800 | ||||

| To Gross Profit c/d (Transferred to Profit & Loss A/c) | 1,96,200 | ||||

| 10,23,000 | 10,23,000 | ||||

| To Insurance | 16,000 | By Gross Profit b/d

(Transferred from Trading A/c) |

1,96,200 | ||

| To Salaries | 54,000 | By Rent | 6,000 | ||

| To Advertisement | 13,200 | Less: Received in advance | 2,000 | ||

| To Depreciation on: | 4,000 | ||||

| Furniture | 3,060 | By Discount | 2,400 | ||

| Business Premises | 12,000 | By Provision for bad & doubtful debts Old Provision | 7,000 | ||

| 15,060 | Less: Bad debts 800 | ||||

| To Net Profit | 1,05,140 | New Provision 5400 | 6,200 | ||

| 800 | |||||

| 2,03,400 | 2,03,400 | ||||

Balance Sheet of Mr.Imran as on 31st March, 2005

Liabilities |

Rs. |

Rs. |

Assets |

Rs. |

Rs. |

| Sundry Creditors | 79,800 | Sundry Debtors | 1,08,000 | ||

| Bank Overdraft | 25,200 | Less: New Provision for bad and doubtful debts | ___5,400 | ||

| Rent received in advance | 2,000 | 1,02,600 | |||

| Capital | 1,50,000 | Closing Stock | 1,20,000 | ||

| Add: Net profit | 1,05,140 | Furniture | 30,600 | ||

| 2,55,140 | Less: Depreciation | __3,060 | |||

| Less: Income Tax | ____4,000 | 27,540 | |||

| 2,51,140 | Business Premises | 1,20,000 | |||

| Less: Depreciation | __12,000 | ||||

| 1,08,000 | |||||

| 3,58,140 | 3,58,140 |

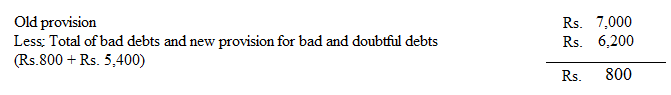

Note:

Total of Bad debts written off and new provision for bad and doubtful debts is (Rs.800 + Rs.5,400) Rs.6,200. Old provision for

bad and doubtful debts given in the Trial Balance is Rs.7,000 which is greater than Rs. 6,200. So the difference will appear on the credit side of of the Profit and Loss account as follows: