Preparation of Profit and loss appropriation account :

Illustration :

Mahesh and Ramesh are partners sharing profits in the ratio of 3:2 with capitals of Rs.50,000 and Rs.40,000 respectively. Interest on

capital is agreed at 8% p.a. Interest on drawings is fixed at 10% p.a. The drawings of the partners were Rs.15,000 and Rs.10,000, the interest for Mahesh Rs.750 and for Ramesh Rs.500. Mahesh is entitled to a salary of Rs.12,000 p.a. and Ramesh is entitled to get a commission of 10% on the Net Profit before charging such commission. The Net Profit of the firm before making the above adjustments was Rs.60,000 for the year ended 31st March, 2005.

Prepare the profit and loss appropriation account.

Solution :

In the Books of the Firm

Dr. Profit and Loss Appropriation Account Cr.

|

Date |

Particulars | Rs. | Date | Particulars | Rs. |

| 2005

Mar 31 |

To Interest on Capital |

2004 Mar 31 |

By Net profit b/d

|

60,000 |

|

|

Mahesh 4,000 |

2005 Mar31 |

By Interest on Drawings | |||

|

Ramesh 3,200 |

7,200 |

Mahesh 750 |

|||

| To Partners’ salary Mahesh |

12,000 |

Ramesh 500 |

1,250 |

||

|

“ |

To Commission Ramesh

(10% on Rs. 42,050) |

4,205 |

|

||

|

“ |

To Profit transferred to capital A/c | ||||

|

Mahesh 22,707 |

|||||

|

Ramesh 15.138 |

37,845 |

________ | |||

| 61,250 |

61,250 |

||||

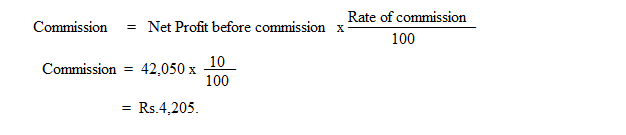

Note: Calculation of commission.

Step 1➙ Total the credit side of the Profit and Loss Appropriation Account. i.e., Rs.61,250.

Step 2➙ Total the debit side of the Profit and Loss Appropriation Account. i.e., Rs. 19,200.

Step 3 ➙ Find the balance. i.e., Rs. 42,050. Step 4 à Apply the formula.

The Balance of Rs. 37,845 (Rs.42,050 – Rs.4,205) is transferred to Partners’ Capital accounts in the ratio.

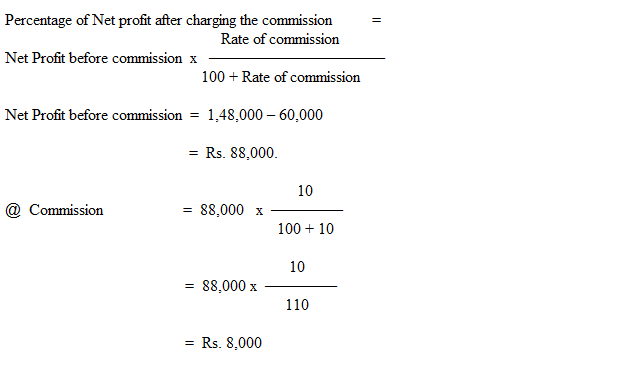

Illustration :

X and Y are partners in a firm, sharing profits and losses equally. X is entitled to a salary of Rs.5,000 p.m. Y is entitled to a commission

of 10% of Net profit after charging such commission. Net profit before charging commission and salary was Rs.1,48,000. Show the Profit and loss appropriation account.

Solution:

a) Calculation of salary to X :

In the Books of the Firm

Dr. Profit and Loss Appropriation Account Cr.

| Date | Particulars | Rs. | Date | Particulars | Rs. |

| To X’s Salary 60,000 By Net profit b/d | 1,48,000 | By Net profit b/d | 1,48,000 | ||

| To Y’s Commission | 8,000 | ||||

| To Net profit transferred to: | |||||

| X 40,000 | |||||

| Y 40,000 | 80,000 | ||||

| 1,48,000 | 1,48,000 |