Primary Market :

In this market, securities (shares, debentures, bonds etc) are offered to the public for subscription with a view to raise capital fund. The public issues are to be handled as per the guidelines of the regulator of Capital market, i.e., the Securities Exchange Board of India (SEBI) and applicable legal framework like the Companies Act. There are number of facilitators (intermediaries) in the primary market like merchant bankers and others, who through their services facilitate the public issue at different stages, to enable the investors to decide and invest in a company.

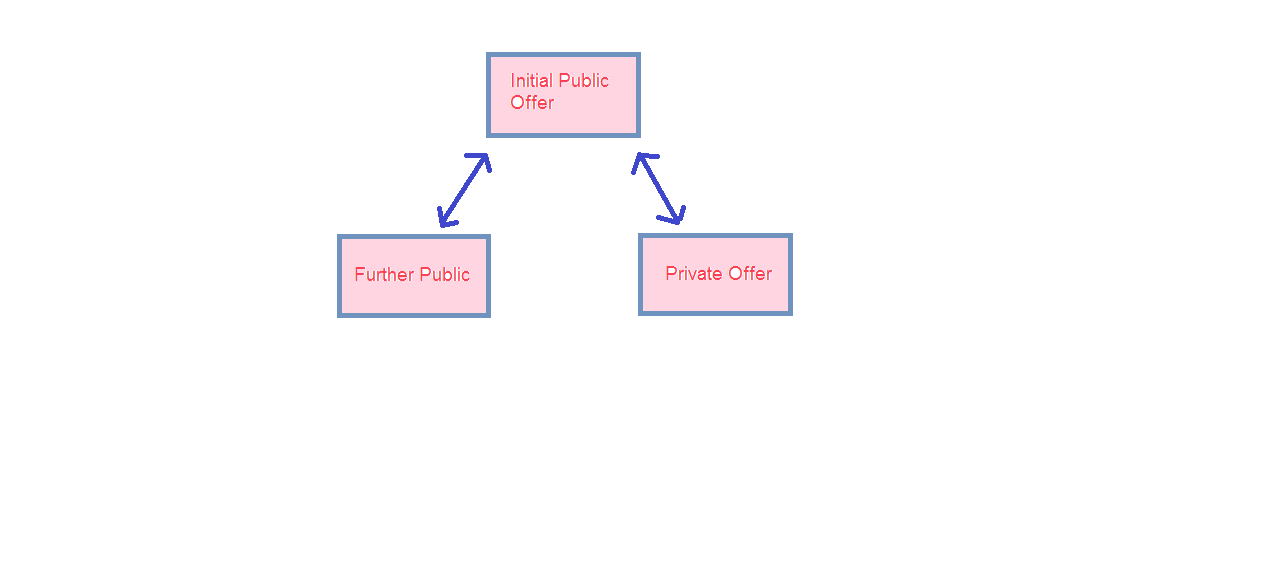

In the primary market, issues are classified into public, rights or preferential issues (also known as private placements). The public and rights issues involve a detailed procedure, whereas in case of private placements or preferential issues, the procedures are relatively simpler.

Public issues can be classified into Initial Public Offerings (IPOs) and Further/Follow-on Public Offerings (FPOs). When an unlisted company makes either a fresh issue of shares or an offer for sale of its existing shares or both for the first time to the public, it is called IPO. On the other hand, a company which is already a listed company, either makes a fresh issue of securities to the public or an offer for sale to the public through an offer document, it is known as FPO.

Rights Issue (RI) is one, when a listed company proposes to issue fresh securities to its existing shareholders as on a record date. The rights issue is normally offered in a particular ratio to the number of shares already held by the shareholders.

Private placement means any offer of securities or invitation to subscribe securities to a select .group of persons by a company (other than by way of public offer) through issue of a private placement offer letter and and which satisfies the conditions specified in section 42 of the Companies Act 2013

An example of private placements is a Qualified Institutional Placement (QIP). It is a private placement of equity shares or securities convertible into equity shares, by a listed company to Qualified Institutional Buyers (QIB) only.

The advantages of private placement are:

1. Private placement of securities is subject to much less compliance than the public issues.

2. Private placement is cost effective as compared to public issues.

3. Private placement is time effective as deals can be easily and directly negotiated with a few investors

4. Private placement helps to tailoring the issues according to the needs of the companies

The Private placement market, however has several limitations for the efficient functioning of the capital markets. There is little information available about this market and there is little transparency.

SEBI has laid down eligibility norms for entities accessing the primary market through public issues. As per SEBI’s guidelines, different facilitators provide service to ensure that the primary market issues are handled as per laid down laws and procedures.