Recording Depreciation :

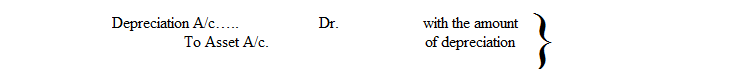

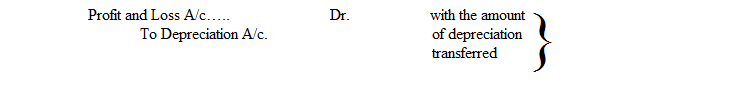

Depreciation is directly charged against the asset by debiting Depreciation account and crediting the Asset account. Depreciation

account is closed by transferring to Profit and Loss account at the end of the year. The entries will be as under:

1) For the amount of depreciation to be provided at the end of the year

2) For transferring the amount of depreciation at the end of the year.

Asset Account will be shown at cost less depreciation i.e., written down value at the end of the year in the Balance sheet.

Illustration :

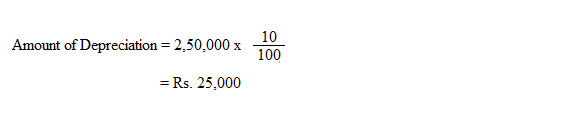

Raheem & Co. purchased a fixed asset on 1.4.2000 for Rs.2,50,000. Depreciation is to be provided @10% annually according to the Straight line method. The books are closed on 31st March every year.

Pass the necessary journal entries, prepare Fixed asset Account and Depreciation Account for the first three years.

In the Books of Raheem & Co.

Journal Entries

| Date | Particulars | Debit Rs. |

Credit Rs. |

| 2000 Apr 1 |

Fixed asset A/c Dr. | 2,50,000 | |

| To Bank A/c | 2,50,000 | ||

| (Fixed asset purchased) | |||

| 2001 Mar 31 |

Depreciation A/c Dr | 25,000 | |

| To Fixed asset A/c | 25,000 | ||

| (Depreciation provided) | |||

| 2001 Mar 31 |

’’ Profit & Loss A/c Dr | ||

| To Depreciation A/c | 25,000 | ||

| (Depreciation transferred to Profit & Loss A/c) | 25,000 | ||

| 2002 Mar 31 |

Depreciation A/c Dr | 25,000 | |

| To Fixed asset A/c | 25,000 | ||

| (Depreciation provided) | |||

| 2002 Mar 31 |

’’ Profit & Loss A/c Dr | 25,000 | |

| To Depreciation A/c | 25,000 | ||

| (Depreciation transferred to Profit & Loss account) | |||

| 2003 Mar 31 |

Depreciation A/c Dr | 25,000 | |

| To Fixed asset A/c | 25,000 | ||

| (Depreciation provided) | |||

| 2003 Mar 31 |

’’ Profits & Loss A/c Dr | 25,000 | |

| To Depreciation A/c | 25,000 | ||

| (Depreciation transferred to Profit & Loss A/c) |

Fixed Asset Account

Dr. Cr.

|

Date |

Particulars | Rs. | Date | Particulars |

Rs. |

| 2000 |

2001 |

||||

| Apr 1 | To Bank A/c |

2,50,000 |

Mar 31 |

By Depreciation A/c |

25,000 |

| “ | By Balance c/d |

2,25,000 |

|||

|

2,50,000 |

2,50,000 |

||||

| 2001 |

2002 |

||||

| Apr 1 | To Balance b/d |

2,25,000 |

Mar 31 |

By Depreciation A/c |

25,000 |

|

“ |

By Balance c/d |

2,00,000 |

|||

|

2,25,000 |

2,25,000 |

||||

| 2002 |

2003 |

||||

| Apr 1 | To Balance b/d |

2,00,000 |

Mar 31 |

By Depreciation A/c |

25,000 |

|

“ |

By Balance c/d |

1,75,000 |

|||

|

2,00,000 |

2,00,000 |

||||

| 2003 | |||||

| Apr 1 | To Balance b/d |

1,75,000 |

Depreciation Account

Dr. Cr.

|

Date |

Particulars | Rs. | Date | Particulars |

Rs. |

|

2001 |

2001 |

||||

|

Mar 31 |

To Fixed Asset A/c |

25,000 |

Mar 31 |

By Profit & Loss A/c |

25,000 |

|

25,000 |

25,000 |

||||

|

2002 |

2002 |

||||

|

Mar 31 |

To Fixed Asset A/c |

25,000 |

Mar 31 |

By Profit & Loss A/c |

25,000 |

|

25,000 |

25,000 |

||||

|

2003 |

2003 |

||||

|

Mar 31 |

To Fixed Asset A/c |

25,000 |

Mar 31 |

By Profit & Loss A/c |

25,000 |

|

25,000 |

25,000 |

Illustration :

A Company purchased Machinery for Rs.50,000 on 1st Apri12002. It is depreciated at 10% per annum on Written Down Value method. The accounting year ends on 31st March of every year.

Pass necessary Journal entries, prepare Machinery account and Depreciation account for three years.

Solution:

Journal Entries

| Date | Particulars | L.F. | Debit Rs. |

Credit |

| 2002 | ||||

| Apr 1 | Machinery A/c Dr |

50,000 |

||

| To Bank A/c |

50,000 |

|||

| (Machinery purchased) | ||||

| 2003 | ||||

| Mar 31 | Depreciation A/c Dr |

5,000 |

||

| To Machinery A/c |

5,000 |

|||

| (Depreciation provided) | ||||

| 99 | Profit & Loss A/c Dr |

5,000 |

||

| To Depreciation A/c |

5,000 |

|||

| (Depreciation provided) | ||||

| 2004 | ||||

| Mar 31 | Depreciation A/c Dr |

4,500 |

||

| To Machinery A/c |

4,500 |

|||

| (Depreciation provided) | ||||

| 99 | Profit & Loss A/c Dr |

4,500 |

||

| To Depreciation A/c | 4,500 | |||

| (Depreciation transferred to Profit & Loss account) | ||||

| 2005 | ||||

| Mar 31 | Depreciation A/c Dr |

4,050 |

||

| To Machinery A/c |

4,050 |

|||

| (Depreciation provided) |

| Profit & Loss A/c Dr |

4,050 |

|||

| To Depreciation A/c |

4,050 |

|||

| (Depreciation transferred to Profit and Loss Account) |

Ledger Accounts

Machinery Account

Dr. Cr.

|

Date |

Particulars | Rs. | Date | Particulars |

Rs. |

|

2002 |

2003 |

||||

|

Apr 1 |

To Bank A/c |

50,000 |

Mar 31 |

By Depreciation A/c |

5,000 |

| “ | By Balance c/d |

45,000 |

|||

|

50,000 |

50,000 |

||||

|

2003 |

2004 | ||||

|

Apr 1 |

To Balance b/d |

45,000 |

Mar 31 | By Depreciation A/c |

4,500 |

| “ | By Balance c/d |

40,500 |

|||

|

45,000 |

45,000 |

||||

|

2004 |

2005 | ||||

|

Apr 1 |

To Balance b/d |

40,500 |

Mar 31 | By Depreciation A/c |

4,050 |

| “ | By Balance c/d |

36,450 |

|||

|

40,500 |

40,500 |

||||

|

2005 |

|||||

|

Apr 1 |

To Balance b/d |

36,450 |

Depreciation Account

Dr. Cr.

| Date | Particulars | Rs. | Date | Particulars |

Rs. |

|

2003 |

2003 |

||||

|

Mar 31 |

To Machinery A/c |

5,000 |

Mar 31 |

By Profit & Loss A/c |

5,000 |

|

5,000 |

5,000 |

||||

|

2004 |

2004 |

||||

|

Mar 31 |

To Machinery A/c |

4,500 |

Mar 31 |

By Profit & Loss A/c |

4,500 |

|

4,500 |

4,500 |

||||

|

2005 |

2005 |

||||

|

Mar 31 |

To Machinery A/c |

4,050 |

Mar 31 |

By Profit & Loss A/c |

4,050 |

|

4,050 |

4,050 |