Refund of service tax paid on services used in the export of goods :

I. Refund of service tax where service tax is paid by exporter himself under reverse charge mechanism: The exemption would be available on:

(i) Transport of goods by road from any container freight station (CFS) or inland container depot (ICD) to port/airport / land customs station, as the case may be, from where the goods are exported; or

(ii) Transport of goods by road directly from place of removal, to an ICD, a CFS, a port/airport / land customs station, as the case may be, from where the goods are exported;

[Notification No. 31/2012 ST dated 20.06.2012]

II. Rebate of service tax paid on specified services used in the export of goods:

Under this scheme, the exporters of goods have been provided with an option to claim refund electronically through ICES scheme. Otherwise, they can claim rebate on the basis of documents.

The rebate shall be granted by way of refund of service tax paid on the “specified services”.

| Specified services means-

(i) in the case of excisable goods, taxable services that have been used beyond the place of removal, for the export of said goods; (ii) in the case of goods other than (i) above, taxable services used for the export of said goods; but shall not include any service mentioned in sub-clauses (A), (B), (BA) and (C) of rule 2(l) of the CENVAT Credit Rules, 2004. |

Manner of claiming rebate

The exporters now have a choice to opt either of the following options:

A. Electronic rebate through ICES system, which is based on the notified ‘schedule of rates‘ on the lines of duty drawback, or

B. Rebate on the basis of documents, by approaching the Central Excise/Service Tax formations.

| It may be noted that the rebate on the basis of documents shall not be claimed wherever the difference between the amount of rebate under ICES system and amount of rebate on the basis of documents is less than 20% of the rebate under ICES system. |

A. Procedure for electronic rebate through ICES system

(a) An exporter should

(i) have a bank account and also a central excise registration or service tax code number** and the same should be registered with Customs ICES, and

(ii) declare his option to avail service tax rebate on the electronic shipping bill/bill of export while presenting the same to the proper officer of Customs.

**Note: If the exporter does not have Service tax code number referred to in clause (i) above, it should be obtained by filing a declaration in Form A-2 to the jurisdictional Assistant Commissioner / Deputy Commissioner of Central Excise.

(b) Service tax paid on the specified services eligible as rebate under this exemption shall be calculated electronically by the ICES system, by applying the rate specified in the schedule against the said goods, as a percentage of the FOB value.

(c) Rebate shall be deposited in the bank account of the exporter.

(d) An exporter who has claimed the rebate electronically cannot claim the refund again on the basis of documents.

(e) Minimum service tax rebate for an electronic shipping bill is Rs 50.

B. Procedure for refund on the basis of documents

(a) Actual payment of service tax: For claiming rebate, the exporter has to actually pay the service tax on the specified service used for export of goods.

(b) No rebate to service provider: The service provider which provides the specified services to the exporter claiming rebate of the service tax paid on such services, will not be eligible to claim rebate.

(c) Time-limit for filing the rebate claim: Time-limit for filing the rebate claim shall be one year from the date of export of the said goods.

The date of export shall be the date on which the proper officer of Customs makes an order permitting clearance and loading of the said goods for exportation under section 51 of the Customs Act, 1962.

(d) Minimum amount of rebate: is Rs 500.

(e) Realization of export proceeds: Sale proceeds in respect of exported goods must be received by or on behalf of the exporter, in India, within the period allowed by the RBI, including any extension thereof.

Where any rebate of service tax paid on specified service utilized for export of said goods has been allowed to an exporter but the sale proceeds in respect of said goods are not received by or on behalf of the exporter, in India, within the period allowed by the Reserve Bank of India including any extension thereof, such rebate shall be deemed never to have been allowed and recovered under the provisions of the said Act and the rules made thereunder.

(f) Documents to be submitted for rebate claim

1. Exporter registered under Central Excise Act, 1944 shall file a claim for rebate of service tax in Form A-1 to the jurisdictional Assistant Commissioner/Deputy Commissioner of Central Excise. Where the exporter is not so registered, he shall first file a declaration in Form A-2, seeking allotment of service tax code to the jurisdictional Assistant Commissioner/Deputy Commissioner of Central Excise and on obtaining the service tax code, file refund claim in Form A-1.

2. Relevant invoice/ bill/ challan/ any other document for each specified service, in original, evidencing payment for the specified service used for export of the said goods and the service tax payable needs to be attached with the application.

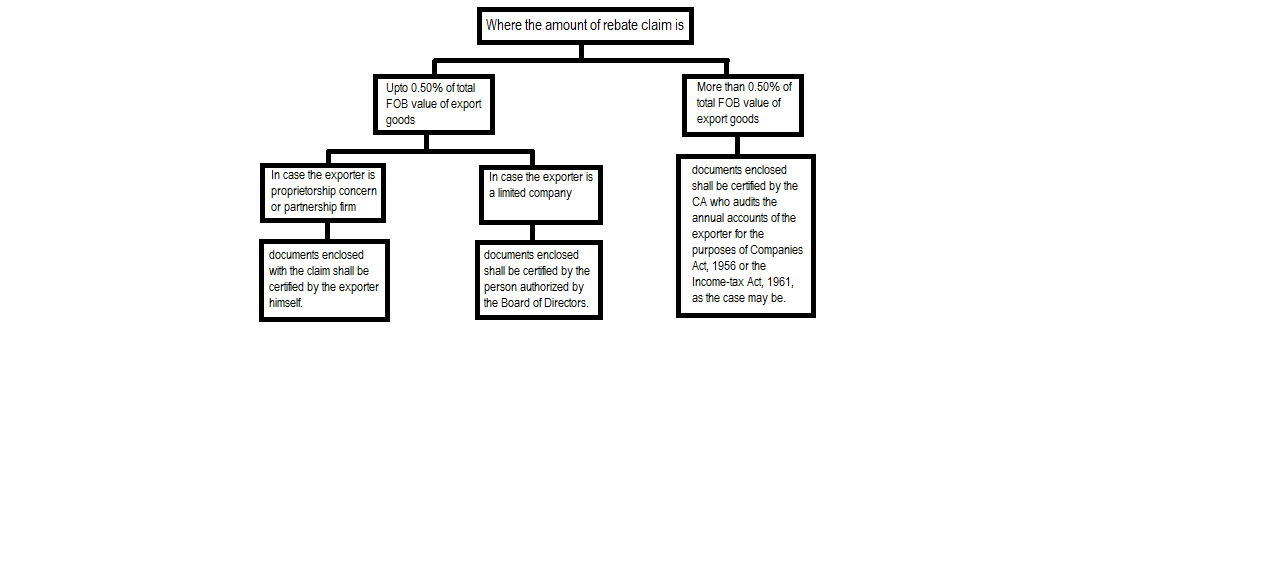

(g) Certification of the documents enclosed with the rebate claim [mentioned in clause 2. of point (f) above]: The documents enclosed with the rebate claim have to be certified in the manner depicted in the diagram given in the next page.

(h) Grant of refund: Assistant Commissioner/Deputy Commissioner of Central Excise, shall, after satisfying himself, shall grant the rebate to the exporter within a period of one month from the receipt of the said claim.

| Points to be noted:-

(a) No CENVAT credit on the specified services used for export: No CENVAT credit of service tax paid on the specified services used for export of the said goods can be taken under the CENVAT Credit Rules, 2004. (b) No exemption to SEZ: The aforesaid exemption cannot be claimed by a Unit or Developer of a Special Economic Zone. |

[Notification No. 41/2012 ST dated 29.06.2012]