Repayment of the Amount due to Deceased Partner

On death of a partner, the amount due to his legal representatives will have to be paid. It may not be possible to pay the whole amount in a lump sum. As a rule, the payment is made according to the terms of partnership agreement. The various courses available are –

(a) Repayment in installments over a period of time and interest being paid on outstanding balances.

(b) The amount due may be treated as a loan to the firm. The firm may pay interest at an agreed rate or a share of profit of the firm.

(c) An annuity may be paid to the heirs of deceased partner.

Illustration :

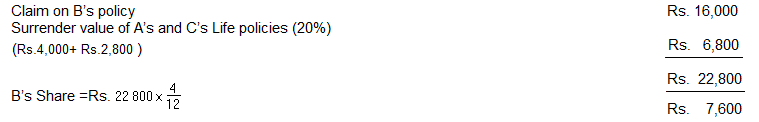

A, B and C are partners in a firm sharing profits and losses in the ratio of 5:4:3 respectively. The firm had insured the partners’ lives severally, A’s life for ` 20,000, B’s life for Rs.16,000 and C’s life for Rs.14,000. The premiums were charged to the firm’s profit and loss account. B died on 1.4.2013. The surrender values of these policies were 20% of the policy amount. Calculate B’s share in policies.

Solution:

Illustration :

A, B and C are partners sharing profits in the ratio of 2:1:1 respectively. On 30th June, 2012 their balance sheet was as follows:

| Liabilities | Rs. | Assets | Rs. |

| Creditors | 40,000 | Goodwill | 30,000 |

| Bills Payable | 20,000 | Freehold Property | 1,00,000 |

| Capitals: | Joint Life Policy | 20,000 | |

| A | 1,00,000 | Stock | 55,000 |

| B | 60,000 | Debtors | 45,000 |

| C | 40,000 | Cash | 10,000 |

| 2,60,000 | 2,60,000 |

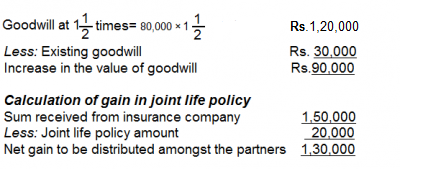

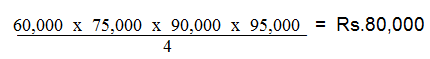

A died on July 1, 2012. The firm had taken a joint life policy for Rs.1,50,000, the payment for which was received on July 31, 2012. According to the partnership agreement, on retirement or death of a partner, the goodwill was to be valued at 1-1/2 times the average profit of the last four years. The profits for the last four years were Rs. 6,000, Rs. 75,000,Rs. 90,000 and Rs. 95,000 respectively. For paying the amount due to A’s legal representative, B and C brought as much cash as would bring their capitals in profit-sharing ratio and the firm would have cash in hand Rs. 3,000. Calculate goodwill, prepare partners’ capital accounts and the balance sheet.

Solution:

Calculation of goodwill

Average profit for four years =

Dr. Partners’ Capital Accounts Cr.

| Particulars | A

(Rs.) |

B

(Rs.) |

C

(Rs.) |

Particulars | A

(Rs.) |

B

(Rs.) |

C

(Rs.) |

| To Cash A/c | 2,10,000 | – | – | By Balance b/fd | 1,00,000 | 60,000 | 40,000 |

| To A’s Capital A/c | – | 22,500 | 22,500 | By B’s Capital | 22,500 | – | – |

| To Balance c/d | – | 1,00,000 | 1,00,000 | By C’s Capital | 22,500 | – | – |

| By Joint Life Policy A/c | 65,000 | 32,500 | 32,500 | ||||

| By Cash | – | 30,000 | 50,000 | ||||

| 2,10,000 | 1,22,500 | 1,22,500 | 2,10,000 | 1,22,500 | 1,22,500 |

Calculation of cash brought in by B and C:

| Rs. | Rs. | |

| Amount payable to A’s legal representatives | 2.10,000 | |

| Add: Desired cash in hand | __30,000 | |

| Amount required | 2,40,000 | |

| Less: Amount received from Insurance company | 1,50,000 | |

| Existing balance of cash in hand | ___10,000 | 1,60,000 |

| Shortage of cash to be brought in By B and C | __80,000 | |

| B’s capital after adjustment of Goodwill and Life Policy | 70,000 | |

| C’s capital after adjustment of Goodwill and Life Policy | 50,000 | |

| Shortage of cash to be brought in | 80,000 | |

| Total capital of B and C after A’s death | 2,00,000 | |

| Share of B being 1/2th of Rs.20,000 | 1,00,000 | |

| Less: Already in the business | 70,000 | |

| Cash to be introduced by B | 30,000 | |

| Share of C being 1/2 of Rs.20,000 | 1,00,000 | |

| Less: Already in the business | 50,000 | |

| Cash to be introduced by C | 50,000 | |

Balance Sheet of B and C

| Liabilities | Rs. | Assets | Rs. |

| Creditors | 40,000 | Goodwill | 30,000 |

| Bills Payable | 20,000 | Freehold Property | 1,00,000 |

| Capitals: | Stock | 55,000 | |

| B 1,00,000 | Debtors | 45,000 | |

| C 1,00,000 | 2,00,000 | Cash | 30,000 |

| 2,60,000 | 2,60,000 |

Illustration :

On 31st March, 2012 the balance sheet of Sen, Sil and Som who shared profits and losses in the ratio of 4 : 3 : 2 respectively stood as follows:

| Liabilities | Rs. | Assets | Rs. |

| Sundry Creditors | 20,600 | Furniture and Fittings | 12,000 |

| Joint Life Policy Reserve | 6,000 | Joint Life Policy (Policy for ` 18,500) | 10,000 |

| Capital Accounts: | Sundry Debtors | 17,500 | |

| Sen | 10,000 | Stock | 30,500 |

| Sil | 30,000 | Cash at Bank | 7,100 |

| Som | 10,500 | ______ | |

| 77,100 | 77,100 |

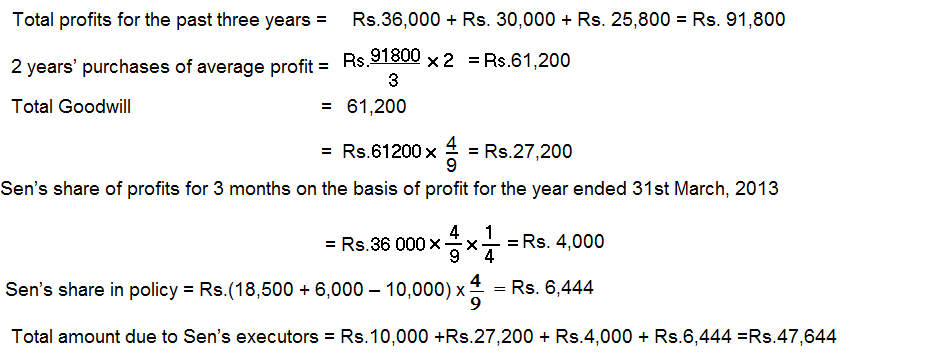

On 30th June, 2012 Sen died. According to partnership deed, at the time of death, goodwill of the firm was to be valued at 2 years’ purchase of average profits of the last three years and deceased partner’s capital account was to be credited with the share of profits for the period he lived in the year of death on the basis of profit of immediately previous year.

Find out the amount due to Sen’s executors on 30th June, 2012. Profits for the past three years have been as follows:

| For the year ended 31st March, 2012 | Rs.36,000 |

| For the year ended 31st March, 2011 | Rs. 30,000 |

| For the year ended 31st March, 2010 | Rs. 25,800 |

Solution:

Illustration :

Following is the balance sheet of A, B and C as at 1st April, 2012:

| Liabilities | Rs. | Assets | Rs. |

| Sundry Creditors | 20,000 | Goodwill | 40,000 |

| Reserve fund | 32,000 | Plant and Machinery | 60,000 |

| Capital Accounts: | Stock | 40,000 | |

| A | 1,00,000 | Sundry Debtors | 60,000 |

| B | 50,000 | Cash at Bank | 50,000 |

| C | 50,000 | Cash in Hand | 2,000 |

| 2,52,000 | 2,52,000 |

C died on 30th June, 2012. Under the terms of partnership deed, the executors of a deceased partner were entitled to –

(a) Amount standing to the credit of partner’s capital account;

(b) Interest on capital balance at 15% per annum;

(c) Share or goodwill on the basis of twice the average of the past three years’ profit; and

(d) Share of profit from the closing of the last financial year to the date of death on the basis of the average of three completed year profits before the death.

Profits for the years ended 31st March, 2010, 2011 and 2012 were Rs.60,000, Rs.70,000 and Rs.80,000 respectively.

Profits were shared in the ratio of capitals.

Pass the necessary journal entries and draw up C’s Capital Account to be rendered to his executors.

Solution:

Journal Entries

| Particulars | Dr.(Rs.) | Cr.(Rs.) |

| Reserve Fund Dr. | 8,000 | |

| To C’s Capital A/c | 8,000 | |

| (Reserve fund transferred to capital account) | ||

| Interest on Capital A/c Dr. | 1,875 | |

| To C’s Capital A/c | 1,875 | |

| (Interest @ 15% credited to C’s Capital Account) | ||

| A’s Capital A/c Dr. | 16,667 | |

| B’s Capital A/c Dr. | 8,333 | |

| To C’s Capital A/c | 25,000 | |

| (Share of goodwill due to C, debited to the capital accounts of existing partners) | ||

| Profit and Loss A/c Dr. | 4,375 | |

| To C’s Capital A/c | 4,375 | |

| (Share of profit till 30th June, 2012 based on the average profit of the preceding three years credited to C’s Capital Account) |

Dr. C’s Capital Account Cr.

| Particulars | Rs. | Particulars | Rs. |

| To C’s Executors | 89,250 | By Balance b/fd | 50,000 |

| By Reserve fund | 8,000 | ||

| By Interest on Capital | 1,875 | ||

| By A’s Capital A/c | 16,667 | ||

| By B’s Capital A/c | 8,333 | ||

| _______ | By Profit and Loss A/c | 4,375 | |

| 89,250 | 89,250 |

Working Notes

(i) Calculation of Goodwill

Total profit of three years =Rs.2,10,000

Average Profit = Rs.2,10,000 ÷ 3 = Rs.70,000

Goodwill = Rs.70,000 x 2 = Rs.1,40,000

Existing Goodwill = Rs.40,000

Goodwill to be increased by Rs.1,00,000

C’s Share = Rs.1,00,000 ÷ 4 = Rs.25,000

(ii) Calculation of C’s Share of Profit

Average Profit = Rs.70,000