REWARD SCHEMES :

Reward schemes are the schemes which entitle the exporters to duty credit scrips subject to various conditions. These scrips can be used for payment of customs duties on import of inputs/goods including notified capital goods, payment of excise duties on domestic procurement of inputs/goods including capital goods, payment of service tax on procurement of services.

These scrips are transferable, i.e. they can be sold in market, if the holder of duty credit scrip does not intend to import goods against the scrips. Goods imported under the scrip are also freely transferable.

Following are two schemes for exports of merchandise and services:

(i) Merchandise Exports from India Scheme (MEIS)

(ii) Service Exports from India Scheme (SEIS)

1. MERCHANDISE EXPORTS FROM INDIA SCHEME (MEIS)

The objective of MEIS scheme is to compensate infrastructural inefficiencies and associated costs involved in export of goods/products, which are produced/manufactured in India, especially goods having high export intensity, employment potential and thereby enhancing India‟s export competitiveness.

(i) Reward under the scheme: Under MEIS, exports of notified goods/products to notified markets shall be eligible for reward at the specified rate(s). Unless otherwise specified, the basis of calculation of reward would be:

(i) on realised FOB value of exports in free foreign exchange,

or

(ii) on FOB value of exports as given in the Shipping Bills in free foreign exchange,

whichever is less.

(ii) Ineligible categories under MEIS: Some exports categories/sectors ineligible for Duty Credit Scrip entitlement under MEIS are listed below:

(1) EOUs / EHTPs / BTPs/ STPs who are availing direct tax benefits / exemption

(2) Supplies made from DTA units to SEZ units

(3) Exports through trans-shipment, i.e., exports that are originating in third country but trans-shipped through India

(4) Deemed Exports

(5) SEZ/EOU/EHTP/BPT/FTWZ products exported through DTA units

(6) Export products which are subject to Minimum export price or export duty

(7) Ores and concentrates of all types and in all formations

(8) Cereals of all types

(9) Sugar of all types and all forms unless specifically notified.

(10) Crude / petroleum oil and crude / primary and base products of all types and all formulations

(11) Export of milk and milk products and meat and meat products unless specifically notified.

(iii) Export of goods through courier/foreign post offices using e-commerce: Exports of handicraft items, handloom products, books/periodicals, leather footwear, toys and tailor made fashion garments through courier or foreign post office using e-commerce of FOB value upto ` 25,000 per consignment shall be entitled for rewards under MEIS.

2. SERVICE EXPORTS FROM INDIA SCHEME (SEIS)

The objective of SEIS scheme is to encourage export of notified services from India. The scheme applies to export of services made on or after 01.04.2015.

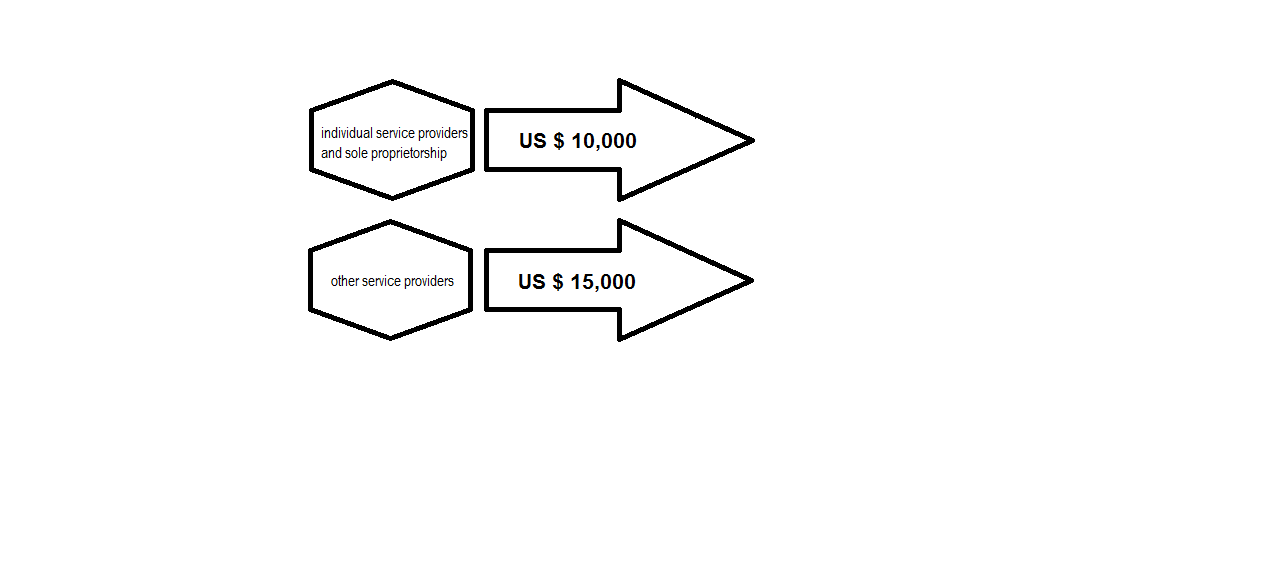

(i) Eligible service providers: A service provider (with active IEC at the time of rendering services) located in India, providing notified services rendered in the specified manner* shall be eligible for reward at the notified rate(s) on net foreign exchange earned provided the minimum net free foreign exchange earnings of such service provider in preceding financial year is:

*Specified manner is supply of a „service‟ from India to any other country; (Mode 1 – Cross border trade) and supply of a „service‟ from India to service consumer(s) of any other country in India; (Mode 2-Consumption abroad).

Payment in Indian Rupees for service charges earned on specified services, shall be treated as receipt in deemed foreign exchange as per guidelines of Reserve Bank of India. The list of such services and the notified rates of rewards are as under:

| Sl No | SECTORS | Admissible rate |

| 1. | BUSINESS SERVICES | |

| A. | Professional services

Legal services, Accounting, auditing and bookkeeping services, Taxation services, Architectural services, Engineering services, Integrated engineering services, Urban planning and landscape architectural services, Medical and dental services, Veterinary services, Services provided by midwives, nurses, physiotherapists and paramedical personnel |

5% |

| B. | Research and development services

R&D services on natural sciences, R&D services on social sciences and humanities, Interdisciplinary R&D services |

5% |

| C. | Rental/Leasing services without operators

Relating to ships, Relating to aircraft, Relating to other transport equipment, Relating to other machinery and equipment |

5% |

| D. | Other business services

Advertising services, Market research and public opinion polling services Management consulting service, Services related to management consulting, Technical testing and analysis services, Services incidental to agricultural, hunting and forestry, Services incidental to fishing, Services incidental to mining, Services incidental to manufacturing, Services incidental to energy distribution, Placement and supply services of personnel, Investigation and security, Related scientific and technical consulting services, Maintenance and repair of equipment (not including maritime vessels, aircraft or other transport equipment), Building- cleaning services, Photographic services, Packaging services, Printing, publishing and Convention services |

3% |

| 2. | COMMUNICATION SERVICES

Audiovisual services Motion picture and video tape production and distribution service, Motion picture projection service, Radio and television services, Radio and television transmission services, Sound recording. |

5% |

| 3. | CONSTRUCTION AND RELATED ENGINEERING

SERVICES General Construction work for building, General Construction work for Civil Engineering, Installation and assembly work, Building completion and finishing work |

5% |

| 4. | EDUCATIONAL SERVICES (Please refer Note 1)

Primary education services, Secondary education services, Higher education services, Adult education |

5% |

| 5. | ENVIRONMENTAL SERVICES

Sewage services, Refuse disposal services, Sanitation and similar services |

5% |

| 6. | HEALTH-RELATED AND SOCIAL SERVICES

Hospital services |

5% |

| 7. | TOURISM AND TRAVEL-RELATED SERVICES | |

| A. | Hotels and Restaurants (including catering) | |

| a. Hotel | 3% | |

| b. Restaurants (including catering) | 3% | |

| B. | Travel agencies and tour operators services | 5% |

| C. | Tourist guides services | 5% |

| 8. | RECREATIONAL, CULTURAL AND SPORTING

SERVICES (other than audiovisual services) Entertainment services (including theatre, live bands and circus services), News agency services, Libraries, archives, museums and other cultural services, Sporting and other recreational services |

5% |

| 9. | TRANSPORT SERVICES (Please refer Note 2) | |

| A. | Maritime Transport Services

Passenger transportation*, Freight transportation*, Rental of vessels with crew*, Maintenance and repair of vessels, Pushing and towing services, Supporting services for maritime transport |

5% |

| B. | Air transport services

Rental of aircraft with crew, Maintenance and repair of aircraft, Airport Operations and ground handling |

5% |

| C. | Road Transport Services

Passenger transportation, Freight transportation, Rental of Commercial vehicles with operator, Maintenance and repair of road transport equipment, Supporting services for road transport services |

5% |

| D. | Services Auxiliary To All Modes of Transport.

Cargo-handling services, Storage and warehouse services, Freight transport agency services |

5% |

Notes:

(1) Under education services, SEIS shall not be available on Capitation fee.

(2) *Operations from India by Indian Flag Carriers only is allowed under Maritime transport services.

| 1. Net Foreign exchange earnings

= Gross Earnings of Foreign Exchange Minus Total expenses/ payment/ remittances of Foreign Exchange by the IEC holder, relating to service sector in the financial year. 2. ‘Services’ include all tradable services covered under General Agreement on Trade in Services (GATS) and earning foreign exchange. 3. ‘Service Provider’ means a person providing: (i) Supply of a „service‟ from India to any other country; (Mode1- Cross border trade) (ii) Supply of a „service‟ from India to service consumer(s) of any other country in India; (Mode 2- Consumption abroad) (iii) Supply of a „service‟ from India through commercial presence in any other country. (Mode 3 – Commercial Presence) (iv) Supply of a „service‟ from India through the presence of natural persons in any other country (Mode 4- Presence of natural persons). |

(ii) Ineligible categories under SEIS:

(A) Foreign exchange remittances other than those earned for rendering of notified services would not be counted for entitlement. Thus, other sources of foreign exchange earnings such as equity or debt participation, donations, receipts of repayment of loans etc. and any other inflow of foreign exchange, unrelated to rendering of service, would be ineligible.

(B) Following shall not be taken into account for calculation of entitlement under the scheme:

| (1) Foreign Exchange remittances

A. Related to Financial Services Sector: ¨ Raising of all types of foreign currency Loans ¨ Export proceeds realization of clients ¨ Issuance of Foreign Equity through ADRs/ GDRs or other similar instruments ¨ Issuance of foreign currency Bonds ¨ Sale of securities and other financial instruments ¨ Other receivables not connected with services rendered by financial institutions. B. Earned through contract/ regular employment abroad (e.g. labour remittances) |

| (2) Payments for services received from EEFC Account |

| (3) Foreign exchange turnover by Healthcare Institutions like equity participation, donations etc. |

| (4) Foreign exchange turnover by Educational Institutions like equity participation, donations etc. |

| (5) Export turnover relating to services of units operating under EOU/ EHTP/ STPI/ BTP Schemes or supplies of services made to such units |

| (6) Clubbing of turnover of services rendered by EOU/ EHTP/ STPI/ BTP units with turnover of DTA Service Providers |

| (7) Exports of Goods |

| (8) Foreign Exchange earnings for services provided by Airlines, Shipping lines service providers plying from any foreign country X to any foreign country Y routes not touching India at all |

| (9) Service providers in Telecom Sector |

Common Provisions for Exports from India Schemes (MEIS and SEIS)

(i) CENVAT/ Drawback:

- Additional Customs duty/excise duty/Service Tax paid in cash or through debit under Duty Credit scrip shall be adjusted as CENVAT Credit or Duty Drawback as per DoR rules or notifications.

- Basic Custom duty paid in cash or through debit under Duty Credit scrip shall be adjusted for Duty Drawback as per DoR rules or notifications.

Duty credit scrip shall be permitted to be utilized for payment of duty in case of import of capital goods under lease financing.

(ii) Transfer of export performance: Transfer of export performance from one IEC holder to another IEC holder shall not be permitted. Thus, a shipping bill containing name of applicant shall be counted in export performance / turnover of applicant only if export proceeds from overseas are realized in applicant’s bank account and this shall be evidenced from e – BRC / FIRC.

However, MEIS rewards can be claimed either by the supporting manufacturer (along with disclaimer from the company / firm who has realized the foreign exchange directly from overseas) or by the company/ firm who has realized the foreign exchange directly from overseas.

(iii) Incentives of MEIS & SEIS are available to units located in SEZs also.

3. STATUS HOLDER

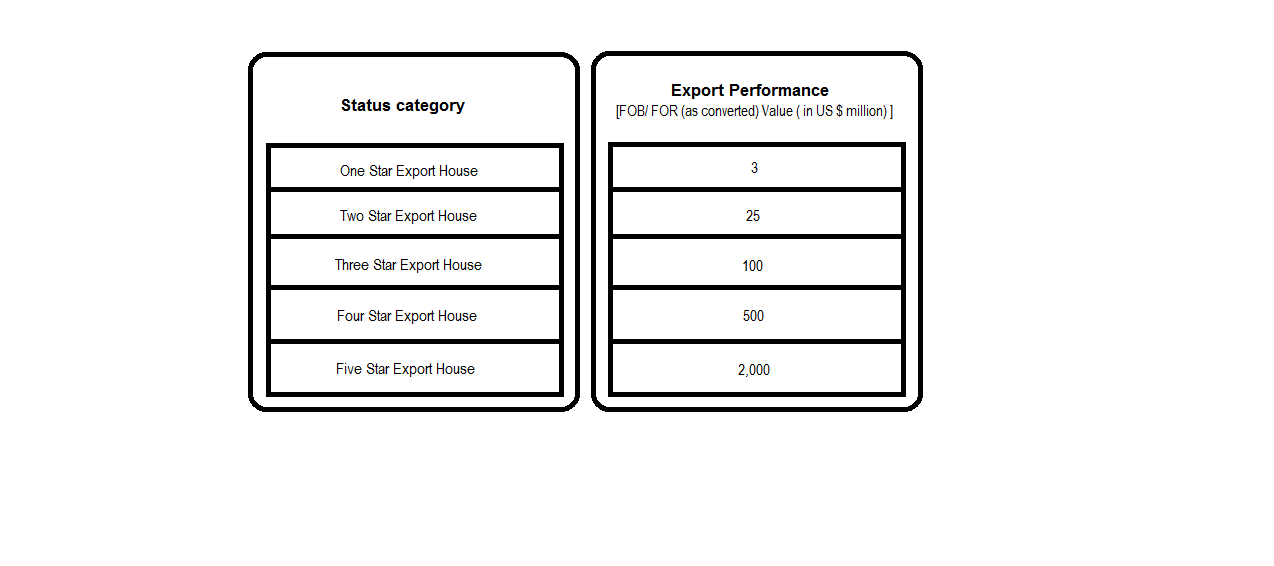

Status Holders are business leaders who have excelled in international trade and have successfully contributed to country‟s foreign trade. All exporters of goods, services and technology having an import-export code (IEC) number shall be eligible for recognition as a status holder. Status recognition depends upon export performance**.

An applicant shall be categorized as status holder upon achieving export performance during current and previous two financial years, as indicated below:

| **Points which merit consideration while computing export performance for grant of status:

(a) Export performance will be counted on the basis of FOB value of export earnings in free foreign exchange. (b) For deemed export, FOR value of exports in Indian Rupees shall be converted in US$ at the exchange rate notified by CBEC, as applicable on 1st April of each Financial Year. (c) For granting status, export performance is necessary in at least 2 out of 3 years. (d) For calculating export performance for grant of One Star Export House Status category, exports by IEC holders under the following categories shall be granted double weightage : (i) Micro, Small & Medium Enterprises (MSME) (ii) Manufacturing units having ISO/BIS (iii) Units located in North Eastern States and Jammu & Kashmir (iv) Units located in Agri Export Zones. (e) Export performance of one IEC holder shall not be permitted to be transferred to another IEC holder. Hence, calculation of exports performance based on disclaimer shall not be allowed. (f) Exports made on re-export basis shall not be counted for recognition. (g) Export of items under authorization, including SCOMET items, would be included for calculation of export performance. |

Privileges of Status Holders: Status holders are granted certain benefits like:

(a) Authorisation and custom clearances for both imports and exports on self-declaration basis.

(b) Fixation of Input Output Norms (SION) on priority i.e. within 60 days.

(c) Exemption from compulsory negotiation of documents through banks. The remittance receipts, however, would continue to be received through banking channels.

(d) Exemption from furnishing of Bank Guarantee in Schemes under FTP.

(e) Two Star Export Houses and above are permitted to establish export warehouses.

(f) Three Star and above Export House shall be entitled to get benefit of Accredited Clients Programme (ACP) as per the guidelines of CBEC.

(g) Status holders shall be entitled to export freely exportable items on free of cost basis for export promotion subject to an annual limit of `10 lakh or 2% of average annual export realization during preceding 3 licensing years, whichever is higher.