RISK MANAGEMENT – AN OVERVIEW :

Risks

A risk arises on account of an uncertain event, which might result in a loss or gain to the parties associated with such risk. Even though the risk is an independent event, invariably risks are interlinked in the sense; one risk may lead to other risks as well.

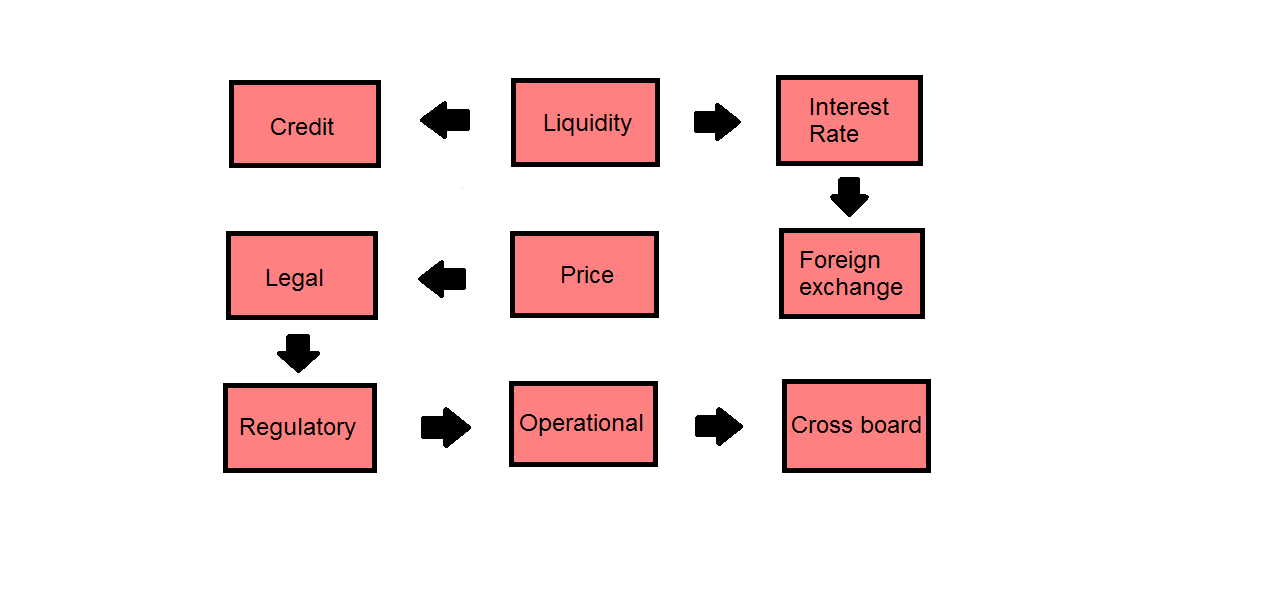

Risks can be classified into various types. Few examples of risks are shown in the following diagram:

As per the Basel norms, these risks are broadly classified into three:

The first diagram indicates various risks and the second diagram shows three important classifications of the risks. To illustrate how these risks are interlinked, let us take examples of two market situations.

(1) Bank A lends to B Rs.10,00,000.00 for a period of six months. On the due date (maturity of the loan) borrower B needs to repay to Bank A Rs. 10,00,000.00 + applicable interest. Assuming on the due date if B fails to repay the amount, then it becomes a credit risk for bank A, on account of default in payment by the borrower. On account of the non receipt of the funds, Bank A would face another risk called liquidity risk. Not only that, it would lead to a situation of asset liability mismatch (gap risk) for bank A. In view of the shortage of funds, and also to manage the mismatch in its asset liability, bank A should arrange for funds from (a) accepting new deposits and/or approach the market to borrow at the markets interest rate. Hence bank A would be facing the market risk (and needs to pay the market interest rate). In the ordinary course, these transactions would not have arisen, if the borrower B had repaid his loan on the original due date. Further, our assumptions are that after few days, if borrower B repays the loan amount and interest thereof, once again the bank A would face asset liability mismatch on account of funds received. Such funds need to be deployed in the market subject to market interest rate. Assuming on the date of deployment if the market rates come down, the bank A would face a loss. A recap of this illustration would show case how; one risk is extended to series of risks. Credit risk – liquidity risk – mismatch (gap) risk – market risk (interest rate)

(2) Bank X entered into a spot forex deal with Bank Y. Bank X agreed to sell US$ 1 million to Bank Y at a particular exchange rate. On the date of delivery Bank Y settled the equivalent rupee funds to Bank X. However, Bank X could not deliver the US$ 1 million. So Bank Y is facing a credit risk, also called settlement risk. This would lead to further risks for Bank Y. There would be shortage of funds in the Nostro account of Bank Y. Bank Y needs to fund the account and should (a) either arrange for a fresh deal and/or (b) borrow in US markets at the market’s interest rate. The non receipt of US funds has created not only credit risk, but also liquidity as well as mismatch risk in the assets and liabilities of the bank Y. Further on account of approaching the forex markets as well as US market, to enter into a new forex deal and to borrow funds in the US market, bank Y would also face market risks (viz., Exchange Rate risk and Interest rate risk respectively).

Basel Norms categorized these risks broadly into three viz, (1) Credit Risk (2) Market Risk and (3) Operational Risk

We have seen examples of Credit Risk and Market Risk and how these are interlinked.

Let us take another example i.e., Operational Risk: Apart from credit and market risks, other risks can be recognized as part of operational risk. Operational risk mainly arises out of non adherence to the regulatory directives, guidelines, non compliance of legal frame work, on account of human and system errors, natural disasters, and also on account of frauds, misappropriation of funds, weak internal control systems etc. Any risk which arises out of one or more factors mentioned above can be recognized as operational risk. Any of the operational risk would create a credit risk for the counter party, and as already explained above, there would be chain effect, like operational risk credit risk-. liquidity risk – mismatch (gap) risk – market risk (interest rate).

In view of the above, banks should be very careful in their risk management.