Statutory requirement of declaring retail sale price on the package of notified excisable goods is a pre-requisite for applying section 4A :

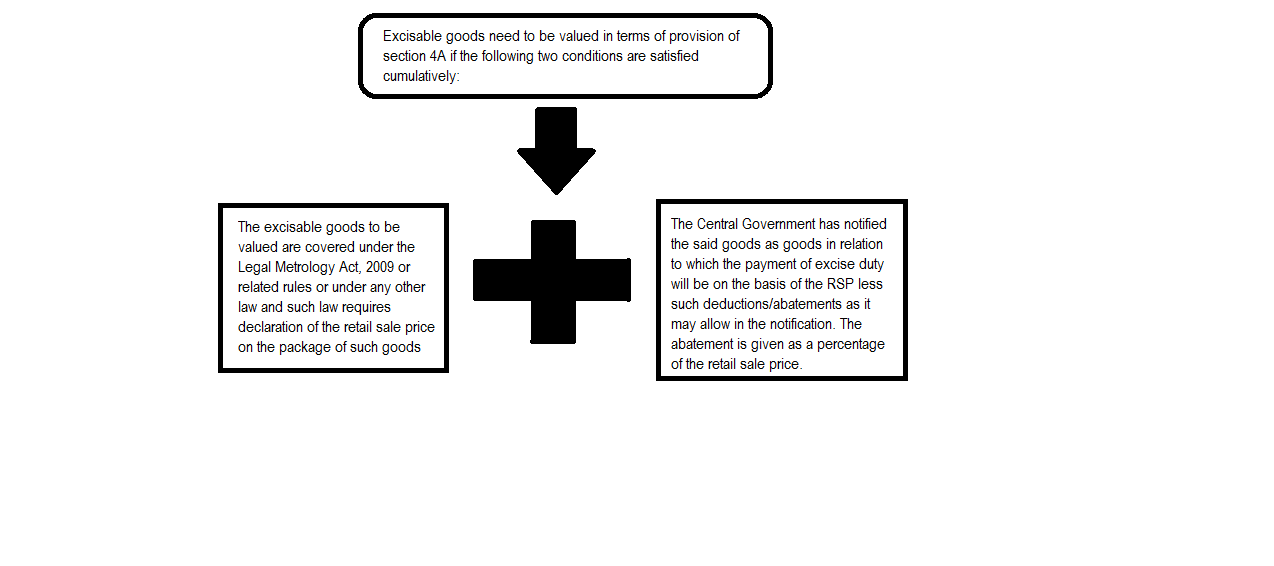

The provisions of section 4A of Central Excise Act, 1944 would apply only if a particular product [on which declaration of the retail sale price is required as per the Legal Metrology Act, 2009] is also notified with abatement under provisions of the Central Excise Act. Otherwise, such product will be valued as per section 4 of the Central Excise Act, 1944 or as per section 3(2) of the Central Excise Act, 1944, if tariff values have been fixed for the commodity.

For instance, hand tools require MRP to be printed on package. However, these are not notified under section 4A. Therefore, shall not be valued on basis of MRP less abatment under section 4A of the Central Excise Act.

A. MRP provisions are overriding provisions: MRP provisions override the provisions of section 4. In other words, when the provisions of section 4A are applicable, the assessable value shall be determined on the basis of MRP less abatement and not on the basis of section 4 of the Act.

B. When is MRP required to be declared?: Let us now understand on what kind of goods the provisions of Legal Metrology Act, 2009 and rules made thereunder are applicable. The provisions requiring MRP declaration apply only to package intended for retail sale. Thus, MRP declaration will not be required if good are sold in bulk or they are not packed or they are not intended for retail sale.

Section 18(1) of Legal Metrology Act, 2009 provides that no person shall manufacture, pack, sell, import, distribute, deliver, offer, expose or possess for sale any pre-packed commodity (commodity placed in a package without buyer being present, containing a predetermined quantity) unless such package is in such standard quantities or number and bears thereon such declarations and particulars in such manner as may be prescribed under Legal Metrology (Packaged Commodities) Rules, 2011.

Legal Metrology (Packaged Commodities) Rules, 2011, inter alia, envisage two types of packages – (a) Retail package and (b) Wholesale package. Rule 6(1)(e) provides that every package intended for retail sale shall, inter alia, have declaration of the retail sale price of the package.

| “Retail sale price‟ means the maximum price at which the commodity in packaged form may be sold to the ultimate consumer and the price shall be printed on the package in the manner given below;

Maximum or Max. retail price……Rs………/`………inclusive of all taxes or in the form MRP Rs………/`………incl., of all taxes after taking into account the fraction of less than fifty paise to be rounded off to the preceding rupee and fraction of above 50 paise and up to 95 paise to the rounded off to fifty paise [Rule 2(m) of Legal Metrology (Packaged Commodities) Rules, 2011]. “Retail package‟ means the packages which are intended for retail sale to the ultimate consumer for the purpose of consumption of the commodity contained therein and includes the imported packages [Rule 2(k) of Legal Metrology (Packaged Commodities) Rules, 2011]. “Retail sale‟, in relation to a commodity, means sale, distribution or delivery of such commodity through retail sale shops, agencies or other instrumentalities for consumption by an individual or a group of individuals or any other consumer [Rule 2(l) of Legal Metrology (Packaged Commodities) Rules, 2011]. |

C. Non-applicability of MRP provisions: The provisions of marking MRP are not applicable to the following:

(a) Packages above 25kg/ 25litre: Provisions do not apply to packages of commodities containing quantity of more than 25 kg or 25 litre [excluding cement and fertilizer sold in bags up to 50 kg].

(b) Packaged commodities meant for industrial consumers or institutional consumers: Provisions do not apply to packaged commodities meant for industrial consumers or institutional consumers (this exclusion is irrespective of weight or volume of package).

| „Industrial consumer‟ means the consumer who buys packaged commodities directly from the manufacturer or from an importer or from wholesale dealer for use by that industry and the package shall have declaration ‘not for retail sale‘ [Rule 2(bb) of Legal Metrology (Packaged Commodities) Rules, 2011].

“Institutional consumer‟ means the institution who hires or avails of the facilities or services in connection with transport, hotel, hospital or other organisation which buy packaged commodities directly from the manufacturer or from an importer or from wholesale dealer for use by that institution, and the package shall have de claration ‘not for retail sale‘.[Rule 2(bc) of Legal Metrology (Packaged Commodities) Rules, |

(c) Wholesale packages: Retail sale price is required to be declared only on packages intended for retail sale and not on wholesale packages. The valuation of wholesale packages will be as per section 4 of the Central Excise Act, 1944.

| „Wholesale package‟ means a package containing:

(i) a number of retail packages, where such first mentioned package is intended for sale, distribution or delivery to an intermediary and is not intended for sale direct to a single consumer; or (ii) a commodity sold to an intermediary in bulk to enable such intermediary to sell, distribute or deliver such commodity to the consumer in similar quantities; or (iii) packages containing ten or more than ten retail packages provided that the retail packages are labelled as required under the rules [Rule 2(r) of Legal Metrology (Packaged Commodities) Rules, 2011]. |

(d) Small packages of 10gm/10 ml or less: Provisions do not apply to packages containing commodity if the net weight or measure of the commodity is ten gram or ten millilitre or less, if sold by weight or measure. However, the provisions of this clause shall not be applicable for tobacco and tobacco products.

(e) Fast food items: Provisions do not apply to any package containing fast food items packed by restaurant or hotel and the like.

(f) Scheduled drugs and formulations: Provisions do not apply to package containing scheduled formulations and non-scheduled formulations covered under the erstwhile Drugs (Price Control) Order, 1995 [now DPCO, 2013] made under section 3 of the Essential Commodities Act, 1955.

(g) Agricultural farm produce: Provisions do not apply to agricultural farm produces in packages of above 50 kg.

(h) Thread sold in coils to handloom weavers: Provisions do not apply to any thread which is sold in coil to handloom weavers.

(i) Bidis for retail sale: Declaration of retail price is not required on any package containing bidis.

(j) Domestic LPG gas: MRP is not required to be indicated in domestic LPG of which the price is covered under Administrative Price Mechanism of Government.

D. Same product partly sold in retail and partly in wholesale: CBE&C has clarified in Circular No. 625/16/2002-CX dated 28.02.2002 that when goods covered under section 4A are supplied in bulk to large buyer (and not in retail), valuation is required to be done under section 4. Provisions of section 4A apply only where manufacturer is legally obliged to print MRP on the packages of goods. Thus, there can be instances where the same commodity would be partly assessed on basis of section 4A and partly on basis of transaction value under section 4.

E. Valuation of free samples of the product assessed on the basis of MRP: As explained earlier, Circular No. 813/10/2005-CX dated 25.4.2005 clarifies that in the case of free samples, the value should be determined under rule 4.

The CBEC has further clarified vide Circular No. 915/05/2010-CX dated 19.02.2010 that in respect of the free samples of the products covered under MRP based assessment, the valuation of these samples shall also be done under rule 4 of the valuation rules by taking into consideration the deemed value under section 4A(1) notwithstanding the n on excise duty would be determined under section 4A for the similar goods (subject to

adjustment for size, pack etc.).availability of normal price under section 4(1)(a) of the Act. Accordingly, the value for excise duty would be determined under section 4A for the similar goods (subject to adjustment for size, pack etc.).

F. Some important decisions:

1. Provisions applicable to all packaged commodities: The provision of Legal Metrology Act applies to all pre-packaged commodities. Specific notification indicating classes of goods is not required [Khaitan Electricals v. UOI (2011) 267 ELT 185 (Kar.) and Reebok India Co. v. UOI (2011) 270 ELT 513 (Kar.)]

2. Provisions not applicable if product is not packed: Provisions of Legal Metrology Act do not apply to sale of a car [Mahindra and Mahindra v. Director of Standards of Weights and Measures (2011) 272 ELT 488 (Ker .)].

3. Outer packaging for protection/safety during transportation not wholesale package: Such packaging does not require details like name/address, cost, month year etc. [State of Maharashtra v. Raj Marketing (2011) 272 ELT 8 (SC)] . Therefore, valuation of such package will be done on the basis of section 4A i.e., RSP less abatement.

| Examples of some goods that are notified along with percentage of abatement under section 4A is as follows: | |

| (i) Biscuits | 30% |

| (ii) Toothbrush | 30% |

| (iii) Photographic cameras | 30% |

| (iv) Pressure cooker | 25% |