TERM LOANS :

The loan is disbursed by way of single debit/stage-wise debits (wherever sanction so accorded) to the account. The amount may be allowed to be repaid in lump sum or in suitable installments, as per terms of sanction. Loan is categorized Demand Loan if the repayment period of the loan is less than three years, in case the repayment of the loan is three years and above the loan be considered as Term Loan.

Under the loan system, credit is given for a definite purpose and for a predetermined period. Normally, these loans are repayable in installments. Funds are required for single non-repetitive transactions and are withdrawn only once. If the borrower needs funds again or wants renewal of an existing loan, a fresh request is made to the bank. Thus, a borrower is required to negotiate every time he is taking a new loan or renewing an existing loan. Banker is at liberty to grant or refuse such a request depending upon his own cash resources and the credit policy of the central bank.

Advantages of Loan System

1. Financial Discipline on the borrower: As the time of repayment of the loan or its installments is fixed in advance, this system ensures a greater degree of self-discipline on the borrower as compared to the cash credit system.

2. Periodic Review of Loan Account: Whenever any loan is granted or its renewal is sanctioned, the banker gets as opportunity of automatically reviewing the loan account. Unsatisfactory loan accounts may be discontinued at the discretion of the banker.

3. Profitably: The system is comparatively simple. Interest accrues to the bank on the entire amount lent to a customer.

Drawbacks

1. Inflexibility: Every time a loan is required, it is to be negotiated with the banker. To avoid it, borrowers may borrow in excess of their exact requirements to provide for any contingency.

2. Banks have no control over the use of funds borrowed by the customer. However, banks insist on hypothecation of the asset/ vehicle purchased with loan amount.

3. Though the loans are for fixed periods, but in practice the roll over, i.e., they are renewed frequently.

4. Loan documentation is more comprehensive as compared to cash credit system.

Types of Term Loans:

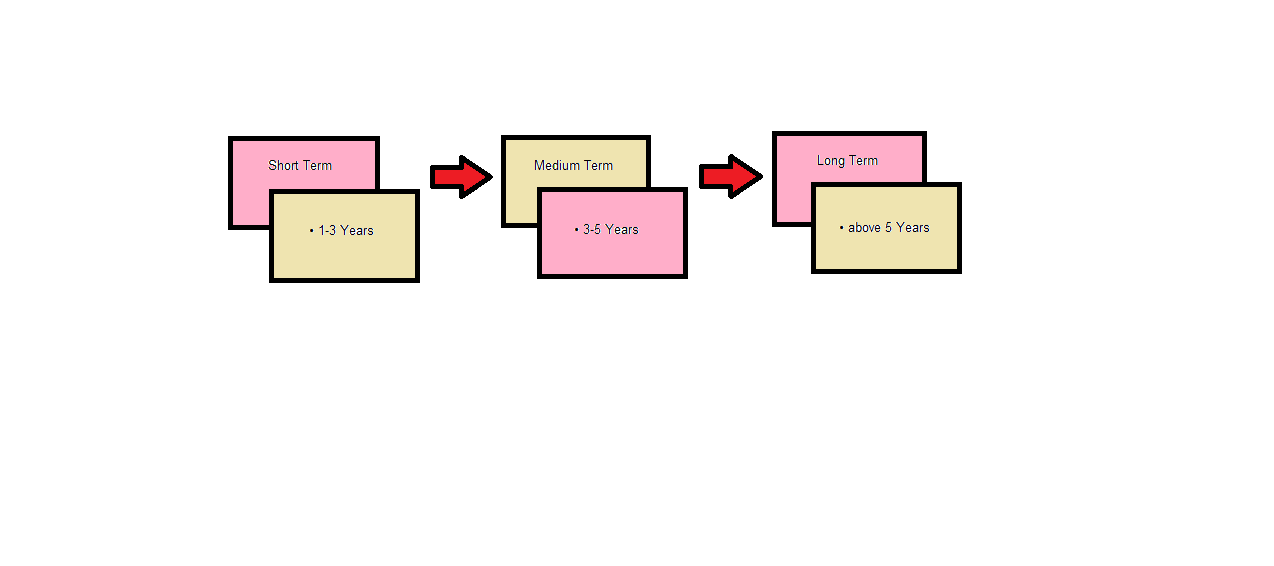

Term loans are granted by banks to borrowers for purchase of fixed assets like land and building, factory premises, embedded machinery etc., to enable their manufacturing activities, and their business expansion, if the amounts are repayable after a specific period of time, they are all called as term finance. On the basis of the period for which the funds are required by the borrowers, these loans are classified as short, medium and long term loans.

Banks have been given freedom to fix their own interest rate for loans and advances. As per bank’s lending and interest rate policies applicable interest and other charges would be applicable to CC, OD, Term loan accounts.

Each bank should decide “base rate” of interest on advances as per RBI directives.

Loans which are repayable within 1 – 3 years are classified as Short term, 3-5 years are classified as Medium Term and above 5 years are classified as long term.

Term Loans – Important aspects:

1. Term loans are given to the manufacturing, trading and service sector units which require funds for purchasing various items of fixed assets, such as, land and building, plant and machinery, electrical installation and other preliminary and pre-operative expenses.

2. Repayment of term loans would depend upon the firm’s capacity to produce goods or services by using the fixed assets as financed by banks.

3. Like any other loan, a term loan is sanctioned by the bank, after evaluation of credit proposal (application).

The bank before granting terms loans needs to carry out a clear due diligence as to the borrower’s requirement, capacity and other aspects.

4. While considering a term loan proposal, the bank need to verify the financial status, economic viability and the firm’s production capacity.

5. After proper verification and satisfaction of various requirements, banks can grant a term loan, on certain terms and conditions, covenants, including repayment terms.

6. Term loans like any other credit facility needs to cover Six C concepts and the banks should follow bank’s lending policy, exposure norms and the RBI’s guidelines and directives

7. All required valid collateral security, duly executed should be one of the pre conditions for the loan amount to be disbursed.

8. The assets created out of the bank loan, are charged depending upon the nature of security (hypothecation, mortgage, etc.

9. At the time of fixing the limit and quantum of finance, a banker is required to make assessment of actual cost of assets to be acquired, margin to be contributed, sources of repayment, etc.

A legal case decided by High Court in respect of term loans is given below:

(i) Acceleration of Repayment: P.K. Achuthan vs State Bank of Travancore 1974 K.L.T. 806 (FB)

A question that came for decision in this case was whether a provision in hypothecation bonds to the effect that on a default of borrower in paying any of the instalments, the lender would be entitled to recover the whole of the debt due, inclusive future instalments in one lump sum. The Kerala High Court held that where contract provides for repayment of money in instalments and also contains a stipulation that on default being committed in paying any of the instalments, the whole sum shall become payable, then the lender would be entitled to recover the whole sum inclusive of future instalments.

Bridge Loans

Bridge loans are essentially short term loans which are granted to industrial undertakings to meet their urgent and essential needs during the period when formalities for availing of the term loans sanctioned by financial institutions are being fulfilled or necessary steps are being taken to raise the funds from the capital market. These loans are granted by banks or by financial institutions themselves and are automatically repaid out of amount of the term loan or the funds raised in the capital market.

In April, 1995, Reserve Bank of India banned bridge loans granted by banks and financial institutions to all companies. But in October, 1995, Reserve Bank of permitted the banks to sanction bridge loans/interim finance against commitment made by a financial institutions or another bank where the lending institution faces temporary liquidity constraint subject to the following conditions:

(i) The prior consent of the other bank/financial institution which has sanctioned a term loan must be obtained.

(ii) The term lending bank/financial institution must give a commitment to remit the amount of the term loan to the bank concerned.

(iii) The period of such bridge loan should not exceed four months.

(iv) No extension of time for repayment of bridge loan will be allowed.

(v) To ensure that bridge loan sanctioned is utilized for the purpose for which the term loan has been sanctioned.

In November, 1997, Reserve Bank permitted the banks to grant bridge loans to companies (other than non- banking finance companies) against public issue of equity in India or abroad. The guidelines for sanction of such loans are to be laid down by each bank and should include the following aspects:

(i) Security to be obtained for the loan.

(ii) The quantum of outstanding bridge loan (or the limit sanctioned, whichever is higher) during the year.

(iii) Compliance with individual/group exposure norms.

(iv) Ensuring end use of bridge loan.

(v) The maximum period of the bridge loan to be one year.

Composite Loans

When a loan is granted both for buying capital assets and for working capital purposes, it is called a composite loan. Such loans are usually granted to small borrowers, such as artisans, farmers, small industries, etc. Consumption Loans

Though normally banks provide loans for productive purposes only but as an exception loans are also granted on a limited scale to meet the medical needs or the educational expenses or expenses relating to marriages and other social ceremonies etc. of the needy persons. Such loans are called consumption loans.