TRADING ACCOUNT :

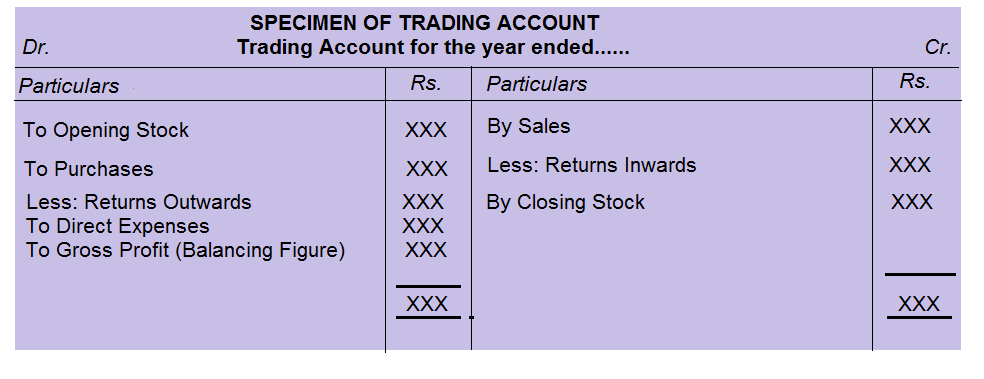

Trading Account is the first part of income statement which is prepared to ascertain the gross profit or gross loss for a given accounting period.

Trading Account is prepared before the preparation of profit & loss account. It shows the result of trading activities relating to purchases & sales of goods & services. Trading account is prepared to calculate separately the profit from sale & purchase transactions

only. The profit or loss is termed as gross profit or gross loss as various other expenses of an organsiation like administrative, selling & distribution and maintenance expenses etc. are not deducted. Only the direct expenses which are incurred to bring goods into saleable condition like freight, insurance, carriage inwards, fuel, power, royalties on production, consumption of stores etc. are taken into account to calculate gross profit/loss.

– In case debit side exceeds the credit side, the balance will be gross loss and that will be shown on the credit side of Trading Account as “By Gross Loss”.

– In trading account, closing stock is shown at cost price or net realisable market value whichever is lower.

– While taking stock for the purpose of preparation of trading account, stock in hand on the last day of the accounting year should be adjusted for purchases recorded but goods not yet received, goods sold but not yet delivered and goods that may be out of business premises because of consignment, goods delivered on sale or return basis, etc.

– Gross profit or gross loss revealed by Trading Account is transferred to Profit and Loss Account.