Types of Cash Book

(i) Single Column Cash Book: It is like an ordinary cash account. In this all cash receipts are recorded on the left hand side (real account – debit what comes in) and all cash payments are recorded on the right hand side (real account – credit what goes out).

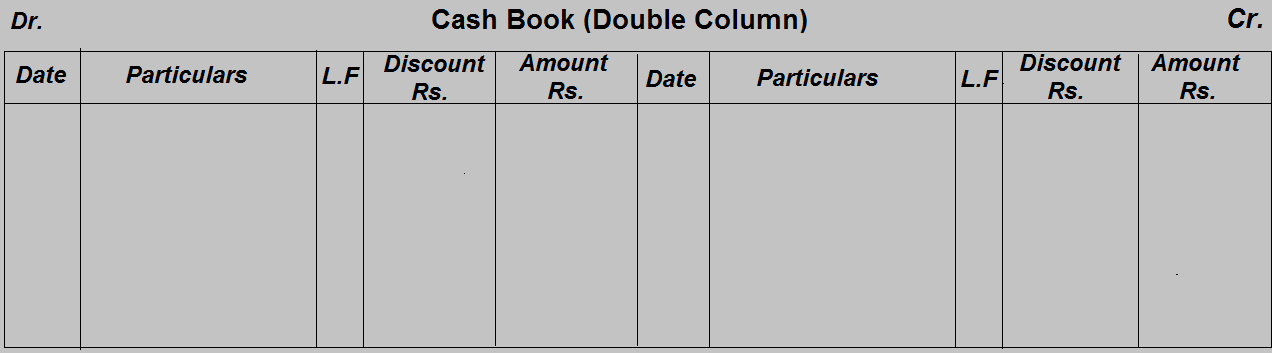

(ii) Two (Double) Column Cash Book: It has two amount columns on both sides; one is for cash and another is for discount. Cash column is meant for recording cash receipts and payments while discount column is meant for recording discount received and allowed. The discount column on the debit side represents the discount allowed while discount column on the credit side represents the discount received.

Note: Discount columns do not serve the function of a discount account. Discount columns are merely memorandum columns. Discount allowed account and discount received account are opened in the ledger and the totals of discount columns are posted to these accounts.

Illustration 4:

Record the following transactions in Cash Book of Mr. Singh:

| 2012 | Rs. | |

| 1-Apr | Mohan Lal commenced business with cash | 1,00,000 |

| ” 2 | Bought goods for cash | 65,700 |

| ” 3 | Sold goods for cash | 4,320 |

| ” 6 | Received cash from Fateh Singh | 1,800 |

| ” 6 | Allowed him discount | 50 |

| ” 9 | Paid cash to Shugan Chand | 19,500 |

| Discount allowed by Shugan Chand | 500 | |

| ” 12 | Paid for Office Furniture | 5,680 |

| ” 18 | Sold goods for cash | 7,810 |

| ” 23 | Received cash from Subramaniam | 9,870 |

| ” | ” Discount allowed to him | 120 |

| ” 27 | Paid for advertising | 500 |

| ” 28 | Cash paid to Asia Trading Co. | 20,300 |

| Discount received | 250 | |

| ” 30 | Cash sales | 1,280 |

| ” 30 | Cash received from Fateh Singh | 2,850 |

| Discount allowed to him | 100 | |

| Salary paid in cash | 3,150 |

Solution:

Mr. Singh

Dr. Cash Book Cr.

| Date | Particulars | L.F | Discount Rs. | Cash Rs. | Date | Particulars | L.F | Discount Rs. | Cash Rs. |

| 2012 | 2012 | ||||||||

| April | April | ||||||||

| 1 | To Capital A/c | 1,00,000 | 2 | By Purchases A/c | 65,700 | ||||

| 3 | To Sales A/c | 4,320 | 9 | By Shugan Chand | 500 | 19,500 | |||

| 6 | To Fateh Singh | 50 | 7,810 | 12 | By Furniture A/c | 5,680 | |||

| 18 | To Sales A/c | 1,800 | 27 | By Advertising | 500 | ||||

| 23 | To Subramaniam | 120 | 9,870 | 28 | By Asia Trading Co. | 250 | 20,300 | ||

| 30 | To Sales A/c | 1,280 | 30 | By Salary | 3,150 | ||||

| 30 | To Fateh Singh | 100 | 2,850 | 30 | By Balance c/d | 13,100 | |||

| To Balance B/d | 270 | 1,27,930 | 750 | 1,27,930 | |||||

| 1-May | 13,100 |

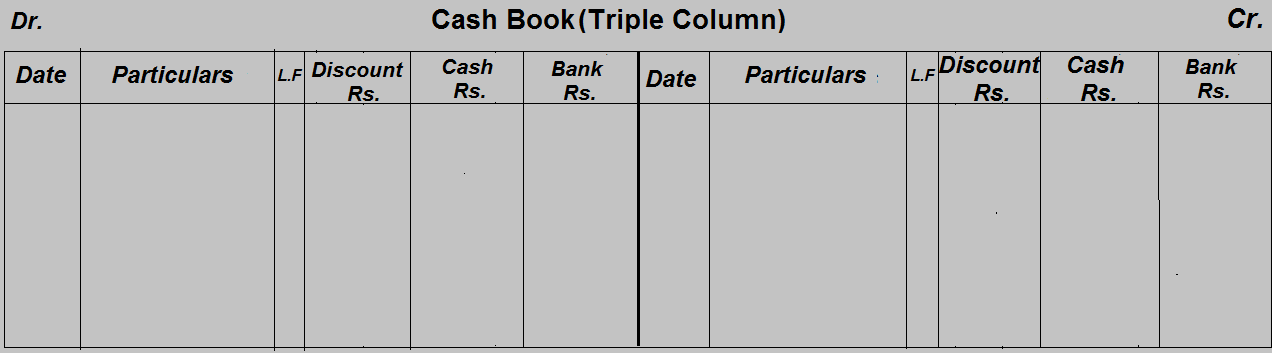

(iii) Three Columnar Cash Book: This type of cash book contains the following three amount columns on each side:

(a) Discount column for discount received and allowed;

(b) Cash column for cash received and cash paid; and

(c) Bank column for money deposited and money withdrawn from the bank.

When triple column cash book is prepared, there is no need for a separate bank account in the ledger. The bank account maintained by the enterprise is a personal account and the cash account is a real account. For recording transactions in the bank column of the cash book the rule of debit and credit applicable to personal accounts should be followed i.e. debit the receiver and credit the giver. Thus, when cash is deposited with bank, the bank would be the receiver and would be debited in the bank column of the cash book. Similarly, for cash withdrawn from the bank the bank would be the giver and would be credited in the bank column of the cash book.

Contra Entry: If a transaction involves both cash and bank accounts, it is entered on both sides of the cash book, one in the cash column and other in the bank column, though on opposite sides. There are is called contra entries and word ‘C’ is indicated against that item in L.F. columns e.g. when cash is withdrawn from the bank, it is recorded on the debit side in cash column and on the credit side in the bank column. Similarly, when cash is deposited with the bank, the amount is recorded on the debit side in bank column and on the credit side in the cash column.

Illustration 5:

On 1st May, 2012 the columnar cash book of Mitra showed that he had Rs. 2,000 in his cash box and that there was a bank overdraft of ` 8,000. During the day the following transactions took place:

| Cash withdrawn from bank for office use | 10,000 |

| Paid salaries in cash | 3,000 |

| Cash paid to Harish & Co. | 6,500 |

| Drawings in cash made by Mitra for household expenses | 1,000 |

| Received from G. Guha in settlement of an account of ` 10,000, | |

| Rs.1,800 in cash and a cheque of ` 8,000. The cheque was immediately deposited in bank | |

| Cash sales | 6,500 |

| Bank returns a cheque of ` 9,900 received from Kulu & Sons in settlement of an account of Rs.10,000 | |

| Paid rent by cheque | 1,500 |

| Cash deposited with bank | 6,000 |

| Write up the Cash Book for the day and balance it. |

Solution:

Dr. Cash Book (Triple Column) Cr.

| Date | Particulars | L.F | Discount Rs. | Cash Rs | Bank Rs. | Date | Particulars | L.F | Discount Rs. | Cash Rs | Bank Rs. |

| 2012 | 2012 | ||||||||||

| May | To Bal. b/d | 2,000 | May | By Bal. b/d | 8,000 | ||||||

| 1 | To Bank | (C) | 10,000 | 1 | By Cash | (C) | 10,000 | ||||

| To G.Guha | 200 | 1,800 | 8,000 | By Salaries A/c | 3,000 | ||||||

| To Sales A/c | 6,500 | By Harish | 6,500 | ||||||||

| To Cash | 6,000 | By Drawings A/c | 1,000 | ||||||||

| To Bal. c/d | 15,400 | By Kulu & Sons | 100 | 9,900 | |||||||

| By Rent A/c | 1,500 | ||||||||||

| By Bank | 6,000 | ||||||||||

| ___________ | ___________ | ___________ | By Bal c/d | © | ________ | 3,800 | ________ | ||||

| 200 | 20,300 | 29,400 | 200 | 20,300 | 29,400 | ||||||

| May. 2 | To Balance b/d | 3,800 | May.2 | By Balance b/d | 15,400 |