Exemption of long-term capital gains on sale of residential property, where net consideration on sale is invested in shares of an eligible start-up [Section 54GB]

Effective from: A.Y.2017-18

(i) Exemption available under section 54GB so far

Under section 54GB, exemption is available from tax on long term capital gains arising on account of transfer of a residential property, if such capital gains are invested in subscription of shares of a company which qualifies to be a small or medium enterprise under the Micro, Small and Medium Enterprises Act, 2006, and such subscription is used in purchase of new plant and machinery, which excludes, inter alia, office appliances including computer and computer software.

(ii) Scope of exemption under section 54GB expanded to cover LTCG on sale of residential property invested in shares of eligible start-up company:

In order to encourage individuals/HUF to setup a start-up company by selling a residential property and investing in the shares of such company, section 54GB has been amended to provide that long term capital gains arising on account of transfer of a residential property shall not be charged to tax, if:

(1) the net consideration is invested in subscription of equity shares of a company which qualifies to be an eligible start-up on or before the due date of filing return of income under section 139(1);

(2) the individual or HUF holds more than 50% shares of the company or 50% voting rights after the subscription in shares by such individual or HUF; and

(3) such company utilises the amount invested in shares to purchase new plant and machinery within one year from the date of subscription in equity shares.

(iii) Quantum of exemption:

If the cost of new plant and machinery ≥ Net sale consideration of residential house, entire capital gains is exempt. If the cost of new plant and machinery < Net sale consideration of residential house, only proportionate capital gains is exempt i.e.

|

LTCG × |

Cost of new plant and machinery |

| Net sale consideration |

(iv) Purchase of computers or computer software out of amount invested in shares of an technology driven start-up permitted

In case of an eligible start-up, being a technology driven start-up so certified by the notified Inter-Ministerial Board of Certification (IMBC), the company can also utilise the amount invested in shares to purchase computers or computer software. This is because computers or computer software form the core asset base of such technology driven start-ups.

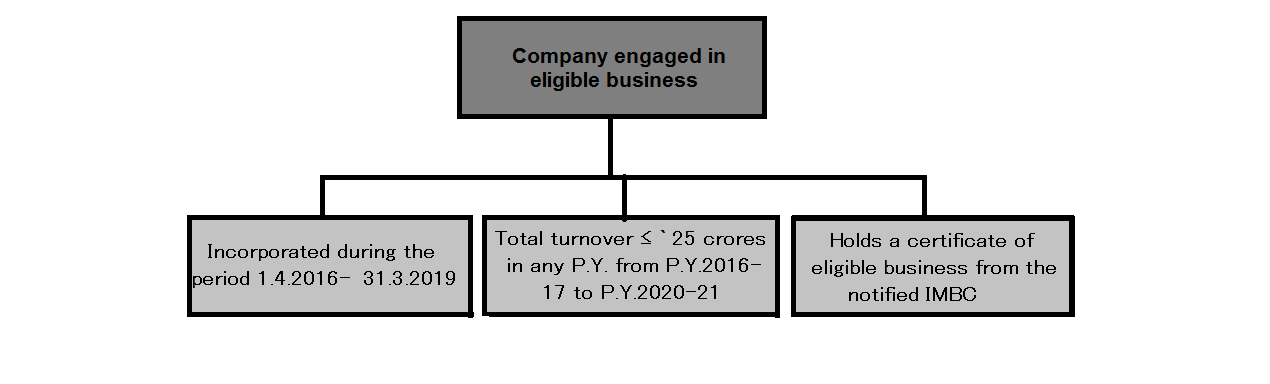

(v) Meaning of eligible start-up:

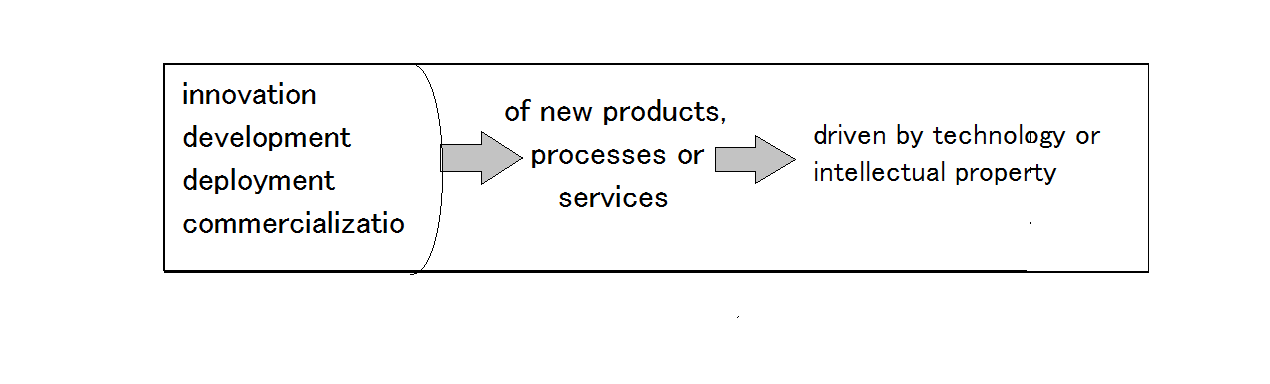

(vi) Meaning of eligible business :