Scope of permissible adjustments while processing a return under section 143(1)(a) expanded

Effective from: A.Y.2017-18

(i) As per section 143(1)(a), a return filed is to be processed and total income or loss is to be computed after making the adjustments on account of any arithmetical error in the return or on account of an incorrect claim, if such incorrect claim is apparent from any information in the return.

(ii) For the purpose of facilitating removal of mismatch between the return of income and the information available with the Department, the scope of adjustments that can be made at the time of processing of returns under section 143(1) has been expanded.

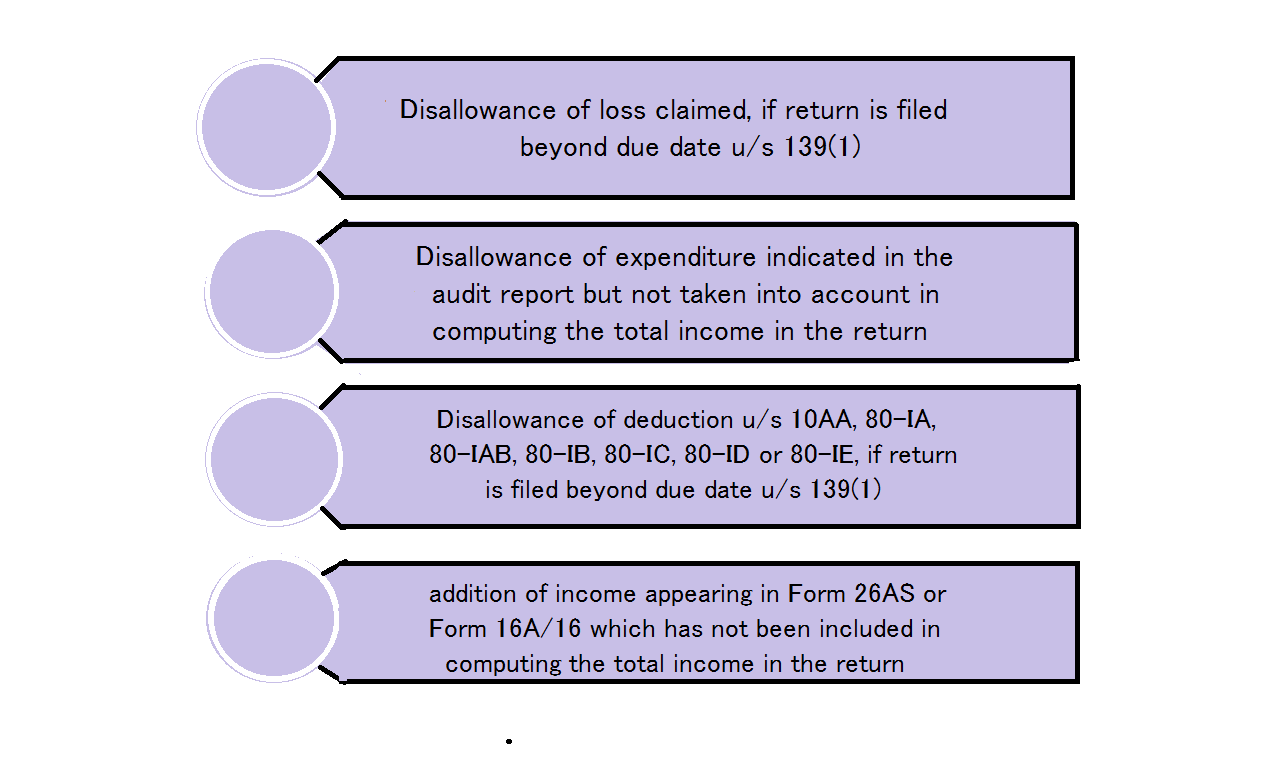

(iii) Accordingly, with effect from 1st April, 2017, the following adjustments can also be made at the time of processing of returns u/s 143(1):

(iv) Thus, adjustments can be made on the basis of data available with the Department in the form of audit report filed by the assessee, returns of earlier years of the assessee, Form 26AS, Form 16, and Form 16A.

(v) However, before making any such adjustments, in the interest of natural justice, an intimation has to be given to the assessee requiring him to respond to such adjustments. Such intimation may be in writing or through electronic mode. The response received, if any, has to be duly considered before effecting any adjustment. However, if no response is received within 30 days of issue of such intimation, the processing shall be carried out incorporating the adjustments.