Deferral of applicability of POEM based residence test and incorporation of transition mechanism for a company incorporated outside India and which has not earlier been assessed to tax in India [Section 6(3)] :

Related amendment in section: 115JH

Effective from: A.Y. 2017-18

(i) Determination of residential status of a company, other than an Indian company: Certain concerns:

(1) Under section 6(3), conditions to be satisfied by a company, to be a resident in India for a previous year are provided.

(2) A company is said to be resident in India in any previous year, if-

(a) it is an Indian company; or

(b) during that year, the control and management of its affairs is situated wholly in India.

(3) Since the condition for a company to be resident was that the whole of control and management should be situated in India and that too for whole of the year, a company could easily avoid becoming a resident by simply holding a board meeting outside India. The existing provision gave scope for creation of shell companies which were incorporated outside but controlled from India.

(ii) Place of effective management: Globally recognized concept for determination of residence of a foreign company

(1) ‘Place of effective management’ (POEM) is a globally recognized concept for determination of residence of a company incorporated in a foreign jurisdiction. The concept of ‘place of effective management’ for determination of residence of a company as a tie-breaker rule for avoidance of double taxation is recognised by

many of the tax treaties entered into by India. The Organisation of Economic Cooperation and Development (OECD) also recognises the principle of POEM.

(2) The place of effective management has been defined in the OECD commentary on model convention to mean a place where key management and commercial decisions that are necessary for the conduct of the entity’s business as a whole, are, in substance, made.

(iii) Incorporation of concept of POEM in the Income-tax Act, 1961

(1) Incorporation of the concept of POEM in the Income-tax Act, 1961 to determine the residence of a company would be in line with international standards. It would also help in aligning the provisions of the Act with the Double Taxation Avoidance Agreements (DTAAs) entered into by India with other countries.

(2) This requirement would also discourage the creation of shell companies outside India but being controlled and managed from India.

(3) Accordingly, section 6(3) was substituted by the Finance Act, 2015 with effect from A.Y.2016-17 to provide that a company would be resident in India in any previous year, if-

(i) it is an Indian company; or

(ii) its place of effective management, in that year, is in India .

Explanation to section 6(3) defines “place of effective management” to mean a place where key management and commercial decisions that are necessary for the conduct of the business of an entity as a whole are, in substance made.

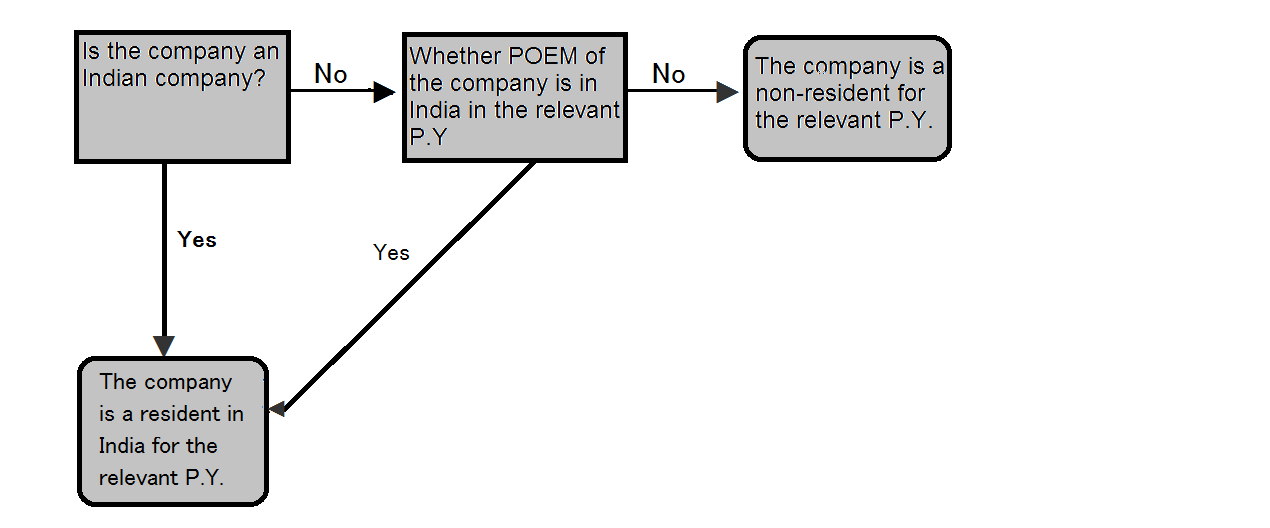

Determination of residential status of a company

(iv) Implementation of concept of POEM for determining residential status of foreign companies: Certain concerns

(1) In order to address the concerns regarding the applicability of provisions of the Income-tax Act, 1961 to a company which is incorporated outside India and has not earlier been assessed to tax in India, the applicability of POEM has been deferred by one year i.e., from A.Y.2016-17 to A.Y.2017-18. Particularly, th issues concerning the applicability of specific provisions of the Income-tax Act, 1961 on advance tax payment, TDS provisions, computation of total income, set off of losses and manner of application of transfer pricing regime have to be addressed, since they are in the nature of compliance requirements which would not have been undertaken by the company at the relevant point of time on account of absence of any such requirement under tax laws of country of incorporation of such company. Likewise, issues relating to depreciation computation also arise when in earlier years it has not been subject to computation under the Income-tax Act, 1961.

(2) It is also possible that a company may be claiming to be a foreign company not resident in India. However, in the course of assessment, it may be held to be resident based on POEM being in fact in India. This assessment would be well after closure of the previous year and it may not be possible for company to undertake many of procedural requirements.

(v) Deferral of applicability of POEM-based residence test by one year and putting in place requisite transition mechanism

Therefore, so as to ensure clarity in respect of implementation of POEM based rule of residence and to address concerns of the stakeholders, the Finance Act, 2016 has provided the following : –

(1) Deferral of applicability of POEM-based residence test by one year [Section 6(3)]

The applicability of POEM based residence test has been deferred by one year and the determination of residence based on POEM shall be applicable from A.Y.2017-18.

(2) Transition Mechanism for a company incorporated outside India and has not been assessed to tax earlier [New Chapter XII-BC – Section 115JH]

A transition mechanism for a company which is incorporated outside India and has not earlier been assessed to tax in India has been provided by insertion of Chapter XII-BC comprising of section 115JH.

(a) Accordingly, the Central Government is empowered to notify exception, modification and adaptation subject to which, the provisions of the Act relating to computation of income, treatment of unabsorbed depreciation, set off or carry forward and set off of losses, special provision relating to avoidance of tax and the collection and recovery of taxes shall apply in a case where a foreign company is said to be resident in India due to its POEM being in India for the first time and the said company has never been resident in India before.

(b) In a case where the determination regarding foreign company to be resident in India has been made in the assessment proceedings relevant to any previous year, then, these transition provisions would also cover any subsequent previous year, if the foreign company is resident in India in that previous year and the previous year ends on or before the date on which such assessment proceeding is completed. In effect, the transition provisions would also cover any subsequent amendment upto the date of determination of POEM in an assessment proceeding. However, once the transition is complete, then, normal provisions of the Act would apply.

(c) In the notification issued by the Central Government, certain conditions including procedural conditions subject to which these adaptations shall apply can be provided for and in case of failure to comply with the conditions, the benefit of such notification would not be available to the foreign company.

Accordingly, where in a previous year, any benefit, exemption or relief has been claimed and granted to the foreign company in accordance with the notification, and subsequently, there is failure to comply with any of the conditions specified therein, then –

(i) the benefit, exemption or relief shall be deemed to have been wrongly allowed;

(ii) the Assessing Officer may re-compute the total income of the assessee for the said previous year and make the necessary amendment as if the exceptions, modifications and adaptations as per the notification does

not apply; and

(iii) the provisions of section 154 shall, so far as may be, apply thereto and the period of four years for rectification of mistake apparent from the record has to be reckoned from the end of the previous year in which the failure to comply with the condition stipulated in the notification takes place.

(d) Every notification issued in exercise of this power by the Central Government shall be laid before each house of the Parliament.

Example

ABC Inc., a Swedish company headquartered at Stockholm, not having a permanent establishment in India, has set up a liaison office in Mumbai in April, 2016 in compliance with RBI guidelines to look after its day to day business operations in India, spread awareness about the company’s products and explore further opportunities. The liaison office takes decisions relating to day to day routine operations and performs support functions that are preparatory and auxiliary in nature. The significant management and commercial decisions are, however, in substance made by the Board of Directors at Sweden. Determine the residential status of ABC Inc. for A.Y.2017-18.

Answer

Section 6(3) has been substituted by the Finance Act, 2016 with effect from A.Y.2017-18 to provide that a company would be resident in India in any previous year, if-

(i) it is an Indian company; or

(ii) its place of effective management, in that year, is in India .

In this case, ABC Inc. is a foreign company. Therefore, it would be resident in India for P.Y.2016-17 only if its place of effective management, in that year, is in India.

Explanation to section 6(3) defines “place of effective management” to mean a place where key management and commercial decisions that are necessary for the conduct of the business of an entity as a whole are, in substance made. In the case of ABC Inc., its place of effective management for P.Y.2016-17 is not in India, since the significant management and commercial decisions are, in substance, made by the Board of Directors outside India in Sweden.

ABC Inc. has only a liaison office in India through which it looks after its routine day to day business operations in India. The place where decisions relating to day to day routine operations are taken and support functions that are preparatory or auxiliary in nature are performed are not relevant in determining the place of effective management.

Hence, ABC Inc., being a foreign company is a non-resident for A.Y.2017-18, since its place of effective management is outside India in the P.Y.2016-17.