Settlement of Accounts of Partners :

The Indian Partnership Act has certain provisions for the dissolution of partnership firm. According to section 48, in settling the accounts of a firm after dissolution, the following rules shall be observed subject to agreement by the partners:

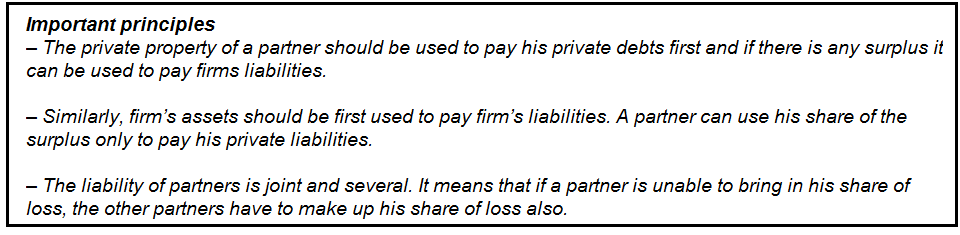

(a) Losses, including deficiencies of capital, shall be paid first out of profits, next out of capital, and, lastly, if necessary, by the partners individually in the proportions in which they were entitled to share profits;

(b) The assets of the firm, including any sums contributed by the partners to make up deficiencies of capital, shall be applied in the following manner and order:

– in paying the debts of the firm to third parties;

– in paying to each partner ratably what is due to him from the firm for advances as distinguished from capital;

– in paying to each partner ratably what is due to him on account of capital; and

– the residue, if any, shall be divided among the partners in the proportions in which they were entitled to share profits.

Thus, on dissolution the assets of the firm are sold out and the proceeds are applied in the following order:

– in paying debts due to third parties.

– in paying ratably the loans advanced by partners to the firm.

– in paying to the partners the sums due to them on account of capital, and

– if there is a surplus, it has to be distributed among the partners in the profit sharing ratio. On the other hand, if there is a loss on dissolution, it has to be made up first out of past accumulated profits, then out of capitals of the partners and lastly out of contributions from private estates of the partners in the profit sharing ratio.