Analysis

Supply:

(a) Generic meaning of ‘supply’: Supply includes all forms of supply (goods and / or services) and includes agreeing to supply when the supply is for a consideration and in the course or furtherance of business (as defined under Section 7 of the Act). It specifically provides for the inclusion of the following 8 classes of transactions:

(i) Sale

(ii) Transfer

(iii) Barter

(iv) Exchange

(v) License

(vi) Rental

(vii) Lease

(viii) Disposal

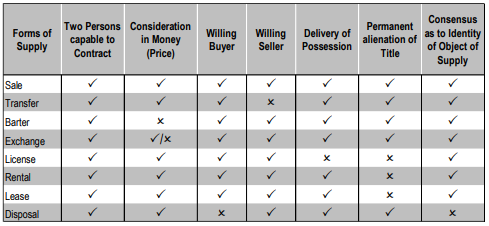

The word ‘supply’ is all-encompassing, subject to exceptions carved out in the relevant provisions. There are various ingredients that differentiate each of these eight forms of supply. On a careful consideration of the purposeful usage of these eight adjectives to enlist them as ‘forms’ of supply, it becomes clear that the legislature makes its intention known by the choice of words that are deliberate and unambiguous. Barter means a “thing or commodity” given in exchange for another. In other words, no value is fixed- viz., bartering a wrist watch with a wall clock. While exchange means:

Mutual grant of equal interests, the one in consideration of another.

When two persons mutually transfer ownership inter-se, at a price agreed upon or for goods and / or services plus money.

Disposal means distribution, transferring to new hands, extinguishment of control over, forfeit or pass over control to another.

Transfer means to pass over, convey, relinquishment of a right, abandonment of a claim, alienate, each or any of the above acts, lawfully.

A tentative attempt at identifying the characteristics of each of these forms of supply is provided below for consideration:

On an understanding of the above chart, one may infer that ‘supply’ is not a boundless word of uncertain meaning. The inclusive part of the opening words in this clause may be understood to include everything that supply is generally understood to be PLUS the ones that are enlisted. It must be admitted that the general understanding of the word ‘supply’ is but an amalgam of these 8 forms of supply.

Any attempt at expanding this list of 8 forms of supply, in case of goods, must be attempted with great caution. Attempting to find other forms of supply has in the normal course not yielded the desired results. However, transactions that do not amount to supply have been discovered viz., – transactions in the nature of an assignment where one person steps into the shoes of another, appears to slip away from the scope of supply, as well as transactions where goods are destroyed without a transfer of any kind taking place. Perhaps, the case of destruction of goods is not included within the meaning of ‘supply’ considering that the input tax credits in respect of destroyed goods is a blocked credit. However, the contradiction may continue until a clarification isissued to state whether the blocked credits is in respect of goods that have been destroyed before the availment of credits, or is applicable even in case where goods are destroyed after the credits have been availed in respect of such goods.

Now looking at ‘services’, we find that the adjectives used to describe the 8 forms of supply in this clause are akin to transactions involving goods and not services. Services other than licensing, rental and leasing services have not been specifically included in the meaning of the term ‘supply’. However, transactions involving services are also required to be passed through the same criteria for determination of supply. In doing so, a slight adjustment in the way of looking at transactions involving services is necessary so as to substitute the object of supply from goods to services while administering the tests for determining the forms of supply involving services. In other words, the same 8 forms of supply must be applied in relation to services but with adjustment that is understood by the expression mutatis mutandis.

The law has provided an inclusive meaning to the word ‘supply’ which implies that the specific transactions which are listed in the said Section are only illustrative.

The word ‘supply’ should be understood as follows:

— It should involve delivery of goods and / or services to another person; The word ‘delivery’ must be understood from allied laws such as The Sale of Goods Act, 1930 or the Contract Laws; Delivery could be actual, physical, constructive, deemed etc.

— Supply will be treated as ‘wholly one supply’ – if the goods and / or services supplied are listed in Schedule II or could be classified as a composite supply or mixed supply;

— It should involve quid-pro-quo – viz., the supply transaction requires something in return, which the person supplying will obtain, which may be in money / monetaryterms / in any other form(except in cases of activities specified in Schedule I which are deemed to be supplies, even when made without consideration);

— Transfer of property in goods from the supplier to recipient is not necessary viz., lease or hiring of goods;

It is essential that all the above forms of transactions including the extended and generic meaning given to the word ‘supply’ should be made for a ‘consideration’. The only exception for this rule of construction will be cases specified in Schedule I. Absence of consideration (as defined in Section 2(31)) will take away the character of the word ‘supply’ under this clause, and accordingly, the transaction will not attract tax. It is important to note supplies listed in Schedule I would nevertheless attract the wrath of tax, even when made without consideration. One has to therefore, be very careful, while analysing the tax implications in respect of supplies listed in Schedule I.

(b) Supply should be in the course or furtherance of business: For a transaction to qualify as ‘supply’, it is essential that the same is ‘in the course’ or ‘furtherance of business’. This implies that it is only such of those supplies of goods and / or services by a business entity would be liable to tax, so long as it is ‘in the course’ or ‘furtherance of business’. Supplies that are not in the course of business or in furtherance of business will not qualify as ‘supply’ for the purpose of levy of tax, except in case of import of service for consideration, where the service is treated as a supply even if it is not made in the course or furtherance of business.

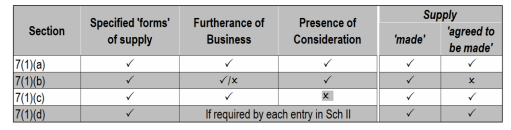

The expression ‘in the course of’ must be construed differently from ‘in the course or’. The GST Laws use the expression ‘in the course or’ and careful analysis is therefore, essential. The expression ‘in the course’ appearing in Section 7(1)(a) does not appear in Section 7(1)(b) or Section 7(1)(c) or Section 7(1)(d). However, one cannot lose sight of the fact that the expression ‘in the course’ is used selectively in respect of transactions listed in Schedule I, II or III. The import of this would mean that the meaning attributable to the expression ‘ in the course’ would apply only in respect of such of those transaction, so listed, in the relevant Schedules.

Let us now try to understand the meaning of the phrase ‘in the course’. The expression ‘in the course’ implies not only a period of time during which the movement or transaction is in progress, but postulates a connected relationship. Therefore, the class of transactions needs to be analysed and cannot be randomly applies to the provisions of Section 7 or Section 8. So construed, the word ‘or’ appearing in the phrase or expression ‘in the course or furtherance of business’ assumes importance. When read in a proper perspective, the preposition ‘or’ actually bisects the entire phrase into two limbs. Therefore, the 8 forms of supply would tantamount to transaction of supply when such supplies are in the course of business, or in the furtherance of business. Therefore, the legislature has supplied huge amount of elasticity in understanding the meaning of the term ‘supply’.

The term ‘business’ has been defined under the GST Laws to include:

(i) a wide range of activities (being “trade, commerce, manufacture, profession, vocation, adventure, wager or any similar activity”),

(ii) “whether or not it is for a pecuniary benefit”,

(iii) regardless of the “volume, frequency, continuity or regularity” of the activity.

(iv) and those “in connection with or incidental or ancillary to” such activities. A recent order of the Authority for Advance Ruling – Kerala has ruled, in a matter involving recovery of food expenses from employees for the canteen facility provided by a Company, that such recovery falls within the definition of ‘outward supply’ and are therefore taxable outward supplies under the GST law. In para 9 of the order, the AARKerala has concluded that the supply of food by the applicant (Company) to its employees would definitely come under clause (b) of Section 2(17) as a transaction incidental or ancillary to the main business and thereby the test of ‘in the course or furtherance of business’ is met by the applicant. – Order No. CT/531/18-C3 dated 26.03.2018.

Drawing similarities from the erstwhile State-level VAT laws, it follows that the said transaction should be with a commercial motive, whether or not there is a profit motive in it or its frequency / regularity. E.g.: sale of goods in an exhibition, participation in a trade fair, warranty supplies, sale of used assets / scrap sales, etc. would be activities in the course of business.

(c) Import of service will be taxable in the hands of the recipient (importer): The word ‘supply’ includes import of a service, made for a consideration (‘consideration’ as defined in Section 2(31)) and whether or not in the course or furtherance of business. This implies that import of services even for personal consumption would qualify as ‘supply’ and therefore, would be liable to tax. This would not be subject to the threshold limit for registration, as tax would be payable in case of import of services on reverse charge basis, requiring the importer of service to compulsorily obtain registration in terms of Section 24(ii) of the Act. However, the GST law has ensured that persons who are not engaged in any business activities will not be required to obtain registration and pay tax under reverse charge mechanism, and it turn, requires the supplier of services located outside India, to obtain registration for the OIDAR (online information and database access and retrieval) services only

Note: Import of services is included within the meaning of ‘supply’ under the CGST / SGST Acts. However, it would be liable to IGST since it would not be an intra-State supply. In fact, Section 2(21) of IGST Act has adopted the meaning of ‘supply’ from CGST/SGST Act.

(d) Transactions without consideration: The law lists down, exhaustively, cases where a transaction shall be treated as a ‘supply ‘even though there is no consideration. Such

transactions are listed in Schedule I. Once an activity is deemed to be a ‘supply’ under the entry listed in Schedule I, the value of taxable supply shall be determined in terms of provisions of Section 15(4) of the Act read with Chapter IV (Determination of Value of Supply) of CGST Rules, 2017.

In this regard, it may be noted that on careful consideration of the essential ingredients of a valid contract, it cannot be disputed that a contract without consideration is not a contract at all. The reference made to ‘transactions without consideration’ In Schedule I does not imply that a void contract is being made valid, by GST laws. It can be argued that transactions listed in Schedule I, are not contracts at all owing to lack of consideration in terms of the Contract Laws. Even though they are not contracts, by legal fiction, flowing from section 7(1)(c) read with Schedule I, they will be nevertheless regarded as a ‘supply’ and made taxable. As can be seen from the above, in all other clauses of section 7(1), supply exists within a valid contract, but in select circumstances supply is imputed by legal fiction in the absence of a contract. It is therefore important not to extrapolate this legal fiction beyond the specific cases to which the law imputes this fiction.

The activities specified in Schedule I are analysed in the ensuing paragraphs:

1. Permanent transfer or disposal of business assets where input tax credit has been availed on such assets.

a. Of the 8 forms of supply, the only forms that qualify as a supply, under this category are ‘transfer’ and ‘disposal’. Other 6 forms of supply listed in section 7(1)(a) would not stand categorised in this entry, given that there is (a) an element of a consideration that is intrinsic to the form, such as the case of a sale or barter or exchange, or (b) there is no business asset that is permanently transferred such as in the case of a licence or rental or lease, or any other service for that matter.

b. Ordinarily, there can be no permanent transfer in case of goods sent for job work. The aspect of sending goods on job work is not a supply, has been clarified vide Circular No.38/12/2018 dated 26.03.2018. However, where a registered person has purchased any moulds, tools, etc. and has sent the same to the job worker, there is a good chance that the goods are never returned, given that the time limits specified in Section 143 for good sent for job work does not apply to moulds, tools and other specified goods.

c. It may be noted that this entry looks to tax such of those permanent transfers or disposals where input tax credit has been availed on the business asset being transferred or disposed. For instance, where a capital asset has been procured, say, by a distillery for the purpose of manufacture of alcoholic beverages, no input tax credit would have been availed on such asset. Accordingly, there would be no output tax payable if the asset is permanently transferred to another entity (unrelated), if the transfer lacks consideration. However, if a consideration exists, there can be no escape from the levy.

d. While the word ‘transfer’ in this Entry suggests that there should be another person who would receive the business assets, there is no requirement of another person in the case of ‘disposal’. Therefore, if a business asset on which credit is claimed has been discarded, the transaction shall be regarded as a supply.

e. Business assets procured for the purpose of serving the requirements of ‘Corporate Social Responsibility’, being a statutorily imposed obligation’ may be contended to be a procurement made in the course or furtherance of business, and an attempt can be made to avail input tax credit. The issue would however remain contentious and there are no precedents. However, there would be no escape from the levy of tax on the transaction, if the asset is permanently transferred. The treatment would be no different even in the case of a donation.

2. Supply of goods or services or both between related persons or between distinct persons as specified in section 25, when made in the course or furtherance of business:

Provided that gifts not exceeding fifty thousand rupees in value in a financial year by an employer to an employee shall not be treated as supply of goods or services or both

a. The deemed supplies covered in this entry are based on a relationship between the supplier and recipient. The relationship referred are as follows:

i. Related persons: The meaning of this term is defined by way of an explanation to Section 15, and is limited to the following relationships, including legal persons:

1. Officers or directors of one another’s businesses;

2. Legally recognised partners in business;

3. Employer and employee;

4. Persons where any third person directly / indirectly owns, controls or holds 25% or more of the outstanding voting stock or shares of both of them;

5. One of them directly or indirectly controls the other;

6. Persons who are directly or indirectly controlled by a third person;

7. Persons who directly or indirectly control a third person;

8. Members of the same family; and

9. Persons who are associated in one another’s business where one is the sole agent or sole distributor or sole concessionaire.

ii. Distinct person in terms of Section 25(4) and 25(5) of the Act: The term ‘distinct person’ is used in specific cases provided under the law, and cannot by attributed to any two different persons. Distinct persons are:

1. GST registrations obtained under a single PAN (including business verticals in the same State having separate registrations);

2. Establishments under a single PAN liable to be registered separately –

say a registration obtained in one State and a branch located in another State that is required to obtain a registration, or SEZ registration and a non-SEZ place of business in the same State that is liable to obtain a registration;

3. Establishments under a single PAN, located in different States – say a registration obtained in one State and an office located in another State from where no supplies are effected (i.e., not required to obtain a registration).

b. Transactions with distinct persons are normally without consideration since they are part of the same entity located in different geographies, unless the accounting system is so sophisticated or so devised, that it treats the locations in each State as a separate / independent entity even for book-keeping purposes and effects payments in monetary terms. Let us take instances of transactions between distinct persons that are not traceable in the books of account, but requires attention from the perspective of this entry in the Schedule:

i. Stock transfers e.g., transfer of sub-assemblies, semi-finished goods or finished goods;

ii. Transfer of new or used capital goods/fixed assets – including movement of laptops when employees are transferred from one location to another;

iii. Bill-to ship-to transactions wherein the vendor issues the invoice to the corporate office and ships the goods to the branch office;

iv. Centralised management function like Board of Directors, Finance, Accounts, HR, Legal, procurement functions and other corporate functions at one location say corporate office and the entity having multiple registrations in various states results in supply of management services by the corporate office to distinct persons;

v. A transaction of sale of goods from one registration and providing after sales support or warranty services/replacement services by another registration of the same entity;

vi. Contract awarded by a customer to an entity at the corporate office from where the centralized billing to the customer is made but the execution of the contract is carried out through various registrations of the same entity located in other / multiple States.

vii. Permitting employees to make use of the office assets for personal use – say usage of motor vehicles, laptops, printers, scanners, etc.

c. It appears that this entry, has an overriding effect on the first entry of the Schedule relating to transfer or disposal. In other words, in case a business asset in respect of which ITC has not been availed is permanently transferred to a distinct person, the transaction although out of scope of entry 1, would be treated as a supply in terms of this entry, considering that this entry does not impose any such condition on the transaction. The provisions would equally apply even in the case of assets procured in the pre-GST regime.

d. The explanation appended to Section 15 of the CGST Act provides that an employer and employee will be deemed to be “related persons”. Accordingly, supplies by employer to employees would be liable to tax, if made in the course or furtherance of business, even though these supplies are made without consideration, except:

i. Gifts by an employer to an employee of value up to Rs 50,000 (to be understood as inclusive of taxes, as read with Rule 35 of the CGST Rules, 2017)in a financial year (whether this value needs to be pro-rated in the first year of implementation of GST / first year of commencement of business is a moot question; however, the presumption is that a part of the financial year would be construed as a whole year);

ii. Cash gifts of any value, given that the ‘transaction in money’ is not a subject matter of supply;

iii. Services by employee to the employer in the course of or in relation to his employment – treated as neither a supply of goods nor a supply of services.

e. The question that arises as to what constitutes a gift is discussed in the following paras.

i. Gift has not been defined in the GST laws.

ii.n common parlance, gift when made without consideration is voluntary in nature and is normally made occasionally.

iii. It cannot be demanded as a matter of right by the employee and the employee cannot move a court of law for obtaining a gift. However, if any gift, by whatever name called, is a right of the employee in terms of the employment contract / employee policy of the entity, then such gift shall be treated as emoluments arising out of the employment(including perquisites),and cannot be treated as a supply.

iv. As a corollary, one can argue that the scope and ambit of the word ‘supply’ also includes a transaction of a barter / exchange, in which case, the transaction may be regarded a taxable supply. In such a case, the question that would arise is as to whether a salary paid in non-monetary terms will attract GST?.

v. The credit restriction on membership of a club, health and fitness centre [under Section 17 (5) (b) (ii)] would not apply where the employer provides the facilities to its employees, whether or not for a consideration, given that such a supply without consideration, would also be deemed to be an outward supply under this entry of the Schedule.

vi. Where gifts are liable to tax under this Schedule, it would be fair and proper to treat such gifts as taxable outward supplies, and therefore, credit thereon may not be required to be restricted under Section 17(5)(h).

vii. It may also be noted that a gift need not always be in terms of goods. A service can also constitute a gift, such as gift vouchers for a beauty treatment.

3. Supply of goods—

(a) by a principal to his agent where the agent undertakes to supply such goods on behalf of the principal; or

(b) by an agent to his principal where the agent undertakes to receive such goods on behalf of the principal.

a. The definition of the terms ‘agent’ and ‘principal ‘have to be understood contextually and have been reproduced below:

Section 2(5) of the Act – “Agent means a person, including a factor, broker, commission agent, arhatia, del credere agent, an auctioneer or any other mercantile agent, by whatever name called, who carries on the business of supply or receipt of goods or services or both on behalf of another”.

Section 2(88) of the Act – “Principal means a person on whose behalf an agent carries on the business of supply or receipt of goods or services or both”.

b. Where an Agent receives goods directly from the Principal, or if the Principal’s vendor directly dispatches goods to the location of the agent, the Principal shall be required to treat the movement as an outward supply of goods by virtue of this clause. If understood in its proper perspective, when an agent receives goods on behalf of the Principal and thereafter issues the goods to the Principal, the transaction will be regarded as a supply by the Agent to the Principal.

c. An important question that may arise is – as to how the transaction would appear to the ultimate recipient of a supply, when effected by the Principal through the Agent, or to the supplier who effects the supply to the Principal through an Agent. An analysis of the transaction where the Principal effects a supply through an Agent is provided as follows:

i. The Principal shall recognise the transfer of goods to the Agent as a supply, at the time of such transfer.

ii. When the Agent supplies such goods to the third-party recipient, the Principal would recognise revenue as a supply (sale) in his books of account.

iii. The Agent would, however, issue the invoice to the third-party recipient in the name of the Principal, while also incorporating the Agent’s own details as the supplier, and discharge taxes on the supply.

iv. The third-party recipient would receive the credits on account of this supply from the GSTIN of the Agent and not the Principal.

v. To this extent, the Principal’s supplies in the GST returns will reflect a lower value as compared to the actual revenue against the supplies, since the value of supply to an Agent would normally, be lower than the actual sale price.

vi. The value of supplies in the GST returns of the Agent would be much higher than the actual revenues earned, which would be limited to the commission income.

vii. It is pertinent to note that the Agent shall be required to issue an invoice on the Principal for the value service provided by him to earn his commission income.

4. Import of services by a taxable person from a related person or from any of his other establishments outside India, in the course or furtherance of business.

a. The expression ‘import of service’ has been defined to bear an innate requirement of an inflow of foreign convertible currency, and therefore, excludes any form of importation of services without consideration. Therefore, this clause is inserted to encompass such of those services, that are received from related persons / their establishments outside India. It is important for one to refer to Explanation 1 to Section 8 of the IGST Act, 2017 which deems any establishment outside India as an establishment of a distinct person. By virtue of this treatment, all services received by a taxable person in India from its branches / establishments located outside India would be considered to be a supply, even when made without consideration.

b. For instance, say A Ltd is a holding company in USA and B Ltd a subsidiary in India. Many business operations are centralized in the USAsuch as accounting, ERP and other software, servers for the backup, legal function, etc. For the purpose of this clause, the back-end support provided by the holding company to the subsidiary company in India shall be regarded as a supply, whether or not there is a cross charge, even if the same is not recognised in the books, or any contracts, since it is categorized as an import of service by a taxable person from a related person without consideration, in the course of business.

(e) Activities to be treated as supply of goods or supply of services:

It is important to understand as to what constitutes a transaction of supply of goods or a transaction of supply of service. Section 7(1)(d) creates a deeming fiction under the statute and specifies ‘what is’ and ‘what is not’ either a transaction of supply of goods or a transaction of supply of service. So understood, one can list out 18 classes of transactions enlisted Schedule II of which 5 classes of transactions are listed out as supply of goods while 13 others would tantamount to supply of services. On a careful consideration of the relevant clauses, it can be noticed that all the 6 classes of transactions listed out in Article 366(29A) of the Constitution of India are covered within the scope and ambit of Schedule II. While 2 transactions, out of the 6, are treated as supply of goods, the other 4 are deemed to be supply of services.

Importantly, para 6 (a) relating to works contracts (as defined in Section 2(119)) is treated as a composite supply, of services. However, Section 2(119) has 14 distinct words, all of which are required to be read in conjunction with the words “immovable property”. Contracts relating to construction of immovable property are specifically covered in Para 5(b) of Schedule II. Therefore, all works contracts other than those relating to immovable property would amount to composite supply in terms of Section 2(30) read with Section 8.

It is important for one to understand that what is specified/listed in Schedule II not only provides clarity but also what has to be treated as supply of goods or supply of services. Transactions listed out in schedule II enlarges the scope of supply as defined under Section 7(1) of the Act. Clause (d) of sub section (1) to Section 7 is part and parcel of definition of ‘supply’, thereby bringing within its scope and ambit, such of those activities that are not covered under the other clauses of sub section (1) to section 7.

It would be interesting to note that certain paragraphs in Schedule II specifies the requirement of “consideration” whereas several others do not. In such a situation, it is important to understand the intent of the legislature. For example, Para 5(a) of Schedule II reads “renting of immovable property”. In this situation, how does one understand the taxability of the transaction where consideration is not involved? The only way to understand this lacuna is that such transactions that lack consideration would be relegated to valuation principles, but, importantly, the transaction would be

treated as a supply.

The activities pertaining to this clause are listed in Schedule II to the Act, and discussed in the following paragraphs.

| Entry in Schedule II | Analysis |

| a. Any transfer of the title in goods is a supply of goods; | This would be a clear case of a transfer of goods. It may be noted that this entry covers even a plain vanilla transfer of title in goods, either by way of sale or otherwise. Accordingly, where any goods are gifted to any person, say a motor car gifted by a businessman to his successor would be a supply of goods, provided there is a transfer of “title in” such goods. In legal parlance the phrase “title in” and “title to” have different connotations. |

| b. Any transfer of right in goods or of undivided share in goods without the transfer of title thereof, is a supply of services; | This entry can be construed to be a case of a temporary transfer whereas a transfer of title in goods would be a sale simpliciter. One must pay attention to the language employed in this entry which speaks of transfer of right and not transfer of title. Even though the activity is categorized as a supply of service, the rate of tax applicable on the supply has been linked to the rate of tax as applicable to the supply of same goods involving transfer of title in goods. Hence, for all practical purposes to determine the rate of tax on such services, all notifications in respect of that particular goods would merit equal consideration to determine the rate of tax for the service.

Refer the entries for Heading 9971 and 9973 to the Notification 11/2017 dt. 28.06.2017 prescribing the rate of tax on services, as amended from time to time. Illustration: Notification 37/2017 Central Tax (Rate) dated 13.10.2017 was issued to reduce the rate of tax on motor vehicle to 65% of the tax rate as applicable with certain conditions. Considering the rate of tax for leasing of such motor vehicle to be same as that of the rate of tax as applicable on the motor vehicle, even the rate of tax on leasing services stands reduced if the conditions specified in the notification are met. |

| c. Any transfer of title in goods under an agreement which stipulates that property in goods shall pass at a future date upon payment of full consideration as agreed, is a supply of goods | Any instalment sale or hire purchase transaction with a precondition that the possession is transferred on day one but the ownership is subject to payment of full consideration/ all instalments, would get categorized as a supply of goods at the time of transfer of possession. However, where the transaction is to be valued at the open market value, due care needs to be exercised so as to determine the value of instalments as against the value of the goods being transferred. One may also note that transactions of movables that could get covered under BOOT, BOLT, BOT etc., may also get covered under this entry. |

| 2. Land and Building | |

| a. Any lease, tenancy, easement, licence to occupy land is a supply of services; | While a transfer (sale) of land is outside the scope of GST laws, the law seeks to tax certain other transfers pertaining to land, by way of this entry.

Notification No. 4/2018 Central Tax (Rate) dated 25.01.2018 warrants attention in this regard. One issue which clearly emerges from the notification is that in case of a joint development agreement (JDA), the activity of providing the right to construct on a land belonging to the owner, is an independent supply in the hands of the owner and that supply, is treated as a supply of service in terms of this clause. It is inferred that such a service is independent of the construction service which the developer provides to the land owner. The challenge that arises would relate to the valuation for both these supplies. It is important to note that such transactions are vivi-sected for the purposes of levy of tax and have not been construed as a single demise. |

| b. Any lease or letting out of the building including a commercial, industrial or residential complex for business or commerce, either wholly or partly, is a supply of services. | The activity of leasing or letting out of complexes for the purpose of business or commerce is covered under this clause, and not those used for the purpose of residence. It may be noted that the services by way of renting of residential dwelling for use as residence is exempt vide Notification No.12/2017 – Central tax (Rate) dated 28.06.2017. While on the subject, it is pertinent to note the distinction between a transaction of rent, lease and a transaction of “letting out”. A transaction of rent is what is lawfully payable by a tenant, a transaction of lease is an alienation or conveyance for the purpose of enjoyment whether or not for a specified period. The word ‘Let’ is to be understood as a verb meaning allow, permit, grant or hire. |

| 3. Treatment or process | |

| Any treatment or process which is applied to another person’s goods is a supply of services. | While this transactions may not be pari-materia with a works contract the activity which could get categorized under this clause it appears would be “job work” as defined under Section 2(68) of the Act.

The only difference between the definition clause in terms of section 2(68) and this entry – is that the activity would be regarded as a job work only if carried out for a registered principal. However, regardless of the registration of the principal, the activity would be categorized as service under this clause. Certain clarifications have been provided vide Circular No.38/12/2018 dated 26.03.2018 on job work which would be relevant and can make a useful read. |

| 4. Transfer of business assets | |

| a. Where goods forming part of the assets of a business are transferred or disposed of by or under the directions of the person carrying on the business so as no longer to form part of those assets, whether or not for a consideration, such transfer or disposal is a supply of goods by the person; | This clause provides for taxability of such of those transactions where business assets stand transferred. Typically, assets donated could be an example of such a transaction. One must pay attention to the fact that this clause abstains from the usage of the expression “in the course or furtherance of business” or “consideration”. Thus, it is possible to infer that all such transactions which escape the attention of Section 7(1)(a) or 7(1)(c), are covered under this clause, so as to be treated as supply of goods. Random thought: A permanent transfer of business asset on which no ITC had been availed may be regarded as a supply of goods under this clause. However, since there exists a competing entry 1 of schedule 1,being the entry more specific would stand attracted. Courts alone can settle this understanding |

| b. Where, by or under the direction of a person carrying on a business, goods held or used for the purposes of the business are put to any private use or are used, or made available to any person for use, for any purpose other than a purpose of the business, whether or not for a consideration, the usage or making available of such goods is a supply of services; | Any part of the business assets if put to use for private purpose of any purpose other than for business, then such usage is termed as supply of services under this clause. Therefore, where the law deems this activity as a supply and subjects the same to tax, it can be contended that there would be no requirement to reverse the input tax credit availed on the goods although the same is put to non-business use, on the premise that the activity is considered to be a taxable outward supply and subjected to tax. Normally, the words “private” and “personal” are used inter-changeably. But the legal connation is that private is “non official concerning one or more individuals” while ‘personal’ does not relate to a business scenario. For example: Audio-visual equipment owned by a business can be put to private use by a group of individuals or by an individual for his or her use. One must exercise caution while determining what amounts to private use / non-business use, since this will have a direct bearing on the deductions claimed under the Income tax law. In this regard, it may be noted that a service by way of transfer of a going concern, as a whole or an independent part thereof, is an exempted service in terms of Notification 12/2017-Central Tax (Rate) dated 28.06.2017 as amended from time to time. |

| This would be a clear case of a transfer of goods. It may be noted that this entry covers even a plain vanilla transfer of title in goods, either by way of sale or otherwise. Accordingly, where any goods are gifted to any person, say a motor car gifted by a businessman to his successor would be a supply of goods, provided there is a transfer of “title in” such goods. In legal parlance the phrase “title in” and “title to” have different connotations. |

| c. where any person ceases to be a taxable person, any goods forming part of the assets of any business carried on by him shall be deemed to be supplied by him in the course or furtherance of his business immediately before he ceases to be a taxable person, unless— i. the business is transferred as a going concern to another person; or

ii. the business is carried on by a personal representative who is deemed to be a taxable person. |

The supply under this clause can be understood to be a supply of goods, although the entry does not explicitly specify so.

Attention is drawn to Section 29(5) of the Act dealing with “Cancellation of Registration”, wherein the law provides that the person applying for cancellation of registration is required to pay an amount equivalent to the credit of input tax or the output tax payable thereon, in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock or capital goods or plant and machinery on the day immediately preceding the date of such cancellation, whichever is higher.

It is important to understand the subtle usage of the expression “ceases to be a taxable person”. Cessation of being a taxable person could result from either closure of business, voluntarily or otherwise, while the clause also speaks of transfer of business in the latter part. One can reasonably infer that in terms of this clause if a business is transferred on a lock, stock and barrel basis as a going concern then such transactions cannot be subjected to tax; even in situations where the transfer of business takes place and a representative (acting as a taxable person) carries on such business, the question of subjecting such a transaction to tax, as a cessation of business does not arise.

|

| 5. Supply of services: The following shall be treated as supply of service, namely: — | |

| a. renting of immovable property; | Renting wholly or partly of any immovable property is treated as a service. Therefore, unless the supply is otherwise exempted (such as renting of residential dwelling for the purpose of residence), the activity shall be regarded as a supply |

| b. Construction of a complex, building, civil structure or a part thereof, including a complex or building intended for sale to a buyer, wholly or partly, except where the entire consideration has been received after issuance of completion certificate, where required, by the competent authority or after its first occupation, whichever is earlier. | Schedule III of the Act at SI No.5 reads “sale of land and, subject to clause b of paragraph 5 of schedule II, sale of building. We need to pay attention as to how this clause is to be read and understood. Let us now read the clause as follows:

Sale of land; Sale of building; Sale of land and sale of building; Sale of land and building in which an undivided share in land stands transferred. It must be noted with caution, that entry 5 of schedule III is ‘subject to clause b of para 5 of schedule II’. It means that, clause b of para 5 of schedule II overrides the entry 5 to schedule III. It is for this reason that development contracts in the real estate sector have been a subject matter of tax in terms of entry 5(b) ofthe second schedule. Any agreement for sale of an immovable property (being in the nature of transfer if UDI in land plus building or in case of revenue share agreements which equally stipulates transfer of UDI in land plus constructed port) would be subject to tax as a service. In this backdrop, it is important to note that some experts are of the view, that the legislature intends to overcome the constitutional bench decision of the Supreme Court in the Larsen & Toubro’s case (65 VST 1). So understood, any part of the consideration if received, prior to obtaining completion certificate or first occupation in a building would stand to be taxed while all transactions entered into thereafter, would be construed asa sale of immovable property. |

| c. Temporary transfer or permitting the use or enjoyment of any intellectual property right; | The words ‘or’ in this clause is to be understood as a disjunctive particle that carves out alternatives. So understood, this clause envisages three separate classes of transactions which could be read as follows:

Temporary transfer of any IPR; Permitting the use of any IPR; Permitting the use or enjoyment of any IPR. In respect of temporary transfer or usage of IPRs one needs to travel to the relevant notification to understand their import. The scheme of classification of services for the heading 9973 provides for temporary as well as permanent transfer of IPR in respect of goods.

|

| d. Development, design, programming, customisation, adaptation, upgradation, enhancement, implementation of information technology software; | The dichotomy which prevailed in the erstwhile service tax and VAT regime (i.e., the question of whether software should suffer service tax or VAT or both) has been put to rest under GST.

While this entry takes care of certain activities in respect of IT software, it must be noted that the supply of pre-developed or pre-designed software in any medium/storage (commonly bought off-the-shelf), or making available of software through the use of encryption keys, is treated as a supply of goods, classifiable under heading 8523. |

| e. Agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act; | Some examples that may get covered under this clause are as under:

Non-compete agreement for a fee; Notice period recovery; Additional amount agreed upon for settlement of any dispute/matter etc. Look at a situation where a supplier would supply product ‘A’ only if the recipient agrees to buy product ‘B’- readers can think as to whether such transactions would amount to supply of goods or supply of services?; |

| f. Transfer of the right to use any goods for any purpose (whether or not for a specified period) for cash, deferred payment or other valuable consideration. | Transfer of ‘right to use goods’ is treated as a supply of service and taxed at par, with the rate of tax as applicable to the goods involved in the transaction. (Refer discussion under clause 1(a) of Schedule II). |

| 6. Composite supply: The following composite supplies shall be treated as a supply of services, namely: — | |

| a. Works contract as defined in clause (119) of section 2; | Our understanding of works contract under the erstwhile VAT / sales tax / service tax laws has no relevance in the GST regime. In the GST regime, only such of those contract that results in an immovable property is a ‘works contract’. Every other contract which was understood to be a ‘works contract ‘under the erstwhile laws will be treated as a composite / mixed supply under the Act. In such cases, the transaction may be treated as goods or services, based on the principles laid down in Section 8 (discussed separately in this Chapter). |

| b. Supply, by way of or as part of any service or in any other manner whatsoever, of goods, being food or any other article for human consumption or any drink (other than alcoholic liquor for human consumption), where such supply or service is for cash, deferred payment or other valuable consideration. | The Law categorises the supplies referred to in this clause as a composite supply, given that there are multiple goods and/or services which are essentially involved in such a transaction culminating into a composite supply of service.

Under this clause both restaurant and outdoor catering services get covered. It may also be contended that the clause also covers other forms such as parcels, take-away, home-delivery, etc. Irrespective of the rate of tax as applicable on independent goods or services that are being supplied, the rate of tax as applicable to a restaurant service or outdoor catering service would be applicable to the goods being supplied. E.g.: Aerated drink which is served in a restaurant would be subject to tax at the rate applicable to the entire supply (restaurant service) regardless of the fact that aerated drinks are otherwise subjected to a higher rate of tax as well as cess. By this logic, some experts argue that tobacco products which are sold in a restaurant and billed along with the supply of food/beverage must also be taxed at the rate as applicable to restaurant services – as a composite supply. The test that one needs to apply in the given situation is find out as to whether tobacco products are “food” or “an article for human consumption”. A plain reading would imply that tobacco products are certainly not “food”. However, the phrase “any other article for human consumption” must be construed in a sense as to how a common man would understand. Meaning, the test of common parlance must be applied. So understood, in plain and simple terms tobacco products cannot get classified under this clause. This entry is not purely for restaurants / outdoor caterers, and is applicable to any person who is engaged in the supply of food / beverages. It may be noted that there is no requirement that such a supply is in the course or furtherance of business. It would be sufficient if the supply is for a consideration. Circular No.28/02/2018 dated 08.01.2018 has provided clarifications regarding GST on college hostel / mess which reads: “It is immaterial whether the service is provided by the educational institution itself or the institution outsources the activity to an outside contractor” |

| 7. Supply of Goods: The following shall be treated as supply of goods, namely: — | |

| Supply of goods by any unincorporated association or body of persons to a member thereof for cash, deferred payment or other valuable consideration | The definition of the term ‘business’ under Section 2(17) includes “provision by a club, association, society, or any such body (for a subscription or any other consideration) of the facilities or benefits to its members;” In order to clarify that the supply of goods by such association etc., to its members is to be treated as a supply of goods and not as a service of providing facilities, this clause has been included. |

(f) Certain supplies will be neither a supply of goods, nor a supply of services: The law lists down matters which shall not be considered as ‘supply’ for GST by way of Schedule III. Since these are transactions that are not regarded as ‘supply’ under the GST Laws, there is no requirement to report the inward / outward supply of such activities in the returns.

| Activities listed in Schedule III | Analysis |

| Services by an employee to the employer in the course of or in relation to his employment. | The entry includes only services and not goods. Further, the entry only covers those services provided by an employee to the employer and not vice versa. Therefore, services such as serving of beverages in the office may possibly be regarded as a supply of service under Entry 2 of Schedule I. |

| Services by any Court or Tribunal established under any law for the time being in force; The term “court” includes District Court, High Court and Supreme Court. | |

| Functions performed by MPs, MLAs, etc.; the duties performed by a person who holds any post in pursuance of the provisions of the Constitution in that capacity; the duties performed by specified persons in a body established by the Central State Government or local authority, not deemed as an employee; | |

| Services of funeral, burial, crematorium or mortuary including transportation of the deceased | |

| Sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building (i.e., excluding sale of under-construction premises where the part or full consideration is received before issuance of completion certificate or before its first occupation, whichever is earlier); | It is intriguing as to why two activities being (i) sale of land and (ii) sale of building, have been clubbed into a single entry. However, one may expand the entry to read the two activities as distinct activities, so as to treat a sale of land without the sale of building, also to be outside the purview of GST. Refer to discussions schedule II para 5(b) supra. |

| Actionable claims, other than lottery, betting and gambling | A plain reading of this entry would mean that actionable claims are neither a supply of goods nor a supply of services. However, the three classes of actionable claims listed in this entry warrant attention.

The definition of the word ‘goods’ includes the words ‘actionable claims’. It has to therefore, be necessarily understood that the three classes of actionable claims viz. lottery, betting and gambling, if and when subjected to tax, must be taxed as goods. The irony is, while lottery is subject to tax as goods, betting and gambling have been subjected to tax as services under the heading 9996. It appears that this faux pas can be setright only through a legislative amendment. |

(g) To be notified: The Government has vested in itself the powers to notify ‘activities or other transactions’ which shall neither be treated as supply of goods nor a supply of services in terms of section 7(2). Such notification would be issued from time to time based on the recommendations of the GST Council.

The Government has notified the following supplies in this regard: Services by way of any activity in relation to a function entrusted to Panchayat under Article 243G of the Constitution (Inserted vide Notification No. 14/2017- Central Tax (Rate) dated 28.06.2017)

The inter-State movement of goods like movement of various modes of conveyance, between ‘distinct persons’ as explained in this Chapter, including trains, buses, trucks, tankers, trailers, vessels, containers & aircrafts, carrying goods or passengers or both, or for repairs and maintenance, would also not be regarded as supplies except in cases where such movement is for further supply of the same conveyance.(Clarified vide Circular No. 1/1/2017-IGST dated 07.07.2017).

The above logic would apply to the issue pertaining to inter-State movement of jigs, tools and spares, and all goods on wheels like cranes, except in cases where movement of such goods is for further supply of the same goods, and consequently no IGST would be applicable on such movements.(Clarified vide Circular No. 21/21/2017-GST dated 22.11.2017).

(h) The Government is also empowered to specify what shall be treated as a supply of goods / services, as is the function of Schedule II, based on the recommendation of the GST Council, by specifying that a supply is to be treated as:

i) A supply of goods and not a supply of service;

ii) A supply of service and not a supply of goods.

(i) In summary, supply can be understood as follows:

(j) The GST Law also treats certain transactions to be supplies by way of a deeming fiction imposed in the statute.

(a) The law expressly uses the phrase ‘deemed supply’ in Section 19(3) and 19(6) in respect of inputs/capital goods sent to a job worker but are not returned within the time period of 1 year/ 3 years permitted for their return.

(b) The bill-to-ship-to transactions wherein the supply is deemed to have been made to the person to whom the invoice is issued, imposes an intrinsic condition that such person who receives the invoice should in turn issue an invoice to the recipient unless the transaction demands a treatment otherwise. For instance, where an order is placed on a vendor based on an order received from a customer, the registered person any request the vendor to directly ship the goods to the customer. In this case, although there is a single movement of goods, there is a dual change of title to goods, and therefore, there would be 2 supplies.