Activity Ratios :

Activity ratios indicate the performance of the business. The performance of a business is judged with its sales (turnover) or cost of goods sold. These ratios are thus referred to as turnover ratios. A few important activity ratios are discussed below:

1. Capital turnover ratio

2. Fixed assets turnover ratio

3. Stock turnover ratio

4. Debtors turnover ratio

5. Creditors turnover ratio

1. Capital Turnover Ratio

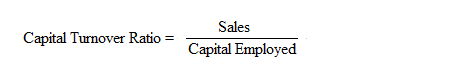

This shows the number of times the capital has been rotated in the process of carrying on business. Efficient utilisation of capital would lead to higher profitability. The relationship between Sales and Capital employed is known as Capital Turnover Ratio. The ratio is calculated as:

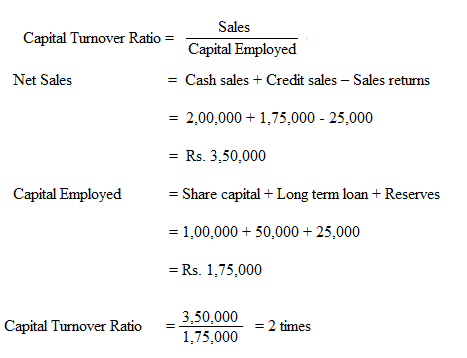

Where Sales means Sales less sales returns and Capital employed refers to total long term funds of the business concern i.e., Equity share capital, Preference share capital, Reserves and surplus and Long term borrowed funds.

Illustration :

Calculate capital turnover ratio from the following information

Rs.

Cash sales 2,00,000

Credit sales 1,75,000

Sales return 25,000

Equity Share Capital 1,00,000

Long term loan 50,000

Reserves 25,000

Solution:

2. Fixed Assets Turnover Ratio:

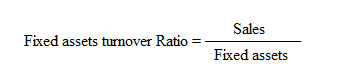

This shows how best the fixed assets are being utilised in the business concern. The relationship between Sales and Fixed assets is known as Fixed assets turnover ratio. The ratio is calculated as:

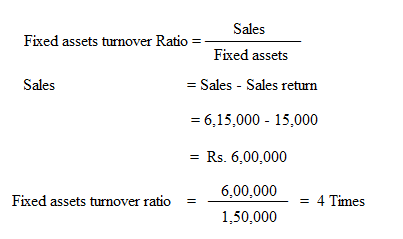

Fixed assets means Fixed assets less depreciation.

Illustration :

Calculate the fixed asset turnover ratio from the following figures.

Rs.

Sales 6,15,000

Sales Return 15,000

Fixed assets 1,50,000

3. Stock Turnover Ratio

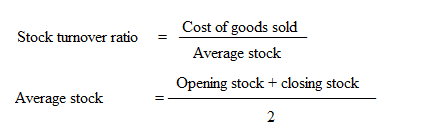

This ratio is otherwise called as inventory turnover ratio. It indicates whether stock has been efficiently used or not. It establishes a relationship between the cost of goods sold during a particular period and the average amount of stock in the concern. The ratio is calculated as:

If information to calculate average stock is not given then closing stock may be taken as average stock.

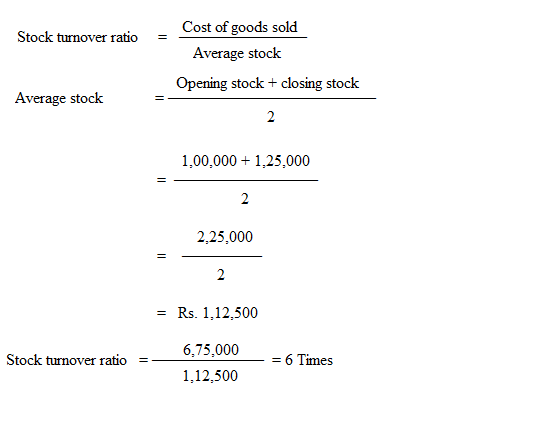

Illustration :

Calculate stock turnover ratio from the following:

Rs.

Cost of goods sold 6,75,000

Stock at the beginning of the year 1,00,000

Stock at the end of the year 1,25,000

Solution:

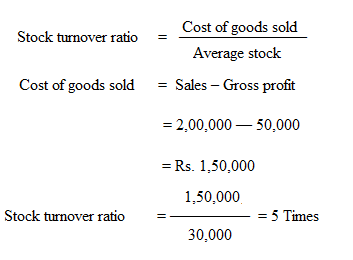

Illustration :

Calculate stock turnover ratio from the following information.

Rs.

Sales 2,00,000

Gross profit 50,000

Stock 30,000

Solution:

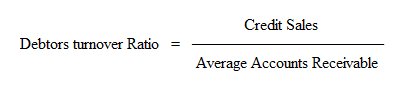

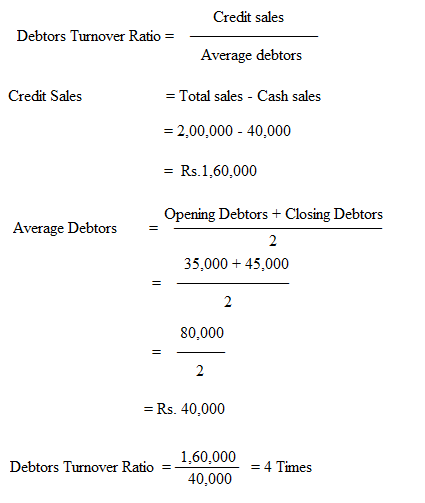

4. Debtors Turnover Ratio

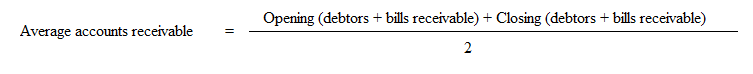

This establishes the relationship between credit sales and average accounts receivable. Debtors turnover ratio indicates the efficiency of the business concern towards the collection of amount due from debtors. The ratio is calculated as:

Accounts receivable includes sundry debtors and bills receivable.

In case credit sales is not given, total sales can be taken as credit sales.

In case credit sales is not given, total sales can be taken as credit sales.

Illustration :

Calculate Debtors turnover ratio from the following:

Rs.

Total sales 2,00,000

Cash sales 40,000

Opening debtors 35,000

Closing debtors 45,000

Solution:

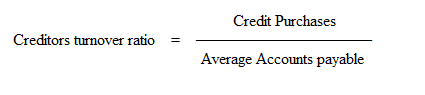

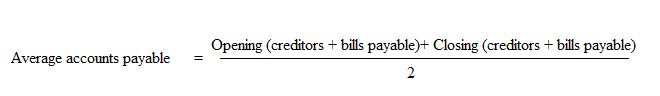

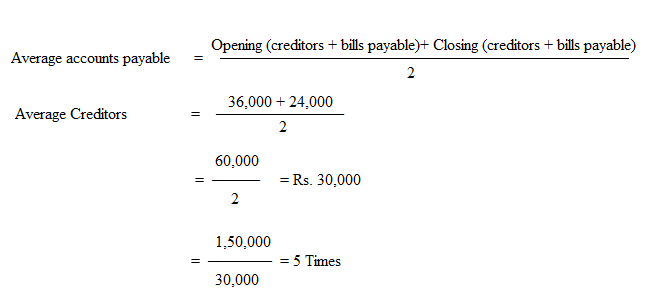

5. Creditors Turnover Ratio:

This establishes the relationship between credit purchases and average accounts payable. Creditors turnover ratio indicates the period in which the payments are made to creditors. The ratio is calculated as:

Accounts payable include sundry creditors and bills payable.

In case credit purchases is not given total purchases can be taken as credit purchases.

Illustration :

Calculate creditors turnover ratio from the following:

Rs.

Credit purchases 1,50,000

Opening creditors 36,000

Closing creditors 24,000

Solution:

(Note: All turnover ratios will be expressed in terms of times.)