Additional deduction for interest on loan borrowed for acquisition of self-occupied house property by an individual [Section 80EE]

Effective from: A.Y.2017-18

(i) Under section 80EE, a deduction of upto ` 1 lakh in respect of interest paid on loan by an individual for acquisition of a residential house property was allowed for A.Y.2014-15 and A.Y.2015-16.

(ii) As a step towards achieving the Government’s aim of providing ‘housing for all’, first-home buyers availing home loans are encouraged, by providing additional deduction under section 80EE from A.Y.2017-18 in respect of interest on loan taken by an individual for acquisition of residential house property from any financial institution. The maximum deduction allowable is ` 50,000.

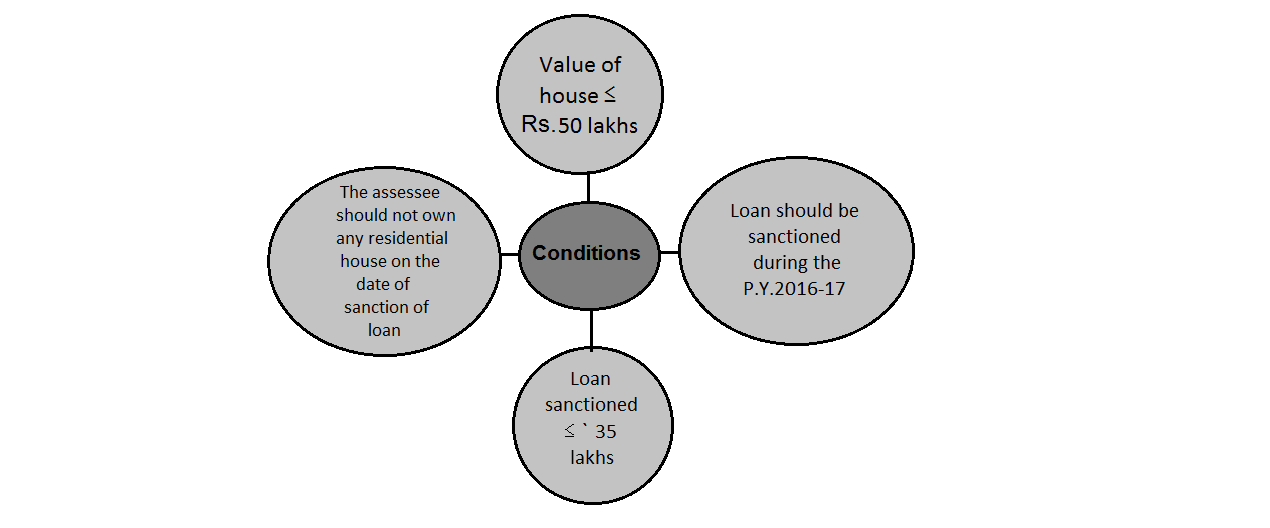

(iii) The conditions to be satisfied for availing this deduction are as follows –

(iv) The benefit of deduction under this section would be available till the repayment of loan continues.

(v) The deduction of upto ` 50,000 under section 80EE is over and above the deduction of upto ` 2,00,000 available under section 24 for interest paid in respect of loan borrowed for acquisition of a self-occupied property.

(vi) Meaning of certain terms:

|

Term |

Meaning |

|

| (a) | Financial institution | A banking company to which the Banking Regulation Act, 1949 applies ; or

Any bank or banking institution referred to in section 51 of the Banking Regulation Act, 1949; or

A housing finance company. |

| (b) | Housing finance company | A public company formed or registered in India with the main object of carrying on the business of providing long-term finance for construction or purchase of houses in India for residential purposes. |

Example

Mr. A purchased a residential house property for self-occupation at a cost of ` 45 lakh on 1.6.2016, in respect of which he took a housing loan of ` 35 lakh from Bank of India@11% p.a. on the same date. Compute the eligible deduction in respect of interest

on housing loan for A.Y.2017-18 under the provisions of the Income-tax Act, 1961, assuming that the entire loan was outstanding as on 31.3.2017 and he does not own any other house property.

| Particulars | Rs. |

| Interest deduction for A.Y.2017-18 | |

| (i) Deduction allowable while computing income under the head “Income from house property”

Deduction under section 24(b) ` 3,20,833 [` 35,00,000 × 11% × 10/12] Restricted to

(ii) Deduction under Chapter VIA from Gross Total Income Deduction under section 80EE ` 1,20,833 (` 3,20,833 – ` 2,00,000) Restricted to

|

2,00,000

50,000 |