Analysis :

A. Tax invoice on supply of goods or services: Every registered person is required to issue a tax invoice on effecting a taxable outward supply of goods or services.

a. In order to determine when the tax invoice is to be issued, the supply must be classified into one of these two cases, that is, whether it is case of supply that involves movement or one that does not involve movement of the goods. Timelines for issuance of a tax invoice on the supply of taxable goods:

i. Where the supply involves movement of goods: Before or at the time of removal of goods;

ii. Where the supply does not involve movement of goods: Before or at the time of delivery of the goods / making them available to the recipient.

Please refer to chapter regarding time of supply for a detailed discussion about removal and movement of goods, mode and time of delivery of goods and the role of supplier or recipient in determining the answers to these questions.

b. It is crucial for the supplier to determine the point of time at which the service is provided. Service being intangible in nature, would throw several challenges in identifying the point of time at which it can be said to be provided / completed.

Timelines for issuance of tax invoice on the supply of taxable services:

i. Before the provision of the services; or

ii. After the provision of the services but within 30 days (or 45 days in case of suppliers of services being an insurer / banking company / financial institution, including a NBFC) from the date of supply of the service.

c. In terms of Rule 46 of CGST Rules, 2017, a tax invoice referred to in this section shall be issued by the registered person containing all the particulars specified in the said Rule, as applicable to the transaction.

Notes:

Where the registered person is engaged in effecting both taxable and exempt supplies, he may title the document ‘Tax invoice cum bill of supply’ instead of ‘tax invoice’, ONLY in respect of supplies effected to an unregistered person.

A registered person can issue multiple series of invoices. No application is required to be filed with the Tax office in this regard. However, the suppliers would be required to report the serial numbers (from & to, along with the number of cancellations during the tax period) of all the series of tax invoices (and other documents covered under this Chapter).

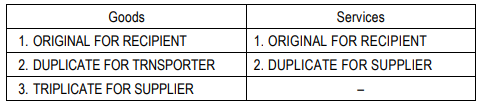

d. The tax invoice must be prepared in triplicate for goods, and in duplicate for services. Each copy of the tax invoice is required to be marked as follows:

e. As regards the requirement to quote the HSN of the supplies, the requirement is has been provided on the basis of the annual turnover of the registered person in the previous year: In case of suppliers having annual turnover in the previous year:–

(i) Upto Rs. 1.5 Crore – No HSN required;

(ii) Exceeding 1.5 Crore upto Rs. 5 Crore – HSN upto 2 digits required;

(iii) Exceeding Rs.5 Crore – HSN upto 4 digits required.

Please note that the term ‘annual turnover’ has not been defined. Therefore, it may be understood, to be the Turnover in the State as defined in Section 2(112) of the Act, computed for the preceding financial year.

It is also relevant to note that there has been no notification issued in respect of services, separately. However, considering that the term ‘HSN’ has been used commonly in respect of both goods and services, the aforesaid order can be applied even in respect of services, while quoting the code from the scheme of Classification of Services, as provided in the Annexure to Notification No. 11/2017- Central Tax (Rate) dt.28.06.2017.

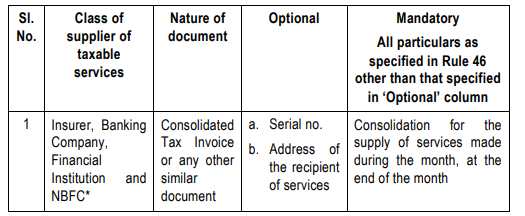

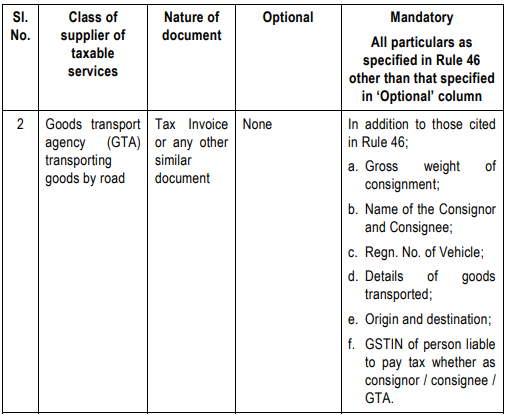

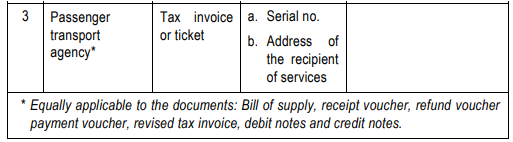

f. Tax Invoices in cases of outward supply of special services

g. Specifically in case of export of goods or services, the following may be noted:

(i) The invoice shall carry an endorsement as follows:

1. Where the supply is effected on payment of IGST: “Supply meant for export/supply to SEZ unit or SEZ developer for authorised operations on payment of integrated tax” or

2. Where the supply is effected without payment of IGST: “Supply meant for export/supply to SEZ unit or SEZ developer for authorised operations under bond or letter of undertaking without payment of integrated tax”.

(ii) In lieu of the State name & State code, the details of the country of destination would have to be provided.

h. Special declaration would have to be made on a tax invoice prominently, containing the words “INPUT TAX CREDIT NOT ADMISSIBLE”, where any invoice has been issued when tax has been found to be payable in accordance with the provisions of section 74 or section 129 or section 130.

i. Discount provided before or at the time of supply must be reflected on the face of the tax invoice in order to avail a reduction from the taxable value. Trade discounts not reflected on the face of the invoice would not qualify for such benefit, and therefore, tax on that value would also be payable.

j. Where an invoice contains multiple goods and / or services, please note that the details would be required to be provided in respect of every line item of the invoice (such as Description, HSN, quantity, unit of measurement, value, discount, increase in value on account of inclusions specified in Section 15(2), taxable value as agreed or as determined in terms of the valuation rules, etc.).

k. Exception to the rule that every supply must be supported by a tax invoice: A registered person is not required to issue a separate tax invoice in respect of supply of goods and / or services where the value of supply is lower than Rs200/-, subject to the following conditions:

(i) the recipient is not a registered person; and

(ii) the recipient does not require such invoice; and

(iii) the supplier issues a consolidated tax invoice for such supplies at the close of each day in respect of all such supplies.