Analysis

(a) In respect of the return for outward supplies filed by the supplier of goods / services (under section 37 of CGST / SGST Act, 2017), recipient of supply is required to match his inward supply details with that of the details uploaded by the supplier by way of furnishing Form GSTR 1.

(b) The details uploaded by the supplier will be made available to the recipient in Part ‘A’ of Form GSTR 2A (the details of input tax credit distributed by input service distributor will be made available in Part ‘B’ of said Form i.e., Form GSTR 2A). The details will be available for verification as and when the supplier has furnished Form GSTR 1.

However, a recipient using the said details can accept, reject, modify, add or mark it pending (in cases where the goods or services or both are not yet received). Such corrections can be effected on or after 11th day of succeeding month to which such input tax credit relates to, the said activities can be done any time before 15th day of the said month and Form GSTR 2 is to be submitted.

(c) The details of tax deducted at source and tax collected at source will be made available in Part ‘B’ of Form GSTR 2A and the activities as specified supra for Part ‘A’ can be done i.e., accept / modify / reject / add, for values made available to the recipient of supply in Part ‘B’ of the said form.

(d) Any modification, deletion to details made available to recipient in Form GSTR 2A or any addition made by him to Form GSTR 2, will be made available to every such supplier in Form GSTR 1A, which the supplier needs to either accept or reject, such modification or deletion or addition as the case may be. On either acceptance or rejection of details made available in Form GSTR 1A the supplier will amend form GSTR 1 to that effect automatically and will either increase / decrease supplier’s output tax liability.

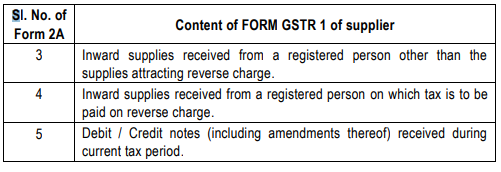

Part A of FORM GTSR 2A will contain the following details (auto-populated on basis of Form GSTR 1 submitted by supplier).

Note: The filing of Form GSTR-2 has been suspended for the time being and same will be notified by way of notification.

(e) In case, any error or omission is discovered in the course of matching as specified inthe Act and discussed under Section 42 and 43, rectifications of the same shall be effected and tax and interest, if any as applicable shall be paid on such corrections by the person responsible for filing the return of inward supplies.

(f) Such rectification of error or omission, however, is not permitted after filing of annual return or before the due date for filing the return for the month of September of the following financial year to which the details pertain, whichever is earlier.