Analysis

Where a supply involves multiple (more than one) goods or services, or a combination of goods and services, the treatment of such supplies would be as follows:

(a) If it involves more than one goods and / or services which are naturally bundled together and supplied in conjunction with each other in the ordinary course of business and one such supply would be a principal supply:

(i) These are referred to as composite supply of goods and / or services. It shall be deemed to be a supply of those goods or services, which constitutes the principal supply therein. Only where all of the conditions specified for a supply of a combination of goods and/or services to be treated as a composite supply are satisfied, the supply can be regarded as a composite supply. The conditions are as follows:

1. The supply must be made by a taxable person: This condition presumes that composite supplies can only be effected by a taxable person.

2. The supply must comprise2 / more taxable supplies: The law merely specifies that the supplies included within a composite supply must contain 2 or more taxable supplies. A question may then arise as to what would be the treatment in case of a supply that fulfils all the conditions, but involves an exempt supply – say, purchase of fresh vegetables from a store which offers home delivery for an added charge. Fresh vegetables are exempt from tax, whereas the service of home delivery would attract tax. No clarification has been issued in this regard. However, on a plain reading of the provision, it appears that this condition would not be satisfied where the composite supply involves an exempt supply.

3. The goods and / or services involved in the supply must be naturally bundled: The concept of natural bundling needs to be examined on a case to case basis. What is naturally bundled in one set-up may not be regarded as naturally bundled in another situation. For instance, stay with breakfast is naturally bundled in the hotel industry, while the supply of lunch and dinner, even if they form part of the same invoice, may not be considered as naturally bundled supplies along with room rent.

4. They must be supplied in conjunction with each other in the ordinary course of business: Where certain supplies could be naturally bundled, it is essential

that they are so supplied in the ordinary course of business of the taxable person. For instance, it is possible to consider the supply of a water purifier along with the first-time installation service as a naturally bundled supply.

However, if a supplier of water purifiers does not ordinarily provide the installation service, and arranges for a person to provide the installation service in the case of an important business customer, the supply would not satisfy the said condition.

5. Only one of the supplies involved must qualify as the principal supply: In every composite supply, there must be only one principal supply. Where a conflict between the various components of the supply, as to which of those qualify as the principal supply, cannot be resolved and results in multiple predominant supplies, the supply cannot be regarded as a composite supply.

(a) A principal supply is defined to mean the predominant element of a composite supply to which any other supply forming part of that composite supply is ancillary.

(b) Therefore, mere identification of the predominant element would not suffice, and it must be ascertained that all other supplies composed in the composite supply are ancillary to that predominant element of the supply.

(c) Consider the case of a supply of dining table with chairs. There would normally be no issue in this regard if both the components are made of the same material. However, if the dining table is made of granite, while the chairs are made of superior quality wood, there would be a conflict. Normally, the dining table would be regarded as the principal supply to which the supply of chairs is ancillary. However, in this case, it may not be possible to determine which of the two make the principal supply. Where any of the aforesaid conditions are not satisfied, the transaction cannot be treated as a composite supply.

(ii) The matters such as time of supply, invoicing, place of supply, value of supply, rate of tax applicable to the supply, etc. shall all be determined in respect of the principal supply alone, since the entire supply shall be deemed to be a supply of the principal supply alone.

(iii) Some Illustrations and cases of composite supplies have been discussed in the following paragraphs:

Illustration (provided in Section 2(27)): Where goods are packed, and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is the principal supply. This implies that the supply will be taxed wholly as supply of goods.

Para 5(3) of Circular No.32/06/2018-GST dated 12.02.2018 clarifies that “food supplied to the in-patients as advised by the doctor/nutritionists is a part of composite supply of health care and not separately taxable”. It also goes on to clarify further that supplies of food by hospital to patients (not admitted) or their attendants or visitors are taxable.

Circular No.11/11/2017-GST dated 20.10.2017 has provided clarification on treatment of printing contracts. It is clarified that:

In the case of printing of books, pamphlets, brochures, annual reports, and the like, where only content is supplied by the publisher or the person whowns the usage rights to the intangible inputs while the physical inputs including paper used for printing belong to the printer, supply of printing of the content supplied by the recipient of supply is the principal supply.

In case of supply of printed envelopes, letter cards, printed boxes, tissues, napkins, wall paper etc. falling under Chapter 48 or 49, printed with design, logo etc. supplied by the recipient of goods but made using physical inputs including paper belonging to the printer, the predominant supply is that of goods and the supply of printing of the content supplied by the recipient of supply is ancillary to the principal supply of goods and therefore such supplies would constitute supply of goods falling under respective headings of Chapter 48 or 49 of the Customs Tariff.

Circular No. 34/8/2018-GST dated 01.03.2018 provides a clarification on some matters including the following:

The activity of bus body building is a composite supply. As regards which of the components is the principal supply, the Circular directs that it be determined on the basis of facts and circumstances of each case.

Re-treading of tyres– In re-treading of tyres, which is a composite supply, the pre-dominant element is the process of re-treading which is a supply of service, and the rubber used for re-treading is an ancillary supply. The Circular also specifies that “Value may be one of the guiding factors in this determination, but not the sole factor. The primary question that should be asked is what is the essential nature of the composite supply and which element of the supply imparts that essential nature to the composite supply”.

Other examples: If a contract is entered for (i) supply of certain goods and erection and installation of the same thereto or (ii) supply of certain goods along with installation and warranty thereto, it is important to note that these are naturally bundled and therefore would qualify as ‘composite supply’. Accordingly, it would qualify as supply of the goods therein, which is essentially the principal supply in the contract. Thus, the value attributable to erection and installation or installation and warranty thereto will also be taxable as if they are supply of the goods therein.

(b) If it involves supply of more than one goods and / or services which are not naturally bundled together but sold for a single price:

(i) These are referred to as mixed supply of goods and / or services. It shall be deemed to be a supply of that goods or services therein, which are liable to tax at the highest rate of GST. The characteristics of a mixed supply is as follows: 1. It involves 2 / more individual supplies: It may be noted that the term used in the case of mixed supply is “individual supplies” as against “taxable supplies”. Therefore, a mixed supply can include both taxable and non-taxable supplies

2. It is made by a taxable person;

3. The supply is made for a single price: The fact that a composite supply does not include this condition merits consideration. Where a supply of 2 / more oods or services is made for different prices, the supplies cannot be regardedas mixed supplies.

4. The supply does not constitute a composite supply: The expression

“constitute” has a large ambit to include cases where the supply results in a composite supply, as well as a case where some of the components together make a composite supply, whereas the bundle together would make a mixed supply. While the condition as such is not explicit, given that there is no provision for treatment of a bundled supply where only some components together qualify as a composite supply, it may be safe to interpret that a mixed supply is one which is not regarded as a composite supply.

(ii) The matters such as time of supply, invoicing, place of supply, value of supply, rate of tax applicable to the supply, etc. shall all be determined in respect of that supply which attracts the highest rate of tax. However, the law remains silent on what is the treatment required to be undertaken where more than one component is subjected to the highest rate of tax. For instance, consider a case where a commercial complex is let out for a consideration of monthly rentals, and the owner of the complex also supplies parking lots to those tenants who opt for the facility. While both the supplies attract tax @ 18%, the law does not prescribe for treatment of the transaction as that of only one of the two supplies.

(iii) Some Illustrations and cases of mixed supplies have been discussed in the following paragraphs:

Illustration (provided in Section 2(66)): A supply of a package consisting of canned foods, sweets, chocolates, cakes, dry fruits, aerated drink and fruit juices when supplied for a single price is a mixed supply. Each of these items can be supplied separately and is not dependent on any other. It shall not be a mixed supply if these items are supplied separately. This implies that the supply will be taxed wholly as supply of those goods which are liable to the highest rate of GST.

Other examples: If a tooth paste (say for instance it is liable to GST at 12%) is bundled along with a tooth brush (say for instance it is liable to GST at 18%) and is sold as a single unit for a single price, it would be reckoned as a mixed supply. This would therefore be liable to GST at 18% (higher of 12% or 18% applicable to each of the goods therein).

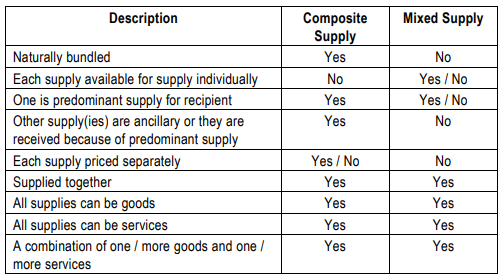

(c) While there are no infallible tests for such determination, the following guiding principles could be adopted to determine whether a supply would be a composite supply or a mixed supply. However, every supply should be independently analysed.