Appeals under service tax :

A. Revision application to CCE (Appeals) by Department [Section 84]

(1) PCCE/CCE may direct to make an application for revision to the CCE (Appeals)

- Principal Commissioner of Central Excise/Commissioner of Central Excise (hereinafter referred to as PCCE/CCE) may, of his own motion, call for and examine the record of any proceedings in which an adjudicating authority subordinate to him has passed any decision/order under this Chapter for the purpose of satisfying himself as to the legality or propriety of any such decision or order .

- He may, by order, direct such authority/any Central Excise Officer subordinate to him to apply to the Commissioner of Central Excise (Appeals) [hereinafter referred to as CCE (Appeals)] for the determination of such points arising out of the decision or order as may be specified by the PCCE/CCE in his order.

(2) Time-limit for making order: Such order shall be made within a period of three months from the date of communication of the decision or order of the adjudicating authority .

(3) Provisions relating to appeal to apply to the application filed to CCE (Appeals) by adjudicating authority/any other authorised officer

- In pursuance of an order of PCCE/CCE [referred to in point (1) above], the adjudicating authority or any other officer authorised in this behalf shall make an application to the CCE (Appeals) within a period of one month from the date of communication of such order to the adjudicating authority.

- Such application shall be heard by the CCE (Appeals), as if such application were an appeal made against the decision or order of the adjudicating authority and the provisions of this Chapter regarding appeals shall apply to such application.

B. Appeals to CCE (Appeals) by assessee [Section 85]

(1) Appealable orders: Any person may appeal to the CCE (Appeals) if he is aggrieved by any decision or order passed by an adjudicating authority subordinate to the PCCE/CCE.

(2) Documents to be enclosed: The appeal in Form ST-4 along with Statement of facts and the Grounds of appeal shall be filed in duplicate and shall be accompanied by a copy of the decision or order appealed against.

(3) Time limit for filing appeal: The appeal has to be filed within 2 months from the date of receipt of the order of such adjudicating authority.

Extension of time-limit allowed: The CCE (Appeals) may allow a further period of 1 month if sufficient cause is adduced for the delay.

(4) Procedure to be followed

1. The procedure laid down in the Central Excise Act, 1944 for hearing appeals and making orders is applicable under service tax also.

2. The CCE (Appeals) is required to hear and determine the appeal and pass the requisite order including an order enhancing the service tax, interest or penalty.

3. However, an order enhancing the service tax, interest or penalty shall not be made unless the person affected thereby has been given a reasonable opportunity of showing cause against such enhancement.

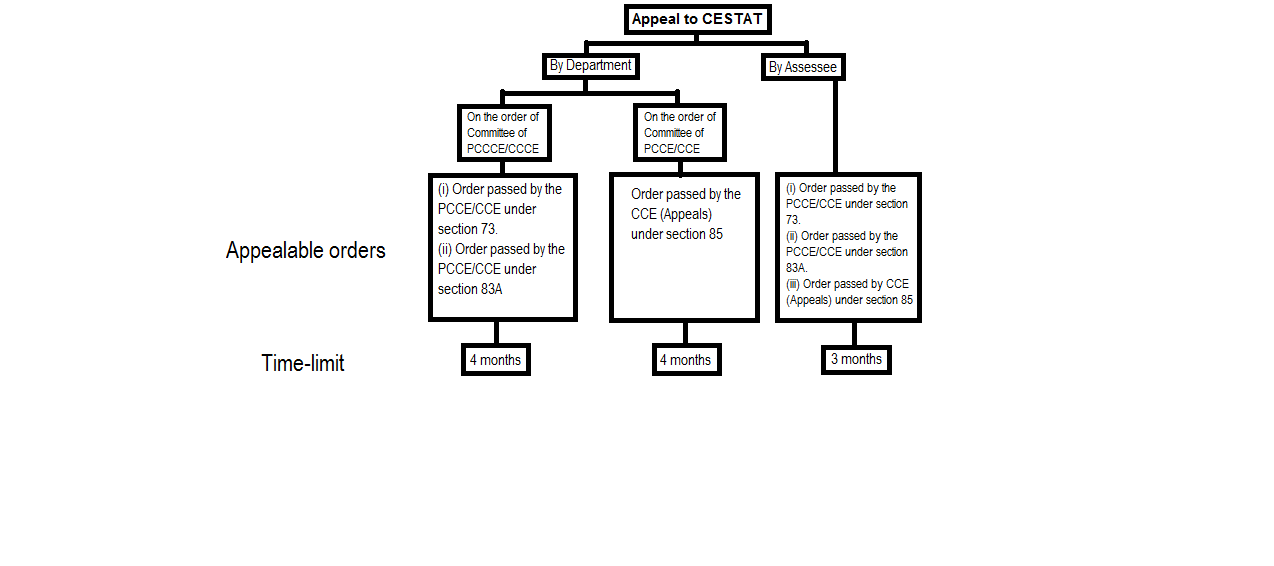

C. Appeals to the Appellate Tribunal [Section 86]

(1) APPEAL BY THE ASSESSEE

(a) Appealable orders [Sub-section (1)]: Subject to point (b), an assessee aggrieved by any of the following orders may apply to the Appellate Tribunal:-

(i) Order passed by a Principal Commissioner/Commissioner of Central Excise under section 73

(ii) Order passed by a Principal Commissioner/Commissioner under section 83A

(iii) Order passed by CCE (Appeals) under section 85

(b) Revision application against the order of Commissioner (Appeals) in matters involving service tax rebate (not an appeal before CESTAT): The remedy against the order passed by Commissioner (Appeals) under section 85 in a matter involving rebate of service tax on input services or rebate of duty paid on inputs, used in providing the service which has been exported, shall lie in terms of section 35EE of the Central Excise Act i.e., a revision application will be filed with the Revisional Authority in such cases and not an appeal with CESTAT.

(c) Documents to be enclosed: The appeal in Form ST-5 along with a Statement of Facts and Grounds of Appeal shall be filed in quadruplicate and accompanied by equal number of copies of the order appealed against (including one certified copy).

(d) Time-limit for filing appeal: The appeal shall be filed within 3 months from the date on which the order sought to be appealed against is received by the assessee.

(2) APPEAL BY THE DEPARTMENT

(a) Appeal to be filed by PCCE/CCE [Sub-section (2)]

Appealable orders: Committee of Principal Chief Commissioner of Central Excise/Chief Commissioner of Central Excise (hereinafter referred to as PCCCE/CCCE) may direct the PCCE/CCE to appeal to the Appellate Tribunal if it objects to any of the following orders passed by the PCCE/CCE:-

(i) Order passed under section 73.

(ii) Order passed under section 83A.

Difference in opinion of the Committee of PCCCE/CCCE against the order of the PCCE/CCE: Where the Committee of PCCCE/CCCE differs in its opinion against the order of the PCCE/CCE, it shall state the point or points on which it differs and make a reference to the Board.

If the Board, after considering the facts of the order, is of the opinion that the order passed by the PCCE/CCE is not legal or proper, it shall direct the PCCE/CCE to appeal to the Appellate Tribunal against the order.

(b) Appeal to be filed by Central Excise Officer [Sub-section (2A)] Appealable orders: Committee of PCCE/CCE may direct any Central Excise Officer to appeal to the Appellate Tribunal if it objects to order passed by CCE (Appeals) under section 85.

Difference in opinion of the Committee of PCCE/CCE against the order of the CCE(Appeals): If the Committee of Principal Commissioners/Commissioners differs in its opinion against the order of the CCE(Appeals), it shall state the point or points on which it differs and make a reference to the jurisdictional Chief Commissioner .

The Chief Commissioner shall direct any Central Excise Officer to appeal to the Appellate Tribunal against such order if it is of the opinion that the order passed by the CCE(Appeals) is not legal or proper.

Meaning of jurisdictional Chief Commissioner: “Jurisdictional Chief Commissioner” means the Chief Commissioner having jurisdiction over the concerned adjudicating authority in the matter [Explanation].

(c) Time-limit for filing appeal: The appeal shall be filed within 4 months from the date on which the order sought to be appealed against is received by the Committee of Chief Commissioners or, the Committee of Commissioners, as the case may be.

(d) Documents to be enclosed: The appeal by the Department shall be filed in Form ST-7 including the Statement of facts and Grounds of application, in quadruplicate and an equal number of copies of the decisions or order appealed against.

Constitution of Committee of PCCCE/CCCE or PCCE/CCE: Central Board of Excise and Customs has been empowered to constitute, by order, Committees comprising of two PCCCE/CCCE or two PCCE/CCE, as the case may be [Sub-section (1A)].

(3) MEMORANDUM OF CROSS-OBJECTIONS [Sub-section (4)]

An assessee or the PCCE/CCE or any Central Excise Officer subordinate to him may present a memorandum of cross-objections in Form ST-6, in quadruplicate, to the Appellate Tribunal, within 45 days from the receipt of notice that an appeal against the order of PCCE/CCE or the CCE (Appeals) has been preferred.

(4) CONDONATION OF TIME-LIMIT FOR FILING APPEAL/MEMORANDUM OF CROSS OBJECTIONS [Sub-section (5)]

The Appellate Tribunal can admit an appeal filed by the PCCE/CCE or a Central Excise Officer following the direction of Committee of PCCCE/CCCE or Committee of PCCE/CCE respectively after the expiry of the statutory period (4 months) for filing the same, if it is satisfied that there was sufficient cause for not presenting it within that period. Similarly, the Tribunal can also admit an appeal filed by the assessee after the expiry of the statutory period for filing the same, i.e., 3 months, if it is satisfied that there was sufficient cause for not presenting it within that period.

Further, the Tribunal also has the powers to permit the filing of a memorandum of crossobjections by the PCCE/CCE/ Central Excise Officer/ assessee after the expiry of the statutory period (45 days) for filing the same, if it is satisfied that there was sufficient cause for not presenting it within that period.

(5) FEES FOR FILING THE APPEAL [Sub-section (6)]

Following fees for filing an appeal to the Appellate Tribunal has been prescribed:

| Amount of service tax, interest demanded and penalty levied by any Central Excise Officer | Fee for filing an appeal |

| Less than or equal to Rs 5,00,000 | Rs 1,000 |

| More than Rs 5,00,000 but not exceeding Rs 50,00,000 | Rs 5,000 |

| More than Rs 50,00,000 | Rs 10,000 |

No appeal filing fees in the certain cases: No such fee shall be payable in case:-

(i) An appeal is preferred by the Department [by PCCE/CCE/Central Excise Officer].

(ii) A memorandum of cross-objections is filed.

Fees for filing an application for rectification of mistake or restoration of an appeal/application [Sub-section (6A)]

Every application made before the Appellate Tribunal, —

(a) for rectification of mistake in an appeal or for any other purpose; or

(b) for restoration of an appeal or an application,

shall be accompanied by a fee of Rs 500.

No application filing fees in the certain cases: No such fee shall be payable in the case of an application filed by the PCCE/CCE or Assistant/Deputy Commissioner of Central Excise.

D. Appeal to High Court and Supreme Court

Appeal may be made to the High Court/Supreme Court in accordance with the provisions of the Central Excise Act which are made applicable to service tax.