Basic Concept of VAT :

Generally, any tax is related to selling price of product or value of services. In modern production technology, raw material passes through various stages and processes till it reaches the ultimate stage. Output of the first manufacturer becomes input for second manufacturer, who carries out further processing and supply it to third manufacturer. This process continues till a final product emerges. This product then goes to distributor / wholesaler, who sells it to retailer and then it reaches the ultimate consumer.

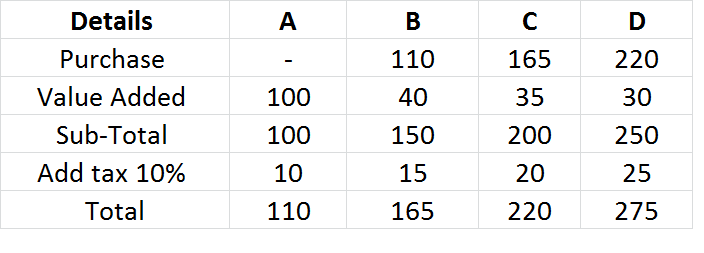

For example, steel ingots are made in a steel mill by ‘A’. These are rolled into plates by a re-rolling unit ‘B’, while third manufacturer say ‘C’ makes furniture from these plates. He sales it to ‘D’ who is final consumer. Of tax on a product is 10% of selling price, the transaction would go as follows.

The value added by B is only Rs 40 while he is paying tax on Rs 100 on which A has already paid the tax. He is also paying tax on Rs 10 which is actually tax paid by A. Similarly, C is paying tax on material on which A and B have already paid the tax. Thus, tax is paid again and again on the material which has already suffered tax. There is also tax on tax.

Similar situation arises when one service provider uses another service as his input service.

This is called cascading effect or ‘snow balling effect’ of taxes. ‘Snow balling’ means suppose a small ice ball starts rolling from top of Himalaya, it accumulates ice as it rolls down and become very big piece by the time it reaches bottom of hill.

This has the following disadvantages—

(a) Computation of exact tax content difficult

(b) Varying Tax Burden as tax burden depends on number of stages through which a product passes. If same product passes through 5 stages, tax burden will be less. If same product passes through 10 stages, tax burden will be more.

(c) Discourages Ancillarisation and growth of small scale industries, since manufacturer tends to manufacture himself instead of buying the parts from outside. This increases cost of production.

(d) Concessions on basis of end use is not possible. For example, Government wants to exempt product of D as it is for flood relief or for common man’s consumption. Now, even if Government gives tax exemption to D, the product or service does not become tax free as relief of taxes earlier paid by A, B and C cannot be given.

(e) India is member of World Trade Organisation (WTO). As per WTO, there should be free and fair competition. Hence, no country can give export incentives, but exported product or service can be made tax free. In aforesaid example, if D is exporting his product or his service, such exports cannot be made tax free, since Government does not know how much tax was paid earlier and cannot give relief. Thus, exports cannot be made tax free.