Basic customs duty [Section 12 of the Customs Act & Section 2 of the Customs Tariff Act] :

Basic Customs Duty is levied under the provisions of section 12 of the Customs Act and section 2 of the Customs Tariff Act.

1. Charging section: The duties of customs shall be levied

- at such rates* as may be specified under the Customs Tariff Act, 1975 or any other law for the time being in force

- on goods imported into or exported from India [Section 12 of the Customs Act, 1962]

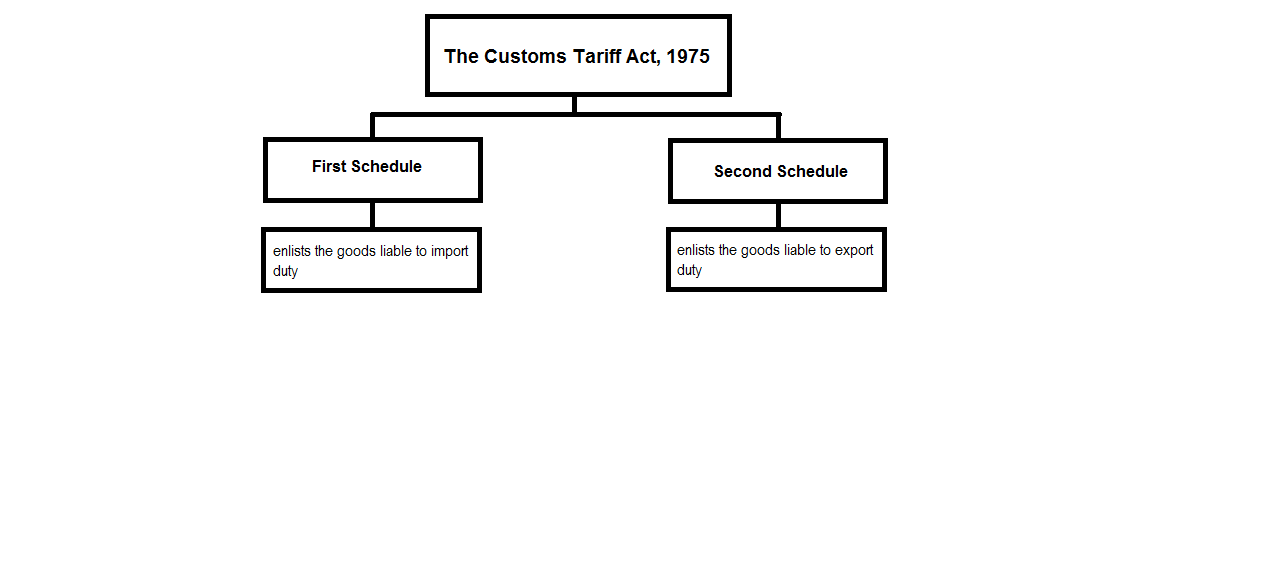

2. Rates of basic custom duty: *The rates at which duties of customs shall be levied under the Customs Act 1962 are specified in the First and Second Schedules [Section 2 of the Customs Tariff Act, 1975]

3. Standard rate of duty: Generally, the rate of duty specified in column (4) is applicable.

4. Preferential rate of duty: If the goods are imported from the areas notified by the Central Government to be preferential areas, then the rate of duty under column (5) will be applicable.

The Government may by notification under section 25 of the Customs Act prescribe preferential rate of duty in respect of imports from certain preferential areas.

Conditions to be fulfilled for preferential rate of duty: The importer will have to fulfill the following conditions to make the imported goods eligible for preferential rate of duty:-

(a) At the time of importation, he should make a specific claim for the preferential rate.

(b) He should also claim that the goods are produced or manufactured in such preferential area.

(c) The area should be notified under section 4(3) of the Customs Tariff Act to be a preferential area.

(d) The origin of the goods shall be determined in accordance with the rules made under section 4(2) of the Customs Tariff Act.

If the importer fails to discharge the above duties, the goods shall be liable to standard rate of duty.