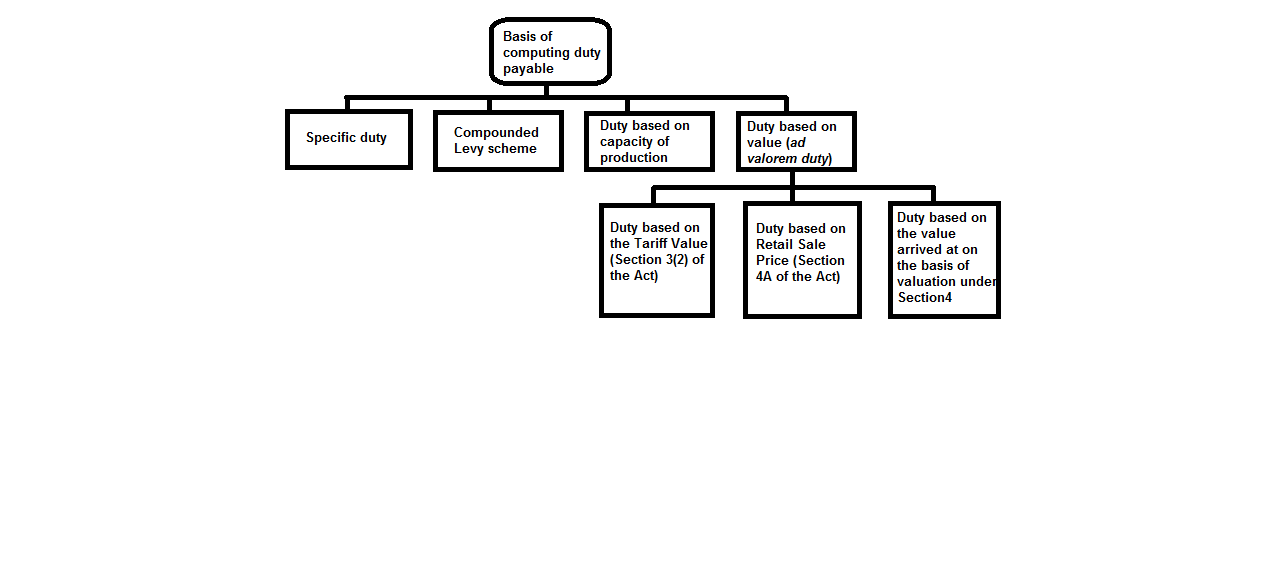

Basis of computing duty payable :

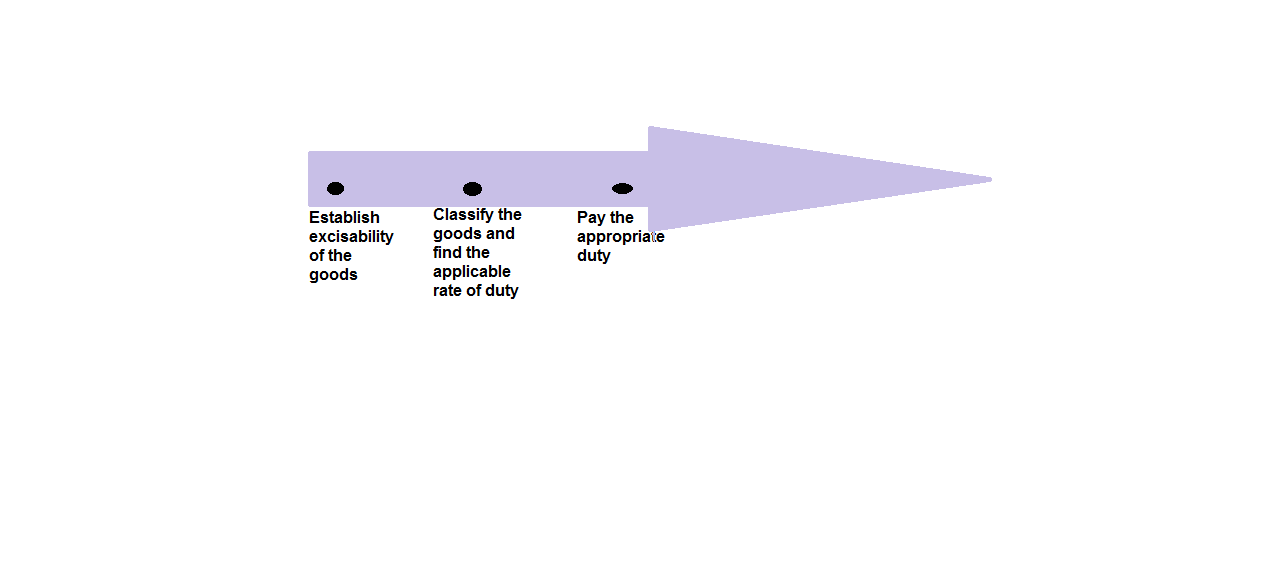

Significance of valuation: Valuation is important to understand as duty under central excise is payable based on different criterion. As a first step, an assessee has to establish whether the goods manufactured by him are excisable. After the excisability is decided, the goods have to be correctly classified. The next step is to value the goods so as to compute the duty payable on the excisable goods.

Basis of computing duty payable: The duty is payable on the basis of any of the following:

(a) Specific duty

(b) Duty based on value

(i) Duty based on the Tariff Value (Section 3(2) of the Central Excise Act, 1944)

(ii) Duty based on the value arrived at on the basis of valuation under Section 4

(iii) Duty based on Maximum Retail Price [MRP] (Section 4A of the Central Excise Act, 1944)

(c) Compounded Levy scheme (Rule 15 of the Central Excise Rules, 2002).

(d) Duty based on capacity of production (Section 3A of the Central Excise Act, 1944)