Tax incentives for new start-ups [Section 80-IAC] :

Effective from: A.Y.2017-18

(i) Objective:

In order to provide an incentive to start-ups and aid their growth in the early phase of their business, new section 80-IAC has been inserted.

(ii) Quantum of deduction:

Accordingly, a deduction of 100% of the profits and gains derived by an eligible start-up from an eligible business is allowed for any three consecutive assessment years out of five years beginning from the year in which the eligible start up is incorporated.

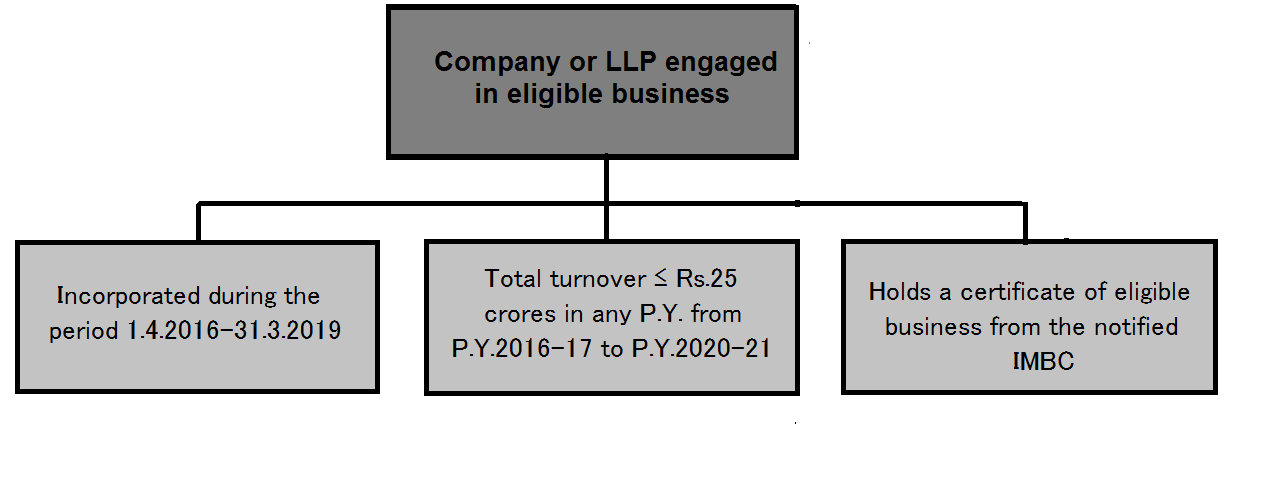

(iii) Meaning of eligible start-up:

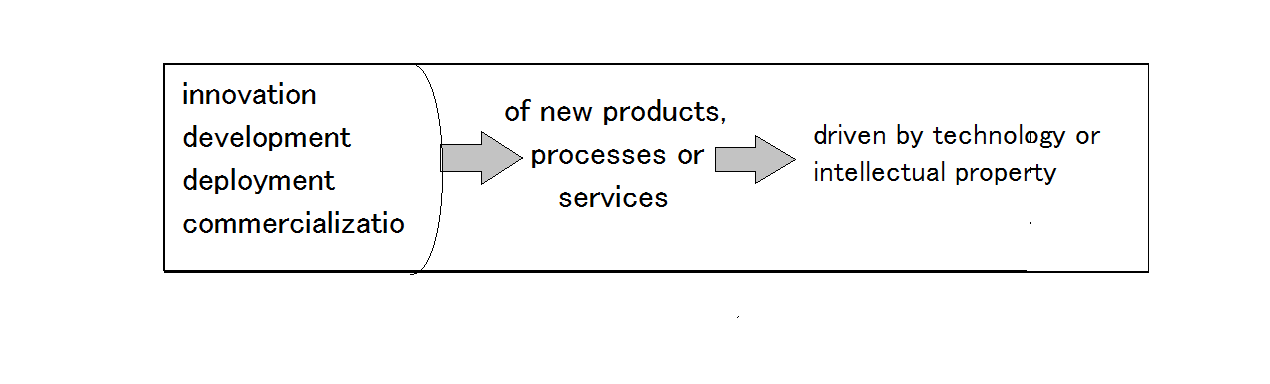

(iv) Meaning of eligible business :

(iv) Meaning of eligible business :

(v) Conditions to be fulfilled:

This incentive is available to an eligible start-up which fulfils the following conditions:

(1) It is not formed by splitting up, or the reconstruction, of a business already in existence.

However, this condition shall not apply in respect of a start-up which is formed as a result of the re-establishment, reconstruction or revival by the assessee of the business of any such undertaking as referred to in section 33B, in the circumstances and within the period specified in that section;

(2) It is not formed by the transfer to a new business of machinery or plant previously used for any purpose.

However, any machinery or plant which was used outside India by any person other than the assessee shall not be regarded as machinery or plant previously used for any purpose, if all the following conditions are fulfilled, namely:—

(a) such machinery or plant was not, at any time previous to the date of the installation by the assessee, used in India;

(b) such machinery or plant is imported into India;

(c) no deduction on account of depreciation in respect of such machinery or plant has been allowed or is allowable under the provisions of the Income-tax Act, 1961 in computing the total income of any person for any period prior to the date of the installation of the machinery or plant by the assessee.

Further, where in the case of a start-up, any machinery or plant or any part thereof previously used for any purpose is transferred to a new business and the total value of the machinery or plant or part so transferred does not exceed 20% of the total value of the machinery or plant used in the business, then, the condition specified that it should not be formed by transfer to a new business of plant and machinery used for any purpose shall be deemed to have been complied with.

(vi) Eligible business to be considered as the only source of income:

For the purpose of computing deduction under this section, the profits and gains of the eligible business shall be computed as if such eligible business were the only source of income of the assessee during the relevant previous years.

(vii) Audit of Accounts:

The deduction shall be allowed only if the accounts of the start-up for the relevant previous year have been audited by a chartered accountant and the assessee furnishes the audit report in the prescribed form, duly signed and verified by such accountant along with his return of income.

(viii) Transfer of goods/services between eligible business and other business of the assessee:

Where any goods or services held for the purposes of the eligible business are transferred to any other business carried on by the assessee, or vice versa, and if the consideration for such transfer does not correspond with the market value of the goods or services, then, the profits and gains of the eligible business shall be computed as if the transfer was made at market value. However, if, in the opinion of the Assessing Officer, such computation presents exceptional difficulties, the Assessing Officer may compute the profits on such reasonable basis as he may deem fit.

(ix) Deduction not to exceed profits of eligible business:

The deduction claimed and allowed under this section shall not exceed the profits and gains of the eligible business. Further, where deduction is claimed and allowed under this section for any assessment year no deduction in respect of such profits will be allowed under any other section under this chapter.

(x) Assessing Officer empowered to make adjustment in case any transaction produces excessive profits to eligible business:

The Assessing Officer is empowered to make an adjustment while computing the profit and gains of the eligible business on the basis of the reasonable profit that can be derived from the transaction, in case the transaction between the assessee carrying on the eligible business under section 80-IAC and any other person is so arranged that the transaction produces excessive profits to the eligible business.

However, if the arrangement involves a specified domestic transaction referred to in section 92BA, the amount of profits from such transaction shall be determined

having regard to the arm’s length price.

(xi) Central Government empowered to deny deduction to any class of start-up:

The section empowers the Central Government to declare any class of start-up as not being entitled to deduction under this section. The denial of exemption shall be with effect from such date as may be specified in the notification issued in Official Gazette.

Example

A Ltd. was incorporated on 1.4.2016 to carry on the business of innovation, development, deployment and commercialization of new processes driven by technology. It holds a certificate of eligible business from the notified IMBC1.

Its total turnover and profits and gains from such business for the P.Y.2016-17 to P.Y.2020-21 are as follows:

|

Particulars |

P.Y.2016-17 | P.Y.2017-18 | P.Y.2018-19 | P.Y.2019-20 | P.Y.2020-21 |

|

(Rupees in crores) |

|||||

|

Total turnover |

15.42 | 18.36 | 20.21 | 22.72 | 24.95 |

|

Profits/ Losses |

(2.52) |

(1.37) | 6.52 | 8.13 |

9.87 |

Is A Ltd. eligble for any tax benefit under the provisions of the Income-tax Act, 1961? If yes, what is the benefit available?

Answer

A Ltd. is an eligible start-up, since –

(1) it is a company engaged in eligible business of innovation, development, deployment and commercialization of new processes driven by technology. It holds a certificate of eligible business from the notified IMBC.

(2) it is incorporated during the period 1.4.2016 to 31.3.2019.

(3) its total turnover does not exceed Rs.25 crores in any previous year from P.Y.2016- 17 to P.Y.2020-21.

(4) it holds a certificate of eligible business from the notified IMBC

Therefore, A Ltd., being an eligible start-up, is eligible for deduction under section 80-IAC of 100% of the profits and gains derived by it from an eligible business for any three consecutive assessment years out of five years beginning from the year in which the eligible start up is incorporated i.e. P.Y.2016-17.

In the first two years i.e., P.Y.2016-17 and P.Y.2017-18, A Ltd. has incurred a loss. In the subsequent three years i.e., P.Y.2018-19, P.Y.2019-20 and P.Y.2020-21, A Ltd. has earned profits from eligible business and can hence, claim 100% of its profits as deduction under section 80-IAC from the P.Y.2018-19 to P.Y.2020-21. However, for P.Y.2018-19, the profits eligible for deduction would be the profits after set-off of brought forward losses of P.Y.2016- 17 and P.Y.2017-18.