Cancellation of Registration – Sec 29 Reasons for cancellation

- Cancellation can be done by Proper Officer suo motu or on application made by the registered taxable person:-

*Transfer of business or discontinuation of business

*Change in the constitution of business. (Partnership Firm may be changed to Sole Proprietorship due to death of one of the two partners, leading to change in PAN )

*Persons no longer liable to be registered under Section 22 or 24 (Except when he is voluntarily registered)

- Cancellation can be done by Proper Officer including retrospective date as deem fit :-

*Where registered taxable person has contravened provisions of the Act as may be prescribed

*A composition supplier has not furnished returns for 3 consecutive tax periods/ any other person has not furnished returns for a continuous period of 6 months

*Non-commencement of business within 6 months from date of registration by a person who has registered voluntarily.

*Where registration has been obtained by means of fraud, willful statement or suppression of facts.

An opportunity of being heard provided by Proper officer before cancellation.

- Liability to pay tax before the date of cancellation will not be affected;

- Cancellation under CGST Act will be deemed cancellation under SGST Act and vice-versa;

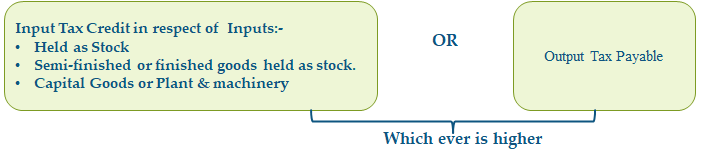

- Amount required to be pay by debit of Electronic credit/ cash ledger, equivalent to the:-

- In case of P & M or Capital Goods, an amount shall pay = (ITC taken – % points prescribed) or tax on Transaction value, whichever is higher.